My endgame is simple.

I’m going to start laying out a prescriptive roadmap for everyone to investigate the possibility Illumina insiders committed fraud (by omission) to self-enrich by omitting material facts that arguably would have treated undisclosed Grail-related transactions as “related party transactions”.

This “related party” treatment is significant, because the company would be required to disclose these currently undisclosed transactions and apply different accounting and disclosure standards in Illumina’s public filings.

I suspect much of this alleged scheme relies upon taking advantage of certain accounting “presumptions”, and the grey area of what’s considered a “related party transaction” and the requirements of VIE vs. Equity vs. Cost accounting. Bascially, there seems to be a pattern of not disclosing important facts and terms one would need to determine if certain accounting “presumptions” shouldn’t be applied when determining “related parties”, “related party transaction”, etc., and a different accounting treatment should be used.

Put another way, if what I’m positing is true, Illumina will - at the very least - need to look into restating financials and disclosures going back to Q1 2016, and clawbacks and disgorgement of profits are very much on the table for those involved (which may include Arch Venture Partners, mind you).

Grail is considered by many Illumina shareholders a value destructive acquisition, but the company (as a “victim) might actually have some standing to get a portion of the proceeds back (via disgorgement, etc.) from the individuals and entities complicit in the alleged scheme. Yes, I’m telling every long-term Illumina shareholder they have an actual “incentive” to look into this.

Before I start getting into the weeds of the endgame, it’s important to explain “why” this brouhaha is so important. There are ramifications here that go beyond Illumina.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated. As previously disclosed, I submitted an SEC whistleblower tip regarding the Illumina situation. As a courtesy, premium subscribers will get to read this in advance before it’s released to everyone on Tuesday, May 16, 2023 at 6:30am PT.

Image: Flower Garlands by su-lin, available under a CC BY-NC-ND 2.0 License. For context, the use of this image is inspired by my last name and the occasions you’d give these floral arrangements. Happy (Belated) Mother’s Day.

This Goes Beyond Illumina

In my opinion, the Illumina-Grail saga has far reaching ramifications and will likely be a case study for many different issues - and potential resolutions - currently plaguing corporate governance and public markets.

“Unrelated” Party Transactions

If I was forced to choose the biggest “issue” in corporate governance today, it is “unrelated” party transactions and the undisclosed financial relationships between key decision-makers.

What I mean by “unrelated” is there are very specific rules on what needs to be disclosed as a “related party transaction”, and there’s a massive hole regarding the (often sizable) financial transactions, relationships, and windfalls occurring elsewhere between key decision-makers that aren’t disclosed, because they’re not considered a “related” transaction.

A big reason why I was able to “figure out” Illumina-Grail potentially had undisclosed financial windfall issues is I was already cognizant that “unrelated” party transactions is a problematic issue in corporate governance. I knew to look for signs of “unrelated party transactions”.

The entire alleged Illumina-Grail scheme requires treating what should be disclosed “related party transactions” as “unrelated” so it doesn’t require disclosure.

Public company corporate governance is a small, clubby world and most public investors don’t fully appreciate just how influential - and problematic - these undisclosed transactions and relationships can be on decision-making and oversight.

Frankly, it’s the reason many want to be public company Directors. You can get quite wealthy “indirectly” by serving on certain Boards. It’s kind of how “public servants” in Congress and the Senate seem to leave office with 8-figure plus net-worths despite entering service with “nothing” and receiving a modest salary.

In particular, compensation arrangements and conflicts that public company Directors and Executives may have through private markets dealings are usually unknown and aren’t disclosed.

