Illumina: "Classical" vs. "Quantum" Governance

Getting back to basics and revisiting GRAIL's "classical" disclosure holes

Recognizing it’s quite a jump to say GRAIL’s stake was structured inside a REIT - or Steve MacMillan has GRAIL shares masquerading as Hologic stock - I’m going to go “back to the basics” and focus on GRAIL’s disclosure holes.

Some of this is rehashing things I’ve already said and me consolidating those thoughts so everyone can be on the same page. It’s also a reminder of the “big picture” and to reduce the noise.

A strong disclosure-based case can be made that GRAIL was a self-enrichment scheme enacted by Illumina insiders which relied upon fraud (i.e. accounting fraud, misleading statements, etc.) to pull off, and Helix Holdings I, LLC was a key part of making that possible:

The implication that Illumina insiders used Helix Holdings I, LLC to accumulate a material undisclosed stake in GRAIL - which likely influenced their decision to defy regulators and complete the GRAIL acquisition - is a legitimate story worthy of news coverage and a historic scandal that doesn’t require believing any crazy assumptions nor the existence of a REIT.

The mechanics to accumulate an undisclosed GRAIL can, in my opinion, enter REIT territory, but you don’t have to believe nor entertain that to explain GRAIL’s undisclosed stake.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated. As previously disclosed, I submitted an SEC whistleblower tip regarding the Illumina situation.

Reconciling Holes: "Classical" vs. "Quantum" Governance

The best analogy I can come up with to explain this REIT conjecture is it’s akin to discovering the need for quantum physics to explain behaviors and disclosures I’m seeing at a “micro” level when the original intent was a “macro” explanation.

The “classical” governance I’m familiar to breaks down and “quantum” governance - which can embed crazy assumptions - kicks in.

That said, there are “macro” explanations and observations that provide directional answers to how Illumina could accumulate an undisclosed stake in GRAIL:

Public companies aren’t required to specifically include compensation received from consolidated VIEs (i.e. GRAIL),

There’s precedent of Arch Venture Partners and Johnson & Johnson investing in GRAIL’s venture rounds on-behalf of others and transferring those shares,

Dr. Klausner’s ownership stake attributed to Milky Way Investments can “disappear” implying shares held at Illumina and elsewhere are potentially shares held on behalf of others,

Helix Holdings I, LLC was likely used to fund GRAIL, etc.

Moving from directional he specific explanations to reconcile “micro” observations/disclosures is where it gets wild at times.

That said, leveraging those same “micro” observations/disclosures, but focusing on “macro” holes and explanations, still provides a compelling - and less crazy - story.

Hole: Reconciling GRAIL’s Series A Ownership Math

This entire series revolves around trying to answer this simple question:

How much money did Illumina insiders (past and present) make from splitting-off and subsequently re-acquiring Grail?

When I wrote Malignant Governance, I was very intentional with how I framed this question. After reviewing the disclosures, my instincts were already telling me there’s something going on here where the “answer” is going to be more nuanced than just owning and selling GRAIL shares. I felt saying “money” or “financial windfall” better captured what I was seeing at the time. That’s still true today.

This suspicion was further supported by - if not arguably confirmed - with the way Illumina responded to my write-up which only emboldened me to write Icahn’s Gambit using their response as a roadmap to try and answer this question myself.

To this day, Illumina still refuses to answer nor address this question and talks around it.

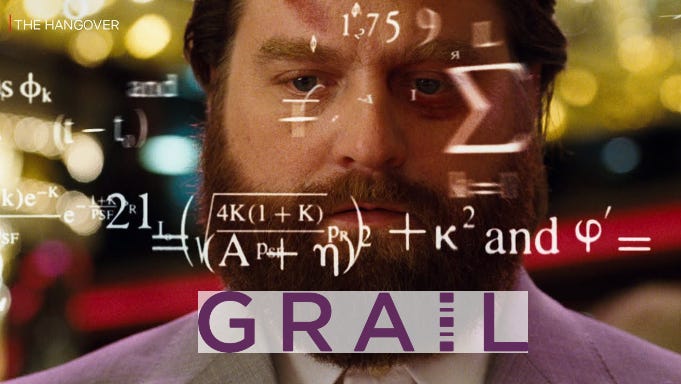

You don’t have to be a forensic accountant, nor a conspiracy theorist, to know that GRAIL’s post Series A ownership math requires a materially large undisclosed ownership stake going to someone to reconcile:

