Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

I finally got around to watching Knives Out on Amazon Prime, and I have to say I really enjoyed it. For those who haven’t seen the film (see it!), Knives Out is a whodunit movie about a detective investigating the circumstances surrounding a rich patriarch's death. It’s a classic mystery movie plot, but I like Director Rian Johnson’s take on it.

Anyway, the movie randomly got me thinking about corporate governance and compensation (I know…pretty weird), and reminded me how examining equity grants can sometimes feel like a “whodunit” plot.

Most equity grants are very straightforward (open-and-shut case!), but sometimes you come across a situation that doesn’t feel right and the game is afoot. It warrants further examination to understand the true circumstances and motivations of the grant. And if you’re lucky, the true nature of the grant will (profitably) reveal itself to you.

Join me as I scrutinize the (still unfolding) stock grant “mystery” at The Trade Desk.

Note to Premium Subscribers: This write-up overlaps a previous premium write-up, but the section titled The “Truth” is Slowly Revealing Itself adds some new insights to the situation. Feel free to jump ahead.

Note: The Knives Out movie poster is great.

“Whodunit” Equity Grants

Every equity grant has a story. The vast majority of them are incredibly boring and predictable. The procedural boredom of equity grants causes most folks to tune out and defer to the Proxy Advisors.

Does ISS and Glass Lewis approve of the grant?

If yes, terrific, check-the-box and move on.

But every now-and-then, you’ll see an equity grant that reminds you there are individuals, with underlying motives and interests, driving these decisions.

If you’ve been following the corporate governance “dark arts” series, you already know it’s important to pay attention to changes in compensation:

Changes in compensation and grant timing are “tells” (to borrow a poker term) so it’s important to understand the “why” behind those changes. Usually the changes means nothing, but occasionally it hints to something very material.

“Whodunit” is about understanding the who and the why behind these changes.

When there’s a lot of chaos and volatility in a company’s stock (or in markets), stay alert and pay attention to any changes in compensation. Figure out (if possible) who is driving the change, and what possibly motivates them to make the change.

If you determine “profit” is a key motive, there may be an opportunity to trade alongside.

I believe The Trade Desk’s May 2020 equity grant to management is an intriguing “whodunit” situation.

The Trade Desk: Why Were Grants Moved to May 2020?

Full disclosure, The Trade Desk (ticker: TTD) is not the typical situation you’d hunt for “spring load” equity grants.

The stock is not considered “cheap” and the high valuation generally reflects the company’s attractive positioning within the high growth connected TV ad market, which is arguably approaching an inflection right now.

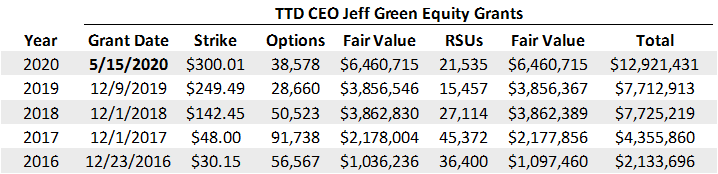

That said, The Trade Desk disclosed equity grants that caught my attention. Notably, management received sizable equity grants in May 2020:

Note: 2020 options fair value is estimated. Not all options and strike price captured.

I already covered the May grant extensively in a previous premium write-up, but long story short the company shifted executive equity grants to May (from December) and a week after withdrawing full year 2020 guidance due to COVID-19 uncertainty. The dollar amount of equity granted was also a sizable step-up.

This decision seemed very peculiar given the circumstances:

Remember, this is a sizable grant just 5 months after 2019 equity grants and after suspending 2020 guidance due to COVID-19 driven uncertainty. No company decides to move their grant cadence this dramatically without a specific reason (or opportunity).

I have no proof and don’t follow the company/industry closely, but that’s the kind of decision you’d see from a company that thinks things are turning for them or is trying to be opportunistic (i.e. thinks the equity is undervalued). (source)

The reasoning behind the grant’s timing remains a “mystery” (and we’ll probably never know the full answer), but I hypothesized that the equity grants signaled TTD was seeing positive business visibility/signs in May, and the Board may have been motivated to opportunistically grant equity before the market properly priced in improving trends.

Remember, the company had signaled uncertainty by suspending 2020 guidance, causing the stock to trade somewhat sideways in early May. Any improving trends was certainly not getting priced into the stock at the time of grant.

I don’t have any concrete evidence on any of this and am working off of hunches, but my hunches started looking pretty good (in my opinion) as the “truth” (i.e. industry data points) slowly revealed itself.

The “Truth” is Slowly Revealing Itself

Again, I can’t prove the grants are specifically tied to improving trends and business health, but I find it interesting that the shift in equity grants to May 15, 2020 aligns with a 40% increase in programmatic OTT/CTV ad spend during the week ending May 16:

Note: As measured by Pixalate

TTD has a real-time view of improving demand whereas investors typically rely on delayed reporting from third-party sources. This creates a window of opportunity to grant equity before the improving trend is properly accounted for and priced in the stock.

