And I’m back with another installment of Illumina “finds out”.

As mentioned in Icahn’s Gambit, I believe Illumina is currently in a “losing” endgame regarding the questions and issues I raised in Malignant Governance, and believe the company is “playing to checkmate”. Resignations are, in my opinion, very much on the table, but I suspect I need to keep “playing the game” and provide another set of moves to make my case and help shepherd things along to its eventual destination.

I also discussed how top shareholders Baillie Gifford and Edgewood Management have a “complicated” vote to contemplate in the upcoming contested election, and should consider their own liabilities and constraints due to having (in my opinion) material non-public information from Baillie Gifford funds and (allegedly) Alan Breed’s participation in Grail’s Series B. They can certainly vote as they please, but I’m not being hyperbolic when I say this contest is likely historic.

For this write-up, I explore the potential impact of Glass Lewis supporting two Carl Icahn Directors and share my SEC whistleblower tip on Illumina’s misleading reply to the questions and issues I raised.

Submitting a tip means this statement is declared under penalty of perjury and without D&O insurance to indemnify my liability. I also believe Illumina’s Board responded to me in “bad faith” and should have known they were misleading voters with these “factual” statements which is especially egregious given it’s a contested election.

Hopefully, by the time this series wraps up, I’ve provided the reader a convincing case for why resignations are a “graceful exit” for management, and “for cause” terminations should arguably on the table.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Glass Lewis Supports Two Icahn Nominees

Illumina hasn’t lost the proxy contest yet, but I do believe the walls are starting to close in with Glass Lewis supporting two Icahn nominees:

Influential proxy adviser Glass Lewis has urged investors to vote against the reappointment of the chief executive and chair of Illumina, the world’s largest gene sequencing company, saying the pair have failed to take responsibility for the “value crimping” acquisition of cancer-screening group Grail.

Generally speaking, Glass Lewis is somewhat of a “default” vote for many institutional investors that requires them to justify and keep record of votes that run contrary to their recommendation. It is what it is.

If Baillie Gifford, Edgewood Management, and a smorgasbord of Nongaap Newsletter subscribers (thank you for your support) communicate to management a directionally similar vote as Glass Lewis’ recommendation, we might actually see a settlement before the Annual Meeting.

It’s a bit complicated, though, because the questions and issues I raised remain outstanding, and I wouldn’t be surprised if there’s concurrent resignations announced as part of the settlement. I also wouldn’t dismiss an acknowledgment the questions and issues I raised have some standing and are directionally correct.

After all, if Illumina decides to go to a vote - and Icahn’s directors win seats - it’s a matter of when, not if, the truth comes out. We still have to see how ISS recommends shareholders should vote, but so far so good for Mr. Icahn.

Commencing a Regulation Game

Regardless of the contested election, I’m operating on a much different and independent timeline. If it turns out what I think happened here is true, this is not ok.

I’ll be the first to acknowledge serving on a public company Board isn’t always Director dinners and group hikes. When things get bad, they can get really bad.

And yes, I acknowledge this having never been on a public company Board, but I’d like to think I’m one of the most overqualified unqualified Director candidates you’ll meet.

Anyway, a (rare) lever stakeholders can use to compel change is through the regulators. To be honest, this lever is rarely available and I have no idea if the SEC will even pick this up, but Illumina is an extraordinary governance situation (in my opinion) so figure it’s worth a shot.

I believe Illumina’s response to me was so egregious it violated SEC rules. I’m not going to dispute Illumina shared statements of “fact”, but they did in it a way that was arguably very misleading by omitting material facts. Why the Board thought it was a good idea to sign off on that response in a contested election against Carl Icahn is beyond me given the visibility. This is exactly the kind of situation the SEC needs to review.

Consequently, I’m submitting an SEC whistleblower tip.

The easiest way to understand how Illumina is trying to mislead voters is recognize Grail’s governance and compensation documents are arguably Jay Flately optimized/friendly and equity compensation is options centric.

Mr. Flately seems to prefer using Flatley Family Trust as an investment vehicle where he’s a trustee. Knowing “trust”, “options”, and he’s a “director” quickly helps to clarify how Illumina trying to work around acknowledging he may have generated a meaningful undisclosed financial windfall from Grail by focusing on “individual”, “equity”, and “director” references. Their mistake was trying to completely absolve him with “has ever held any equity interests in GRAIL”. To be honest, I wouldn’t be surprised they recognized how consequential that mistake was the moment I publicly called it out and explained “why”.

SEC Whistleblower Tip

Note: Edited from original tip

Submitting a tip means this statement is declared under penalty of perjury and without D&O insurance to indemnify my liability. I also believe Illumina’s Board responded to me in “bad faith” and should have known they were misleading voters with these “factual” statements which is especially egregious given it’s a contest election.

