Direct Listocracy: Giving Bag Holders What They Crave

How Silicon Valley's Solution to the Broken IPO Process is Broken

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Direct Listocracy

Public investors are getting inundated with news that Direct Listings are the “simpler and superior alternative to the IPO”, and I can’t help but think of the scene from Idiocracy where protagonist Joe Bauers (played by Luke Wilson) is surveying failing crops when he’s randomly sprayed with Brawndo (basically Gatorade) by the irrigation system and says:

“What the hell is this?”

Public investors are getting sprayed with Direct Listing talk while surveying languishing, newly public companies.

What the hell is this?

TLDR Kind-of-Long Summary

This post is primarily for folks interested in understanding some of the quirks of the Direct Listing process that can potentially create bigger problems/issues.

The IPO “pop” is (in my opinion) a structurally manufactured one-day wealth transfer that Direct List advocates are not necessarily incentivized (nor in a rush) to remove when they take Companies public via Direct Listing.

After studying Slack’s Direct List, it appears insiders can still apply IPO type tactics (with the help of Morgan Stanley as both an adviser and major accumulator of shares) to drive the stock up in a “pop” like fashion. [Update: I want to be clear that I am not accusing Morgan Stanley Investment Management (buyer of shares) of wrongdoing. It was just in this particular Direct Listing, MSIM was a major accumulator of Slack shares (which they are certainly entitled to do) and I thought the timing was curious relative to LP stock distributions. I do believe their purchases were made independent of MS influence. The “optics” aren’t great, but that’s an opinion and this writeup should be viewed as me pointing out things out of curiosity since Direct Listings are still a very new concept that I’m trying to grasp how things all fits together. That said, I do think it be a good idea for MS to provide more transparency & disclosure around MSIM share ownership pre-listing and post-listing to better manage optics.] This, in turn, allows VCs to maximize carry by 1) selling shares and 2) more importantly distribute stock to LPs at “peak pricing”. None of the VC write-ups advocating Direct List seem to discuss this issue around LP stock distributions, its impact on float/prices, and the potential conflicts-of-interests.

Structural day-one “pops” are eventually unwound as more shares come into the market, causing lagging price performance until shareholder equilibrium is achieved.

How an IPO or Direct List is structured absolutely has an impact on the Company’s stock 6 to 18+ months later despite arguments to the contrary.

Normally, the lock-up period provides some incentive to keep insiders engaged while the Company gets its foothold as a public company. Given Direct Listings have no lock-up, there is potential incentive to be overly aggressive on promotional behavior and guidance to prop the stock up near-term while insiders exit and capture “peak pricing” returns.

This debate is still evolving, rules are changing in real-time, and there’s an opportunity to shape how Direct Listings are executed. Exciting times! I suspect a more “optimized” version of the Direct List will entail a primary capital raise on the first day (given the recent NYSE proposal) and some variation of lock-up (with price and/or time-based staggered triggers) should be implemented to provide steadier visibility into float expansion. At the very least, there need to be a “lock-up” on LP stock distributions to discourage price manipulation.

This isn’t in the newsletter, but I’m still trying to reconcile how a WeWork style catastrophe can be filtered out via the Direct List process. The IPO process played a key part in avoiding a catastrophic public offering with prospective IPO investors pushing back on the WeWork offering. How late-stage investors negotiate with early stage investors within the context of a Direct Listing process will be interesting to watch for “battleground” companies (i.e. DoorDash) since there’s no certainty into how the stock will price until Direct List day…or, as you’ll see in this newsletter, there are some ways to make a Direct List stock behave like an IPO and “pop” near-term.

Idiocracy

You better believe I have a section dedicated to Mike Judge’s Idiocracy (and its robust $495,303 box office). That movie helped me get through the Global Financial Crisis.

For those unfamiliar with the movie, Luke Wilson plays a soldier (Joe Bauers) who participates in a top secret human hibernation experiment, and accidentally awakens 500 years in the future where it turns out he’s the smartest man on Earth and is surrounded by idiots. (Can’t believe I’m writing about this.)