It doesn’t go over my head many leading venture capital and private equity investors recognize - and take advantage of - this dynamic and you end up with situations like:

Illumina Chairman John Thompson serving on the Board of early Grail Investor Arch Venture Partners’ [collaborator] SPAC in 2021 ahead of Illumina closing the Grail acquisition. [Note: To be clear, Mr. Thompson did not serve directly on an Arch SPAC (from what I can find). He was involved in a General Catalyst SPAC who was actively and concurrently collaborating with Arch on a separate SPAC. The point I was trying to highlight is the overlap of undisclosed relationships can create potential conflicts. Apologies for the confusion. I recognize a missing word can change the context of what I meant and have included ‘collaborator’ as an edit to clarify.]

Former Illumina CEO and Executive Chairman Jay Flatley being involved or invested in multiple Arch Venture Partners investments (Juno, Denali, 908 Devices) where he reaped a financial windfall before Illumina chose Arch as their Series A lead when splitting-off Grail.

Former Illumina Chief Medical Officer Dr. Richard Klausner, Former Grail CEO Hans Bishop, and Former Grail Director Hal Barron all previously being involved at Arch Venture Partners’ investment Juno Therapeutics and all getting generous compensation packages at Grail, including Dr. Klausner and others receiving generous amounts of Grail options AFTER Illumina approached the company regarding an acquisition and were floating takeout prices. By the way, from what I understand, insider trading rules can still apply to private companies.

Whether they want to admit it or not, these transactions and relationships can-and-will influence insider decision-making. Even if the “right” decision is made (i.e. choosing Arch as their Series A investment partner, bringing in former Juno executives to lead Grail, etc.), it places a cloud over how “arm’s length” these decisions are.

Disgorgement of Profits

If it’s proven Illumina insiders defrauded the company by splitting-off and subsequently re-acquiring Grail, the SEC’s longstanding practice of seeking disgorgement of profits takes center stage given it’s unsettled case law (from what I can find) regarding how much the “victim” (i.e. Illumina) is entitled to receive and who must disgorge profits.

For instance, if it’s determined Arch Venture Partners was involved in the scheme, what exactly gets disgorged? Do LPs need to return distributions from the funds directly involved?

There will be lawyers.

A Prisoner’s Dilemma

Speaking of lawyers, if it’s proven Illumina insiders defrauded the company, a huge question mark in all of this is which advisors assisted in structuring and facilitating these undisclosed Grail transactions.

Who signed-off on this alleged scheme? Did they know what they were assisting in was potentially wrong?

To even pull off the undisclosed financial windfall I explored and estimated (i.e. $500 million to $1 billion+) in my previous write-up Malignant Governance, it arguably requires a ton of coordination and planning. This isn’t a 1 or 2 rogue actors “story” if fraud happened here.

For example, recall there were many peculiarly timed Director and Executive departures at Illumina that I have a hard time rationalizing and seem to be timed in a way to avoid disclosure. Were they really all “independent” decisions or were they coordinated and/or informed/advised by someone?

It’ll be interesting to see how this plays out, because one could argue everyone involved and/or exposed is in a “prisoner’s dilemma” of sorts.

It doesn’t go over my head entities like Arch Venture Partners might be heavily incentivized to claim they should’ve been treated as a “related party”, because the arrangement/relationship with Illumina and Illumina insiders prevented them from “fully pursuing its own separate interests”, and any potential wrongdoing is due the decisions of other parties.

If what I’m positing is true, I would expect potentially affected/exposed parties to start proactively reaching out to regulators to “cooperate” and seek plea deals.

Illumina’s Antitrust Fight over the Grail Deal

This sounds crazy, but there’s a potential case to be made that the “significant influence” and control exerted on Grail by Illumina and Illumina insiders through various (undisclosed) governance and voting rights means Grail should’ve been treated as a Variable Interest Entity (VIE) this entire time.

If that’s true, can the FTC and other regulators actually block a company from acquiring full control/interests of their VIE on antitrust grounds and forcibly have them divest it?

Antitrust Issues in Private Markets

If public company corporate governance is a small, clubby world, private company corporate governance would make European royal family trees look genetically diverse.

