I’m going to share my disclosure-based rationale for why I believe insiders violated insider trading laws in regards to undisclosed Grail transactions and a few other perspectives, but it admittedly probably won’t matter all that much for the upcoming vote.

By this point, I suspect most voters have made up their minds and I’ve already covered such issues as Illumina insiders potentially:

Reaping a sizable undisclosed financial windfall in Grail.

Conflicting the President of a large Illumina shareholder by letting him invest in Grail’s Series B using an LLC (name) that is typically associated with a real estate investment firm.

Making intentionally misleading statements in their proxy statements (twice) regarding the undisclosed financial windfall issue I flagged to influence voters in a contested election.

Committing accounting fraud with their cost method treatment of their Grail investment that will likely require financial restatements.

These aren’t small “shadowy truths” I’m shining a light on. Individually, each issue is arguably a “boogeyman hiding in the shadows” and I’ve somehow stumbled upon a room full of them. It’s scenario I’d consider impossible a month ago, and yet, the company won’t directly address these “monstrous” discoveries that look more like imaginative fiction than factual claims rooted in reality.

If these “boogeymen” haven’t moved the needle, I don’t think this one will move it all that much as well. And to be fair, I completely understand the inertia relative to the ramifications if these findings are confirmed. It’s a lot to take in, even for me who did the leg work and analysis.

The punchline is this alleged insider trading “scheme” can’t really work without an “unrelated” third-party or parties being involved (in some way) to facilitate many of the transactions and reconcile with existing disclosures. I think I figured out how it generally “worked” and the potential parties involved, but I’ll leave to the reader to decide if I’m actually onto something or if I should refund premiums subscribers (again) and take a permanent vacation from this newsletter.

Warning, this is a long write-up and preemptive apologies for typos. I’m kind of over writing and editing this thing.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated. As previously disclosed, I submitted an SEC whistleblower tip regarding the Illumina situation.

The Illumina-Grail Saga

If you’re new to the Illumina-Grail saga that’s currently playing out, welcome! I’ve provided a summary of all the topics I’ve covered to-date that you can explore at your own pace at the end of this write-up (“End Notes”).

That said, I did my best to keep this write-up as “standalone” as possible.

Voters Should Focus on the Undisclosed Grail Shares

Note: If you need a refresher of Grail’s Post Series A ownership math, jump to “Refresher: Grail’s Post Series A Ownership Math”. It’s not that different from my initial napkin math in Malignant Governance, and adds additional my color/context to my thinking based on the disclosures. I think it’s complementary to this section.

This is probably the least crazy part of the write-up so let’s lead with it.

If there are voters “still on the fence” out there and haven’t casted their vote, I believe you should focus on reconciling this “simple” disclosure from 2016:

On a fully diluted basis, the Company holds a 52% equity ownership interest in GRAIL as of April 3, 2016.

Take a moment and really think about this disclosure and why reconciling this seemingly trivial fact from 2016 isn’t trivial and matters a lot today.

After a single $120 million Series A round, Illumina was diluted down to 52% equity ownership in Grail. That’s a remarkable amount of dilution and arguably a “tip of the iceberg” type disclosure for many current issues hiding beneath the surface that will have real - and material - future ramifications.

If you’re a large voter and have an audience with the company, you should consider asking this question:

How did Illumina’s Grail stake get diluted down to 52%, and who received the undisclosed equity interest, Mr. deSouza?

I genuinely believe, if Illumina refuses to directly and earnestly answer this question, shareholders are violating their own fiduciary duties supporting the company’s slate.

Again, voters can vote however they believe is appropriate, but they shouldn’t feign ignorance - and be surprised about the consequences - for endorsing folks that are arguably conducting themselves in an untrustworthy, “bad faith” manner on this issue.

Keep in mind Illumina participated in the Series A round and contributed 1/3 of the $120 million raised (i.e. $40 million for 40 million Series A shares), and separately received 112.5 million Grail shares executing a long-term supply agreement with Grail.

Despite these “dilution mitigating” transactions, Illumina went from (presumably) 100% pre-Series A ownership in Grail to 52% ownership on a fully diluted basis.

Illumina could easily answer this question and lay out the ownership math to shareholders to fill this “hole”, but they refuse to do that. Why?

I believe they won’t directly answer this question, because it is simply impossible to reconcile the post Series A ownership math without explicitly acknowledging insiders were somehow given a material undisclosed equity (interest) stake in Grail.

The company’s reluctance to answer this question only emboldens my belief insiders reaped a meaningful undisclosed financial windfall from Grail, and are (rightfully) concerned about the consequences of disclosing this.

One of the biggest consequences of acknowledging insiders received undisclosed shares is it arguably acknowledges insider trading violations were committed.

Insider Trading Violations

Note: Consider this section “big picture” and generalized commentary. The specific securities laws Illumina insiders violated via “insider trading” (or other violation) will need to be investigated and litigated (i.e. that’s outside my lane of expertise).

When discussing insider trading violations, I’m referring to the SEC’s recent commentary and framing of this topic:

“Insider trading” refers to the purchase or sale of a security of any issuer, on the basis of material nonpublic information about that security or issuer, in breach of a duty of trust or confidence that is owed directly, indirectly, or derivatively, to the issuer of that security or the shareholders of that issuer, or to any other person who is the source of the material nonpublic information.

The SEC uses the terms “insider” and “corporate insider” to refer to persons (other than issuers) for whom the purchase or sale of a security of any issuer, on the basis of material nonpublic information about that security or issuer, would represent a breach of a fiduciary duty or a duty of trust or confidence that is owed directly, indirectly, or derivatively, to the issuer of a security or the shareholders of that issuer, or to any other person who is the source of the material nonpublic information.

Basically, I’m not talking about “classic” insider trading that most investors are familiar with, but the more nuanced breach of fiduciary duty/trust/confidence that occurred as part of facilitating (mostly undisclosed) Grail transactions to insiders.

So when I think about where insider trading violations may have occurred in regards to Grail transactions, there are 3 periods stakeholders should pay attention to:

Grail’s Series A round in February 2016 where a material amounts of equity interests was potentially granted/given to undisclosed insiders.