Anyway, he saves the world by irrigating failing crops with water instead of Brawndo, but his initial suggestion to use water was met with some “push back”:

Joe: For the last time, I'm pretty sure what's killing the crops is this Brawndo stuff.

Secretary of State: But Brawndo's got what plants crave. It's got electrolytes.

Attorney General: So wait a minute. What you're saying is that you want us to put water on the crops.

Joe: Yes.

Attorney General: Water. Like out the toilet?

Joe: Well, I mean, it doesn't have to be out of the toilet, but, yeah, that's the idea.

Secretary of State: But Brawndo's got what plants crave.

Attorney General: It's got electrolytes.

I hear Silicon Valley talk about the “superiority” of Direct Listing, but really all I can hear echoing in my head is:

“Direct Listing got what Bag Holders crave! It’s got shares.”

This was a very long setup to explain my subject line. Let’s move on.

Solving the IPO “Problem”

The questions I’m wondering aloud are:

What is the “problem” we’re trying to solve?

Is Direct Listing the correct solution to the IPO “problem”?

Or are we inadvertently worsening the “problem” or creating new ones by introducing Direct Listing?

The IPO process is an imperfect process. Daresay it’s a rigged process, but what is Direct Listing (and all those additional shares) really solving for public shareholders?

From a public shareholder’s perspective, having more shares doesn’t necessarily address the primary problems public shareholders face when investing in newly public companies.

Direct Listing may, in fact, exasperate those problems.

With more Direct Listings expected to roll out in 2020, what can public shareholders do to engage and (hopefully) get some of their concerns addressed?

Well, how did Joe Bauers convince the folks in Idiocracy to go along with his “water” plan?

Narrator: After several hours, Joe finally gave up on logic and reason, and simply told the cabinet that he could talk to plants and that they wanted water. He made believers out of everyone.

I can talk to public shareholders and know what they want! lol

Jokes aside, I think we can use logic and reason to improve the process. The first step is to point out key concerns public investors have about the Direct List process and (hopefully) start a conversation to address them.

Reality for public investors is Direct Listings are an inevitability, but I believe a few enhancements to this new process can go a long way in making things more “public shareholder friendly” and truly superior to IPOs.

IPO vs. Direct Listing Debate: An Issue of Costs?

The IPO vs. Direct List debate is pretty well-covered so I’ll try to focus on the key issues.

Before digging in, I highly recommend you jump over to Brad Slingerlend’s post on The Great IPO Debate that offers (in my opinion) a more balanced view of the IPO vs. Direct Listing debate and is written by someone with experience in both IPO investing and late-stage private market investing.

I tend to align with Brad’s view that IPO costs are not as “bad” on a percentage basis vs. the eye popping dollar amounts being used to advocate for Direct Listing:

“Hundreds of millions of dollars are NOT being left on the table on the day of a traditional IPO. The cost of a traditional banker led IPO is approximately 2% dilution to existing shareholders, which is less than most growth tech companies issue in equity every year.” - Brad Slingerlend

And if you don’t believe Brad, here is Stewart Butterfield discussing Slack’s Direct Listing:

“The [Direct List] savings aren’t that great to be honest, and that’s certainly not the motivator.” - Stewart Butterfield

That all said, Silicon Valley’s publicly stated problem with the IPO process is this:

The IPO is a broken process because:

Underwriters systematically and structurally underprice IPO shares to engineer a price “pop” when the Company goes public.

Companies leave “money on the table” due to this underpricing and value is effectively transferred from the Company to the IPO investors who benefit from the one-day wealth transfer.

IPO process allows the underwriter to enrich themselves and their 5 to 10 preferred hand-picked clients at the expense of the Company, VC investors, and at-large public shareholders.

The lock-up period creates a rigid, low float environment that prevents the release of additional shares to meet demand, creates an artificial one-day pop, and causes price volatility until the lock-up expires which then causes downward price pressure.

The solution to this IPO underpricing “problem” is to implement a Direct Listing that:

Allows “market based” pricing.

Gives open and equal access to shares to interested buyers.

