Illumina: Icahn Drops "Helix" Bombshell

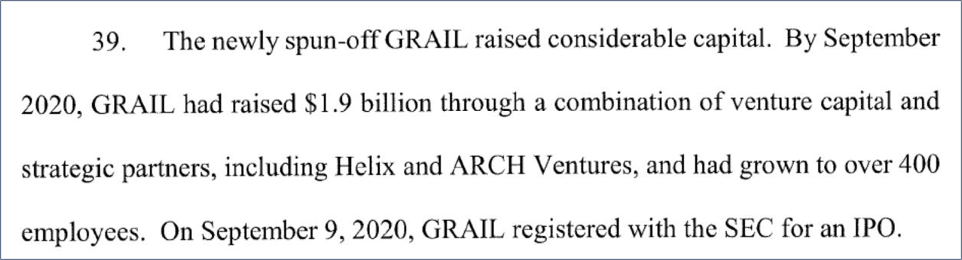

Carl Icahn alleges GRAIL raised capital from Helix and was a strategic partner

Carl Icahn low-key dropped a bombshell allegation in his lawsuit against “conflicted” Illumina Directors by using one word: Helix

I’m already on-record saying that I believe Helix was used to fund GRAIL, but Carl Icahn making this “factual allegation” as part of a high-stakes lawsuit carries orders of magnitude more credibility. He’s also privy to information that goes beyond the publicly available information I’ve been relying on to make the same allegation.

Keep in mind this is the first time an Illumina-linked party has explicitly mentioned/alleged Helix being involved with GRAIL. Neither GRAIL nor Illumina has ever brought in the disclosures as far as I can tell.

It’s also the first time I’ve seen anyone describe Helix as a “strategic partner” of GRAIL. Maybe he’s using the description generically, but a part of me believe this “strategic partner” language is informed by material non-public information. If so, I believe Illumina has a duty to file an 8-K - or equivalent - to meet their Regulation FD disclosure requirements given the materiality of this unredacted statement.

Overall, I wouldn’t underestimate the significance of Mr. Icahn making this allegation and decisions it catalyzes down the road, including wholesale changes to the Board before the next Annual Meeting. It has landscape changing ramifications.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated. As previously disclosed, I submitted an SEC whistleblower tip regarding the Illumina situation.

Summarizing Carl Icahn’s Lawsuit

I’d recommend reading Carl Icahn’s lawsuit for yourself, but I think the punchline is straightforward:

Carl Icahn believes the “true” reasons behind Illumina closing the GRAIL acquisition are so egregious that simply disclosing them to shareholders is enough to catalyze wholesale changes.

Basically, he’s suing to get the truth (i.e. “Undisclosed Matters”) out and I get the impression he’s confident there won’t be much ambiguity regarding the Board’s “law breaking” motives to close the GRAIL acquisition and mislead shareholders during the 2023 contested elections:

Icahn’s position is pretty wild when you think about it, because there aren’t many scenarios where simply disclosing the “truth” can legitimately trigger wholesale Boardroom changes.

Taking into consideration these lawsuits include some narrative “theatrics”, seeing someone as tenured - and institutional - as Carl Icahn filing this lawsuit and implying the “truth” is enough leverage to drive wholesale changes is extraordinary.

“Throughout my long, long career as an activist, I have never found it necessary, until today, to sue a board of directors in this manner” - Carl Icahn

A second-level takeaway of Carl Icahn’s lawsuit is he’s potentially operating under the assumption the “truth” will eventually come out, especially with an active SEC investigation underway, and he’s proactively getting ahead of that.

He can now hand over an unredacted version of this lawsuit to the regulators to help guide their own investigation into GRAIL - assuming they don’t already know about the things being redacted - and demonstrate he’s proactively cooperating and trying to remedy issues while the “conflicted” Directors are in-contrast resisting their inquiry.

Obviously, I’m speculating, but things must be pretty bad if he’s resorting to a lawsuit after securing a Board seat.

Icahn Drops “Helix” Bombshell

While most of the (presumably) bombshell “factual allegations” and “law breaking” transgressions are redacted in Carl Icahn’s lawsuit, it doesn’t redact arguably one of the biggest allegations I’ve made in this GRAIL saga:

Helix Holdings I, LLC was used to fund GRAIL

Candidly, I wouldn’t have written this piece if I didn’t see this “Helix” allegation since the rest of the unredacted lawsuit is mostly wait-and-see. It’s that big of a deal for me, and believe it’s needle-moving information that warrants a Regulation FD disclosure filing. A part of me actually wonders if Illumina “missed” redacting this.