Grail’s sizable $900 million Series B round in February 2017 where a material number shares held by undisclosed insiders may have been repurchased.

Summer 2020 and beyond when “spring-loaded” Grail equity awards were granted to insiders during acquisition talks with Illumina and also after the deal was announced.

These are the periods I can make a disclosure-based argument insider trading violations potentially happened, but there could be material violations elsewhere, especially after February 2017 when Grail was treated as a cost method investment and “unrelated” entity.

Before I get into these 3 “insider trading” periods, I’m going to provide some, okay a lot of, background - highlighting specific disclosures - that informed my thinking so it doesn’t feeling like I’m arbitrarily “jumping to conclusions” when discussing my “insider trading” perspective.

You’re more than welcome to skip all of this and jump straight to “Grail’s 2016 Series A Round”. Fair warning, the explanation might read cursory and feel like I’m “jumping to conclusions” if you’re not familiar with background I provide leading up to those perspectives.

How Did the Insider Trading “Scheme” Potentially Work?

I want to be very clear. I don’t definitively know how the insider trading scheme specifically “worked”. We can rely on disclosures and refer to other “playbooks” to get a conceptual understanding of the alleged “scheme”, but we won’t know with any certainty how it actually worked until the Board and/or regulators pursue an investigation and force the issue.

Based on the existing disclosures and my analysis of those disclosures (and “holes” in the disclosures), I’m aware that:

Arch Venture Partners co-led the $125 million Series A round with Illumina.

Illumina Ventures was formed in 2016 as an unrelated, independent entity with Illumina committing $100 million. Illumina Innovation Fund I, L.P. discloses this $100 million commitment on April 18, 2016 shortly after Grail’s February 2016 Series A round, and Illumina explicitly calls out and says this fund and and its subsidiaries, successors, and partners are not an “Affiliate” of Illumina in their Supply and Commercialization Agreement with Grail.

Illumina also explicitly calls out and says Helix Holdings I, LLC, and and its subsidiaries, successors, and members are not an “Affiliate” of Illumina in their Supply and Commercialization Agreement with Grail.

From Q1 2019 to Q2 2020, Illumina discloses one of their non-marketable equity investments is a Variable Interest Entity (VIE) where they’re “not the primary beneficiary” which is later disclosed to be Grail in Q3 2020 following the Illumina’s announced acquisition. Illumina doesn’t disclose the assumptions and agreements that drive the VIE status and “not the primary beneficiary” status. There’s arguably a big “can of worms” to be opened here.

A material amount of equity (interests) needed to go to undisclosed insiders around Grail’s Series A round to make the disclosed ownership math “work”.

A material amount of shares - presumably held by insiders - were repurchased around Grail’s Series B round to make the ownership math “work” and reconcile with known facts/disclosures.

Insiders arguably “spring-loaded” equity awards during and after Illumina’s acquisition talks and deal announcement in 2020.

Illumina potentially committed “fraud by omission” to arguably ensure Grail was treated as a “cost method” investment and Grail transactions wouldn’t be disclosed as “related party transactions”.

Overall, as I dug into how the potential “scheme” worked, it’s honestly hard for me to say this was the act of 1 or 2 “rogue actors”. We’re talking “private” Grail shares after all, and it takes real planning, coordination, and thought to pull this off. There are simply too many (undisclosed) agreements and parties intertwined and nested together like a Russian Doll to make that feasible. If one party is “going down”, odds are it’s taking down a lot of other parties which may explain Illumina’s current “behavior” in their proxy fight with Carl Icahn.

Again, this is my “working conclusion”, but hopefully you’ll align with my perspective after this reading.

Again, the punchline is this alleged insider trading scheme can’t really work without an “unrelated” third-party or parties being involved (in some way) to facilitate many of the transactions and reconcile with existing disclosures.

I put “unrelated” in quotes, because an argument could be made the third-party (or parties) should arguably be treated as a “related” entity, but we’re conveniently not provided the key facts and terms that drive the company’s decisions to treat these entities as “unrelated” and/or “unaffiliated” that would warrant “related party transaction” disclosure.

I touch upon this in my original write-up, Malignant Governance, but entities like Arch Venture Partners and Illumina Ventures need to be seriously scrutinized here due to the intertwined and nested Russian Doll dynamics of Grail’s governance, voting, and selling agreements. I really don’t think this alleged scheme “works” without one, both, or a mix of other “third-parties” being involved in some way, which potentially includes Helix Holdings I, LLC.

Jay Flatley and The Flatley Family Trust

I’ve already pointed this disclosure out in previous write-ups, but Illumina simply refuses to explain how or why Mr. Flatley was entitled to be a Grail Observer:

Mr. Flatley currently serves as an observer of the board of directors of GRAIL in his personal capacity.

Source: 2018 Proxy

As a reminder, venture capital funded startups don’t exactly give these Observer seats away to anyone, and you typically need an ownership stake or be affiliated with an ownership group to have this Observer “right”. Also, if it turns out Mr. Flatley did have equity interests through other vehicles, this “omission” in their response to the questions and issues I’ve raised regarding undisclosed Grail transactions is arguably an SEC violation:

None of Illumina’s directors involved in either the decision to sign or the decision to close the GRAIL acquisition – including our former CEO and Executive Chairman Jay Flatley, our current CEO Francis deSouza and each of Illumina’s current directors – has ever held any equity interests in GRAIL.

Since Illumina does not explicitly disavow Mr. Flatley may have held Grail equity interests in other vehicles (outside his “person”), this offers a guidepost on how the insider trading “scheme” potentially worked and where we should be looking.

A simple search of “Jay Flatley” and “Arch Venture Partners” (unsponsored shoutout to BamSEC), we see that Mr. Flatley is a signatory of Denali Therapeutics’ Investors’ Rights Agreement via THE FLATLEY FAMILY TRUST.

