"Dark Arts" Corp Governance - Part 7

LHC Group: Insider Transactions During UnitedHealthcare M&A Discussions

Welcome to Part 7 of the Corporate Governance “Dark Arts” series!

In my previous “Dark Arts” write-up, I discussed Twitter and RSUs granted to Twitter executives on April 13, 2022 ($45.85 stock price), the same day Elon Musk submitted a non-binding proposal to acquire Twitter for $54.20, and one day before Elon disclosed his Twitter buyout offer to the public.

For Part 7, I explore a similar situation at LHC Group (ticker: LHCG), and aggressive insider transactions (i.e. insider buying, share repurchases, and RSU grants) that occurred during buyout discussions with UnitedHealth.

Individual investors would be charged with insider trading if they purchased LHCG stock on March 1, 2022 with the knowledge UnitedHealth offered $170 per share to acquire the company on February 7, 2022, and yet, management AND directors were granted RSUs on March 1st and financially benefitted from that inside information without any scrutiny.

Let’s dive in!

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Shameless Plug

If you enjoy this write-up, consider subscribing to the Premium Newsletter.

Premium explores “real time” situations and looks for interesting governance signals, like indicators of strategic options and other noteworthy inflections, before they potentially happen and/or gets priced in.

Note: If you previously subscribed to premium, a friendly reminder you were issued a pro-rated refund in February 2022 and will need to re-subscribe to receive premium emails again.

Dark Arts Series

If you’re new to “Dark Arts”, this series examines how insiders use the “Dark Arts” of corporate governance to take advantage of unsuspecting stakeholders, influence decision-making, generate excess profit for themselves, etc.

And yes, there can be windows of opportunity to participate alongside.

UnitedHealth Announces LHC Group Acquisition

On March 29, 2022, UnitedHealth (UNH) announced they would be acquiring in-home healthcare provider LHC Group (LHCG) for $170 per share.

The deal was initially expected to close in the second half of 2022, but an FTC probe push the expected close to the first quarter of 2023.

Insider Transactions During Buyout Discussions

The timing of the announcement is notable, because - like many companies - LHCG annually grants equity to management in early March which meant the 2022 RSUs were essentially “spring load” grants given how far along the company was in their sales process and had already received a $170 per share acquisition offer from UnitedHealth on February 7, 2022.

As a reminder, “spring loading” is when equity is granted before positive material non-public information is released that positively impacts the stock price. Inadvertent “spring loading” - such as granting management their annual equity during a sales process - is a situation Boards occasionally have to navigate. There’s a lot of temptation to take advantage of these situations given how much “business judgement” discretion Boards are bestowed by regulators and courts.

A subtle way to take advantage of these situations is to simply grant more equity to management, but not so much that it raises a red flag.

For instance, on March 1, 2022, LHCG granted CEO Keith Myers 31,845 RSUs when the stock price was $139.78. Compared to prior RSU grants, this appears to be an “upsized” grant in terms of dollar value ($4.5 million vs. $3.3 million prior year):

It’s a nice year-over-year raise for the CEO and, adjusted for UnitedHealth’s $170 per share acquisition offer, the grant is a really nice raise worth $5.4 million. A ~$2 million step-up in value vs. the $3.3 million 2021 RSU grant ain’t bad!

Reviewing of the merger proxy, we know the Board approved this “upsized” 2022 RSU grant with the full knowledge of UnitedHealth’s $170 per share offer:

On February 7, 2022, representatives of SVB Securities and Mr. Mattera held a telephonic meeting to, among other things, discuss the proposed purchase price per share in UnitedHealth Group’s most recent proposal received on February 3, 2022. In response to LHC’s request to increase the proposed purchase price, Mr. Mattera reported that UnitedHealth Group was prepared to further increase its proposed purchase price per share to $170.00 in cash, which represented a premium of 38.8% over the $122.47 per share closing price of LHC Common Stock on February 4, 2022. He noted that this was UnitedHealth Group’s best and final proposal. (Merger Proxy)

On February 16, 2022, Mr. Mattera sent LHC a written, non-binding indication of interest (the “February 16 IOI”) confirming UnitedHealth Group’s proposal for an acquisition of all outstanding shares of LHC Common Stock for $170.00 per share in cash. (Merger Proxy)

Now, the company can say the “upsized” grant had little or nothing to do with UnitedHealth’s offer, but keep in mind this sizable RSU grant comes off the heels of LHCG stock being down approximately -36% in 2021. The 2021 business fundamentals and subsequent stock price decline don’t offer much support to give a 35% RSU dollar value raise. Consequently, it’s hard to ignore the possibility the compensation committee “juiced” the dollar value of his 2022 RSUs as a “reward” for a soon-to-be successful sales process.

Simply put, individual investor would be charged with insider trading relying on the same information LHCG insiders are seemingly using to receive RSU grants without much fuss nor scrutiny.

Welcome to corporate governance “dark arts”.