Anyway, I believe Carl Icahn wouldn’t make this allegation unless he had direct knowledge of it and/or compelling evidence to support his claim. Given that Icahn Portfolio Manager, Andrew Teno, is on the Board, you have to operate under the assumption this “factual allegation” is informed/influenced by material non-public information and/or ongoing conversations in the Boardroom.

Big picture, if Helix was used to fund GRAIL, this should trigger new disclosures and arguably financial restatements. I honestly can’t think of a scenario where the company can get around this without entering “obstruction of justice” territory and/or committing SEC violations. The stakes are too high to not clarify the relationship between Helix and GRAIL, and the role it may have played in Illumina’s acquisition of GRAIL.

The State of GRAIL’s Share Count and Why Helix Matters

Just so we’re all on the same page regarding the importance of Helix and why I consider them the “missing link” in this GRAIL saga, state-level financial disclosures indicate (to me) other entities could issue “GRAIL” shares.

Specifically, when reviewing GRAIL’s 2021 Annual Report filed with the state of Massachusetts, their “issued and outstanding” share count (as of September 23, 2021) is 91 million shares over the “total authorized” shares they’re allowed to issue:

Assuming this isn’t a typo/error, the most plausible explanation for these 91 million shares is through the purchase/acquisition of GRAIL equity interest rights “outside” of GRAIL.

Basically, I believe these 91 million shares were secured through a non-GRAIL entity, or entities, prior to GRAIL’s 2016 Series A round and the shares were later issued before Illumina closed the GRAIL acquisition.

This is why Helix “matters”, because I believe most - or all - of these transactions flowed through Helix based on the likely timing of these transactions (i.e .Q3 2015) and the amount of shares. Also, there aren’t many parties who’d have access to these shares, and I believe Illumina insiders would have been the disproportionate beneficiary of acquiring these shares.

If that turns out to be the case, it would certainly help to explain why Illumina didn’t include a standard “dilution cap” when negotiating their acquisition since they’d be the beneficiary. By my rough calculation, GRAIL’s share count to grew ~41% between the time Illumina announced and closed the GRAIL deal less than a year later.

An argument could even be made that Illumina insiders knew - or should have known - the cost of acquiring GRAIL was going to be a much higher than the original $8 billion figure from the get-go and were misleading shareholding by not sharing the “fully loaded” price.

Further, I’m not entirely convinced the shares Illumina says they “own” in GRAIL is actually theirs. For instance, I can’t seem to cleanly reconcile Illumina’s publicly stated $40 million Series A investment in GRAIL to what’s actually going on in the financials.

It also doesn’t help that GRAIL shares can seemingly be held elsewhere on behalf of the beneficial owner, and the ownership of those shares would no longer be attributed to the beneficial owner and be transferred to the entity holding the shares “in escrow”.

Overall, understanding how Helix and GRAIL are connected is a critical step in better understanding how GRAIL shares moved between entities, how reported owner vs. beneficial owner is determined, etc.

Side Note: Adesto Technologies is another name to consider when thinking about the 91 million “excess” shares, but that’s complete rabbit-hole speculation on my part.

Undisclosed Stakes

I’m not going to spend too much time exploring the possibility Illumina’s “conflicted” Directors had an undisclosed stake in GRAIL, because that deserves/requires a dedicated write-up to fully explain my rationale.

Simply put, it is a critical issue that I hope was explained/addressed in the redacted portions of Carl Icahn’s lawsuit:

The [Icahn] lawsuit alleges it’s possible that defendants financially benefited from indirect investment vehicles, such as related companies, but the unredacted portions don’t offer any evidence. (Endpoints)

It is my belief that multiple “conflicted” directors generated an undisclosed financial windfall as a result of closing the GRAIL acquisition, and shareholder should especially focus on the Directors who currently hold committee chair assignments and their potential undisclosed interest.

Landscape Changing Ramifications: Biogen

Wrapping up, this piece focuses on Helix, but I believe they’re just the tip of a very large iceberg and there are multiple companies involved.

