Illumina’s $9.8 billion acquisition of Grail has been a disaster for shareholders.

As the company battles both regulators and shareholder activist Carl Icahn over the divestiture of Grail, I can’t answer a seemingly simple question:

How much money did Illumina insiders (past and present) make from splitting-off and subsequently re-acquiring Grail?

It’s the “missing piece” to understanding everything, and the disclosures on this topic are (suspiciously) non-existent and/or vague.

While company disclosures give the impression the financial windfall was limited, after sequencing (pun intended) the various Grail-related disclosures, Illumina shareholders need to consider the possibility the UNDISCLOSED financial windfall to insiders is well in excess of $500 million. And depending on your assumptions, that figure can conceivably be $1 billion+.

If true, this extraordinary transfer of wealth to insiders is suspiciously coincident with (and may in fact have helped along) the recent destruction of $50 billion in Illumina shareholder value.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Join Premium

If you enjoy this write-up, consider subscribing to the Premium Newsletter.

Premium explores “real time” situations and looks for interesting governance signals, like indicators of strategic options and other noteworthy inflections, before they potentially happen and/or gets priced in.

Note: If you previously subscribed to premium, a friendly reminder you were issued a pro-rated refund in February 2022 and will need to re-subscribe to receive premium emails again.

Incentivizing the Grail Fiasco

Many investors are puzzled by Illumina’s defiant re-acquisition of Grail in 2021—especially so soon after splitting-off the company in 2016—and the huge premium they paid in the process. When you review Illumina’s proxy statements and filings, there doesn’t seem to be any direct financial incentive that would motivate insiders to pursue the Grail deal.

Despite the lack of disclosed financial incentives, I posit there were meaningful financial incentives driving the Grail deal that Illumina shareholders are unaware of.

In theory, Grail was formed to create a distinct company that could “retain and attract best-in-class people through equity, culture, and quality of the science” to pursue an admirable and audacious goal of detecting cancer early when it can be cured.

In practice, Grail’s formation allowed Illumina insiders to load-up on “startup” priced equity and generate a huge financial windfall—disproportionally benefiting themselves - by leveraging Illumina’s market advantages and talent to unlock tremendous value at the expense of core Illumina.

Undisclosed Grail Shares

So how many undisclosed Grail shares did Illumina insiders acquire, and how were they able to accumulate these shares without disclosing it to Illumina shareholders?

Candidly, my forensic accounting skills aren’t what they used to be. (Please do your own homework!)

Fortunately, we can still rely on company disclosures, basic math, and a general understanding of disclosure rules to piece together directional answers.

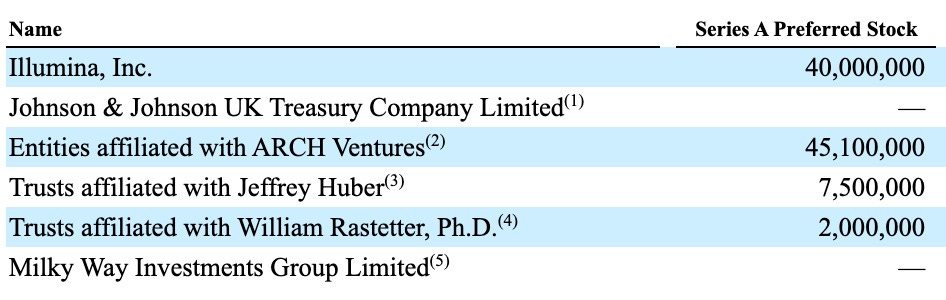

First, when Grail raised their $120 million Series A round (with Illumina contributing $40 million), Illumina was diluted down to 52% equity ownership!

In January 2016, the Company obtained a majority equity ownership interest in GRAIL, Inc. (GRAIL), a company formed with unrelated third party investors to pursue the development and commercialization of a blood test for asymptomatic cancer screening. The Company determined that GRAIL is a variable interest entity as the entity lacks sufficient equity to finance its activities without additional support. Additionally, the Company determined that it has (a) control of the entity’s Board of Directors, which has unilateral power over the activities that most significantly impact the economic performance of GRAIL and (b) the obligation to absorb losses of and the right to receive benefits from GRAIL that are potentially significant to GRAIL. As a result, the Company is deemed to be the primary beneficiary of GRAIL and is required to consolidate GRAIL. On a fully diluted basis, the Company holds a 52% equity ownership interest in GRAIL as of April 3, 2016.

For the three months ended April 3, 2016, the Company absorbed 90% of GRAIL’s losses based upon its proportional ownership of GRAIL’s common stock.