Optimizes supply and demand due to no share lock-up.

Has no dilution since there’s no offering because the Company isn’t raising capital.

Wait a minute…the solution to “leaving money on the table” in an IPO offering is to not have an offering at all and do a Direct List?

Until Nasdaq or NYSE allows Companies to raise capital via Direct Listing (and I’m sure it will be an option in time), the current “solution” is to raise capital in the private markets prior to Direct Listing and pretend those private market investors will not insist on a similar expected return as an IPO investors. (Expected returns that are probably correctly captured in the approximate “underpricing” by the banks.)

I’m tying to be reasonable here, but it’s a bit naive to assume the “last-money-in” before going public would not expect at least a 20% to 30%+ return (similar to IPO underpricing) on Direct List day.

But let’s not kid ourselves. “Cost” isn’t the primary reason for Direct Listing.

Direct Listing: Leave the Bankers, Take the Bag Holders

Simply put, VCs want to remove the middle-man bank and IPO investors to capture the one-day wealth transfer for themselves. It’s a business decision straight out of The Godfather (“Leave the gun, take the cannoli).

“Bag holder” seems harsh but let’s look at some of the research on IPO returns:

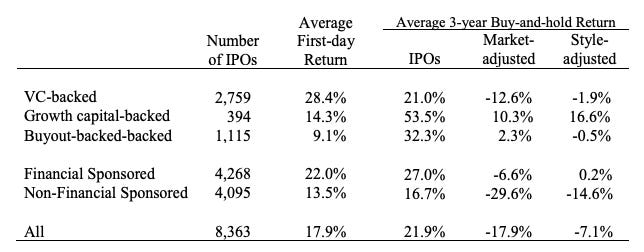

Dimensional’s Research team studied the first-year performance of more than 6,000 US IPOs from 1991 to 2018 and found they generally underperformed industry benchmarks…

…Researchers have shown that initial trading prices typically exceed the IPO offering price.

Professor Jay Ritter (University of Florida):

The average 3-year buy-and-hold return of VC-backed IPOs is captured, on average, entirely on the first-day return.

Most IPOs underperform, some new offerings outperform dramatically.

Asymmetric returns have led to the average IPO slightly outperforming while the median IPO stock significantly underperforms.

Generally speaking, the research indicates it’s great to sell shares into a first-day “pop” but holding shares after the first-day usually means you’re likely selling at lower prices.

Intuitively, this makes sense given IPOs are low key restructurings with the Board (adding new Directors and VCs departing), management, and shareholders turning over while shares flood the market, and the Company simultaneously trying to prove out its strategy in the public markets with a brand new shareholder base. As I like to say…

The key takeaway for me looking at all of this is, while fundamentals are important, the share overhang is capable of dominating and influencing valuation for a much longer period of time than most folks appreciate or want to admit.

It’s easy to brush off lagging performance 6 to 12 months later as business fundamentals that has nothing to do with go-public decisions, but this view seems to run counter with the data. Those early decisions really do matter, and have structural medium to long-term consequences.

You would think the Direct Listing process would be a great opportunity to eliminate or better manage the “Bag Holder” problem, but I believe VCs are not necessarily incentivized nor in-a-hurry to eliminate the structural drivers that lead to a day-one “pop”.

Given these factors, the best way for VCs to maximize their returns is to get rid of the middle-man bank while retaining the inflated day-one valuation “pop”.

Leave the Bankers, take the bag holders.

Let’s take a look at a real world example of this.

No Slack in Direct Listings

I have to admit I had zero intention of writing about Direct Listing until I randomly started looking at Slack Form 4 filings (Why does the CEO sell 2,500 shares every day?! He has over 40M shares.) and curiosity got the best of me trying to figure out what the hell was going on.

I thought everything that needed to be said about Direct Listings was covered, but as they say…the truth hides in plain sight. I noticed some interesting quirks worth sharing so here we are…

“One of the hopes for a Company like us is that there’s not too much volatility and we are hoping that this model where there’s many sellers and many buyers, supply and demand, we reach a market clearing price a lot earlier.” - Stewart Butterfield

Direct Listing was meant to provide better access and liquidity and yet Slack’s stock was priced and behaves a lot like an IPO. Incidentally, like many IPOs, I think the stock is approaching its true “market clearing” price 6 month after going public. Can we explain what’s going on outside of “fundamentals”? Let’s try!