During the three months ended April 3, 2016, GRAIL completed its Series A convertible preferred stock financing, raising $120.0 million, of which the Company invested $40.0 million

On a fully diluted basis, the [Illumina] holds a 52% equity ownership interest in GRAIL as of April 3, 2016.

For the three months ended April 3, 2016, [Illumina] absorbed 90% of GRAIL’s losses based upon its proportional ownership of GRAIL’s common stock.

Illumina’s fully diluted equity ownership interest was 52% despite:

GRAIL was wholly owned by Illumina prior to the Series A.

Illumina participated in GRAIL’s $120 million Series A contributing $40 million.

Illumina concurrently executed a long-term supply agreement with GRAIL and received 112.5 million Class B shares to go along with their $40 million Series A Preferred Stock investment.

By the way, Illumina discloses this 112.5 million share transaction in their filings, but GRAIL doesn’t acknowledge it in their S-1.

So how in the world did Illumina get diluted down to 52% ownership?!

To reconcile the ownership math (i.e. 52% diluted ownership, 90% common stock ownership), and working off of the available disclosures I did have, I originally guesstimated up to ~70 million GRAIL shares went to insiders, right out-of-the-gate:

It’s not a perfect fit and subsequent estimates were closer to ~60 million shares, but I don’t think the actual answer is that far off from these estimates:

We can argue over who got this stake, and how, but the ownership math is the ownership math. There’s a massive ownership “hole” here that Illumina refuses to acknowledge, nor answer, and ultimately led me the crazy REIT conjecture to reconcile it.

REIT conjecture aside, all signs (i.e. disclosures, company decisions, executive turnover, etc.) point to the answer of this ownership “hole” involving accounting fraud, insider trading, and self-dealing.

This unaccounted for ownership hole is very much grounded in reality and basic math. It doesn’t require believing crazy assumptions or conspiracies.

The SEC isn’t investigating some wild REIT conspiracy. They’re investigating this “hole” and they (in my opinion) should at the very least uncover the connection between Helix Holdings I, LLC and GRAIL to reconcile it.

If it turns out GRAIL is just a “simple” fraud story, and not some systemic problem, I’ll actually be over the moon and can move on. Seriously.

Besides, the notion one can review REIT filings to predict M&A transactions and generate alpha based on debt maturity dates, etc. is like reading Weekly World News for actual news is ludicrous world-view even if “quantum” governance reconciles to it:

At the end of the day, I just want an answer to this question.

Helix Holdings I, LLC and Faux Start-Ups

As a reminder, Illumina announced the formation of Helix in August 2015, and raised $100 million, to “enable individuals to acquire an unprecedented amount of genetic information by providing affordable sequencing and database services for consumer samples brought through third party partner”:

Already Helix has developed two major collaboration partners, the Center for Individualized Medicine at Mayo Clinic and Laboratory Corporation of America Holdings (LabCorp , currently the largest clinical diagnostic laboratory company in the U.S. Mayo will assist in developing applications focused on consumer education and health-related questions. They also invested in Helix. LabCorp will work on developing and marketing analysis and interpretation services, with an early focus on “medically actionable genetic conditions.” (Biospace)

This is supposed to be a separate entity, pursuing a separate opportunity from GRAIL, but the disclosures indicate Helix was used as a funding vehicle for GRAIL and was actually a way for Illumina insiders to accumulate an undisclosed stake in GRAIL.

Helix being a “faux start-up raising capital actually meant to facilitate GRAIL transactions” is a “micro” observation that seems to translate (i.e. “quantum” governance) to other entities (i.e. Artemis Health) that have disclosures which appear to reconcile to GRAIL.