Bear in mind Illumina concurrently executed a long-term supply agreement with Grail and received 112.5 million Class B shares to go along with their $40 million Series A Preferred Stock investment.

So how in the world did Illumina get diluted down to 52% ownership?!?

To make the math work (i.e. 52% diluted ownership, 90% common stock ownership), I guesstimate up to 70 million Grail shares went to insiders, right out-of-the-gate.

Now, the dilution mix could be different if Series A investors received warrants as part of their investment (which the filings don’t disclose or acknowledge). In this scenario, the ownership math would imply Illumina didn’t retain their Series A warrants and gave/sold them to insiders.

Because Grail was treated as a consolidated “variable interest entity” (VIE), Illumina (from what I understand) wasn’t required to disclose compensation to named executive officers and directors received from Grail:

…in its annual reports or proxy statements, a public company is generally required to disclose all compensation awarded to, earned by, or paid to its named executive officers and directors for their services rendered in all capacities to the company and its subsidiaries. This requirement, including its related instructions, does not specifically include compensation received from the public company’s consolidated VIEs.

Source: Reporting Obligations of Variable Interest Entities (2018)

This would create a tremendous opportunity for Illumina insiders to accumulated a significant amount of Grail shares without disclosing the mis-aligned incentives it could create.

If my dilution math is correct (even if only directionally so), and Illumina insiders (past and present) were sitting on undisclosed Grail shares and/or options as low as $0.23 per share, it completely changes the narrative and perception around Illumina’s acquisition of Grail for $12.63 per share (total consideration).

Accumulating Shares via Venture Vehicles?

Additional undisclosed Grail shares may have also been acquired through investments with Arch Ventures and/or other venture vehicles. For instance, Arch Ventures invested $45 million in Grail’s Series A round in exchange for 45 million Series A redeemable convertible preferred shares, but it was later disclosed in the text of Grail’s S-1 they had transferred 100,000 shares in excess of their 45 million share ownership to former Grail President George Golumbeski.

This implies investors could acquire Series A shares through an Arch Ventures investment vehicle, and those shares would be separate from the disclosed 45 million shares Arch Ventures acquired.

Interestingly, shortly after Grail’s Series A round, Illumina announced they were investing in a newly “independent” venture fund (Illumina Ventures) run by a former Illumina executive and transferred $3.2 million of its cost-method investments to the new fund:

On April 14, 2016, we announced our commitment to invest $100.0 million in a new venture capital investment fund (Venture Fund) established by Nicholas Naclerio, Ph.D., our former Senior Vice President, Corporate and Venture Development. The capital commitment is callable over ten years, and up to $40.0 million can be drawn down during the first year. During 2016, the Company transferred $3.2 million of its cost-method investments to the Venture Fund and contributed $7.4 million in cash.

The point is: we really don’t know the full extent to which Illumina insiders accumulated Grail shares through equity packages, venture investments, and/or co-investments, but the undisclosed number could potentially be in excess of 100+ million shares.

Pursuing Aggressive Buybacks at All Costs (Method)

When Grail raised their Series A round in February 2016, Series A shares were priced at $1 per share and Class A common stock was priced at ~$0.23 per share.

Fast forward to February 28, 2017. Grail’s $900 million Series B round was being priced at $4.0085 per share. That’s a tremendous step-up in value!

What’s really interesting about the $900 million Series B fundraise is it appears a significant portion of the Series B proceeds was used to repurchase existing shares. Per the disclosures:

As of January 1, 2017, Illumina’s balance sheet includes $75.9 million of cash and cash equivalents attributable to GRAIL and Helix (another VIE).

On February 28, 2017, Grail initially raises ~$914m in their Series B round (would eventually raise $1.085 billion in total).

After selling $278 million in Series A and Series A-1 shares back to Grail on February 28, 2017, Illumina would remove $52 million in Grail cash from their balance sheet after deconsolidating Grail.

Where did the ~$900 million in Series B cash go!? It should have been reflected in the cash balance deconsolidated from Illumina’s balance sheet. And yet, we only see $52 million in cash deconsolidated despite a $900 million cash infusion.