Slack’s Private Round Capital Raise

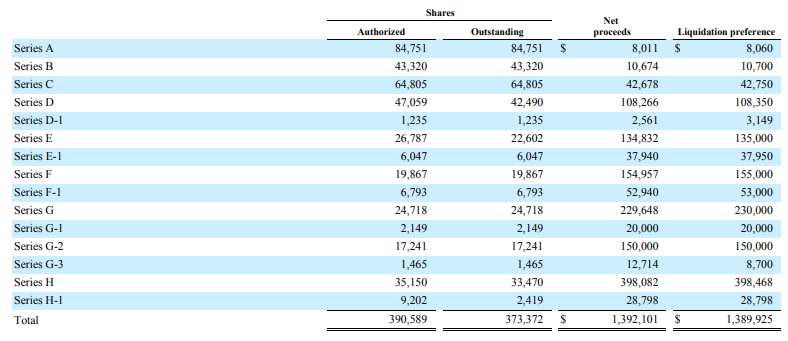

Going through the Company’s Direct Listing filing, Slack had $793M in cash and securities leading up to the Direct Listing with their last funding round occurring August 2018 when they raised $427M Series H round at $11.91.

From August 2018 through September 2018, we sold an aggregate of 33,469,795 shares of our Series H convertible preferred stock at a purchase price of $11.9053 per share, for an aggregate purchase price of $398.5 million and an aggregate of 2,418,922 shares of our Series H-1 convertible preferred stock at a purchase price of $11.9053 per share, for an aggregate purchase price of $28.8 million, pursuant to our Series H and Series H-1 convertible preferred stock financing.

Looking at the preferred stock table, Series H represented ~10% of the preferred shares making it very similar to an IPO type financing. Which makes sense. Given the current rules in place, a Direct Listing requires a “private market IPO” financing if a Company wants capital cushion prior to going public.

What’s interesting is when you look at the share selling activity around the Series H, Slack stock was trading in the $13 to $20+ range. Based on Crunchbase and eyeballing the revenue numbers, it looks like the Series H was priced at a mid teens (14x to 15x?) forward revenue multiple. That’s quite a discount to the ~30x multiple the Company debuted at on Direct List day and I suspect an “underpriced” IPO would have been a priced at a premium multiple to Series H.

I know Slack is currently trading back down to 15x forward revenue and I’m aware August 2018 was the start of a pretty volatile market, but my main point is this is a complicated topic. It may make absolute sense to do an underpriced private round just like it may make sense to do an IPO over a Direct Listing. Other factors need to be considered beyond “leaving money on the table”, including how management wants to manage and coordinate an orderly share exit of insiders and who they want as key stakeholders in the Company.

Slack’s Direct List Structure

Taking a rough inventory of the shares leading up to Direct List day:

Slack has approximately 505M shares.

They planned on converting 118M shares into Class A stock to sell in a Direct Listing.

Acknowledging there is no actual lock-up, this structure is essentially signaling an opportunity to acquire approximately 24% of the Company from insiders. This kind of mimics an IPO offering 10% to 20% of shares.

Approximately 73M or 60% of Class A shares “available” come from the top shareholders (Accel, Andreessen, Social Capital, Softbank) and the CEO Stewart Butterfield.

Conceptually, the large holders could sit on their 73M shares and throttle the signaled “available” Class A shares down to 45M shares or 9% of outstanding shares creating an IPO like share volume.

Lead Up To Slack’s Direct List Day

Leading up to Direct List day, Slack announces earnings, has a call, and issues guidance on June 10, 2019.

I like the idea of releasing earnings and putting out guidance ahead of the Direct Listing, but I think all public investors have similar concerns that no lock-up period incentivizes an overly optimistic narrative to drive valuation and an exit.