Hole: Helix and GRAIL’s Missing Form D

I mention this in my SEC Investigation write-up, but, when reviewing GRAIL’s filings, you’ll notice there isn’t a Form D (i.e. required filing for exempt security offerings) for their 2016 Series A. The first Form D filed is dated February 28, 2017 and is for the initial capital raised for their Series B:

The absence of a Form D for GRAIL’s $120 million Series A is another “macro” hole and reconciling this hole means some other entity filed a Form D to initially fund GRAIL.

If GRAIL wasn’t the entity used to fund their $120 million Series A round, where did that capital come from?

I believe the answer is Helix Holdings I, LLC which filed a Form D on July 29, 2015 to raise up to $130 million (~$108 million already sold when the Form D was filed) which would have the capacity to absorb GRAIL’s $120 million Series A round.

This is a very basic concept, but, if a start-up announces a large venture funding round, you should be able to confirm/reconcile it to a Form D filing. If there isn’t one filed, some other entity is filing the Form D “on its behalf”. Companies can’t cherry-pick when they choose to file a Form D.

GRAIL’s $120 million Series A came from somewhere and that entity filed a Form D.

Things can certainly enter into “quantum” governance territory trying to reconcile announced raises with what’s actually being filed to EDGAR and chasing down the entities raising the capital that have a Form D filed.

This is how you end up on a wild goose chase trying to reconcile a start-up like Omniome (i.e. a company within GRAIL’s constellation) whose disclosed investors and publicly announced capital raises looks a lot different between what EDGAR, press releases (1,2), and PacBio’s acquisition filing says when they acquired the company:

I’m not going to get too off track, since I’m trying to minimize the conspiracy stuff, but those Omniome investors and aggregate investment figures look A LOT different from what you’d expect the Schedule of Investors and aggregate investment to look like based on EDGAR, Crunchbase, and press releases.

ARCH Venture Partners and Madrone Capital Partners are notable - and very public - investors of Omnione and they’re nowhere to be found. Reconciling why causes you to enter “quantum” governance territory.

Hole: Helix and GRAIL’s Reported Cash Balance

Anyway, positing that Helix Holdings I, LLC was used to fund GRAIL is already a scandal in-the-making, and a conspiracy-free proposition, too.

A simple “sanity check” is to look at Illumina’s March 2016 10-Q which discloses the aggregate cash balance of GRAIL and Helix was ~$136 million:

As of April 3, 2016, the accompanying condensed consolidated balance sheets includes $136.3 million of cash and cash equivalents attributable to GRAIL and Helix (source)

This balance should be closer to $200 to $250 million given Helix announced a $100 million raise ($130 million capacity per Form D) and GRAIL (initially) announced a $100 million raise (later raising $120 million):

This ~$100+ million “hole” doesn’t make much sense unless the $100 million Helix raised went to Grail instead, which would explain why GRAIL didn’t file a Form D for their Series A and why the financials indicates high overlap between Helix and GRAIL.

Now, there could be some lag on the actual cash coming in, but not to the extent the cash balance reported wold be as low as $136.3 for both GRAIL and Helix if they were truly operating as “separate” entities. Also, Helix would amend their Form D on December 22, 2016 indicating they raised $21.7 million and amended it again on April 28, 2017 indicating they raised $55 million.

The reported cash balance for Helix during those periods don’t come close to reflecting the capital they supposedly raised, which implies it went somewhere else:

As of April 2, 2017, the accompanying condensed consolidated balance sheet includes $5 million of cash and cash equivalents attributable to Helix

As of July 2, 2017, the accompanying condensed consolidated balance sheet includes $10 million of cash and cash equivalents attributable to Helix

Further, the amended April 28, 2017 Form D would disclose 13 investors had invested in this offering, matching the number of investors who participated in Grail’s Series A round:

In January and February 2016, we completed our initial and additional closings of our Series A financing, whereby we issued an aggregate of 120,000,000 shares of Series A redeemable convertible preferred stock to 13 investors, including Illumina, for an aggregate purchase price of $120 million, or $1.00 per share.