Speaking of insider trading, when you read the entire Background of the Merger, it appears LHCG General Counsel, Nicholas Gachassin, purchased stock on December 16, 2021 while deal discussions were underway with UnitedHealth:

Mid-November 2021: LHC began having conversations with several potential strategic partners and buyers, including UnitedHealth Group.

December 2, 2021: SVB Securities held a telephonic conference with representatives of UnitedHealth Group to discuss a potential transaction between UnitedHealth Group and LHC.

December 6, 2021: SVB Securities had a telephonic meeting with representatives of UnitedHealth Group regarding UnitedHealth Group’s potential interest in a transaction with LHC. SVB Securities proposed to arrange a meeting among UnitedHealth Group and LHC management to discuss the possibility of exploring the merits of an acquisition transaction.

December 10, 2021: SVB Securities sent preliminary background materials about a potential transaction with LHC to UnitedHealth Group.

December 16, 2021: LHC Group executives held an in-person meeting in Minneapolis, MN with representatives of UnitedHealth Group to discuss a potential transaction.

LHC General Counsel purchases 800 shares the same day LHC executives meet UnitedHealth representatives in-person.

Buying 800 shares ($100,200) doesn’t seem like an egregious amount, but I find it remarkable the General Counsel - the person in charge of preventing insider trading on material non-public information - is buying stock when there are (in my opinion) material M&A conversations happening.

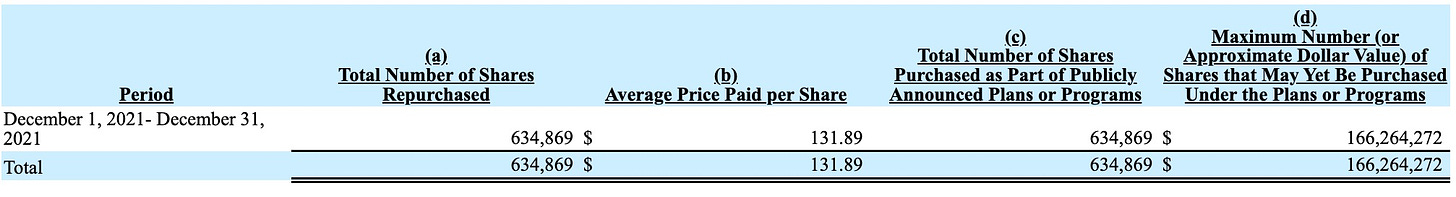

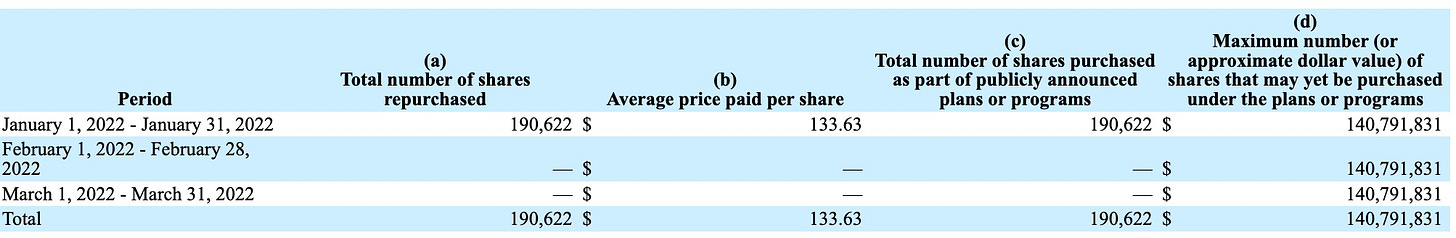

Obviously, LHCG disagrees these M&A discussions were “material” since the company also announced a $250 million share repurchase authorization on December 6, 2022 and was buying stock in December 2021 and January 2022 while deal discussions were in-process with UnitedHealth and other parties:

It appears repurchases halted around the time UnitedHealth made an oral, non-binding proposal to acquire the company for $160 per share on January 29, 2022.

That said, I suspect the SEC might disagree with LHCG’s “not material” assessment:

Materiality of M&A Discussions—The SEC’s findings suggest it views M&A discussions as particularly material. While the discussions for the sale of the company were at an early stage at the time the 10b5-1 plan was enacted, the SEC’s order notes that it is “well established than an acquisition need not be more-likely-than-not to occur for it to be material”. With materiality of information is typically adjudged as a matrix of significance and likelihood, the SEC’s view of M&A, especially a sale of the company, is of high significance meaning the requisite likelihood to find materiality is comparably lower. It bears noting that M&A discussions may constitute MNPI precluding trading even if not yet requiring disclosure in a 10-Q or 10-K filing. (Kirkland & Ellis, 11/6/2020)

Between the share repurchases, insider buying, and upsized RSU grants, LHCG was quite aggressive with insider transactions during M&A talks.