This disclosure is particularly fascinating to me given the Investors’ Rights Agreement is dated May 2015 which pre-dates Grail’s Series A round in February 2016 and includes signatories/entities who would later be involved at Grail, including Grail CEO Hans Bishop and ARCH Venture Fund VIII. Also, the disclosures on these documents are day and night to what I find for Grail.

It was also this “discovery” that I realized I could potentially use Denali Therapeutics and other publicly filed Arch Venture Partners investments as a “reference” to try and unpack what may have happened at Grail.

For example:

Mr. Flatley facilitated Denali transactions through The Flatley Family Trust.

We also see Denali entered into a convertible promissory note with a “related party” (a stockholder) that was later converted into A-1 preferred shares.

In January 2015, the Company entered into a convertible promissory note with a related party, a stockholder of the Company. The principal amount of the promissory note was $5.0 million at a fixed interest rate of 8.0%, which was repayable in January 2016. Interest of $0.1 million accrued on the note and was recognized within interest income (expense), net in the consolidated statement of operations and comprehensive loss in the year ended December 31, 2015. The entire amount due, including interest, was converted into 5,109,589 shares of Series A-1 convertible preferred stock in May 2015

I can’t prove Mr. Flatley used The Flatley Family Trust to facilitate Grail transactions, but I certainly have an actual disclosure that shows me he has used this vehicle for private company transactions, and I’m now also aware there are ways to transact shares (i.e. convertible promissory note, etc.) that could potentially give Illumina insiders an avenue to avoid disclosure of Grail transactions.

When reviewing Grail’s 2016 Equity Incentive Plan, related documents, and bylaws we see that:

Restrictions (i.e. prior written consent by Grail) on transferring shares shall not apply to the transfer of any or all shares to a trust for the benefit of Plan Stockholder or Plan Stockholder’s Immediate Family. It’s considered an “Exempt Transfer”. (Grail Bylaws)

Exempt Transfers shall be exempt from this Right of First Refusal (i.e. Grail or its assignee(s) shall not have a right of first refusal to purchase the Shares). (Grail Bylaws)

Option may not be transferred in any manner other than by will or by the laws of descent and distribution, and, with respect to NQSOs, by instrument to a testamentary trust in which the options are to be passed to beneficiaries upon the death of the trustor (settlor) or a revocable trust, or by gift to “immediate family”. (Stock Option Agreement)

All Awards and any shares acquired pursuant to the exercise of any Awards, whether vested or unvested, shall not, without the prior written consent of the Board, be sold, assigned, transferred, pledged or otherwise encumbered by the person to whom they are granted, either voluntarily or by operation of law, except by will or the laws of descent and distribution. (Grail 2016 Equity Incentive Plan)

Now, these could be “standard” terms (probably are), but it appears to me utilizing The Flatley Family Trust would be the ideal vehicle for Mr. Flatley to transfer his Grail equity interests without requiring prior company approval and not expose the transferred shares to “right of first refusal”.

Given this “exempt transfer” provision, I also don’t think it’s a “surprise” the insiders who were required to disclose Grail equity interests have many of those shares housed in a family trust vehicle.

Arch Venture Partners’ Co-Founding Playbook

A personal investment heuristic of mine is most sophisticated “schemes” aren’t bespoke and conjured “out of the blue”. There’s too much “margin of error” doing that, and the more “sensible” presumption is there’s a proven “risk adjusted” blueprint or playbook somewhere that’s being relied upon. This is where studying Arch Venture Partners and their co-founding “playbook” is relevant and interesting:

Firms usually provide more than capital. What is your firm’s “value-add?”

ARCH is quite unusual among venture firms in that we often help co-found our portfolio companies. This can include creating the business plan, establishing the first office, recruiting the team, consolidating and licensing the intellectual property from multiple sources, recruiting board members and advisors, and assembling the initial investment syndicate among other duties. As the company matures, we support the company from our board seat with guidance on tactical and strategic decisions, introductions to customers, suppliers, and partners, reviews of significant business agreements and transactions, syndication for new rounds of financing, and strategy and planning for the exit, either a trade sale or an initial public offering of stock.

If Illumina insiders received undisclosed shares and reaped an undisclosed financial windfall, it’s really hard to ignore the reality that Arch Venture Partners is quite hands-on with their investments and an influential party in Grail. I feel it’s pretty sensible and obvious to ask:

What role - if any - did Arch Venture Partners play in these alleged undisclosed Grail transactions to Illumina insiders (past and present)?

Now, it’s one thing to have a “hunch” Arch Venture Partners might be involved facilitating Grail transactions for insiders, but are there any disclosures or other signs to support this notion?

The only explicit disclosure of Arch Venture Partners facilitating any kind of transaction on behalf of insiders is the purchase and transfer of 100,000 Series A shares to Dr. George Golumbeski:

In 2016, ARCH Venture Fund VIII, L.P. transferred 100,000 shares of our Series A redeemable convertible preferred stock to George Golumbeski, Ph.D. Dr. Golumbeski is a venture partner at ARCH Venture Partners and also served as our President and as one of our directors from August 2018 to August 2019.

As noted previously, Dr. Golumbeski is party to Grail’s Investors’ Rights Agreement (IRA), but isn’t shown as a signatory. This makes sense given the Series A shares were purchased and transferred by Arch Venture Partners.

This could also potentially signal they facilitated similar “buy-and-transfer” type transactions for other parties beholden to the IRA who aren’t signatories, but that’s currently speculation. That said, we do know Arch was reimbursed for “certain expenses incurred by legal counsel to the purchasers of our Series B redeemable convertible preferred stock” that other Grail insiders - who participated in the Series B - don’t have a similar reimbursement disclosure.

While there’s no “smoking gun” regarding Arch Venture Partners facilitating Grail transactions beyond the 100,000 Series A shares “bought-and-transferred” to Dr. Golumbeski, we do know there’s precedent of them using ARCH Venture Fund VIII, L.P. and ARCH Venture Fund IX Overage, L.P. (i.e. the vehicles used to invest in Grail) to facilitate/structure transactions (i.e. stock subscription agreement, promissory notes, etc.) and moving shares between Arch investment vehicles elsewhere.