It would be great if Companies were willing to provide a historical snapshot of previous guidance to bracket how the current outlook compares to past forecasts/expectations. Given how long some companies have stayed private, there’s a good chance a few of them have missed expectations. Obviously, insiders don’t want that information to depress the Direct Listing “clearing price”, but these are the long-term vs. short-term issues management need to balance to manage volatility has insiders exit.

Reference price is set at $26. A reference price is not an offering price. It is also not an opening price. That number will ultimately be determined by the designated market maker, based off a calculation of a figure where buy orders can be met with sell orders.

I’m not a fan of reference price and if they insist on putting out a number, I wish the Direct List banker would release a fairness opinion similar to what you’d see in a merger transaction proxy. I’d assume a fairness opinion is done internally to give VCs an idea of how shares should trade.

Side note: I also expect fairness opinions to be an essential part of convincing late-stage investors (with their anti-dilution and liquidation preference protections) to go along with future Direct Listings (especially at “battleground” valuation Companies like DoorDash).

Slack’s Direct List

Direct List Day arrives (June 20, 2019).

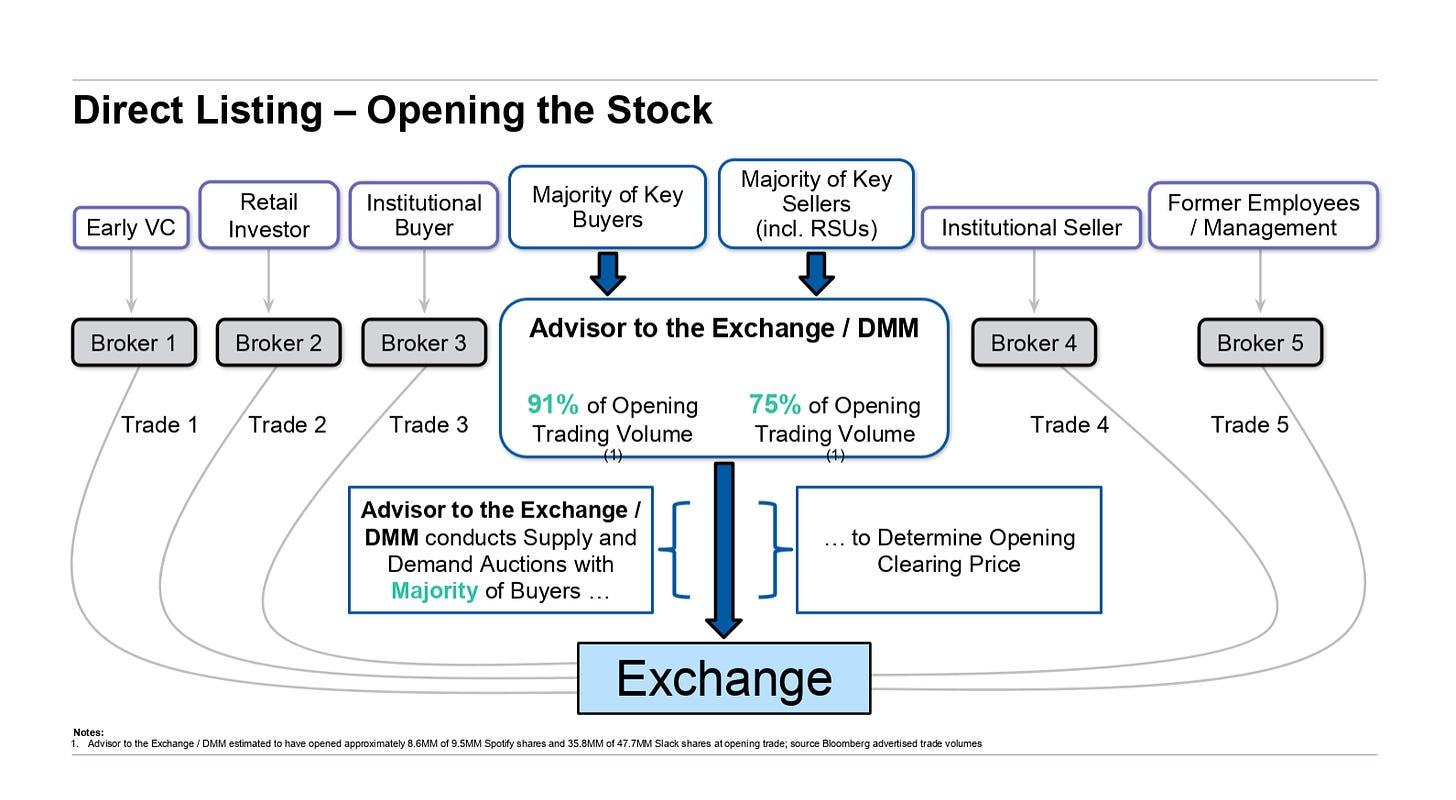

There’s a pretty interesting Techcrunch interview of Morgan Stanley’s Michael Grimes that discusses Slack and Direct Listing.

Morgan Stanley, the advisor to Slack and the exchange/DMM, opens with 35.8M of the 47.7M Slack shares available for “opening trade”, conducting supply and demand auctions with the majority of key buyers and key sellers to determine a “market clearing” price.

Morgan Stanley is involved with 91% of the opening “key buyers” volume and 75% of the opening “key sellers” volume.

Here’s Where Things Get Interesting

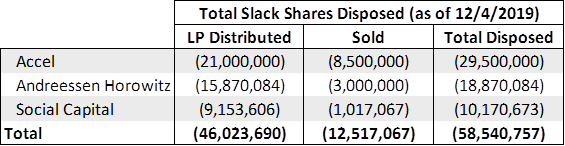

The big holders of Slack stock don’t actually sell that many shares. Accel, Andreessen, Social Capital, and Stewart Butterfield collectively sell 12.5M shares on Direct List day relative to the 73M they had signaled was available if they chose to sell. (Not sure if Softbank sold. Couldn’t find Form 4s)

Despite signaling 118M shares were potentially available for trading, large holders essentially created IPO style share scarcity on opening day.

