Illumina: Mutually Insured [D&O]estruction

How atom-sized problems can turn into nuclear meltdowns

Generally speaking, most Directors know the problems that are festering at a company. The challenge is finding the right moment to bring them up in the Boardroom and properly address them. These problems are allowed to fester, because they’re usually tied to some high priority (i.e. and non-negotiable) initiatives management is pursuing.

The desire to not “rock the boat” is one of the biggest drawbacks of too much “collegial culture” in the Boardroom.

Occasionally, these atom-sized problems can turn into a Chernobyl-esque nuclear meltdown.

I suspect Illumina’s Board knew there were various atom-sized problems with the Grail acquisition process, but, at some point, an uncontrollable nuclear reaction started to happen and they’ve been dealing with the fallout since.

I say this, because Illumina is saying their Grail-related D&O insurance was a “standard” decision, but it appears to me “bad faith” decisions and/or actions may have informed the need for additional D&O insurance. If true, proxy voters might feel rightfully misled by this “standard” practice narrative.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Everyone Inside the Same Tent

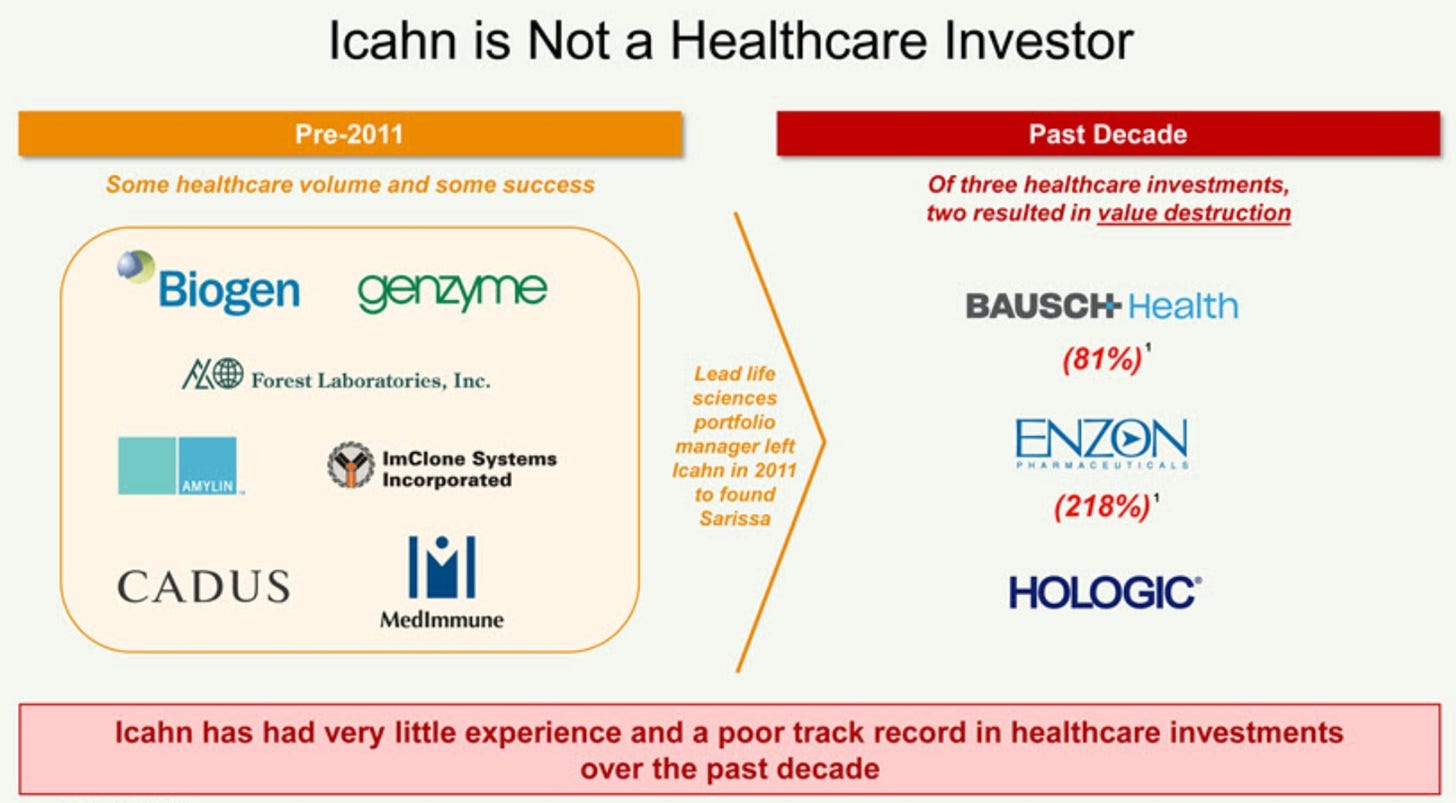

Back in 2010, when Carl Icahn settled his proxy fight with Genzyme, Relational Investors’ Ralph Whitworth - who joined Genzyme’s Board as part of an earlier settlement - said the following:

“It’s always good to have everyone inside the same tent, particularly when you have a company with the challenges that this one has.” - Ralph Whitworth

I bring this up, because having “everyone inside the same tent” and working earnestly together really matters when you’re dealing with the problems Illumina is dealing with. I also bring this up, because Illumina low-key complimented some of my past engagement work featuring Genzyme as a “success”. Thank you.

Anyway, to highlight how “joining the tent” can add value, I reviewed Illumina’s Grail-related D&O insurance disclosure to see if there were any notable nuggets of information to add to the current debate we’re having.

And the answer is YES. There’s actually some material insight in the disclosure provided (when applied to a mosaic of disclosures), but I’ll save that analysis for another time.

Carl Icahn Criticizes Grail-Related D&O Insurance

Mr. Icahn’s opinion on Illumina’s Grail-related D&O insurance is straightforward (albeit very pointed):

Put simply, it appears that, on the day prior to closing the GRAIL deal, the directors required Illumina to commit to provide them with an unprecedented level of additional personal liability protection – and buried the news in the hopes that no one would notice. (Icahn Letter)