In addition to improving ad spend trends, we would later find out that competitor Adobe was exiting/de-emphasizing the ad market:

Our current advertising offerings consist of Advertising Cloud software solutions as well as Advertising Cloud transaction-driven solutions. We will continue to offer our Advertising Cloud software solutions to our Digital Experience customers, but this will not be an area of growth moving forward. CMOs want a single source of reporting and attribution for their advertising investment, which we can uniquely offer through the combination of Advertising Cloud and the Adobe Experience Cloud. We have decided to accelerate our previously stated strategy of eliminating the low-margin Advertising Cloud transaction-driven offerings. These offerings are no longer core to our overall value proposition of delivering on customer experience management nor contributing to our subscription-based bookings and revenue and in fact are extremely resource intensive. The impact of this strategic shift was evident in our Q2 revenue, cost of goods sold and gross margin results and will be factored into future Digital Experience targets. (source)

As outlined on our Q1 earnings call, our Advertising Cloud revenue was negatively impacted given the COVID-19 situation. As we saw the extent of the global decline in advertising spend, we made the strategic decision mid-quarter to cease pursuing transaction-driven Advertising Cloud deals. Together this resulted in a shortfall of approximately $50 million relative to our targeted Q2 revenue. A significant portion of the revenue from the transaction-driven Advertising Cloud offerings is recognized on a gross basis, with the related cost of media purchased recognized as cost of goods sold, resulting in low gross margin percentages for these offerings. (source)

While Adobe would not disclose their “strategic decision” until their June 2020 earnings call, TTD would have had real-time visibility into this decision as well.

Between improving ad spend trends and a well-capitalized competitor exiting the market, this is a lot of positive news to get excited about if you’re TTD. I can see why the Board would potentially be motivated to “reward” management with May 15, 2020 equity grants before this favorable news is priced in.

Signal or Noise?

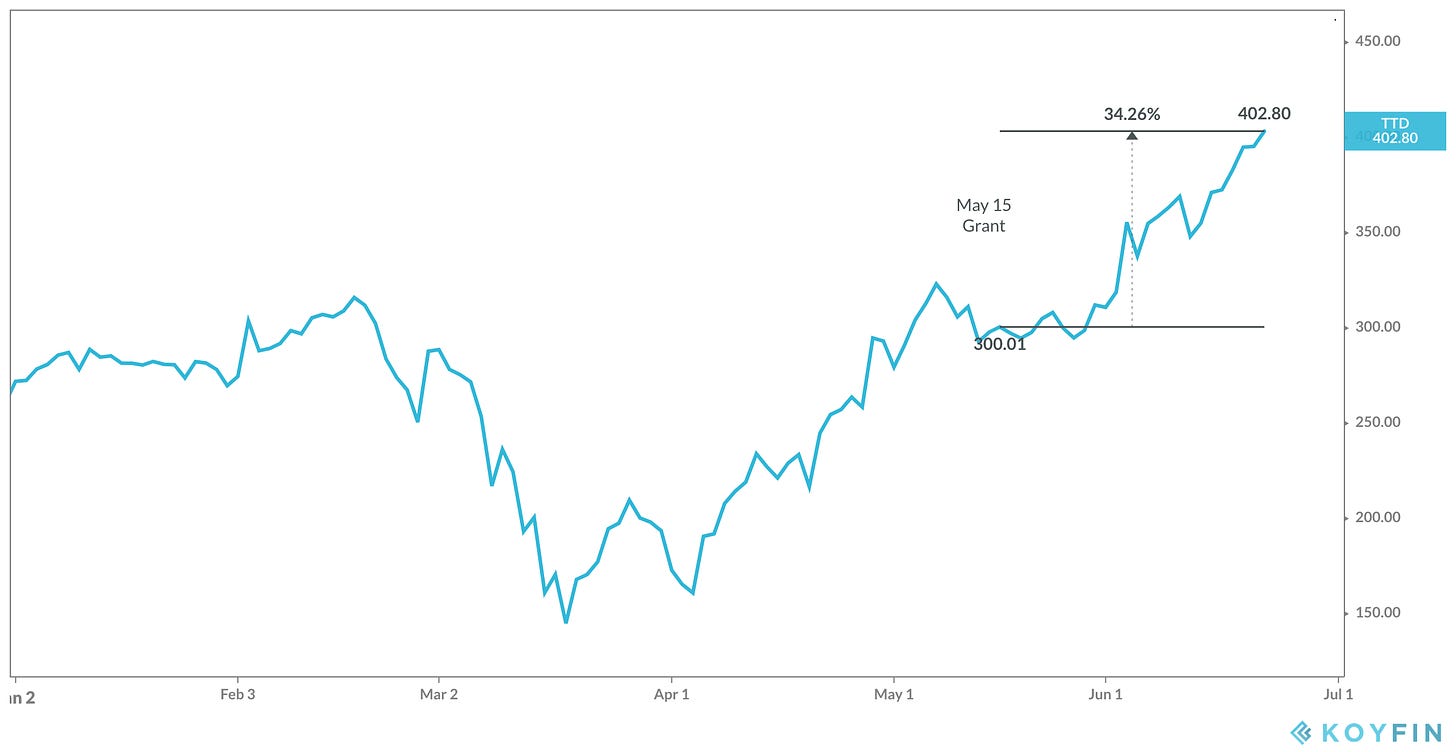

Overall, were the equity grants signal or noise?

With the benefit of hindsight and a 34% stock run since the May 15 grant, I believe the grants were a signal:

Yes, recent market momentum can also explain the strong stock run, but I do believe (stock price moves aside) the grants were made with the knowledge that the CTV ad market, and TTD’s positioning in that market, was strengthening. We’ll have a better idea of this when TTD reports 2Q 2020 results.

Regardless, these situations are fun to contemplate and forces you to put on your investor hat and your detective hat to connect-the-dots and determine “whodunit”.

The game is afoot! See you next time.