Vir Biotechnology:

In April 2016, we entered into a stock subscription agreement pursuant to which we issued 444,444 shares of our common stock at a price of $0.00000002 per share to ARCH Venture Fund VIII, L.P., or ARCH VIII. In September 2016, ARCH VIII transferred all such shares to ARCH Venture Fund IX, L.P., or ARCH IX.

In June 2016, we entered into a promissory note, or the ARCH Loan, with ARCH VIII. Under the terms of the ARCH Loan, we drew down an aggregate of $0.3 million from ARCH VIII, with an interest rate of 5% per annum. The ARCH Loan was repaid in September 2016.

In January 2017, we issued two promissory notes to Dr. Scangos, our President, Chief Executive Officer and a member of our board of directors, and Vicki Sato, Ph.D., Chairman of our board of directors, for principal amounts of $2.9 million and $0.2 million, respectively, with an interest rate of 1.97% per annum, to allow Dr. Scangos and Dr. Sato to purchase 3,338,222 shares and 286,133 shares of our restricted stock, respectively, pursuant to their respective restricted stock purchase agreements.

We also see precedent of Arch Venture Partners’ companies repurchasing “early” granted/given shares from insiders and structuring other transactions that may be relevant references for undisclosed Grail transactions. Interestingly, Dr. Klausner is a big holder a presence at Grail.

Lyell Immunopharma:

Prior to the adoption of the 2018 Plan, the Company issued 20,450,000 of founder’s RSAs to certain employees, directors and consultants.

Source: Lyell Immunopharma S-1

In August 2018, we issued and sold a convertible promissory note in the principal amount of $500,000 to ARCH Venture Partners which converted into 274,751 shares of Series A convertible preferred stock in connection with the Series A convertible preferred stock financing

Source: Lyell Immunopharma S-1

In March 2020, we repurchased 546,806 shares of its Series A convertible preferred stock from Richard D. Klausner and Rachel D. Klausner, Trustees of the Klausner Family Revocable Trust of May 8, 2014 at the then estimated fair value of $7.76 per share for a purchase price of $4.2 million.

In March 2020, we repurchased 2,032,166 shares of its common stock from Richard D. Klausner at the then estimated fair value of $5.81 per share for a purchase price of $11.8 million.

Source: Lyell Immunopharma S-1

Apologies for the “wall of quotes”, but hopefully you get my point. There’s plenty of other Arch investments to look at for these sort of structures and transactions, but featuring all of them is overkill.

Simply put, Arch Venture Partners’ playbook is (in my opinion) generally quite aggressive (which isn’t necessarily “bad”, especially when properly disclosed and explained) when it comes to transacting and facilitating shares with/for insiders. It’s all disclosed and out there for anyone to see. And yet, disclosures involving Arch and Grail transactions are non-existent. Maybe this the rare instance where they weren’t involved transacting shares, but that’s peculiar to me given the propensity of both Illumina and Grail to not disclose information on essential issues/information regarding Grail transactions.

A General Disclosure-Based Framework

I know I’ve thrown a lot at you, and there’s still more to go, so let’s take a step back and walk through a general disclosure-based framework on how this alleged insider trading “scheme” may have “worked”.

Again, I don’t definitively know how the scheme specifically worked, but we can still reference the known disclosures, “playbooks” of those involved, the rules as I know them, and first principles to mock up a general framework.

The “big picture” framework relies on a simple-ish - albeit convoluted - alleged narrative:

Insiders accumulated undisclosed Grail shares and generated an undisclosed financial windfall by working with - or around - known disclosure rules that informed how to facilitate, distribute, and time transactions so they wouldn’t require explicit disclosure. This would require the coordination, control, and planning of multiple “unrelated” parties that worked together to execute these undisclosed transactions.

A key “risk factor” - aside from insiders aware of the scheme having a moral conscience and speaking up - was the various agreements and requirements needed to ensure “control” could turn these “unrelated” parties transactions into “related” parties transactions, but that can be mitigated - or circumvented - through careful planning of well-timed departures, transactions, and non-disclosure of key terms to ensure transactions would tilt towards being undisclosed and take advantage of nuanced “judgement” guidelines and known accounting “presumptions” to avoid detection.

These decisions could be considered fraud (by omission) and/or see pushback so it also required allocation of shares to key decision-makers to ensure/encourage collective compliance and buy-in to the scheme. Put another way, mutually assured destruction if anyone tries to “out” it.

I know, this alleged narrative sounds crazy and unbelievable to read, but this is the “story” the disclosures were telling me when I started connecting-the-dots. You have to admit it’s pretty hard for me - or anyone - to “make up” this convoluted narrative - out of the blue - with this kind of specificity. It’s the kind of narrative that’s stumbled upon in the disclosures and crudely pieced together, and not something that’s drafted on a blank page with a clean - and understandable - story arc guiding the narrative.

With this in mind, let’s unpack the key elements that make this narrative “work” and identify the disclosures, playbooks, rules, etc., that form the framework.

Illumina’s Response to Malignant Governance

I’ll be honest. I don’t think I would have really figured this story out without the help of Illumina’s responses to my original write-up Malignant Governance. In fact, I’m half-convinced someone wrote Illumina’s “responses” to intentionally help me figure out this story. If true, someone is an unsung hero.

I’ve already gone into detail about the various signals I extracted in previous write-ups so I’m going to summarize key takeaways relevant to the framework:

Most of the Grail shares were likely transacted through vehicles that insiders had some kind of interest in, but didn’t require disclosure.

It was likely the “type” of equity given to insiders was predominantly stock awards from Grail equity plans.

Based on cherry-picked timelines and implied recusal, an unknown number of Board members (past and present) likely received Grail equity interest.

Jay Flatley’s non-employee Chair status in 2020 may be important.

This establishes the type of equity (i.e. stock awards), where it came from (i.e. equity incentive plan), where it was potentially housed (i.e. investment vehicles and/or third parties), and who received it (i.e. executives and directors). It also indicates multiple parties would need to be involved and/or sign-off on the transactions (i.e. third parties, Grail’s Board, etc.).