The FTC is worried Illumina’s Grail acquisition will hurt competition, but I believe where you actually see insiders flexing a company’s market dominance is in private capital markets.

It makes a ton of sense (to me) when viewed through the lens of personal incentives. “Killing” competition for personal profit draws too much attention whereas insiders can leverage the market power/dominance they “control” to self-enrich in private markets by collecting favorable “lottery tickets” in the ecosystem.

I suspect Illumina insiders are aware there’s an intense competition between biotech/life sciences VCs to partner with top academic institutions and win/partner key licenses and IP to commercialize.

An argument could even be made Illumina shouldn’t have been allowed to execute a preferential supply and commercialization agreement with Grail in 2016 given that the agreement - along with Illumina’s explicit support - likely played a key role in winning other IP deals and meaningfully contributed to Grail’s skyrocketing valuation from ~$0.15 to $0.24 per share in 2016 to $4.0085 per share at the February 2017 Series B round.

To be honest,I don’t think I’m having this current “undisclosed financial windfall” debate without Illumina insiders flexing the company’s market power in private markets.

Antitrust and Collusion Issues Between Illumina Alums

I want to be very, very clear that I’m not accusing current PacBio CEO - and former Illumina Chief Commercial Officer - Christian Henry of any wrongdoing, but if it turns out he had any financial interests and/or involvement (i.e. consulting) at Grail prior to joining PacBio’s Board in 2018, that’s going to be (obviously) problematic.

As a reminder, there’s a noticeable professional gap (based on LinkedIn) between Mr. Henry leaving Illumina as Chief Commercial Officer in January 31, 2017 and him joining PacBio’s Board on July 31, 2018.

When reviewing PacBio’s “Background of the Merger” in regards to Illumina’s proposed acquisition of the company, we know Mr. Henry joined PacBio’s Board after Illumina was already discussing various strategic partnership opportunities with PacBio:

At various times in April, May and June 2018, Susan Barnes, Pacific Biosciences’ executive vice president and chief financial officer, met with a member of Illumina management. These meetings involved discussions of ways that Pacific Biosciences and Illumina might work together, including (1) a strategic partnership; (2) distribution by Illumina of Pacific Biosciences’ products into the clinical market; (3) distribution by Illumina of Pacific Biosciences’ products in the United States and Europe; (4) collaboration on future joint research and development projects; and (5) collaboration on various human sequencing projects.

On June 11, 2018, Dr. Hunkapiller discussed with a member of Illumina management and certain other Illumina employees various technical aspects of Pacific Biosciences and Illumina collaborating on human sequencing projects.

At various times in July, August and September 2018, Ms. Barnes spoke with one or more members of Illumina management. These meetings involved discussions of ways that Pacific Biosciences and Illumina might work together. (source)

Just one month after Christian Henry joins PacBio’s Board, Illumina would express interest in acquiring PacBio and Mr. Henry would not recuse himself from acquisition talks:

In mid-September 2018, Mr. deSouza and Dr. Hunkapiller spoke. During this conversation, Mr. deSouza stated that Illumina might prefer to acquire Pacific Biosciences rather than enter into any type of strategic partnership, but that no final decision had been reached. This discussion was highly preliminary and possible prices at which Illumina would be prepared to acquire Pacific Biosciences were not discussed. This conversation was the first time that Illumina had expressed an interest in an acquisition of Pacific Biosciences. Mr. deSouza stated that he would speak with Dr. Hunkapiller again after a meeting of Illumina’s board of directors later in September 2018.

