I’ve seen my fair share of headline activist campaigns over the years, but Carl Icahn referencing my Illumina write-up and leveraging it in his activist campaign against the company is a noteworthy milestone both personally and (more broadly) in activist investing.

I’ll save the “big picture” activism learnings for another day. For now, let’s examine the Illumina specific impact of Carl Icahn’s “Non-GAAP Adjusted” proxy fight.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Carl Icahn: Cui Bono?

On April 28, 2023, Carl Icahn filed a letter imploring Illumina’s Board conduct an independent investigate into the questions and issues I flagged in my write-up ahead of the 2023 contested election:

CUI BONO?

Additionally, we read an interesting piece recently on Illumina, entitled “Malignant Governance,” which asks the question that has been on the mind of virtually every long term shareholder with whom we have spoken: “How much money did Illumina insiders (past and present) make from splitting-off and subsequently re-acquiring Grail?” We have no idea if the allegations are true. However, based on what we do know of the past actions and lack of transparency exhibited by Illumina CEO Francis deSouza and the incumbent directors, we would not be surprised at all if some or all of the assertions turned out to be accurate. We therefore implore the board to bring in an outside – and demonstrably independent – law firm and forensic accounting team to investigate and address these questions publicly, with enough time prior to the upcoming annual meeting to allow shareholders to take the results into account when casting their votes for directors. We believe that an unbiased investigation into these murky issues is necessary and appropriate, given the fact that the director election will in effect be a referendum on the entire GRAIL fiasco. Unfortunately, we believe that we will see pigs fly before we see such an investigation conducted by this board. (source)

For background, I’ve never met nor interacted with Mr. Icahn, and my piece was independently written out of curiosity. Candidly, the piece is the inadvertent result of going down a proxy rabbit-hole. (It happens…a lot here)

With that in mind, I wholeheartedly agree with Carl Icahn: “We have no idea if the allegations are true.”

The company doesn’t provide enough disclosures to offer definitive answers to some really glaring questions. That said, Carl Icahn pushing these questions to the forefront (okay, I small section in his letter) of his campaign leads me to believe he independently determined there’s enough “smoke” here to push it as an activist agenda item. (Which, for the record, is something I never expected.)

Now, I’d love to believe my analysis stands on its own merit and is worthy of a due-diligence free Carl Icahn call-out, but this is “major league” activism we’re talking about, and at this level, folks don’t haphazardly reference information/perspectives - especially from a small independent newsletter - without doing their own work.

Proxy Fight Impact: Forcing a Sacrifice

So what is Carl Icahn trying to accomplish by featuring my write-up in his latest letter, and imploring the Board to conduct an independent investigation?

Well, there are a few considerations, but “big picture” he’s trying to force the company to make moves they don’t want to make.

To use a chess analogy, Illumina might need to start sacrificing some of their pieces on the Board (pun intended) to avoid activist checkmate. Of course, this assumes the issues I’ve raised are legitimate and have real standing.

If we assume the allegations are directionally true, there are conceivably 4 to 5 insiders (Directors and Executives) potentially on the sacrificial block, and I suspect insiders know this too.

This “forced sacrifice” tension is where things get interesting.

Boardroom Impact: Reputation Roulette

Generally speaking, a hallmark of large-cap activism is the actors tend to be rational. That’s not always the case, but when compared to small-cap activism, I find large-cap Directors more attuned to self-preservation and political bargaining when the chips are down. Less cynically, you have to be pretty thoughtful and accomplished to get invited to a Board like Illumina and/or come from the same college fraternity as the CEO.

A key linchpin to this “rationality” is large-cap Directors are very protective of their reputations and are especially vigilant when it’s exposed for reasons (generally) outside of their control and/or awareness.

Activists can capitalize on this by challenging a Board’s (supposed) “collegial” culture and inserting more tension into the Boardroom to breakdown any fiefdoms or other cultural hurdles that created the “mess” that catalyzed an activist’s arrival.

This tactic “works” especially well when activists are suggesting things and/or pointing out issues Directors (quietly) recognize are problematic, but don’t don’t have the appropriate opening (for a whole slew of reasons) to address them until there’s a chaotic “wartime” environment (i.e. Stock sells off, bad acquisition, poorly structured incentives, etc. attracts an activist).

In these “wartime” situations, if a Director sees an opening to protect their reputation and concurrently “do the right thing” (whatever that may be), they’ll make the move. The alternative of standing pat and remaining deferential is just too risky and essentially playing a game “reputation roulette”.

In Illumina’s case, the “opening” here is Directors can and should proactively ask for information regarding any-and-all Grail shares acquired by and/or affiliated with past and present Illumina executives and Directors.