Grail’s 2016 Equity Incentive Plan

Given the implied “facts” from Illumina’s response, it’s obvious reviewing Grail’s 2016 Equity Incentive Plan, the accompanying stock option and RSU forms, equity grant/compensation disclosures in Grail’s S-1, and any other equity compensation related disclosures are essential:

The plan allows for the granting of “Unrestricted Stock” and not subject to vesting. Grail doesn’t seem to disclose who received these type of shares, or explain what they’re for, but reviewing other equity incentive plans involving Arch Venture Partners these shares are usually given to participants “in recognition of past services or for other valid consideration and may be issued in lieu of cash compensation due to such participant”.

RSUs have a clawback provisions whereas stock options don’t meaning the undisclosed equity awards were likely options if you assume insiders are aware their activity might be “crossing the line”.

The stock options can be pledged (under specific conditions), purchased with promissory notes, and are to be held in escrow designated by Grail.

The “fair market value” is determined by the Board.

Reviewing other disclosures and documents, including former Grail CEO Jeff Huber’s transition agreement, the timing for when shares are delivered looks fluid and it doesn’t appear there are many disclosures in regards to purchasing/acquiring shares through the equity incentive plan which is probably why stock awards is the preferred means to facilitate transactions.

After reviewing the incentive plan and terms, we can see the story coming together with shares potentially being given “in lieu of cash”, the escrow mechanics requiring the shares be held at a designated third-party, Arch Venture Partners’ influence and presumed sign-off given their involvement on Grail’s Board, the prospects of using promissory notes and/or loans to facilitate transactions, and how the “fluid” timing of granting awards can help with staying “within the borders” of various ownership thresholds for related party disclosures and accounting requirements.

Illumina’s Pledging, Loan, and Compensation Disclosures

Reviewing Illumina’s various compensation and governance documents, there are a few interesting disclosures that would seem to align with what we’re seeing in Grail’s equity plan:

I can’t seem to find a disclosed “no pledging” policy until the 2018 Proxy.

Non-employee directors may receive shares in lieu of cash.

The October 2014 bylaws allow Illumina to “lend money to, or guarantee any obligation of, or otherwise assist any officer or other employee of the corporation or of its subsidiary, including any officer or employee who is a director of the corporation or its subsidiary”, including pledging shares.

This potentially allows Illumina to help insiders acquire Grail shares and structure transactions through loans, pledging, and receive shares in lieu of cash.

Arch Venture Partners Equity Transaction Playbook

I’m not going to rehash the previous section, but we’re aware Arch Venture Partners have transacted shares, used promissory notes, and moved shares between funds at other investments. We also know they’re on the Board of Grail which means undisclosed Grail transactions would require their sign-off and/or done with their awareness.

Grail’s Variable Interest Entity (VIE) Status

I’m keeping my comments on Grail’s VIE somewhat abbreviated given the length of the write-up, but I definitely went down the rabbit-hole here.

For instance, look at this Q1 2019 Illumina disclosure regarding a VIE:

One of our non-marketable equity investments is a VIE for which we have concluded that we are not the primary beneficiary, and therefore, we do not consolidate this VIE in our consolidated financial statements. We have determined our maximum exposure to loss, as a result of our involvement with the VIE, to be the carrying value of our investment, which was $189 million as of March 31, 2019 and December 30, 2018.

When you follow that $189 million VIE to more recent filings, it turns out to be Grail.

I suspect you intuitively sense Illumina’s decision not to explicitly call out Grail by name in Q1 2019 and not explicitly identifying them until Q3 2020 when Illumina announced the Grail acquisition is a bit of a red flag, but there are too many non-disclosure to really determine how problematic - or not - it is.

Suffice to say all the underlying assumptions which lead Illumina to treat their investment in Grail as a VIE and “not the primary beneficiary” gets into some important questions such as the voting and governance agreement in place, who’s potentially the “primary beneficiary”, the determination of unrelated/unaffiliated parties, etc. that remain undisclosed and unanswered. I suspect the various undisclosed agreements and terms - which are nested together - are core to cohesively facilitating undisclosed Grail transactions.

We also know, as noted in my original write-up, because Grail was treated as a consolidated VIE when it was formed, Illumina wasn’t required to disclose equity compensation to named executive officers and directors that may have received Grail awards.

Affiliates and Related Parties

How affiliates and related parties are determined, and the lack of clear disclosures on this topic, is arguably the heart of the entire “scheme”.

As previously mentioned, Illumina Ventures and Helix are explicitly excluded as Affiliates of Illumina in Grail’s Supply and Commercialization agreement. In Illumina’s incentive plan the Board has authority to determine the time or times at which “Affiliate” status is determined. There seems to be a lot of discretion on how a VIE determines its affiliates. Further, I suspect Jay Flately deciding to be a non-employee Chairman in 2020 may have been partly informed/driven by these affiliate dynamics.

Further reinforcing how nuanced and judgement-based who is - or isn’t - an affiliate, I came across an interesting blurb regarding the challenges of defining affiliates in shared ownership arrangements:

Definition of Affiliate. For purposes of Section 13(r), the term “affiliate” is defined by reference to Exchange Act Rule 12b-2. Rule 12b-2 defines “affiliate” by reference to another defined term, “control.”1 Because the existence of control often depends on facts and circumstances, application of this definition may create challenges for companies involved in joint ventures and other shared ownership arrangements.

Source: Weil

Basically, it seems there’s a lot of leeway and discretion to take advantage of these affiliate and related party rules given there’s no bright line, and without specifically knowing the terms and agreements driving these decisions, we really don’t know how within the boundaries - or not - Illumina and Grail are in these determinations.

From the existing disclosures, I’ve already made a case the company is “out of bounds” and potentially committed Fraud by Omission on these decisions.

General Disclosure-Based Framework

I certainly written a lot to share this very basic framework, but here it is:

Grail was formed as a consolidated VIE meaning Illumina insiders didn’t need to disclose equity granted to them from Grail.

Equity interests were primarily housed at third-parties and/or investment vehicles that wouldn’t necessarily require disclosure.

Loans and other purchase agreements were used to structure transactions through third parties to avoid disclosure.

