On December 17, 2024, WM Technology (ticker: MAPS) received a non-binding proposal from founder Justin Hartfield and current CEO Douglas Francis to acquire the company for $1.70 per share in an all-cash transaction.

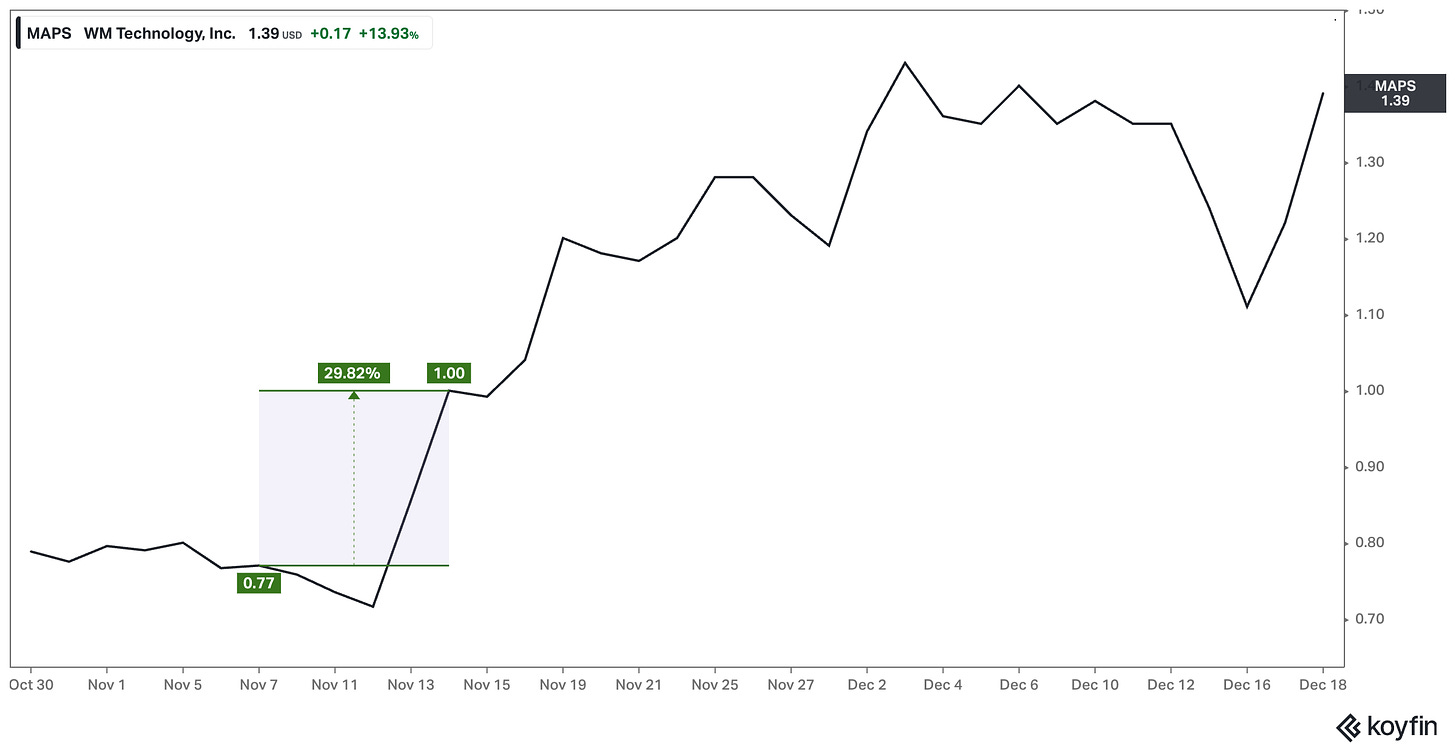

The stock jumped ~14% to $1.39 on the news, and is up ~81% since Douglas Francis was appointed CEO on November 7, 2024.

In response to the non-binding proposal, the Board has formed a special committee to evaluate the offer and there are no assurances a definitive agreement will be executed.

After reviewing the governance disclosures, I believe the offer needs to be significantly enhanced to better align with the price targets outlined in Mr. Francis’ equity compensation package:

A $1.70 per share offer begins to resemble a “takeunder” when, just the previous month, the Board granted Mr. Francis performance-based RSUs with three-year vesting price targets of $3.25 and $5.00.