To give you a better idea of the “landscape changing” ramifications I see potentially coming out of the Icahn lawsuit, I wanted to share a speculative run-down of a company I believe will eventually get roped into this GRAIL mess (i.e. investigated by the SEC) that I haven’t publicly examined before: Biogen

For context and background, here are the core elements/concepts to be aware of that informs my thinking. Feel free to skip if you just want the punchline:

Illumina Audit Chair, Caroline Dorsa, is also the Chair of Biogen.

Former Illumina insider, Bill Rastetter, is (arguably) an influential figure with connections to Illumina Ventures, GRAIL, Biogen, and Idec Pharmaceuticals.

Served on Illumina’s Board for 17 years, including 10 years as Chairman.

Left Illumina to invest/join GRAIL.

Led the “merger of equals” that formed Biogen Idec in 2003.

Served as Chairman and CEO of Idec Pharmaceuticals.

Seres an Advisor to Illumina Ventures

Illumina’s Headquarters (5200 Illumina Way) was previously built for and occupied by Biogen Idec (Nobel Research Campus).

Biogen Idec announces they’re rebranding as Biogen on March 2015.

Biogen Idec is renamed Biogen in California on July 21, 2015

The disclosures indicate GRAIL may require any stock certificates issued in respect of Shares of Restricted Stock be deposited in escrow by the Grantee, together with a stock power endorsed in blank, with the Company (or its designee).

From my understanding, when a stock certificate is "endorsed in blank," it means that the document has been “signed on the back”, but it doesn't specify a particular recipient or owner. An endorsement in blank makes the document bearer or "to the bearer," which means that whoever holds the document physically can claim ownership or take actions related to it. This type of endorsement makes the document similar to a cash banknote, where the person holding the note is considered the owner, and it can be transferred without the need to specify a recipient.

Basically, shares held “in escrow” at Illumina will be disclosed as Illumina being owner of those shares even when they’re not the beneficial owner.

One of the ways I believe an investors can acquire an undisclosed stake in GRAIL is through contingent consideration payments/rights.

For example, we know Sutter Hill Ventures is an early investor in GRAIL, and, yet, they aren’t disclosed as a GRAIL shareholder in the filings.

I suspect Sutter Hill’s stake was acquired through Helix - where we know they’re an early investor and had Board representation. When reviewing the financials, this stake may have been (partly?) funded by Illumina who owed them a contingent consideration payment for a company (Verinata Health) they previously acquired that Sutter Hill invested in.

This “investing via contingent payments” mechanism has major ramifications, because it could mean Verinata Health’s other VCs also acquired an undisclosed stake in GRAIL. The folks connected to those funds would later end up at key positions at Johnson & Johnson, PacBio, and Illumina where those undisclosed conflicts would be highly helpful or problematic depending on your perspective.

All businesses operating in the City of San Diego are required to register for a Business Tax Certificate (BTC). The City of San Diego Issues a "Business Tax Certificate" instead of a business license. Issuance of the Business Tax Certificate acknowledges payment of business taxes. A BTC is required even though the business may not have a fixed place of business in the city or has a BTC from another city.

The punchline of all of this is the following:

It appears Biogen may have had an undisclosed stake in GRAIL and/or was used by Illumina insiders to escrow and/or acquire shares on their behalf.

The first indicator of this is we see Biogen Idec has an expired San Diego Business Tax Certificate which uses Illumina’s headquarters as their address (direct source). This BTC was effective around the time Illumina closes the GRAIL acquisition and Biogen subsequently allowed the certificate to expire:

BIOGEN IDEC INC (owned by BIOGEN IDEC INC) is a business in San Diego registered for tax certificate with the Office of the City Treasurer of the City of San Diego. The account number is #1990015382, and the account was created on December 12, 1990, with certificate effective on September 1, 2021 and expiring on August 31, 2022. The ownership type is Corporation. The account status is Cancelled. The registered business location is at 5200 Illumina Way, San Diego, CA 92122

Several questions come to mind when seeing this:

Why was Biogen using the Biogen Idec name?

Why was Biogen using an address (5200 Research Place) they vacated back in 2010 and had to wherewithal to update it to 5200 Illumina Way?

Why did they have a San Diego Business Tax Certificate after leaving San Diego a decade prior and why do they no longer need one?

Who was their “point of contact” at Illumina to use 5200 Illumina Way?

The “obvious” suspect to consider here is Bill Rastetter who arguably would have the pull and standing to have this “address” arrangement between Illumina and Biogen. If turns out Bill Rastetter is the reason Biogen Idec’s BTC uses Illumina’s address, does this mean GRAIL shares attributed to Illumina - or Mr. Rastetter - in GRAIL’s ownership actually belongs to Biogen?