Voting, right of first refusal, and co-sale agreements ensured cohesion on moving and selling shares in a way that allowed transactions, financial windfalls, and equity interests to remain undisclosed.

Non-disclosure of key terms and rights in aforementioned agreements ensured parties involved weren’t scrutinized as being “related” and/or “affiliated” and thus requiring disclosure.

Knowing all of this and the disclosures I’ve laid out, go re-read the alleged narrative I wrote at the beginning of this section and let me know if 1) I need to get off this crazy narrative train or 2) you’re hopping aboard.

Refresher: Grail’s Post Series A Ownership Math

I’ve explained A LOT and much of it is crazy to contemplate, but don’t forgot the genesis of all of this rabbit-hole dive is a very simple disclosure:

On a fully diluted basis, the Company holds a 52% equity ownership interest in GRAIL as of April 3, 2016.

To reconcile the post Series A ownership math with known disclosures, a lot of shares had to go somewhere and I suspect it went to Illumina insiders:

This table is slightly different from my original back of the envelope calculation, but I think better aligns with the explicitly known disclosures (i.e. ownership) and the mosaic of Grail-related disclosures I reviewed:

I think the “common” is a of mix of restricted and unrestricted shares.

I think the “dilution” is likely options with and I’m guessing $0.15 strike.

Again, the composition and strike price is guesswork informed by a mosaic of disclosures, but the “ownership math” can’t be disputed and Illumina won’t directly address it.

Where things get a bit weird and pulled me further into the rabbit-hole is this disclosure:

The $9 million cash contribution actually fits perfectly with the post Series A ownership math assuming the 60 million “dilution” shares are options with $0.15 strike. The “issue” is this $9 million cash contribution needs to be tied -and flow - to Illumina’s other VIE, Helix, to reconcile with the “fair value” Helix’ redeemable noncontrolling interests. This would, in turn, imply Helix was used to facilitate Grail transactions if you assume the $9 million cash contribution that’s flowing to Helix is intended for Grail shares.

I swear I’m not trying to do any of this on purpose.

Swamp Thing: Helix Holdings I, LLC

I’ll be the first to admit a real consequence of being stuck in the swampy footnotes of Illumina’s Grail-related disclosures (and non-disclosures) is you start seeing things which objectively shouldn’t be there - or even exist - but you can’t totally dismiss the idea you just saw Swamp Thing carrying Jay Flatley’s undisclosed Grail shares to his family trust.

In this case, Swamp Thing is Helix Holding I, LLC.

Maybe I’m inhaling too much swamp gas and I’m hallucinating, but hear me out.

Helix was formed in August 2015, a month prior to Grail’s formation in September 2015, with Illumina, Warburg Pincus, and Sutter Hill Ventures collectively funding it with $100 million.

Interestingly, Sutter Hill Ventures would also participate in Grail’s Series A with Sutter Hill’s Jeff Bird involved in both Helix and Grail, and Warburg Pincus has a previously relationship with Grail CEO Hans Bishop where he was an Executive in Residence.

Also, Jay Flatley served as Chairman of Helix Holdings I LLC, and we know from Grail’s Supply and Commercialization Agreement that Helix Holdings I, LLC, and and its subsidiaries, successors, and members are not an “Affiliate” of Illumina.

Does this mean Jay Flatley was generally not considered an Illumina “Affiliate” by Grail? Remember, Jay Flatley was a Grail Observer “in his personal capacity”.

Is it possible Jay Flatley kept some of his Grail equity interests at Helix and any way?

When I reviewed Illumina’s disclosures on redeemable noncontrolling interests activity, it’s implied most of the activity from December 28, 2014 to December 31, 2017 is flowing through Helix based on the reported “fair value of the redeemable noncontrolling interests related to Helix” which closely approximates the year-end balance for redeemable noncontrolling interests:

The “issue” I have is a lot of these disclosed line items seem to better align - and makes more sense to me with Grail based on the mosaic of Grail-related disclosures and work I’ve done trying to understand and figure out undisclosed Grail transactions, especially the line items “cash contributions”, “escrow”, and “adjustment up to the redemption value”.

Again, maybe I’m inhaling too much swamp gas, but we do know Grail option awards needed to be “held in escrow” designated by Grail, and we literally see “held in escrow by third party” activity that is implied to be tied to Helix.

Also, based on the disclosures, we know there are vested Grail stock awards included in redeemable noncontrolling interests on the balance sheet from Q1 2016 to Q4 2016:

In accordance with GRAIL’s Equity Incentive Plan, the Company may be required to redeem certain vested stock awards in cash at the then approximate fair market value. The fair value of the redeemable noncontrolling interests is considered a Level 3 instrument. Such redemption right is exercisable at the option of the holder of the awards after February 28, 2021, provided that an initial public offering of GRAIL has not been completed. As the redemption provision is outside of the control of the Company, the redeemable noncontrolling interests in GRAIL are classified outside of stockholders’ equity on the accompanying consolidated balance sheets.

Source: Illumina’s 2016 10-K

Maybe the amount is so trivial it doesn’t move the needle, which doesn’t seem plausible given the “ownership math”, but it’s not that farfetched to me there were Grail equity awards housed at Helix.

To add further intrigue, Illumina also extended a line of credit and issued debt to Helix during this particular timeframe. Disclosures per Illumina’s filings:

Q2 2016: [First two quarters of 2016] $2.0 million in proceeds from issuance of debt related to an outstanding line of credit held by Helix.

Q3 2016: [First three quarters of 2016] $5.0 million in proceeds from issuance of debt related to an outstanding line of credit held by Helix.

Q4 2016: As of January 1, 2017, the accompanying consolidated balance sheets include $1.3 million and $3.1 million in current and long-term debt, respectively, related to an outstanding line of credit held by Helix.

Q1 2017: As of April 2, 2017 and January 1, 2017, the accompanying condensed consolidated balance sheets include $1 million and $3 million in current and long-term debt, respectively, related to an outstanding line of credit held by Helix in each of the respective periods.