On September 25, 2018, Mr. deSouza requested an in-person meeting with Dr. Hunkapiller. That meeting occurred later on September 25, 2018. Also in attendance were Mr. Ericson (in his capacity as Pacific Biosciences’ lead independent director) and Ms. Barnes. At that meeting, Mr. deSouza, on behalf of Illumina, provided Pacific Biosciences with a non-binding letter expressing an interest in an all-cash acquisition of Pacific Biosciences for $7.00 per share of common stock. This letter also requested that Pacific Biosciences agree to negotiate exclusively with Illumina for a period of 30 days. (source)

The Pacific Biosciences Board was aware that Christian Henry, who joined the Pacific Biosciences Board as a director in 2018, was a former senior executive of Illumina. Mr. Henry did not recuse himself from any discussions concerning a transaction with Illumina. (source)

I already know this sounds like conspiratorial “inside man” stuff, but the entire point of this write-up is to explain and argue why Grail should have been considered a “related party” to Illumina this entire time.

If Mr. Henry was involved at Grail and/or had financial interests there, and joined PacBio’s Board without proper disclosure of these conflicts and financial interests, I hope everyone can see how there are legitimate antitrust and collusion issues with this entire situation given he didn’t recuse himself from M&A talks.

No Clawback: Did Insiders Telegraph Potential Wrongdoing?

When I first realized “fraud” might be on the table in regards to undisclosed Grail transactions, an obvious question is whether or not insiders were aware they might be red-lining the rules and/or recognize their undisclosed Grail transactions were “wrong”.

While I can point to both Illumina and Grail seemingly withholding key terms in Grail’s Voting and Right of First Refusal and Co-Sale agreements - to arguably ensure auditors don’t compel Illumina into treating these undisclosed Grail transactions as “related party transactions” - that doesn’t necessarily signal insiders knew what they were doing was potentially “wrong”.

Where things get interesting on this “wrongdoing” question, though, is I believe Grail options are the primary instrument used by insiders to generate an undisclosed financial windfall for themselves and GRAIL’S STOCK OPTION AGREEMENT DOES NOT INCLUDE A CLAWBACK PROVISION.

In contrast, both Illumina’s 2015 Stock Incentive Plan and Grail’s RSU Notice Form have clawback provisions:

Clawback/Recovery. All Awards granted under the Plan will be subject to recoupment in accordance with any clawback policy that the Company is required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other Applicable Laws. In addition, the Administrator may impose such other clawback, recovery or recoupment provisions on an Award as the Administrator determines necessary or appropriate, including, without limitation, a reacquisition right in respect of previously-acquired Shares or other cash or property upon the occurrence of cause (as determined by the Administrator).

RECOUPMENT/CLAWBACK. The grant of these RSUs (including any amounts or benefits arising from the RSUs) shall be subject to recoupment or “clawback” as may be required by applicable law, stock exchange rules or by any applicable Company policy or arrangement the Company has in place from time to time.

Source: Grail RSU Notice Form

For those unfamiliar with clawback provisions, they give company’s the right to recover at-risk cash and equity compensation from executive officers in the event of a financial restatement due to misconduct.

So why would Grail not include this very standard and expected provision in their stock option agreement, but include it in their RSUs?

If it’s proven Illumina insiders defrauded the company by splitting-off and subsequently re-acquiring Grail, it’s going to raise a lot of eyebrows if it turns out much of the undisclosed financial windfall was accomplished through Grail options and they’d don’t have a clawback provision.

That said, I suspect the lack of clawback provision in Grail’s stock option agreement will be challenged since the primary beneficiaries of “no clawback” potentially influenced and/or directly signed-off on the exclusion as Grail Board Directors.

Discovering Fraud: Did “New” Directors Telegraph Concern?

If I could figure out “fraud” might be a concern after reviewing Illumina’s proxy and financial disclosures, I’d like to think the “new” Directors that joined the Board after the alleged transgressions occurred would have sensed something was “off”.