The liability of these statements should arguably not be covered by D&O insurance, and the Board should acknowledge they’re misleading and correct the record as soon as possible given the fast approaching May 25, 2023 Annual Meeting.

SEC Whistleblower Violation:

Rule 14a-9 specifically prohibits false or misleading statements made in connection with any proxy solicitation. This includes omitting “any material fact necessary in order to make the statements therein not false or misleading or necessary to correct any statement in any earlier communication with respect to the solicitation of a proxy for the same meeting or subject matter which has become false or misleading.”

Tip:

I believe Illumina violated SEC rules misleading proxy voters in a currently active, ongoing contested election with Carl Icahn by omitting material facts in regards to undisclosed financial windfalls Illumina insiders may have reaped splitting-off and subsequently re-acquiring Grail.

The company will not acknowledge this financial windfall nor provide disclosures of the key facts in Grail’s voting agreement and right of first refusal and co-sale agreement to help investors get a definitive answer.

I did original, independent research based on publicly available information to identify and size the potential financial windfall. The company remains disengaged and won’t answer the questions and issues raised in good faith. Instead, they are misleading investors trying to skirt the issue.

The size of this undisclosed financial windfall also raises questions regarding appropriate disclosures, self-dealing, related party transactions, arm’s length transactions, and proper accounting rules.

Background:

On April 24, 2023, I wrote a piece titled, “Malignant Governance”, exploring and analyzing the possibility Illumina insiders reaped a meaningful, undisclosed financial windfall splitting-off and subsequently re-acquiring Grail, Inc. in the range of $500 million to $1 billion+. The company does not provide enough disclosures to offer definitive answers, but I based my estimates using original, independent analysis relying on publicly disclosed facts, I made a case the amount could be material.

Carl Icahn would subsequently feature my work in his proxy contest.

Instead of directly addressing the questions and issues I raised, I believe Illumina’s response to my analysis violates SEC rules and misleads proxy voters - in an active, ongoing contested election - by omitting material facts.

Below are their statements of “fact” and the material fact(s) I believe they omitted based on publicly available information and my original analysis. They don’t acknowledge the financial windfall nor provide disclosures to get a definitive answer.

Illumina Statement:

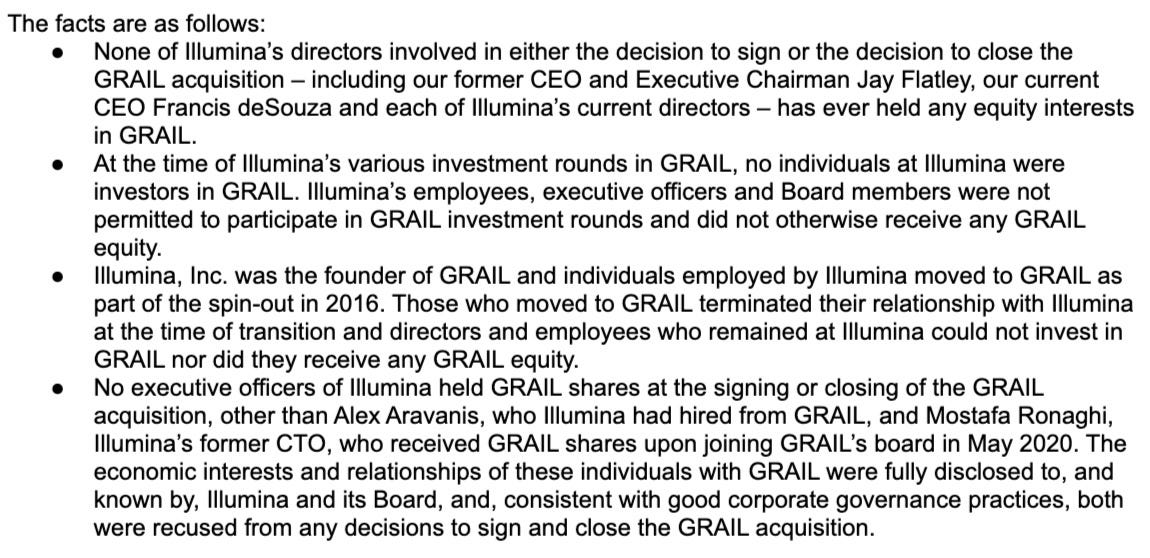

None of Illumina’s directors involved in either the decision to sign or the decision to close the GRAIL acquisition – including our former CEO and Executive Chairman Jay Flatley, our current CEO Francis deSouza and each of Illumina’s current directors – has ever held any equity interests in GRAIL.

Misleading Statement:

Illumina is only referring to the equity interests of the “individual” and doesn’t include equity interests that could be held in other ownership vehicles such as trust, LLCs, and etc. We know reviewing Grail’s disclosed Investors’ Rights Agreement that signatories are predominantly non-individual entities.