Q3 2017: Additionally, $7 million was used by Helix to repay financing obligations [in the first three quarters of 2017].

Q4 2017: Additionally, $9 million was used by Helix to repay financing obligations [in 2017].

Q4 2018: Additionally, $4 million was used by Helix to repay financing obligations [in 2018].

Q1 2019: Additionally, $1 million was used by Helix to repay financing obligations [in Q1 2019].

Again, these could all be legit Helix debt transactions and have nothing to do with undisclosed Grail transactions, but given the mosaic of Grail-related disclosures and analysis (i.e. swamp gas) I’ve walked you through, you can’t blame me for seeing Swamp Thing. I feel like I have some legitimate standing to ask why it’s necessary for Illumina to receive $5 million in proceeds from the issuance of debt to newly formed Helix in 2016 given what we know about Grail options, housing those awards in escrow, and the ability to use promissory notes to pay for them.

Insider Trading Grail’s 2016 Series A Round

Based on Grail’s Series A ownership math, we know a significant amount of Grail equity interest needed to go to insiders somehow.

If you believe my analysis, that relies on a mosaic of Grail-related disclosures, both Illumina Directors and Executive Officers received (or were soon to receive) Grail shares while executing a favorable Supply and Commercialization Agreement with Grail that would arguably benefit them and the future value of their shares.

The Series A round was co-led by Illumina and Arch Venture Partners which brings into question just how arm’s length the valuation and negotiation process was, and how much of an influence these undisclosed Grail had.

Further, Arch Venture Partners’ co-founding model, history of aggressive equity grants/transactions to insiders - including Illumina insiders in other deals- and presumed sign-off of these undisclosed transactions, makes it’s difficult for me to say they were truly an independent, third-party investor when “fair market value” was set.

It’s hard for me to see a path where Illumina can reasonably argue insiders didn’t break their fiduciary duties, weren’t self-dealing, and committing insider trading violations on these transactions when they’ve never disclosed - nor acknowledged - these undisclosed transactions. There should have been some duty to Illumina shareholders to explain the steps takes to mitigate conflicts of interest and ensure a fair, arm’s length negotiation was done. More importantly, they didn’t explain nor justify why so many shares should go to insiders vs. being retained by Illumina.

It’s hard to take any defense seriously when they won’t even admit there are undisclosed Grail shares that went to insiders.

Insider Trading Grail’s 2017 Series B Round

The conflicts arising from insiders receiving undisclosed shares at the Series A carries over to Grail’s Series B round where Illumina shareholders can’t be confident the various voting, right of first refusal, and co-sale agreements were negotiated with Illumina’s best interest in mind, and, instead, used to benefit insider interests.

I’ve already discussed in Malignant Governance the possibility a significant amount of Grail’s Series B round was used to repurchase insider shares based on the known disclosures and ownership math.

To make the ownership math work, I guesstimate Grail would need to repurchase ~129 million shares or $519 million at $4.0085 per share. To make the ownership math work AND have it align with the $52 million in cash that was deconsolidated from Illumina’s balance sheet, an incremental 98 million shares or $395 million at $4.0084 per share needs to be repurchased.

Again, these transactions are at high risk of violating the fiduciary duty owed to Illumina’s and Grail’s interests, and is rife with conflicts and self-dealing given the biggest beneficiary of Grail repurchasing shares using Series B proceeds are the insiders themselves. Illumina shareholders are, again, given no disclosures of these potential insider transactions and how the conflicts were managed when deciding how many shares should be repurchased and whose shares were purchased.

Also, this dynamic creates real questions regarding insiders preventing Illumina from pursuing its best interests which may have involved selling more shares or acquiring the company in 2017.

Spring-Loading Equity: Summer 2020 and Beyond

Finally, when reviewing the background of the transaction regarding Illumina’s acquisition of Grail, we see there’s an “open business point” during the latter parts of deal negotiations where “consideration payable with respect to GRAIL Equity Awards” is a called out topic:

The GRAIL Board continued to hold meetings, with members of GRAIL senior management and representatives of Latham and Morgan Stanley also in attendance, on each of September 15, September 16, September 17 and September 18, 2020 to discuss the drafts of the Merger Agreement and other transaction documents exchanged between Latham and Cravath and the relevant open business points, including the collar structure, consideration payable with respect to GRAIL Equity Awards, post-closing bonus payments to GRAIL employees and certain material terms of the CVR Agreement. On September 18, 2020, the GRAIL Board instructed GRAIL management to contact certain GRAIL stockholders who would be requested to deliver support agreements with respect to the transaction with Illumina.

Given the existing agreements in place, getting the Board to agree to a deal would trigger drag-along rights that would ensure the offer would be approved. This was essentially a “pay to play” type situation since the “key” to winning the deal was paying an equity award “premium” to insiders. I’d be curious how Goldman Sachs advised Illumina on that situation.

I’ve already discussed Illumina seemingly not negotiating greater restrictions on dilution after the deal was announced and how Grail aggressively granted 11.6 million RSUs ($97.3 million “fair value”) as a result.

Further, we know Grail insiders were also aggressively granting options to themselves after Illumina approached the company regarding an acquisition and were floating takeout prices.