Slack stock experienced a ~50% “pop” from the $26 reference price with the stock pushing to $40 per share.

You would think insiders would be motivated to sell more shares to lock in returns and carry when the stock is near $40, but instead of selling more shares and pressuring the stock price, Accel and Andreessen Horowtiz collectively distributed nearly 26M shares to LPs (presumably marking their carry/returns at close to $40 per share). Have your cake and eat it too I suppose.

In total, large insiders unloaded nearly 38.4M shares on Direct List day with ~12.5M actually being sold in the open market and ~25.9M distributed to LPs.

To top it all off, Morgan Stanley (you know…the advisor running the Direct List and advising on trades) files as a 10% holder shortly after the Direct List date indicating they own nearly 20M shares. I don’t know if they bought the shares (effectively acting as a green shoe to support the stock [update: it reminds me of a green shoe in this particular case, but it’s coincidental and not an actual price supporting mechanism.]), or if ownership reflects the shares VCs distributed to their LPs, or if it’s something else.

[Update: I want to be clear that I am not accusing Morgan Stanley Investment Management (buyer of shares) of wrongdoing. It was just in this particular Direct Listing, MSIM was a major accumulator of Slack shares (which they are certainly entitled to do) and I thought the timing was curious relative to LP stock distributions. I do believe their purchases were made independent of MS influence. The “optics” aren’t great, but that’s an opinion and this writeup should be viewed as me pointing out things out of curiosity since Direct Listings are still a very new concept that I’m trying to grasp how things all fits together. That said, I do think it be a good idea for MS to provide more transparency & disclosure around MSIM share ownership pre-listing and post-listing to better manage optics.]

Morgan Stanley currently owns 27M shares of Slack stock making them one of the largest holders in the Company (coincidentally they are also huge holders of Spotify stock where they served as Direct List adviser).

Overall, you have large insiders not selling, the Direct List adviser being a major buyer, and a stock that “pops” nearly 50% like an IPO.

Are we just swapping out one rigged process for another?