History of Aggressive, Incentive-Driven Behavior

Legality and materiality aside, insider transactions during M&A discussions isn’t a great look, especially considering the government scrutiny the company received a decade ago for allegedly encouraging behavior intended to maximize Medicare financial incentives.

In 2010, a WSJ report called out LHCG’s aggressive, incentives-driven behavior which led to a Senate Committee investigation in 2010 and a $65 million settlement with the DOJ in 2011:

The Senate committee, citing emails and other internal documents obtained from the companies, alleges that they encouraged employees to make enough home-therapy visits to reach thresholds that triggered bonus payments, whether or not the visits were medically necessary.

According to a lawsuit filed in 2013, it was CEO Keith Myers who emailed the need to increase therapy visits to meet bonus thresholds:

The Senate Report cited to an email from defendant CEO Myers about the need to increase the number of therapy visits performed by LHC in order to meet bonus thresholds.

Fast forward to 2022 and we see aggressive insider transactions happening when the company is negotiating a deal with UnitedHealth.

How Could This Happen?

Often times, companies can defend “dark arts” decisions by saying they’re simply following regularly scheduled governance procedures. For instance, LHCG grants their annual equity to management on March 1st and the company mentions they don’t have a policy of timing equity awards with material non-public information:

Timing of Equity Grants

Equity awards are made by the Compensation Committee only on dates the Committee meets. Equity awards for 2021 were approved at a regularly scheduled meeting of our Compensation Committee after review and consideration of the company’s performance during the prior fiscal year. We do not have any program, practice, or policy of timing equity awards in connection with the release of material non-public information. (source)

While the company says they don’t time equity awards, that shouldn’t absolve them from granting equity during their “regularly scheduled” meeting while in possession of material non-public information.

To further complicate matters, the Board of Directors also receives their annual equity grant on March 1st. Typically, companies grant equity to directors following the Annual Meeting (May/June), or on a quarterly basis.

So when UnitedHealth is offering $170 per share to acquire the company, directors aren’t exactly incentivized to think through appropriate adjustments to March 1st RSU grants. By simply following the “regularly scheduled” granting process, they get to spring-load their own equity compensation.

Directors wouldn’t be allowed to purchase stock on the open market knowing the $170 per share UnitedHealth offer, but they can approve their own equity compensation during that period.

As for General Counsel Nicholas Gachassin purchasing stock on December 16, 2021 while LHCG was discussing a potential deal with UnitedHealth, it seems like there are either weak and/or inadequate internal controls and processes in place.

For instance, the transaction was initially reported as insider selling on December 17, 2021, and later corrected as insider buying on January 11, 2022:

The original Form 4, filed on December 17, 2021, is being amended by this Form 4/A to correct the previously reported transaction code of S, sale of securities on an exchange or to another person. The number of shares previously reported are correctly stated in this Form 4/A as purchased of securities on an exchange or from another person.

Also, the General Counsel’s legal background is primarily healthcare and not corporate securities. In fact, he is also managing partner of a Louisiana law firm dedicated to representing healthcare providers and healthcare businesses, including LHCG who is a client:

During 2021, the company continued to engage Gachassin Law Firm for certain legal transactions, of which Mr. Gachassin continues to serve as the managing partner. The company paid $306,705 for services provided by Gachassin Law Firm during the fiscal year 2021. (source)

Put it all together and you begin to wonder if these aggressive insider transactions were possibly the result of weak and/or inadequate internal controls and processes.

Sporadic Enforcement Commission

While the SEC is indicating they’re placing a greater focus on spring-loading, investors need to assume enforcement and/or investigations will be sporadic, if not nonexistent.

It’s my understanding companies need to properly account for, value, and disclose if equity grants were made while in possession of material non-public information. It’s not clear to me that LHCG did any of that with their March 1, 2022 RSU grants, and a remedy might not matter given the UnitedHealth deal is expected to close Q1 2023.

I’m also not sure their $250 million buyback authorization on December 6, 2021 and subsequent share repurchases during M&A discussion was appropriately handled based on SEC guidance regarding the materiality of M&A discussions.

Enforcement aside, I do think the SEC needs to provide more clarity and guidance on how companies should approach “regularly scheduled” equity grants while in the middle of M&A discussions, especially if there’s an offer on the table. LHCG isn’t an isolated incident when it comes to this particular situation.

Impact on UnitedHealth

It’ll be interesting to see how UnitedHealth handles these LHCG insider transactions once the deal closes. Maybe they think the issue is immaterial, but recall UnitedHealth had to clean up their own options backdating mess back in the day so I wouldn’t be surprised if they’re vigilant to protect the organization.

At the very least, they’ll need to really assess and scrutinize LHCG’s internal controls and processes.

They might also need to contemplate the possibility the SEC shows up to investigate LHCG insider transactions leading up to the UnitedHealth deal, and what that could mean for their employment arrangement with Keith Myers.

Overall, I believe it makes sense for UnitedHealth to cover all their bases “just in case”.