Source: S-1 Filing

These disclosures are essentially telling you Illumina is lying about something. All of these disclosures regarding Helix and GRAIL can’t be true. What exactly they’re lying about is a separate matter, but I lean towards the “truth” being Helix Holdings I, LLC was being used to fund GRAIL since the filings appear to reconcile to that scenario the most and is the most sensible explanation.

If this assessment is correct, this is another pattern that points to GRAIL being a self-enrichment scheme enacted by Illumina insiders that relied upon fraud to pull off.

Helix is supposedly only financed via cash contributions made by “third-party investors”, but CA disclosures indicate Illumina insiders contributed cash to Helix Holdings I, LLC which would imply Helix was created to help facilitate an undisclosed stake in GRAIL.

Further Connecting Helix to GRAIL with CA Disclosures

The key to figuring out GRAIL relies on disclosures (i.e. annual filings, entity names/changes, employee equity plans, equity transactions, etc.) found on state-hosted sites that aren’t found on EDGAR.

You can thank GRAIL insiders for helping me figure that one out, but that’s a story for another time.

The disclosures on California’s Financial Protection & Innovation site and other state-hosted sites (i.e. business entity searches, property records, etc.) are a game-changer, honestly.

In particular, using CA disclosures allows us to connect-the-disclosures and create a compelling mosaic that Helix Holdings I, LLC was indeed used to fund GRAIL.

To “connect” these two entities, all we need to do is “follow the money”.

We know from Grail’s S-1 that they sold 120 million shares at $1/share between January 8, 2016 and February 10, 2016:

Between January 8, 2016 and February 10, 2016, we sold 120,000,000 shares of Series A redeemable convertible preferred stock to 13 accredited investors at a price of $1.00 per share, for aggregate proceeds of approximately $120,000,000

The starting date of GRAIL’s Series A share sale (January 8, 2016) matter, because Illumina doesn’t file a notice with California regarding Grail’s Series A until January 28, 2016 (effective 2/24/2016) and more than 15 calendar days after the “first” Series A shares were sold on January 8, 2016:

For background, California requires these notices to be filed no later than 15 calendar days after “the first sale of a security in the transaction in this state”, and GRAIL is a California based company. It be one thing if GRAIL was based elsewhere, but the January 8, 2016 “first sale” date for a California based company means this filing needed to occur on January 23, 2016 and NOT on January 28, 2016.

This means that GRAIL’s Series A needed to be funded by a different entity to align with the January 8, 2016 “first sale” disclosure, and Helix Holdings I, LLC had their Form D go effective on California on January 7, 2016:

In order to reconcile with GRAIL’s S-1 disclosure, capital raised at Helix Holdings I, LLC was likely used to fund GRAIL’s Series A.

Also, reconciling why Illumina filed a $125 million Series A disclosure for GRAIL in California, but didn’t file a $125 million Form D on EDGAR, enters “quantum” governance territory.