We know ~$278 million went towards the repurchase of Series A and Series A-1 shares from Illumina, but we don’t know where the rest of the cash went:

On February 28, 2017, GRAIL completed the initial close of its Series B preferred stock financing, raising over $900 million, in which the Company did not participate. Concurrent with the financing, GRAIL repurchased 35 million shares of its Series A preferred stock and approximately 34 million shares of its Series A-1 preferred stock held by the Company for an aggregate purchase price of $278 million. At this time, the Company ceased to have a controlling financial interest in GRAIL and the Company’s equity ownership was reduced from 52% to 19%. Additionally, the Company’s voting interest was reduced to 13%, and the Company no longer has representation on GRAIL’s board of directors. As a result, the Company deconsolidated GRAIL’s financial statements effective February 28, 2017.

To make the ownership math work, I guesstimate Grail would need to repurchase ~129 million shares or $519 million at $4.0085 per share. To make the ownership math work AND have it align with the $52 million in cash that was deconsolidated from Illumina’s balance sheet, an incremental 98 million shares or $395 million at $4.0084 per share needs to be repurchased.

Simply put, there are repurchase scenarios here that imply the undisclosed financial windfall to Illumina insiders is in excess of ~$500 million just 1 year after Grail raised their Series A round. Not bad for a year’s work.

I could probably stop here, but it gets better.

Exodus of Illumina Talent

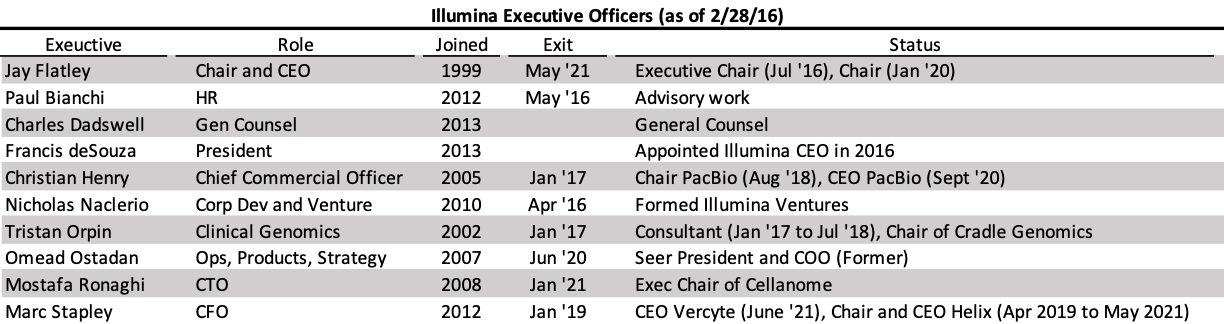

A major side effect of Illumina deconsolidating Grail from their financials and accounting for it as a cost-method investment in 2017 is it arguably triggered an exodus of Illumina Executives and Directors:

While we don’t specifically know how much each Illumina insider benefited from the Grail split-off , it’s not a stretch to assume Illumina insiders with early and/or significant Grail holdings would begin to depart/change roles to either avoid disclosure or further lean into the Grail equity opportunity.

Grail’s Equity Plan allows “consultants” to participate and and receive equity awards, and 2017 offered a unique opportunity for Illumina insiders to depart and engage Grail as a consultant to accumulate significant amounts of Grail shares:

The Company’s 2016 Plan allows for the grant of awards in the form of: (i) incentive stock options, (ii) non-qualified stock options; (iii) stock appreciation rights; (iv) restricted stock; (v) restricted stock units; and (vi) unrestricted stock. Directors, employees, and consultants are eligible to participate in the 2016 Plan.

This means all Illumina insiders that have left the company could have conceivably been retained as consultants at Grail and accumulated more shares.

For instance, Christian Henry left Illumina in January 2017 just before Grail did their February 2017 Series B round, and would seemingly have a “career gap” until August 2018. Tristan Orpin also left Illumina in January 2017, and his LinkedIn profile specifically notes he was a consultant until July 2018:

You would presume senior Illumina executives would be highly sought after, and yet, it appears both voluntarily took a career “break” for a similar period of time. Interesting.

While many rightfully view the Grail acquisition as value destructive, an argument can be made the value destruction actually began earlier in 2016 when Grail split-off from Illumina. It materially altered Illumina’s organizational DNA, misaligned insider incentives, and catalyzed an exodus of talent, attention, resources, and institutional knowledge to work (or “consult”) with Grail and other Illumina-affiliated opportunities—all to the detriment of Illumina’s core business.

Observing Jay Flatley’s Post-CEO Tenure

The biggest unanswered question in all of this is how many Grail shares did former Illumina CEO - and industry icon - Jay Flatley have. He’s the driving force behind Grail’s formation—and we have no idea what his financial stake was.