Without this upward adjustment, I’m skeptical that disinterested shareholders will approve the deal.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Premium Plug

If you enjoy this write-up, consider subscribing to the Premium Newsletter.

Premium explores “real time” situations and looks for interesting governance signals before they potentially happen and/or gets priced in.

December 2024 Write-Ups: PLTR, EVLV, HSY, BL, TWLO, GDRX, and counting…

WM Technology

WM Technology, Inc. operates a leading online “medicinal green” marketplace for consumers together with eCommerce and compliance software solutions for businesses operating in this space, which are sold to both storefront locations and delivery operators (“retailers”) and brands in legalized markets in the United States.

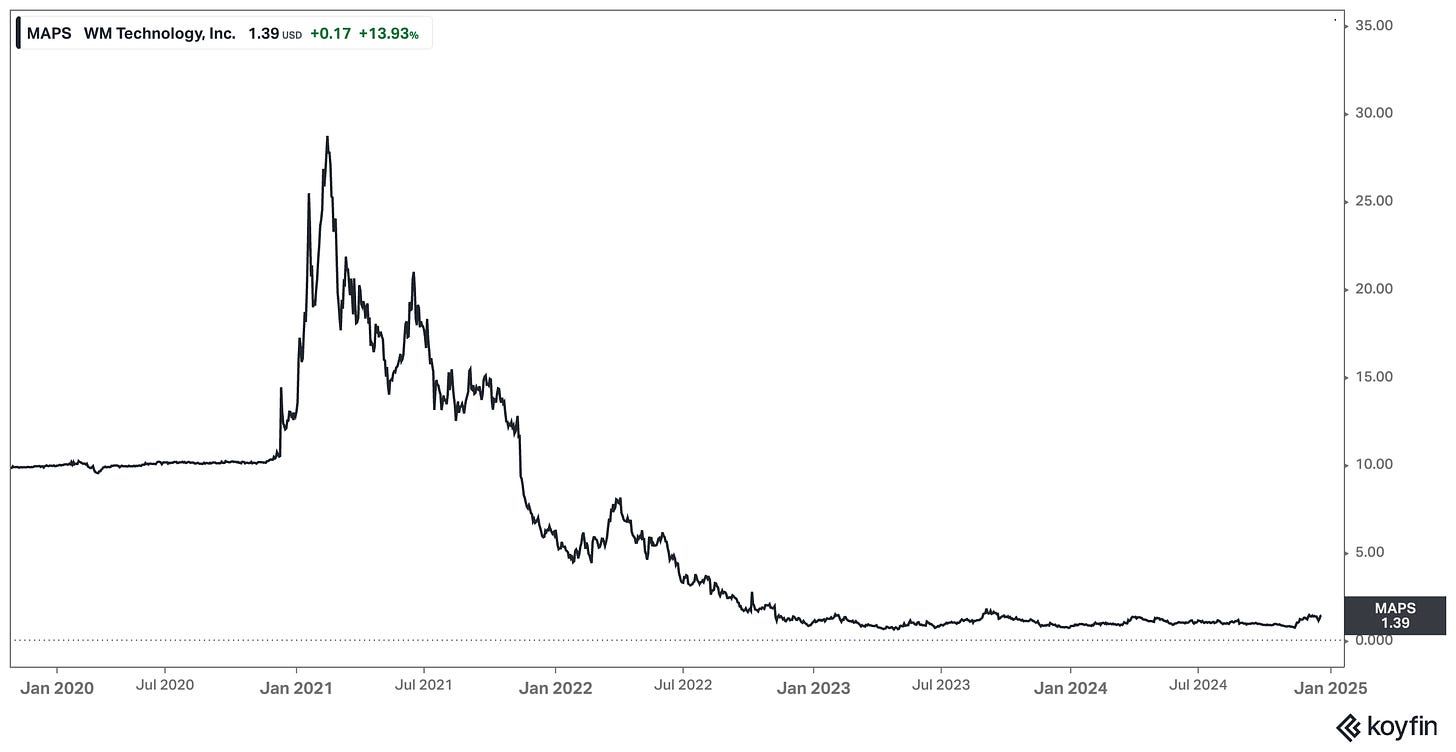

The company went public via SPAC merger and has more-or-less been a “broken” stock once the SPAC bubble burst:

To be fair, the go-public journey isn’t easy, and it can take 2 to 5+ years to build durable credibility and trust with shareholder.