Connecting GRAIL Equity Transactions to Illumina Insiders

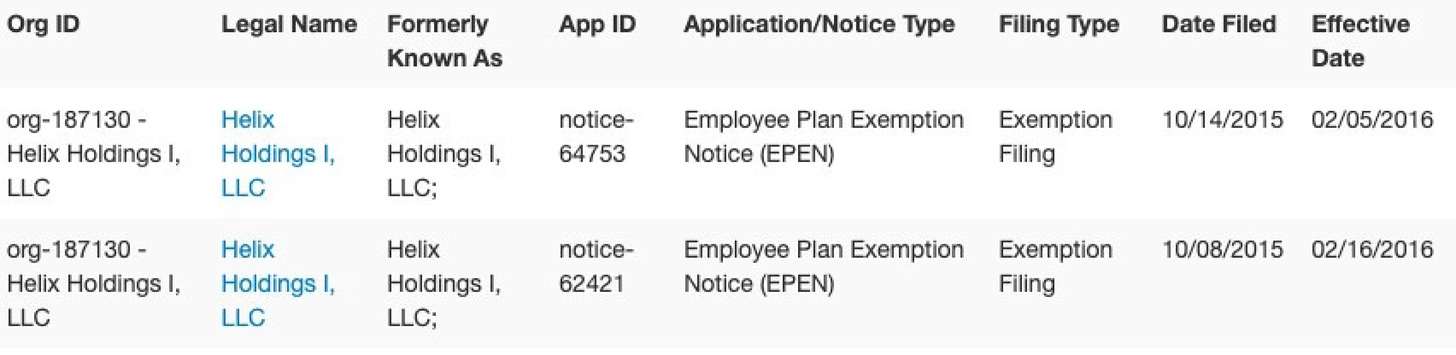

The California disclosures also show that Helix Holdings I, LLC filed Employee Plan Exemption notices for 42,352,000 in Equity Appreciation Units (filed 10/8/15, effective 2/16/16) and Class B Units (filed 10/14/15, effective 2/5/16) priced at $1 per share, aligning with the Series A offering price:

42,352,000 represents the total number of units available under the issuer's 2015 Equity Appreciation Unit Plan and 2015 Class B Units Plan. A separate notice filing is being made for 2015 Class B Units Plan

Calling out the $1/share price isn’t a “smoking gun” and is intended to acknowledge it matches GRAIL’s Series A per share price. If the prices didn’t match, then the rest of this analysis is a non-starter.

What matters more is the “date filed” for these plans and the ability to delay the “effective date”.

These notices need to be filed in California “no later than 30 days after the initial issuance of a security under the [employee benefit plan exemption]” which provides some material takeaways.

We now know Helix Holdings I, LLC was transacting (i.e. delivering cash) Equity Appreciation Units and Class B Units back in September 2015, and well before GRAIL raised their initial Series A capital raise in January 2016.

Given that these are employee equity plan (i.e. “Employee Plan Exemption Notices”), the only people that can transact these shares at the time (i.e. September 2015) were Illumina insiders. Remember, Helix Holdings I, LLC was just formed, raised capital, and was a consolidated VIE under Illumina’s control. Illumina is under no obligation to disclose “compensation” insiders may have received from Helix since it was a consolidated VIE.

That said, I think it’s a little more nuanced than that, but these California filings are an important break-through in reconciling GRAIL’s “ownership math” and figuring out where Illumina insiders could accumulate an undisclosed stake in GRAIL.

Big picture, these filings provide disclosure-based evidence that Illumina insiders could potentially accumulate on undisclosed stake in GRAIL back in Q3 2015 through Helix Holdings I, LLC which also reconciles with Illumina’s response to Malignant Governance:

None of Illumina’s directors involved in either the decision to sign or the decision to close the GRAIL acquisition – including our former CEO and Executive Chairman Jay Flatley, our current CEO Francis deSouza and each of Illumina’s current directors – has ever held any equity interests in GRAIL.

That statement can be true while concurrently being misleading if that GRAIL equity interest was held in the form of a Helix or Illumina stake instead (i.e. “quantum” governance).

Conspiracy-Free Fraud

Without even getting into the REIT conjecture stuff, there’s arguably enough incremental insight provided by the CA disclosures to say that GRAIL was a self-enrichment scheme enacted by Illumina insiders which relied upon fraud (i.e. accounting fraud, misleading statements, etc.) to pull off, and Helix Holdings I, LLC was a key part of making that possible.

Yes, the REIT conjecture is wild and gets into topics like why I believe Steve MacMillan has GRAIL shares masquerading as Hologic stock, but you don’t have to believe any of that and the conjecture is really the result of seeing “micro” observations (i.e. acquiring GRAIL stake using Helix as a proxy, delay in transaction date vs. effective date, etc.) being applicable elsewhere.

This is how I’m able to explain and reconcile why the disclosures point to GRAIL’s formation being years in the making and seem to originate in Utah. It sounds crazy and doesn’t make sense until you use “quantum” governance to make sense of it.

Anyway, if I’m right about the Helix-GRAIL connection, I believe Illumina will at the very least need to restate their financials and disclosures as a result of this conspiracy-free fraud. To expect anything less would require believing some crazy assumptions.

Thanks for dumbing it down again. Now I'm back to understanding what you're talking about lol