Omitted Fact(s) Needed:

Illumina must include all equity interests held in all entities.

Illumina Statement:

At the time of Illumina’s various investment rounds in GRAIL, no individuals at Illumina were investors in GRAIL. Illumina’s employees, executive officers and Board members were not permitted to participate in GRAIL investment rounds and did not otherwise receive any GRAIL equity.

Misleading Statement:

Illumina is only referring to the “individual” and not including other ownership vehicles such as trust, LLCs, and etc. Further, they only note “equity” and doesn’t include other equity interests including Grail stock awards, options, and other derivative securities.

The company’s Q1 2016 filing discloses stock awards were granted to insiders indicating the company is misleading investors: “In accordance with GRAIL’s Equity Incentive Plan, the Company may be required to redeem certain vested stock awards in cash at the then approximate fair market value. The fair value of the redeemable noncontrolling interests is considered a Level 3 instrument.”

Omitted Fact(s) Needed:

Illumina must include all equity interests held in all entities.

Illumina Statement:

Illumina, Inc. was the founder of GRAIL and individuals employed by Illumina moved to GRAIL as part of the spin-out in 2016. Those who moved to GRAIL terminated their relationship with Illumina at the time of transition and directors and employees who remained at Illumina could not invest in GRAIL nor did they receive any GRAIL equity.

Misleading Statement:

Illumina is only referring to the “individual” and not including other ownership vehicles such as trust, LLCs, etc. Further, they only mention “equity” which doesn’t include other equity interests including Grail stock awards, options, and other derivative securities. Illumina was the founder, but the company doesn’t provide key facts such as who were the recipients of Grail’s equity interests to reconcile the estimated 70m shares that are currently not disclosed or attributed to anyone.

The company’s Q1 2016 filing discloses stock awards were granted to insiders indicating the company is misleading investors: “In accordance with GRAIL’s Equity Incentive Plan, the Company may be required to redeem certain vested stock awards in cash at the then approximate fair market value. The fair value of the redeemable noncontrolling interests is considered a Level 3 instrument.”

Omitted Fact(s) Needed:

Illumina must include all equity interests held in all entities.

Illumina Statement:

No executive officers of Illumina held GRAIL shares at the signing or closing of the GRAIL acquisition, other than Alex Aravanis, who Illumina had hired from GRAIL, and Mostafa Ronaghi, Illumina’s former CTO, who received GRAIL shares upon joining GRAIL’s board in May 2020. The economic interests and relationships of these individuals with GRAIL were fully disclosed to, and known by, Illumina and its Board, and, consistent with good corporate governance practices, both were recused from any decisions to sign and close the GRAIL acquisition.

Misleading Statement:

Illumina is only referring to the “individual” and not including other ownership vehicles such as trust, LLCs, and etc. They intentionally don’t include Illumina Directors - and their various investment vehicles that may hold equity interests - in that statement and don’t disclose the equity interests Mostafa Ronaghi may have held (including at other entities) outside this specific timeline.

Omitted Fact(s) Needed:

Illumina must include all equity interests held in all entities for both executive officers and directors, and disclose past equity interests held.

Director Accountability

Wrapping up, this isn’t to be petty, but I think it’s important to recognize corporate governance debates should never be viewed as a faceless Board vs. an individual.

I know what I say or do has consequences, and try to conduct myself accordingly. Yes, I can mess up and I’m not perfect, but I try to engage in good faith. Frankly, I have no other choice. I hope Illumina’s Directors recognize that as well.

At the end of the day, Boards are made up of a collection of individuals with specific roles, responsibilities, and viewpoints trying to work together to do what’s best for stakeholders. It’s easy to get caught up in group dynamics and lose sight of what matters. There’s still a lot of work to get done, but the first step is engaging stakeholders earnestly and honestly.

The issue they’re trying to tamp down is already out of the box as far as I’m concerned.

Illumina Board of Directors:

John Thompson (Chairman, Audit)

Francis deSouza (CEO)

Frances Arnold (S&T Chair, Nominating and Corp Gov)

Caroline Dorsa (Audit Chair, Compensation)

Robert Epstein (Nominating and Corp Gov Chair, Compensation)

Scott Gottlieb (Nominating)

Gary Guthart (Compensation Chair, S&T)

Philip Schiller (Nominating and Corp Gov, S&T)

Susan Siegel (Audit)

Yes, Carl Icahn isn’t exactly the most pleasant person to deal with in public markets, but he doesn’t just show up and cause mayhem. The issues at Illumina have been compounding for some time and it was eventually going to break.

Next Moves

Unless Illumina’s Board magically starts engaging stakeholders in good faith and is more honest about what I think is going on. Things start to get pointed, more specific, and serious from here on out. This also means I’ll be taking my time and being more methodical. It’s one thing to write a newsletter. It’s a slightly different game when you’re shepherding things towards “for cause” checkmate.