Aftermath: The Venture Capital LP Bag Holder?

Direct List was meant to address the IPO “underpricing & pop” problem, but Slack’s Direct List seems to hint at an insider strategy (with [update: coincidental buying] support from Morgan Stanley [update: independent MSIM] acquiring shares) of throttling shares sold to produce a price “pop” in order to distribute stock to LPs at attractive gains without putting actual selling pressure on the stock.

Fred Wilson had an interesting perspective on LP stock distributions in his (2007!!) post titled Venture Fund Distributions - Cash versus Stock:

LPs don’t actually like getting distributed stock. They think "I invested cash, I want cash back". They also have had numerous problems over the years getting stock distributed to them that declines in value, sometimes significantly, before they can sell it. And yet, on the books of the fund, they are getting credited with being distributed something worth a lot more than they could realize.

Dan Primack called the VC distribution system broken when discussing VCs distributing Tesla stock in 2011:

Between 25% and 33% of all VC distributions come in the form of stock, but all of the LPs I spoke with said they would prefer cash (save for instances where the VC fund may still have a board seat with the public company). Not only because it perfectly aligns the carried interest — LPs pay carry on the actual sale price — but also because most LPs do not have in-house trading desks that can easily liquidate large blocks of common stock. Instead, they have to pay a third-party to do it, even further lowering their return on investment.

LP stock distributions is currently the primary means of disposing shares held by Slack VCs. In fact, the top 3 shareholder VCs stopped selling shares since Direct List day (as of 12/4/2019) and seem to prefer stock distributions to dispose shares:

We’ve gone from VCs criticizing the impact of IPOs underpricing shares and forcing Companies to “leave money on the table”, to introducing a Direct List model that is susceptible to an IPO style “pop” and takes advantage of no lock-up to secure higher returns by distributing shares to LPs at “peak prices” in lieu of pressuring the stock price by selling and returning cash.

LP stock distribution can be a meaningful cost to LPs since:

They may not have the infrastructure to sell shares.

Selling can put pressure on the price, hurting their returns.

They pay more carry given it’s calculated off a higher share price. This could be particularly meaningful for LPs of late stage VC where a day-one price “pop” could be the difference between meaningful carry or no carry at all.

They are not experts in the Company and lose institutional knowledge/expertise from VCs who were on the Board for years. This may cause LPs to indiscriminately sell shares and pressure the stock because they don’t have a strong view on the Company’s value to drive selling discipline (Frankly it’s not their job to to have a view! An unintended consequence of this is LPs will start meddling with VC decisions since…hey…they need a view on all portfolio companies due to stock distributions!).

Overall it’s a conflict of interest that needs to be addressed, and I’d argue VCs should have a lock-up on LP stock distributions. Let VCs sell shares, but prevent them from distributing shares to LPs until a future date.

Final Thoughts

Direct Listing definitely has a place in the eco-system, but there’s still a lot of room to improve and address the potential conflicts-of-interest between outgoing VC investors and incoming public investors.

These conflicts and issues include:

Asymmetric information disadvantage vs. selling insiders who have no lockup and incentive to “pop” the stock like an IPO.

Quality & sustainability of the Company’s strategic priorities & financial model.

The trustworthiness of management.

Disruptions caused by Board, management, and investor turnover.

Insiders, especially employees, should have an opportunity to exit sooner rather than later, but a strong case could be made that VCs should have some sort of price-based or staggered lock-up. Similar to granting equity to management and implementing a vesting schedule, I think a similar concept can be applied to VCs and their shares.

I see a ratable share lock-up as a way for Companies to “vest” into public life. It will also manage the temptation to manipulate a “pop”, and prevent aggressive distribution of shares to LPs when the stock price is structurally at its highest and will likely decline in the future.

From a capital allocation perspective, if exchanges allow capital raises through direct listing, the Company should be the primary beneficiary of any first-day “pop” to raise capital.

Finally, let’s appreciate (share) freedom and not take it for granted. Let’s keep “adding water” to this problem and see if we can’t grow a truly superior alternative to IPOs.