Illumina: Discloses SEC Investigation

As regulators investigate Grail, the "missing link" might be Helix Holdings I, LLC

Summary: After reviewing my notes again, I’m increasingly convinced Helix Holdings I, LLC (i.e. Swamp Thing) is the “missing link” to help explain, well, everything. With news the SEC is investigating Grail, I genuinely believe they need to look into Helix and investigate the role this entity may have played in facilitating early Grail transactions, especially during the early days.

Why?

A disclosure-based argument can be made that Helix Holdings I, LLC was used to raise Grail’s initial capital and facilitate undisclosed insider transactions of Grail equity/economic interests which later led to a sizable financial windfall.

Big picture, it’s easy to read Illumina’s disclosure regarding the SEC investigation and underestimate how potentially serious the ramifications are for the parties involved. Investigating “certain statements and disclosures concerning GRAIL” and “the conduct and compensation of certain members of Illumina and GRAIL management” is arguably another way of saying the SEC is investigating Grail-related accounting fraud and insider trading.

If I’m right, the SEC’s investigation is going to embroil a lot of individuals and institutions in the coming months, and I wouldn’t be surprised to see folks voluntarily come forward to cooperate in an effort to mitigate their own liability exposure.

Overall, I think it’s time for Illumina to start coming clean about what exactly happened at Grail, because this SEC investigation can very much turn into a DOJ investigation with the way things are trending. The truth will set you free. Maybe.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated. As previously disclosed, I submitted an SEC whistleblower tip regarding the Illumina situation.

The Illumina-Grail Series

If you haven’t kept up with the Illumina-Grail series (I don’t blame you), I’ve included a summary of all the topics I’ve covered to-date that you can explore at your own pace at the end of this write-up titled: “End Notes”.

Just so we’re on the same page, this series initially started with a simple question:

How much money did Illumina insiders (past and present) make from splitting-off and subsequently re-acquiring Grail?

When I pieced together the disclosures, it seem to imply the UNDISCLOSED financial windfall could be well in excess of $500 million. And depending on your assumptions, that figure could conceivably be $1 billion+.

Illumina pushed back on my takeaways so this series represents me “pushing back”.

My write-ups have been an “effort” to uncover the truth by publicly explaining - via a mosaic of disclosures - how I think this alleged financial windfall was architected and the potential SEC violations that occurred along the way.

And way to “compel” the truth is to show the regulators there are legitimate disclosure-based reasons to investigate the matter, and it now looks like the SEC agrees.

Premium Newsletter Plug

If you enjoy this write-up, I hope you consider the Premium Newsletter.

Premium explores “real time” situations and explores interesting governance signals - such as indicators of strategic alteration and other inflective changes - before they potentially happen and/or get priced in.

Professionals: A sensitive subject for many independent newsletter writers is institutions subbing as an “individual” and liberally distributing content internally. Please be reasonable.

The “Story” Being Told

Disclaimer: This “story” is my opinion and what I think the disclosures are telling me.

Before we go down the rabbit-hole, the “story” I think the disclosures are telling me is pretty basic.

Illumina insiders got too greedy.

Insiders found a way to accumulate a disproportionate economic stake in Grail, without needing to disclose it, by using a joint venture (i.e. Helix Holdings I, LLC) to facilitate Grail’s initial funding and insider transactions in 2015/2016.

In their efforts to hide this sizable stake and subsequent financial windfall, insiders committed fraud and insider trading violations. The intertwining connections between Helix Holdings I, LLC and Grail also created an accounting and incentives nightmare that may have eventually necessitated the acquisition of Grail to “fix” the issues and contributed to elevated CFO and CAO turnover.

With the SEC pursuing an investigation, we have an opportunity to see just how much of this “story” is fact vs. imagination.

SEC Investigation Underway

Illumina made a significant disclosure in their June 2023 10-Q filing indicating the SEC has informed them they are conducting an investigation into Grail:

SEC Inquiry Letter

In July 2023, we were informed that the staff of the SEC was conducting an investigation relating to Illumina and was requesting documents and communications primarily related to Illumina’s acquisition of GRAIL and certain statements and disclosures concerning GRAIL, its products and its acquisition, and related to the conduct and compensation of certain members of Illumina and GRAIL management, among other things. Illumina is cooperating with the SEC in this investigation.

Source: June 2023 10-Q

We don’t know exactly what the SEC is investigating, but the timing of the notification (July 2023) and the issues being investigated align with the SEC starting their preliminary inquiry (i.e. Matter Under Inquiry or MUI) in May 2023 which is around the time I was discussing these particular topics in the newsletter and submitted an SEC Whistleblower tip. For context, MUIs are usually closed or converted to an investigation within 60 days the preliminary inquiry begins.