Take-Private Offer

Given the challenges of operating a public company, I’m not surprised founder Justin Hartfield and current CEO Douglas Francis are offering to take the company private:

We are pleased to submit this non-binding proposal to acquire all of the outstanding shares of common stock (Class A and Class V) of WM Technology, Inc. (“WM” or the "Company") that we do not currently own (the “Transaction”) for $1.70 per share in cash (the “Offer Price”).

Source: Non-Binding Letter (12/17/2024)

The Board has established a special committee of “disinterested and independent directors” to evaluate the non-binding proposal. However, I have concerns that several of the Board's prior decisions leading up to this offer resemble governance “dark arts.”

One could argue that these decisions foreshadowed the non-binding proposal, raising significant doubts about how “arm’s length” Mr. Francis’ CEO appointment and equity compensation package were, especially given their timing ahead of the proposal.

If shareholders cannot trust those earlier decisions, it becomes difficult to have confidence that the special committee will genuinely act in the best interests of WM Technology and all of its stockholders.

Topic: Corporate Governance “Dark Arts”

If you’re new here, corporate governance “dark arts.” is a multi-part series where I walk through how insiders can leverage the various rules and quirks of corporate governance to:

Take advantage of unsuspecting shareholders and directors

Influence decision-making

Profit

Basically, every field has dark patterns available to its practitioners that allow them to exert control and/or influence others in their favor. Corporate governance is no different.

And yes, if you can identify “dark arts” behavior, there are windows of opportunity to participate alongside.

Assessing WM Technology for “Dark Arts”

How to examine “dark arts” at WM Technology doesn’t require galaxy-brained analysis or contrarian assumptions.

Most of the time, it comes down to incentives…

A lot of the “effort” to figure this stuff out involves reading the footnotes of governance disclosures - which horrifies a lot of investors - and building a mosaic to surface interesting insights. The process can also be quite complementary to your existing research funnel.

It entails things like:

Knowing the basic structure and cadence of governance and equity comp

Reviewing the specific terms, timing, and amounts of equity being granted

Flagging and/or tracking notable changes or amendments to key governance disclosures.

Let’s walk through WM Technology, and hopefully by the end of this write-up you’ll better understand the governance concerns I have.

Amendments to 13D Filing

To start, a non-binding proposal doesn’t occur “out of the blue” especially when the interested buyer has a 13D filing.

Back in 2021, Justin Hartfield and Douglas Francis clearly disclose they didn’t have plans to propose a deal, but reserved the right to propose a transaction in the future:

[None] of the Reporting Persons have a present plan or proposal that relates to or would result in any of the actions specified in clauses (a) through (j) of Item 4 of Schedule 13D of the Act. However, each of the Reporting Persons reserves the right to propose or participate in future transactions which may result in one or more of such actions, including but not limited to, an extraordinary corporate transaction, such as a merger, reorganization or liquidation, sale of a material amount of assets of the Issuer or its subsidiaries…

Source: 13D filed 6/28/21

Fast forward to May 2024, they amended this 13D to explicitly say they’re evaluating potential transactions and will be engaging in discussions with the company:

The Reporting Persons have determined to consider and evaluate one or more potential transactions which may result in one or more of the actions specified in clauses (a) through (j) of Item 4 of Schedule 13D of the Act, including, but not limited to, an extraordinary corporate transaction, such as a merger, reorganization or liquidation, sale of a material amount of assets of the Issuer or its subsidiaries, or other transactions which might have the effect of causing the Class A common stock to become eligible for termination of registration under Section 12(g) of the Act.

As part of this consideration and evaluation, the Reporting Persons will be engaging in discussions on an ongoing basis with potential sources of debt and equity financing and with representatives of the Issuer. The Reporting Persons do not intend to amend this schedule in relation to such evaluation and discussions unless and until a formal proposal has been delivered to the Issuer or an agreement has been reached, except if facts and circumstances otherwise require the Reporting Persons to do so.

Source: 13D/A filed 5/31/24

The co-founders are literally telling you they are considering a transaction. So when you review subsequent governance decisions, it’s probably a good idea to have this context in mind.

Douglas Francis Appointed CEO

So when the company announced Douglas Francis is being appointed CEO, alarm bells should be going off:

On November 7, 2024, the Board approved the appointment of Douglas Francis, age 47, to serve as Chief Executive Officer of the Company, effective as of November 7, 2024.