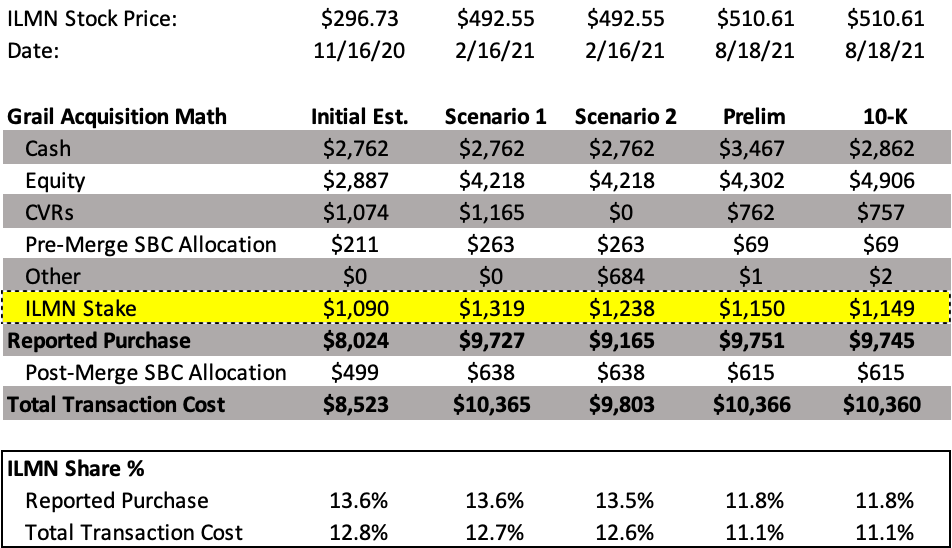

We see the consequences of this excess dilution and spring-loading behavior in Illumina’s muted incremental gain in “fair value” on the deal despite Illumina’s stock appreciating meaningfully from the deal announcement. All the incremental value of Illumina’s rising stock price goes to “equity” which likely captures unvested SBC (as of November 2020) that vested by the time the deal was closed in August 2021:

Once again, Illumina shareholders are impacted by this self-dealing both on the total transaction cost paid to Grail, and the “fair value” which would accrue to Illumina’s stake despite Illumina’s appreciating stock price.

One thing I’m curious about is it’s unclear to me how Grail was calculating and accounting for the “fair value” of these insider equity grants while in possession of material non-public information. With the Board ultimately having final say on the value of these awards, I have my doubts the methods used to determine “fair value” was truly fair and objective.

The Impossible Task

Wrapping up - and thanks for reading if you made it this far - a lesson I personally learned at Relational Investors is the “power” of a single voice:

Never underestimate the power of a single voice and its ability to drive change.

A key component of the activist playbook is to engage in -or threaten – a public proxy fight with the goal of adding a slate of directors to get a desired agenda completed. While Relational was not afraid of getting into a proxy fight, the preference was to quietly engage management teams and Boards behind-the-scenes to drive change and – if necessary – take a single board seat in lieu of a large, messy fight.

A lot of the “friendly”, behind-the-scenes engagement is predicated on reminding insiders there are bigger, existential consequences if a public proxy fight is required. The work I’ve publicly shared on the Illumina-Grail saga is a bit representative of the this behind-the-scenes work (minus the institutional resources and network to really level-up the quality and impact).

The reason Relational was open to taking one seat is because both Ralph Whitworth and David Batchelder are extremely effective at working with other Board members to drive change. They only needed a seat at the table.

Which brings me to “The Impossible Task”:

Truly believing one’s own voice matters and can drive real change.

My “Impossible Task” was never taking down all of Illumina’s governance Boogeymen. It was actually believing, truly believing, my voice mattered and I could make a difference as hokey as that sounds.

In many ways, Carl Icahn throwing me in the middle of this brouhaha was akin to giving me this “Impossible Task”. To finally believe my voice matters and I could make a difference. To really actualize it. Thank you for giving me this task Mr. Icahn.

I’ve gotten many supportive and encouraging messages from readers, and many have shared a similar sentiment: “I couldn’t do what you do.”

I chuckle, because I’ve said something similar over-and-over again to myself over the years. I could never do what Ralph Whitworth did. I could never do what Carl Icahn does. The reality is I can’t, but that doesn’t matter. I don’t need to be anyone else and “do what they do”.

I can do what I do, and I finally believe that’s all that matters and I can make a real difference as a result. That’s all I need to do.

The greatest gift you can give someone is believing in them before they believe in themselves. So maybe you can’t “do what I do”, but I genuinely believe you can still make a dent in this universe “doing what you do”.

I guessing this sentiment is an “Impossible Task” for many, and it certainly took me a long time to believe it myself, but I believe it’s possible. Finally.

"So I've been hearing this phrase y'all got over here that I ain't too crazy about. 'It's the hope that kills you.' Y'all know that? I disagree, you know? I think it's the lack of hope that comes and gets you. See, I believe in hope. I believe in belief." - Ted Lasso

Thank you for reading my work, sharing my perspective, and helping me take on this “impossible task”. I’m genuinely grateful to have your audience and am at peace with how the upcoming contested election plays out. What’s funny (to me) is I’m actually going to be off-the-grid (for the most part) the rest of the week. Apparently, the universe preemptively knew I’d needed to get away a bit. So if you don’t hear from me, Happy Memorial Day.

End Notes: Non-GAAP Write-Ups

Malignant Governance: I explore the possibility Illumina insiders (past and present) reaped a material financial windfall from splitting-off and subsequently re-acquiring Grail (and the period in between).

Non-GAAP Activism: I discuss the potential impact of Carl Icahn featuring my write-up in his activist campaign.

Icahn’s Gambit: I lay the initial groundwork on why I believe Illumina’s “bad faith” response to the questions and issues I raised will eventually lead to resignations and how the company is in “checkmate”.

Baillie Gifford and Edgewood’s Position: I explain why top shareholders Baillie Gifford and Edgewood have legitimate conflicts to consider in regards to the upcoming vote and are potentially in possession of material non-public information regarding the unanswered questions and issues I raised.

Mutually Insured [D&O]estruction: I critique Illumina’s Grail-related D&O insurance for potential signals.

Commencing a Regulation Game: I explore the potential impact of Glass Lewis supporting two Carl Icahn Directors and share my SEC whistleblower tip on Illumina’s misleading reply to the questions and issues I raised.

Prelude to Endgame: I share why all of this matters to me and the material second-order effects that are in-play if I’m directionally correct on what I think happened at Illumina.

Fraud by Omission: I explain why I believe Illumina potentially committed fraud (by omission) to help facilitate undisclosed Grail transactions that will likely require financial restatements if proven true.

Chair Doubles Down on SEC Violations: I explain why I believe Chairman John Thompson is “doubling down” on misleading voters by omitting material facts, and his transgression is so blatant and egregious that I wouldn’t dismiss the possibility John Thompson ends up resigning from Microsoft’s Board once this saga is all said and done.