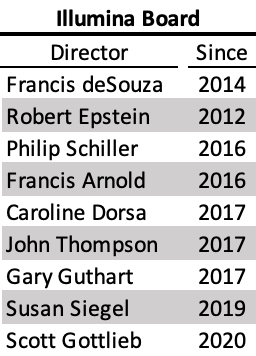

From the outside, I would only expect CEO Francis deSouza and Robert Epstein to really “know” for sure if wrongdoing occurred and they’re potentially complicit and wouldn’t necessarily be incentivized to tell the truth to their colleagues:

As for the other Directors, I wouldn’t expect them to necessarily “discover” they might have a problem on their hands until Directors with Grail equity interests (either personally and/or through other vehicles) started to recuse themselves during Grail acquisition discussions. At that point, I’d expect all the unaware Directors to experience some kind of “WTF” moment.

Once these Directors “know” there’s a problem, the real question is can we find any signs in the disclosures telegraphing “new” directors are concerned fraud/wrongdoing may have occurred and there could be accounting/audit/personal consequences if it comes out.

There are a few potential “clues” to consider that this may be the case:

The Grail-specific D&O insurance has already been mentioned and explored.

Per the 2020 Proxy, Illumina’s Board temporarily established a Demand Evaluation Committee with Caroline Dorsa (who was appointed Audit Chair in 2019) and Robert Epstein (Illumina’s Grail Board observer from 2016 to 2017) serving as committee members to “oversee certain legal matters”.

I can’t find the specific “legal matter” being addressed, but the issue was important enough to create a separate, temporary committee where the time commitment warranted paying Ms. Dorsa and Mr. Epstein an annual cash retainer of $12,000. Boards don’t spool up these sort of committees and pay additional cash retainer fees on a simple shareholder demand letter and/or matter.

In 2017, when Grail did their Series B round and Illumina applied cost method accounting to their Grail investment, the Audit Committee met 6 times. Meetings would jump to 11 in 2020 and 2021 during the time the Board announced and closed the Grail acquisition.

This is a personal heuristic, but John Thompson’s ongoing involvement in the Audit Committee is a flag for me. In my opinion, no Director of standing actually wants to be on the Audit committee so when you see any “heavy hitters” on the Audit Committee that’s going to raise some eyebrows.

In May 2023, Illumina hires Caroline Nolan as head of crisis communications. What would compel Illumina to hire a FULL TIME crisis communications person? That’s a very specific title and mandate to hire for. To me, Illumina’s proxy fight with Carl Icahn and and the current regulatory fight over Grail are transitory and doesn’t justify hiring someone full-time to focus on crisis communications. What other crisis are they concerned about that would require full-time resources and attention? While Ms. Nolan is coming from Meta, she spent over a decade at PwC handling their communications on the various issues the auditor got themselves into.

To be honest, Illumina can say this is all circumstantial and speculative, but what really hammered home I might be onto something is their “bad faith” response to the questions and concerns I raised (which they still avoid addressing). The moment I read the Board’s reply, I realized they just acknowledged how high the stakes truly are for them.

The Clue: The Board’s “Bad Faith” Reply to My Writings

What’s really interesting about the Board’s reply to the questions and concerns I raised is it arguably encapsulates the problem we’re dealing with.

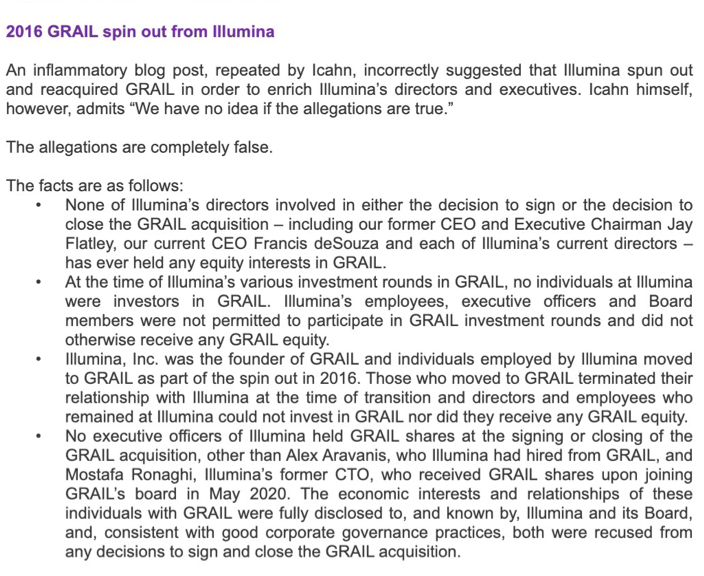

This response is misleading - and violates SEC rules - by omitting material facts that would significantly alter how a “reasonable investor” would perceive and assess their “response”:

I’ve previously discussed why I believe this response was knowingly done in “bad faith” so let’s take a step and discuss “why” the Board even took the risk of signing off on this.

Setting aside the notion the Board was hoping I didn’t know how “big” the problem potentially was and wouldn’t have a persuasive rebuttal, their willingness to sign-off on a “bad faith” response was a massive clue that fraud was legitimately on the table and they were potentially exposed for being aware of it.

I don’t think the Directors would take this kind of reputation and liability risk (remember, “bad faith” actions aren’t covered by D&O insurance) unless there was some level of desperation of the “fraud” problem confronting them.

This gave me the signal that I could “see this through” and actually finish the story myself.

This Matters to Me

You know, a month ago, I had no idea what I was stepping into when I opened Illumina’s proxy statement. Heck, I didn’t even know I had an SEC whistleblower case (or what the program actually entailed) until the day I wrote Regulation Game.

The endgame shall begin shortly, and we can all debate whether or not my perspective has real standing, together, but I want everyone to know “why” seeing this through really matters to me.

It’s easy to present myself as some “Wizard of Governance”, but the reality is I’m just a dude behind a keyboard. 5 to 6 years ago I was jobless and a bit heartbroken the things I loved and knew “didn’t matter” to anyone in the investment profession.

I eventually made peace with that and was actually happy as a clam, all things considered. Even if I couldn’t do corporate governance and investing as a living, that wouldn’t stop me from sharing my love for these topics. That’s why the newsletter exists! That said, I want to share a story to really hammer home the point why I care.

In 2017, I was super excited to organize a meetup and do a presentation to teach some of the things I knew. I was even getting RSVPs!

Of everyone who RSVP'd, only my wife showed up.

I'll admit I was bummed. Of course people aren't going to show up to some jobless dude's niche interests. No matter, wifey was here and we could go grab a meal. Literal lemonade out of lemons.

She said no. She wanted to hear my presentation:

"You committed to this and put in the work. I know it'll be good. You owe it to yourself to see it through." - Mrs. Nongaap

So I did, I presented, we had a laugh, and grabbed a meal afterwards.

It took a while to get here, but I'm pretty content with who I am, where I stand in life, and don't "owe" anything more to myself, really.

What I do owe is a huge debt of gratitude to a lot of people who saw something in me - and held firm to that belief - even when I wasn't so sure myself.

At the end of the day, I've never had a problem being underestimated, overlooked, and dismissed, because that's always been the case for me and, frankly, it never stopped me from accomplishing the things that mattered to me.

This matters to me.

I really hope what happened here isn't as egregious as I think it is, because, if it is, I don't care if everyone on the other side of the table is the platinum standard for what they do.

You're not my standard for what I do, and I owe it to my wife and everyone else who irrationally believed in me to see this through.

The endgame shall begin shortly, and we can all debate whether or not my perspective has real standing together, but I can definitively say I know how to “play to checkmate” and I will take this “game” to its inevitable conclusion. The real question is how many pieces I need to knock off the board before Illumina’s Directors figure that out.

Super compelling. I hope you're right and get that SEC whistleblower bag.

Mike, every one of your subs believes in you and the work you do. As Basil say, I think we all hope you get the whistle-blower bag and keep writing. I'd even suggest bringing back the presentation. If not in person, at least via Zoom. This time with a pre-paid fee. Good luck! Watching and rooting for you.