Mr. Francis told shareholders in the amended 13D he’s evaluating transaction opportunities and is subsequently appointed CEO a couple quarters later.

This doesn’t mean an offer is about to happen, but it does mean you should heavily scrutinize the terms of his employment agreement:

The Employment Agreement also provides that Mr. Francis will receive (i) service-based vesting restricted stock units under the Company’s 2021 Stock Incentive Plan (the “Plan”) with a grant date fair value of $3,995,000.00 (“Service RSUs”) and (iv) performance-based vesting restricted stock units under the Plan with a grant date fair value of $3,995,000.00 (“Performance RSUs”). The Service RSUs will vest quarterly in substantially equal installments over a three-year period, subject to Mr. Francis’ continuous service with the Company. The Performance RSUs will vest upon the achievement of certain stock performance milestones.

The company just granted him ~8.7m shares, ~5.7% of the company, with half of it tied to “stock price milestones”.

Performance RSUs with Stock-Price Hurdles

Regardless of M&A, seeing a CEO get PRSUs that vest at $3.25 and $5.00 when the stock was trading at $0.77 when appointed is incredibly bullish:

One half of the PRSUs will vest if the volume weighted average price ("VWAP") of Issuer's Common Stock during any period of 30 trading days during the Performance Period equals or exceeds $3.25, and one half of the PRSUs will vest if the VWAP of Issuer's Common Stock during any period of 30 trading days during the Performance Period equals or exceeds $5.00, subject to the Reporting Person's Continuous Service (as defined in the Issuer's 2021 Equity Incentive Plan) through each such date.

Generally speaking, that’s a “trembling with greed” tier transaction and the CEO wouldn’t accept these ridiculously high vesting hurdles unless he had a line of sight on how to move the stock in that direction within 3 years.

Change-in-Control Friendly Terms

This is where we start to build the mosaic…

We know:

The amended 13D discloses potential transactions are being considered and evaluated.

The PRSUs have very high stock price hurdles that must be achieved within 3 years to vest.

When you review the change-in-control plan and equity incentive plan that dictate the terms and conditions of Mr. Francis’ equity compensation, it becomes (in my opinion) “abundantly clear” a sale of the company is firmly on the table when he was appointed CEO.

For example, if there’s a change-in-control termination, any performance-based vesting awards will be deemed achieved at target level. This would mean Mr. Francis wouldn’t need to hit $3.25 or $5.00 for these shares to vest if there’s a change-in-control transaction.

Further, it appears (to me) he doesn’t necessarily need to be terminated following a change-in-control to see “target” accelerated vesting:

In the event of a Corporate Transaction in which the surviving corporation or acquiring corporation (or its parent company) does not assume or continue such outstanding Awards or substitute similar awards for such outstanding Awards, then with respect to Awards that have not been assumed, continued or substituted and that are held by Participants whose Continuous Service has not terminated prior to the effective time of the Corporate Transaction…

With respect to the vesting of Performance Awards that will accelerate upon the occurrence of a Corporate Transaction pursuant to this subsection (ii) and that have multiple vesting levels depending on the level of performance, unless otherwise provided in the Award Agreement or unless otherwise provided by the Board, the vesting of such Performance Awards will accelerate at 100% of the target level upon the occurrence of the Corporate Transaction.

Normally, PRSUs with stock price vesting requires the takeout price to meet or exceed the price hurdle in order to accelerate vest upon a change-in-control. The absence of this requirement is a big flag.