SEC investigations can take ~2 years before any formal “enforcement action” is announced, but Illumina’s decision to quickly disclose this investigation could be a sign “remedial” disclosures/changes are underway and/or will be announced before any potential enforcement actions are announced.

Companies generally don’t have a “duty to disclose” SEC investigations, especially this early in the process, so Illumina’s quick disclosure could be a “material” signal regarding where the Board thinks this investigations trends over time:

A company should consider several strategic factors when determining whether and when to disclose publicly an SEC investigation. There is no specific line-item disclosure requirement, meaning a company must assess the materiality of the investigation, underlying conduct, potential collateral consequences, and potential outcomes before deciding whether disclosure is required. (L&W)

A company may choose to disclose earlier than required based on a variety of strategic considerations, including whether earlier disclosure will preserve credibility with investors and analysts (and whether that credibility may be harmed by delayed disclosure), the risk of leaks, and whether the SEC may contact customers or other third parties about the investigation. Taking into account these strategic considerations — particularly if a company fully understands the scope of the potential misconduct — it may choose to disclose the existence of an investigation when the Staff first notifies the company of the investigation. (L&W)

I actually wouldn’t be surprised if Illumina’s proactive disclosure is informed by the seriousness of inferred violations the SEC is investigating based on ongoing conversations, the document being requested, and what they already know the SEC will find in those documents.

Also keep in mind there are 3 new Directors on Illumina’s Board, including a Carl Ichan nominated Director, who aren’t exposed to any transgression that may have occurred and lessens the odds of stonewalling.

Ramifications

The ramifications of this disclosure are quite significant if you believe the issues I have raised are (directionally) correct. I’ve been consistent about this opinion throughout this series and have said folks should think long-and-hard about how they conduct themselves under the assumption the “truth” eventually comes out.

It’s easy to read Illumina’s disclosure and overlook the seriousness of the potential violations and ramifications in-play, but the SEC investigating “certain statements and disclosures concerning GRAIL” and “the conduct and compensation of certain members of Illumina and GRAIL management” is arguably another way of saying the SEC is investigating Grail-related accounting fraud and insider trading. This SEC investigation can very much turn into a DOJ investigation depending on what is uncovered.

As a friendly reminder, Illumina is currently on their 4th Chief Accounting Officer (CAO) and 3rd Chief Financial Officer (CFO) since Grail’s 2016 Series A round with former CFO Sam Samad and former CAO Jose Torres - both outside hires - departing around Q3 2022 and replaced by executives promoted from within. I personally don’t think this is happenstance and go as far as to say it might be informed by accounting-related issues with their Grail and Helix investments.

Consequently, if they haven’t done so already, Illumina’s Board will arguably need to retain independent advisors to look into and investigate the questions and issues I flagged, because they have to assume the SEC might look into them as well. This is especially important for Illumina’s newest Directors to ensure they have all the facts to make properly informed decisions.

We’ll see how this all plays out, but this investigation will arguably embroil multiple individuals and outside parties. Everyone with any potential liability exposure to Grail now knows there’s an active SEC investigation underway and is aware that “Illumina is cooperating with the SEC in this investigation”. If the issues I flagged are (directionally) correct, don’t be surprised to see folks voluntarily come forward to cooperate in this investigation to mitigate their own liability exposure.

There will be lawyers.

Revisiting Helix Holdings I, LLC

As I started to think through the various documents and communications the SEC might request in their investigation of Grail, I ended up revisiting an unresolved question/issue I had with Helix Holdings I, LLC and its potential role with Grail:

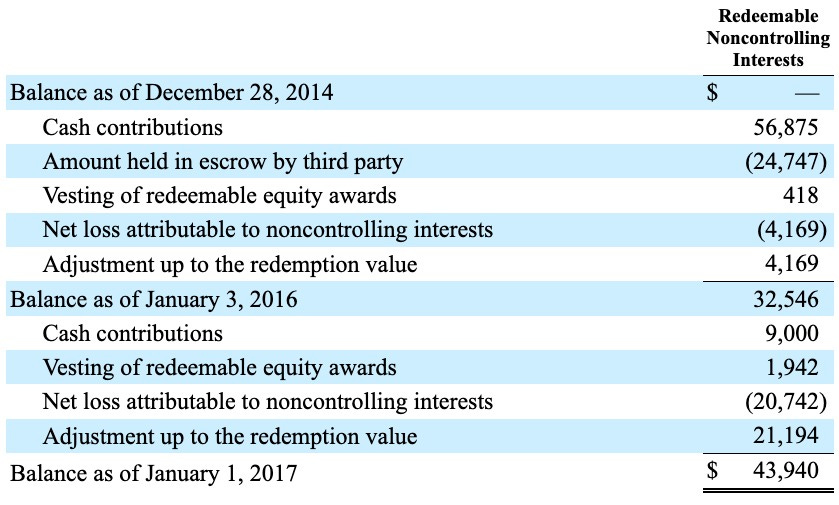

The “issue” I have is a lot of these disclosed line items seem to better align - and makes more sense to me with Grail based on the mosaic of Grail-related disclosures and work I’ve done trying to understand and figure out undisclosed Grail transactions, especially the line items “cash contributions”, “escrow”, and “adjustment up to the redemption value”.

If Helix Holdings I, LLC was indeed involved with Grail, key documents and records relevant to the SEC’s investigation might actually be located there - or some other entity - and not at Illumina.

After reviewing the disclosures and my notes again, I now believe there’s a disclosure-based argument to be made that Helix Holdings I, LLC was used to raise Grail’s initial capital and facilitate undisclosed insider transactions of Grail economic interest. This best explains why certain transactions attributed Helix in Illumina’s filings seems to better “align” with public announcements tied to Grail.

As a reminder, Illumina formed Helix Holdings I, LLC as a variable interest entity (VIE) on July 2015, and obtained a 50% voting equity ownership interest in the VIE after raising $100 million from “unrelated third party investors” Warburg Pincus and Sutter Hill Ventures.

According to the filings, Illumina did not provide financing outside of its “contractual arrangements” when forming the VIE, and Helix was initially financed through cash contributions made by the third party investors in exchange for “voting equity interests in Helix”.

Interestingly, Sutter Hill Ventures would later participate in Grail’s Series A with Sutter Hill’s Jeff Bird involved at both Helix and Grail, and Warburg Pincus had a prior relationship with Grail CEO Hans Bishop where he was an Executive in Residence.

After re-visiting my notes and the disclosures, I think what I “overlooked” when I first examined Helix Holdings I, LLC was not “confirming” the capital being raised there was actually going to Helix’ operating entity Helix Opco, LLC. Candidly, I didn’t consider the existence of an “opco” until I visited Helix.com. That was a mistake.

I presumed the all the capital being raised was going to Helix, but a mosaic of disclosures seems to imply that’s not necessarily the case and arguably points to Grail being the likely recipient of the initial capital raised through Helix Holdings I, LLC.

Helix Facilitates Grail’s Series A and Insider Transactions?

Now, I can’t directly prove Helix Holdings I, LLC was used for Grail’s initial capital raise and facilitated undisclosed insider transactions, but I can make a strong inference this is the case.

When reviewing Grail’s filings, you’ll notice there isn’t a Form D (i.e. required filing for exempt security offerings) for their 2016 Series A round. The first Form D filed is dated February 28, 2017 and is for the initial capital raised for their Series B round.

If Grail, Inc. wasn’t the entity used to fund their $120 million Series A round, where did that capital come from?

I think the answer is Helix Holdings I, LLC which filed a Form D on July 29, 2015 to raise up to $130 million (~$108 million already sold when the Form D was filed) which would have the capacity to absorb Grail’s $120 million Series A round.

A major flag that catalyzed this opinion is Illumina’s March 2016 10-Q discloses the aggregate cash balance of Grail and Helix was ~$136 million. This balance should be closer to $200 to $250 million given Helix announced a $100 million raise ($130 million capacity per Form D) and Grail initially announced a $100 million raise (later raising $120 million):

As of April 3, 2016, the accompanying condensed consolidated balance sheets includes $136.3 million of cash and cash equivalents attributable to GRAIL and Helix (source)

This ~$100+ million “hole” doesn’t make much sense unless the announced $100 million Helix raise went to Grail instead, which would also explain why Grail didn’t file a Form D for their Series A.

Further, an amended Form D would disclose 13 investors had invested in the offering matching the number of investors who participated in Grail’s Series A round:

In January and February 2016, we completed our initial and additional closings of our Series A financing, whereby we issued an aggregate of 120,000,000 shares of Series A redeemable convertible preferred stock to 13 investors, including Illumina, for an aggregate purchase price of $120 million, or $1.00 per share.

Source: S-1 Filing

Adding further intrigue, Helix Holdings I, LLC isn’t registered by (at the time) Helix Opco’s Dawn Barsy as a “Foreign LLC” in California (i.e. non-CA entity that registers with California if they transact business within the state) until February 28, 2017, the same day Grail would file a Form D to raise their initial Series B round and amended their governance documents and supply agreement with Illumina.