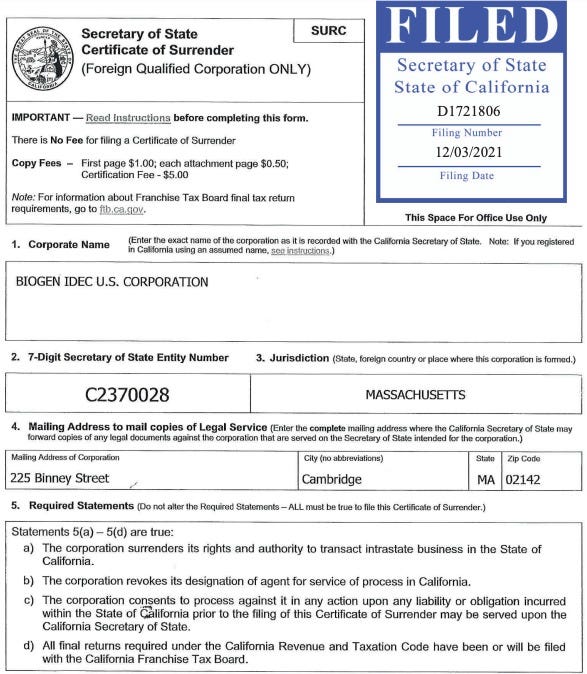

Digging a bit further, we see in the California disclosures that “Biogen Idec - Nobel Research Center, LLC” is activated on September 17, 2015 after previously being “forfeited” as an entity on October 1, 2014. This entity was later terminated on November 19, 2019:

A few things stand out here:

This entity’s business is: “To accept an assignment from Idec of all of its rights & obligations.”

Was Idec entitled to a stake in Helix/GRAIL via contingent consideration payment/rights?

The entity’s reemergence on September 17, 2015 aligns with Helix Holdings I, LLC filing Employee Plan Exemption notices for 42,352,000 in Equity Appreciation Units (filed 10/8/15, effective 2/16/16) and Class B Units (filed 10/14/15, effective 2/5/16).

Was the entity activated to participate in this?

As a reminder, these notices need to be filed in California “no later than 30 days after the initial issuance of a security under the [employee benefit plan exemption]” which provides some material takeaways.

The entity’s termination on November 19, 2019 is around the same time GRAIL would commence their Series D round and I previously shared my view that insiders may have used this financing round to “lock in” gains via Milky Way Investments. Were there GRAIL shares previously housed in this entity that was subsequently transferred to Milky Way, eliminating the need to maintain the entity?

Finally, we see a new Biogen Idec U.S. Corporation filing made in California on March 8, 2021 around the time GRAIL shareholders had to make their elections regarding CVRs. This entity was previously forfeited in California on February 1, 2005, and would subsequently terminate again on December 3, 2021 after the GRAIL deal closed and Illumina’s CVR tender offer:

Why would this entity be active in California on March 2021 after a DECADES long hiatus and and abruptly terminate its presence in December 2021?

Maybe it’s all coincidental and I’m grasping at connections that aren’t there, but if it turns out that these Biogen entities were involved in Helix/GRAIL and played a role in helping Illumina insiders facilitate an undisclosed financial windfall, the ramifications aren’t trivial.

There’s a reason why I believe GRAIL is a historic RICO case in the making, involving some of the biggest names in tech, healthcare, investing, and academia. The amount of coordination and collusion required to pull something like this off is both extraordinary and egregious that requires buy-in from folks at the very top of these organizations. It’s nothing like I’ve seen before.

If Martin Shkreli was sentenced to 7 years and Elizabeth Holmes was sentenced to 11 years for fraud, what kind of sentences are these GRAIL/Illumina insiders potentially facing for alleged fraud that generated billions of dollars for those involved?

But then again, given the folks and companies potentially involved, this could just as easily all go away due to political and/or market considerations. GRAIL seems to operate in a much different reality from the rest of us with its own rule-of-law so I’m not about to dismiss the “nothing happens” scenario from happening. It is what it is.

Curious what you think of the recent change in language of the CELH ceo comp package? I know they are a potential takeout target for PEP and there is stuff in there in change of control. I just don’t have the experience with precedents if you think anything is signal in there or all noise