While clearly we do not possess a crystal ball, this smells strongly to us like a quid pro quo – a group of trepidatious directors were dragged reluctantly, kicking and screaming, by management into an extremely risky deal and ultimately conditioned their approval upon receiving an even thicker blanket of immunity than the extremely luxuriant comforter which they already possessed. (Icahn Letter)

My initial gut instinct directionally aligns with Mr. Icahn’s opinion, but proving there was undisclosed materiality driving the need for extra D&O insurance is tough, especially if one suspects some element of quid pro quo.

Illumina’s Response

This absence of “proof” makes it very easy for Illumina to defend their decision and release a same-day response:

To be honest, this is an open-and-shut defense on Mr. Icahn’s criticism. Voters aren’t going to be swayed to vote one way or the other on this particular issue.

Well, they might actually reconsider after reading this write-up.

Indemnitee Initiated Claim: “San Diego, We Have a Problem”

In my experience, no matter how “standard” a one-off governance decision may seem, there’s usually a few nuggets of unique insight to extract.

In this instance, there’s a very notable nugget in the company’s definition of “claim” (bolded at the bottom):

“Claim” includes any threatened, pending or completed action, suit, arbitration, alternate dispute resolution mechanism, investigation, inquiry, administrative hearing or any other actual, threatened or completed proceeding or claim, whether brought by or in the right of the Company or otherwise and whether civil, criminal, administrative or investigative, in which any Indemnitee was, is or will be involved as a party or otherwise, by reason of the fact that such Indemnitee is or was a director, officer, employee or agent of the Company, by reason of any action taken by such Indemnitee or of any inaction on such Indemnitee’s part while acting as a director, officer, employee or agent of the Company, or by reason of the fact that such Indemnitee is or was serving at the request of the Company as a director, officer, employee, agent or fiduciary of another corporation, partnership, joint venture, trust or other enterprise; in each case whether or not such Indemnitee is acting or serving in any such capacity at the time any liability or expense is incurred for which indemnification can be provided under this Agreement; including one pending on or before the date of this Agreement, but excluding one initiated by an Indemnitee pursuant to this Agreement to enforce such Indemnitee’s rights under this Agreement. (Source: Grail-Related D&O Insurance)

I’m not expert-tier at reading legalese, but my interpretation of what’s being said is:

It appears one of Illumina’s Directors or Officers initiated a claim against an unknown party regarding the Grail acquisition to enforce their rights under this agreement.