Also, when reviewing Illumina’s March 2016 10-Q (i.e. the quarter Grail’s Series A is recorded), there’s an “issuance of subsidiary shares in business combination” line-time in the balance sheet tied to the Grail transaction implying some kind of merger may have occurred between Grail and another entity.

Incidentally, Grail filed a Form D dated May 24, 2018 indicating Grail was previously named “PSC15, Inc.”:

The name of this corporation is GRAIL, Inc., and that this corporation was originally incorporated pursuant to the General Corporation Law on September 11, 2015 under the name PSC15, Inc. and filed a Certificate of Amendment to the Certificate of Incorporation on January 5, 2016 changing the name of this corporation to GRAIL, Inc. (Restated Certificate of Incorporation)

Keep in mind previous Grail Form Ds did not disclose the company previously used a different name which is a glaring omission since it’s a required disclosure.

Simply put, there’s too much smoke here and a case can be made that Helix Holdings I, LLC was used to facilitate Grail’s initial capital raise while it was named PSC15, Inc. If true, the “redeemable non-controlling interest” transactions recorded in Illumina’s 2015 filings for Helix are actually Grail related:

As previously noted in my write-up covering potential insider trading violations, Grail-linked stock options can be pledged (under specific conditions), purchased with promissory notes, and are to be held in escrow at a third party designated by Grail. We literally see “held in escrow by third party” as a line-item (presumably tied to Grail) when Grail was incorporated in Q3 2015.

Basically, this implies Illumina insiders were accumulating “Grail” (when it was named PSC15, Inc.) equity/economic interests - when it was a wholly owned subsidiary of Illumina - and before it was renamed Grail on January 5, 2016 and announces their Series A round.

Overall, this is arguably the “missing link” to explain how Illumina insiders could have accumulated a sizable equity/economic stake in Grail to generate an undisclosed financial windfall splitting-off and subsequently re-acquiring Grail.

Again, I can’t directly prove this, but there is legitimate standing for the SEC to look into this and investigate.

End Notes: Non-GAAP Illumina Write-Ups

Malignant Governance: I explore the possibility Illumina insiders (past and present) reaped a material financial windfall from splitting-off and subsequently re-acquiring Grail (and the period in between).

Non-GAAP Activism: I discuss the potential impact of Carl Icahn featuring my write-up in his activist campaign.

Icahn’s Gambit: I lay the initial groundwork on why I believe Illumina’s “bad faith” response to the questions and issues I raised will eventually lead to resignations and how the company is in “checkmate”.

Baillie Gifford and Edgewood’s Position: I explain why top shareholders Baillie Gifford and Edgewood have legitimate conflicts to consider in regards to the upcoming vote and are potentially in possession of material non-public information regarding the unanswered questions and issues I raised.

Mutually Insured [D&O]estruction: I critique Illumina’s Grail-related D&O insurance for potential signals.

Commencing a Regulation Game: I explore the potential impact of Glass Lewis supporting two Carl Icahn Directors and share my SEC whistleblower tip on Illumina’s misleading reply to the questions and issues I raised.

Prelude to Endgame: I share why all of this matters to me and the material second-order effects that are in-play if I’m directionally correct on what I think happened at Illumina.

Fraud by Omission: I explain why I believe Illumina potentially committed fraud (by omission) to help facilitate undisclosed Grail transactions that will likely require financial restatements if proven true.

Chair Doubles Down on SEC Violations: I explain why I believe Chairman John Thompson is “doubling down” on misleading voters by omitting material facts, and his transgression is so blatant and egregious that I wouldn’t dismiss the possibility John Thompson ends up resigning from Microsoft’s Board once this saga is all said and done.

An Impossible Task: I share my disclosure-based rationale for why I believe insiders violated insider trading laws in regards to undisclosed Grail transactions and how the “scheme” potentially worked.

[Premium] The Calm Before the Storm: I explain why shareholders should consider this current period a “calm before the storm”, because we could see some material and acute changes announced in the near future. I also unpack the appointment of new Chairman Stephen Macmillan, walk through how Director Andrew Teno can quickly establish leverage and influence in the Boardroom, and how strategic alternatives potentially comes into play.

CEO Abruptly Resigns: I explore the possibility Francis deSouza’s departure may have been triggered by something “material” the Board and/or its new Directors were made aware of that compelled and warranted his abrupt resignation.

SEC’s Proxy Fight Review: I explore the potential read-through of the SEC monitoring Illumina-Icahn proxy filings behind-the-scenes.