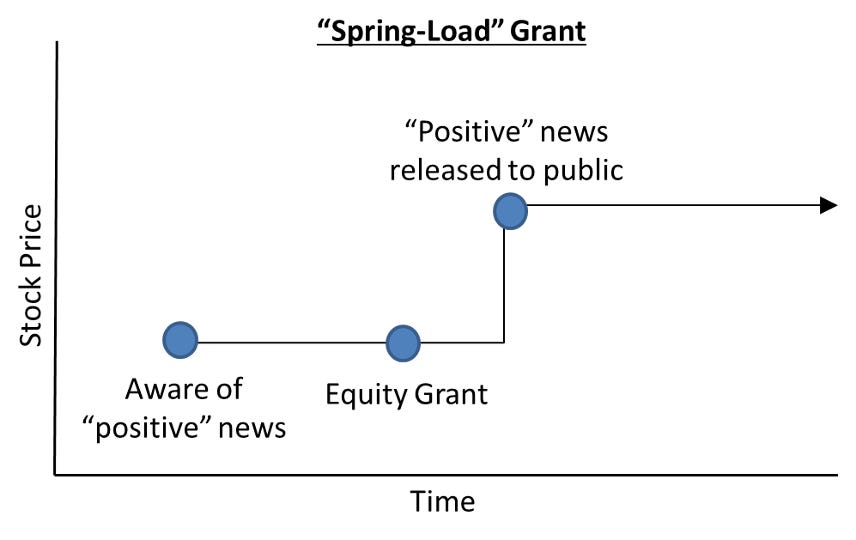

Spring-Loaded Equity Grant

Another thing that’s interesting about Mr. Francis’ equity grant on November 7, 2024 is it occurs days before Q3 2024 earnings are announced on November 12, 2024 and the stock pops.

This sequence arguably makes this a spring-loaded equity grant:

For background, “spring loading” is when a company grants equity and then releases news that positively impacts the stock price:

Companies will often spring-load equity to give insiders undervalued shares and be in-the-money as soon as possible. It’s a classic “dark arts” behavior.

In case there are still doubts about Mr. Francis’ equity being spring-loaded, we’d later find out a confidentiality agreement was executed regarding “a possible negotiated transaction” on October 29, 2024 when he filed an amended 13D on 12/18/2024:

In connection with the consideration by Ghost Media Group, LLC, a Nevada limited liability company (“Recipient”), of a possible negotiated transaction (the “Possible Transaction”) with or involving WM Technology, Inc., a Delaware corporation (collectively with its subsidiaries, the “Company”), acting at the direction of the Special Committee (the “Special Committee”) of its Board of Directors, the Company is prepared to make available to Recipient, following Recipient’s execution and delivery of this letter agreement, certain information concerning the business, operations, employees, finances, assets and liabilities of the Company

The Board appointed Douglas Francis as CEO, and granted him ~8.7m shares (i.e. ~5.7% of the company) with change-in-control friendly terms, AFTER signing a confidentiality agreement regarding a “possible negotiated transaction.”

This is why it’s difficult to have confidence the special committee will genuinely act in the best interests of WM Technology and all of its stockholders.

Attracting the Regulatory Cops (Again)

Now that a non-binding proposal is disclosed and on the table, it wouldn’t shock me if the SEC investigates this alleged spring-loaded equity grant and the circumstances surrounding Mr. Francis’ CEO appointment.

The proxy statement clearly says the Board doesn’t “intend” to time the public release of material information or manipulate when equity is granted to benefit recipients, and Mr. Francis’ grant appears to contradict this:

Also keep in mind WM Technology just settled with the SEC this year concerning the company's reporting of its monthly active users (MAUs). They’re encroaching on repeat offender territory.

Smoke Signals: Reverse Engineering a “Dark Arts” Trade

Put it all together and an argument could be made investors had a risk-adjusted opportunity to make a “dark arts” bet post Q3 2024 earnings:

The amended 13D disclosed a transaction is being considered and evaluated.

New CEO was appointed and given a lot of PRSUs with high price hurdles.

PRSUs are very change-in-control friendly.

Spring-loaded timing of the equity grant point to “trembling with greed” behavior and desire to maximize accumulation of shares.

To be clear, it’s still hard to predict the exact timing of deals since it involves many moving parts, but I’d argue the mosaic of disclosures point still to a potentially compelling investment set-up.

Now What?

After reviewing the governance disclosures, I believe the offer needs to be significantly enhanced to better align with the price targets outlined in Mr. Francis’ equity compensation package:

A $1.70 per share offer begins to resemble a “takeunder” when, just the previous month, the Board granted Mr. Francis performance-based RSUs with three-year vesting price targets of $3.25 and $5.00.

Without this upward adjustment, I’m skeptical that disinterested shareholders will approve the deal. I think the Board is going to have a hard time justifying $1.70 being a fair offer when they literally just negotiated $3.25 and $5.00 as appropriate price targets to pursue over the next 3 years.

Either the offer needs to be increased or Mr. Francis should probably plan on staying public and pursuing the price targets he’s incentivized to achieve.

We own 450,000 shares, where would you like for us to send a complaint? First time i have done this, thx, in advance