Depending on what the claim is, and why it’s excluded for indemnification, this could be a form of quid pro quo. I couldn’t find anything else in Illumina’s filings to help me understand the actual puts-and-takes of this particular disclosure, but I suspect this is something the company doesn’t want to talk in-depth about.

Keep in mind this “claim” was explicitly added to the definition, and the decision to exclude a “claim” proactively in an agreement - intended to cover a broad range of actions and decisions - is telling. I would assume the “evidence” to justify this exclusion is quite strong.

To Fullest Extent Permitted by Delaware Law

Companies can indemnify all sorts of decisions, but they can’t indemnify actions that were done in “bad faith”:

Delaware corporation law provides mandatory “boundaries” for indemnification: a successful defense is always indemnified while persons who were determined to have acted in bad faith cannot be indemnified. Between those extremes, a company has wide discretion to establish its own rules for indemnification. (source)

For background, there are basically two fiduciary duties that must be met:

Directors have fiduciary duties of loyalty and care to the company and its stockholders

Duty of loyalty. You must put the interests of the company and its stockholders over your own personal interests in making decisions for the Company and evaluating opportunities. This includes not taking opportunities that arise for yourself before offering them to the company, and not divulging or using company confidential information for personal gain.

Duty of care. You must exercise care in making decisions as a director, based on adequate information and a good faith belief that your decisions are in the best interest of the company and its stockholders

Source: Cooley

Basically, knowing “bad faith” actions can’t be indemnified, this “claim” definition offers a material nugget of information regarding the the Grail acquisition.

Illumina’s Grail-related D&O Insurance disclosure is potentially implying an unknown party violated their Duty of Loyalty and/or Duty of Care with a “bad faith” action(s) specific to the Grail deal and there’s concrete evidence of this “bad faith” action (meaning it’s an excluded claim). Also, an Illumina Director or Officer had to initiate this particular claim to enforce their rights own under the agreement.

I don’t know about you, but that seems pretty significant. Suddenly, Mr. Icahn’s criticism of Illumina’s Grail-related D&O insurance may have provable standing.

What’s this Excluded Claim?

In my opinion, proving “bad faith” is really tough so to see a claim proactively excluded in the agreement is going to raise a red flag for me.

Given the existing questions and issues I’ve brought up regarding Illumina insiders potentially reaping undisclosed financial windfalls as part of splitting-off and subsequently re-acquiring Grail, this disclosure is potentially an important signal that I might actually be directionally correct with my concerns.

Further, it’s remarkable the claim was significant enough that a Director or Officer had to initiate the claim to enforce their own rights in the agreement.

Would that imply there’ evidence that would be construed as a “bad faith” action for this Director or Officer, and it required initiating a claim to disprove it as “bad faith”?

It’s not often you see an Officer or Director initiating a claim.

Based on this excluded “claim” disclosure, shareholders now can’t dismiss the possibility the Board is aware Illumina insiders reaped an undisclosed financial windfall - possibly in “bad faith” - as a result of acquiring Grail and insiders needed additional D&O insurance as a result.

Expiring 2-Year Clock

One of the interesting things about this disclosure is, if it’s as material as what’s being implied, why have shareholders not seen anything?

Reviewing Illumina’s original, non-Grail D&O insurance disclosure, a concern I have is the company is potentially trying to “run the clock” on this particular claim/liability so they don’t have to do anything about it:

No legal action shall be brought and no cause of action shall be asserted by or in the right of the Company against Indemnitee, Indemnitee’s estate, spouse, heirs, executors or personal or legal representatives after the expiration of two (2) years from the date of accrual of such cause of action, and any claim or cause of action of the Company shall be extinguished and deemed released unless asserted by the timely filing of a legal action within such two-year period; provided, however, that if any shorter period of limitations is otherwise applicable to any such cause of action, such shorter period shall govern.

Given the Grail acquisition closed August 18, 2021, we’re fast approaching the 2-year mark, but for all we know it the window may have passed already.

Regardless, shareholders have a right to know what this excluded “claim” is and who initiated it. This atom-sized disclosure has nuclear meltdown ramifications.