For the record, Directors always have the right to make extensive/detailed information requests to management teams (I’ll die on this hill), but they culturally tend to refrain from “rocking the boat” with such requests and will backoff if there’s even slight pushback from management.

Anyway, from a timeline perspective, I suspect the vast majority of Illumina’s Directors joined the Board after these alleged transactions would have occurred so there’s actually “reputational buffer” to make the request.

Granted, this still doesn’t absolve the Board from closing the Grail deal without regulatory approval, but being unaware of all the key facts is incidentally a fiduciary duty “defense”.

Bear in mind, if a request is made by a Director (or Directors) for Grail shareholder records, they’re essentially putting long-time General Counsel & Secretary Charles Dadswell on trial. I surmise insiders want to avoid that, but Carl Icahn’s push for an “independent investigation” in his activist campaign forces the issue (a bit).

Investigation aside, this current dynamic doesn’t help the Board’s plan of adding two new directors AFTER the proxy contest:

The Governance Committee expects that, as a result of the current assessment, it will propose the appointment of two new directors after the 2023 annual meeting of stockholders - one public company chief executive officer and one public company chief financial officer.

Reading between the lines, it appears 2 current Directors are signaling a desire/intention to leave the Board after the proxy contest. If Carl Icahn wasn’t running a proxy cost, there’s a decent chance a transition would have been announced already based on historical precendent.

Regardless of the contested election voting results, this is a pretty radioactive governance situation (in my opinion) and expecting a PUBLIC COMPANY CEO and CFO to join this Board and commit a disproportionate time and mindshare on Grail the deal and other potential governance issues is quite the ask. I’m not even sure the public company Boards the CEO and CFO reports to would sign-off (either formally or informally) on an Illumina Director appointment.

Media Impact: Unclaimed Scoops

I’m keeping this the “Media” and “Regulatory” sections purposely short and generalized, because they arguably require a separate write-up to properly unpack.

While Carl Icahn has put the Board “on the clock” with his proxy fight, the media’s “clock” might be even faster.

If a media outlet can reliably source and answer the questions being raised in Malignant Governance, they likely just scooped a very big story with far reaching ramifications.

Regulatory Impact: Curbing Undisclosed Market Power

As for regulatory impact, if Illumina insiders were able to reap sizable, undisclosed financial windfalls splitting-out and subsequently re-acquiring Grail, the wrath of the shareholders likely plays second fiddle to the potential regulatory response and investigation.

Frankly, these are the kind of activist engagements that tend to lead to new regulations (yay?) and a rethinking of best governance practices (someday common sense will be a best practice).

Shareholder Impact: Preponderance of the Evidence

To be honest, I think Illumina didn’t help themselves slipping disclosures regarding additional D&O insurance for the Grail deal (even if it’s supposedly “standard”) and the intent to appoint 2 new Directors after Carl Icahn’s proxy fight.

It continues a pattern of (suspiciously) non-existent/vague disclosures and further erodes shareholder trust, especially when serious questions regarding the “real reason” Illumina (defiantly) completed the Grail deal without securing regulatory approval (a critical contractual “condition” in the merger agreement) remain unclear.

The lack of clarity has gotten to the point where proxy advisors and significant shareholders need to demand greater transparency and clearer answers to the potential conflicts of interests that may have swirled the Grail deal and influenced value destructive decision-making.

What’s interesting about contested elections is - in a way - they’re basically a “trial by proxy”, and - similar to 12 jurors determining a trial verdict - a proxy contest is often determined by 12 shareholders and a foreman (proxy advisor).

All this was really just one big lead up to say the “preponderance of the evidence” isn’t favoring Illumina in Carl Icahn’s “trial by proxy”. A basic review of the disclosures and simple math shows there are glaring holes in the disclosures that - in turn - raises serious questions where the “implied” answers aren’t a good look for Illumina insiders.

Grail Impact: Illumina is Diluting Itself

Wrapping up (for now), is anyone else perplexed by how wonky the acquisition math is for the Grail deal?