Frankly, the fact so many former Illumina insiders were getting rich off the Grail deal, and not Jay Flatley (based on the disclosures), is what initially peaked my curiosity. And when you view his post-CEO tenure through the lens of someone trying to avoid disclosing a massive Grail stake, Mr. Flatley’s sequence of maneuvers start to look really interesting and is what compelled me to keep digging to figure out the missing incentives:

In 2016, Mr. Flately transitions from Illumina’s CEO to Executive Chair after Grail’s Series A round, and also serves as Chair of Grail’s Board. Illumina’s 2017 Proxy states Jay Flatley “received no compensation for his service as a member of GRAIL’s board of directors”, but that doesn’t mean he wasn’t compensated by Grail.

After Grail raises their Series B in February 2017, Mr. Flatley resigns from Grail’s Board, but it is later disclosed he serves as a Board observer “in his personal capacity”. This potentially signals he owns a large undisclosed “personal” stake in Grail that would justify his “observer” involvement. If true, this would potentially misalign his incentives, especially when Illumina approached Grail in 2020 to acquire the company.

Effective January 1, 2020, Mr. Flatley would change his employment status at Illumina and become non-employee Chairman of Illumina’s Board, instead of Executive Chairman. 2020 is also the year Illumina would approach Grail and engage in acquisition talks which would culminate in an announced deal in September 2020. Mr. Flatley is noticeably absent in M&A talks, per the “background of the transaction” portion of the filings. It’s as if he recused himself from M&A discussions which would only make sense if he had a large stake in Grail.

Following the announced Grail acquisition, Mr. Flately would step off of Illumina’s Board in May 2021 just before the Grail acquisition would be consummated in August 2021. Had he stayed on Illumina’s Board when the Grail deal closed, he’d be required to disclose the Illumina shares he acquired as part of the Grail transaction (if he owns significant Grail shares).

Overall, knowing Mr. Flatley’s share ownership in Grail is the “missing piece” to the puzzle of Illumina’s decision-making, succession planning, turnover, corporate transactions, etc. leading up to the Grail acquisition fiasco that has perplexed Illumina shareholders.

Non-GAAP’s (Hypothetical) Activist Campaign

Wrapping up, I thought it be fun to dust off my activist investor hat and share what my hypothetical Illumina activist campaign would look like.

First, I want to acknowledge Carl Icahn is one of the greatest to play the activist game, so it’s not my intent to be a back-seat driver on his activist campaign. I’m simply sharing the levers I’d pull.

With that in mind, I’m more inclined to treat Chairman John Thompson as partner I can work with than an adversary (until proven otherwise), but then again, I’m not a confrontational fellow and “friendly activist” biased.

Mr. Thompson - who isn’t new to dealing with activism involving market dominating assets and “legendary” CEO succession - certainly has his hands full on how to proceed and untangle this Grail mess.

If the allegations I explore in this write-up are true, there’s a distinct possibility Mr. Thompson and the newest members of Illumina’s Board (i.e. those present in 2017 and onwards) had limited knowledge of the undisclosed financial stakes driving the Grail acquisition. At the very least, I’d assume they don’t know the full extent of the situation, and would be amendable to addressing the concerns highlighted in this write-up.

Concurrently, I’d make a 220 request to see the complete list of Grail’s Illumina-linked shareholders (i.e. individuals and funds). If it’s as egregious as I think it is, I would be confident in my chances of winning a contested election, and the conversation would likely shift to Board settlement and CEO succession discussions.

If I had to run a public proxy fight, I’d go after Mr. DeSouza (whose Bitcoin shenanigans aligns well with a campaign centered on undisclosed Grail shares) and Mr. Epstein, the latter of whom is the last remaining “independent” Director to have been involved with the Grail split-off. In particular, I would probe Mr. Epstein’s time as a paid Board observer at Grail and inquire why his Illumina holdings magically jumped up by 1,000 shares in 2021.

It could be a clerical error, but 1,000 Illumina shares approximates to the number of shares a Grail Director would receive in exchange for the 70,000 Grail shares they receive when appointed to Grail’s Board. Given that the $40,000 cash retainer Mr. Epstein received as a Grail observer is the same cash retainer Grail Directors receive, I don’t think it’s a stretch to believe he may have received 70,000 shares in Grail stock as well.

Anyway, I look forward to seeing how Carl Icahn’s proxy fight plays out. It’s hard to envision Illumina shareholders supporting the company’s slate in Mr. Icahn’s proxy fight if Illumina insiders indeed achieved an undisclosed $500 million to $1 billion+ financial windfall as a result of Grail’s split-off and re-acquisition.