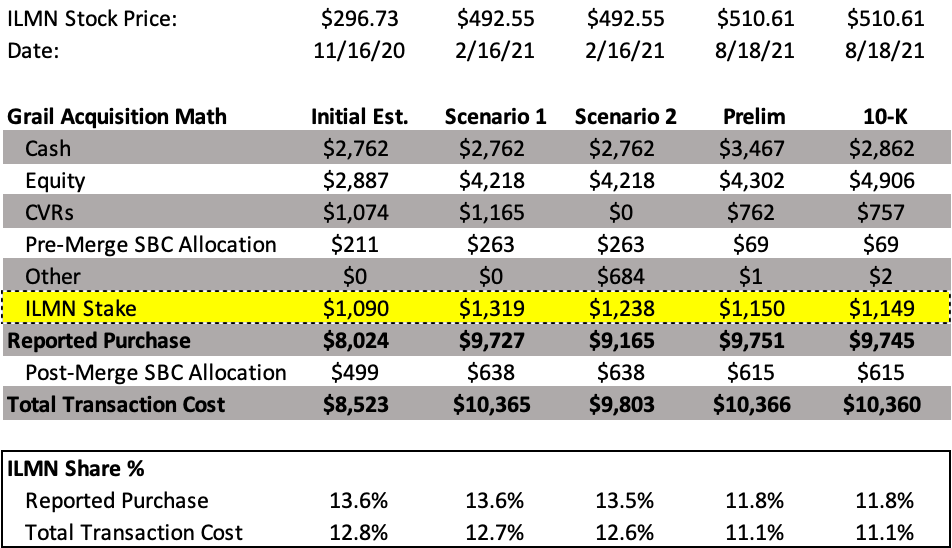

The calculated “fair value” of Illumina’s stake seemingly declines by over ~$100 million and they lose ~150 bps of transaction share percentage when you compare the completed August 2021 deal to the February 2021 estimates. Also, the August 2021 $1,149 million “fair value” for Illumina’s stake is only 5% higher than the original November 2020 estimate despite the stock appreciating 72%.

Also, why didn’t Illumina negotiate greater restrictions on Grail granting equity to insiders after the deal was announced?

I didn’t have the privilege (I was too dumb) of being an M&A banking analyst (slave), but I’m pretty sure negotiating dilution is M&A 101, especially when a significant portion of the transaction is tied to issuing Illumina stock to Grail’s diluted shares count. It’s not capped like the “cash consideration” component so Grail aggressively granting equity can really mess with the “acquisition math”.

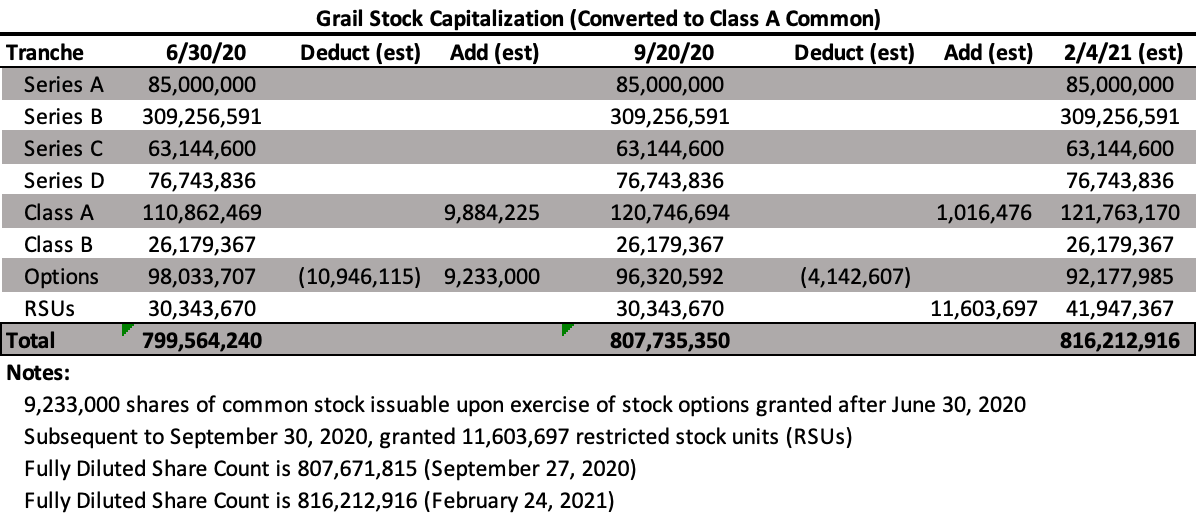

For instance, Grail (in my opinion) aggressively granted 11.6 million RSUs ($97.3 million “fair value”) AFTER the deal was announced despite these shares effectively being accelerated vesting eligible once the deal is completed.

Grail insiders were also aggressively granting options to themselves AFTER Illumina approached the company regarding an acquisition and were floating takeout prices.

In consideration of Consultant's performance of the Services, Consultant will be granted an additional option to purchase up to 1,400,000 shares [at $2.09 per share] of the Company's Class A Common Stock

This is classic “dark arts” spring-loading behavior, and it seems Illumina was okay with it. It makes you wonder why.