Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Topic: Examining “Narrative” When Investing

Disclaimer: This write-up is not investment advice nor an investment recommendation. The focus is on “narrative” analysis and I don’t cover the merits, or risks, of owning MSTR. I do own shares.

On August 11, 2020, business intelligence (B.I.) software vendor MicroStrategy (ticker: MSTR) became the first public-listed company to adopt bitcoin as a primary treasure reserve asset re-allocating $250 million of cash to bitcoin.

Since that decision, the company has allocated $1.125 billion (cost basis) to bitcoin in total and the stock has rocketed towards ~$600 per share from $123.62 (pre-bitcoin announcement) as bitcoin’s price ramps.

While MicroStrategy’s bitcoin story is well understood today, I believe investors had a risk-adjusted window of opportunity to buy into MicroStrategy’s bitcoin “narrative shift” before the stock properly priced it in.

That’s not to say I predicted the stock was going to ~$600 (or bitcoin’s run to $40,000), but you could have certainly seen the bitcoin “narrative” forming and recognized it would be a positive catalyst for the stock with downside price protection provided by MicroStrategy’s new commitment to better capital allocation.

In this post, I walk through how I think about “narrative” when investing, and why I made a highly speculative event-driven investment in MicroStrategy last year based on “narrative shift”.

Premium Write-Ups Unlocked

Note: The MicroStrategy write-up starts at Being Intentional with “Narrative” in your Process. Feel free to jump ahead.

Before we jump into MicroStrategy, if you’re a free subscriber and curious about the premium newsletter, I’ve unlocked 3 premium write-ups you can check out.

The goal of the premium newsletter is to share corporate governance and other lessons using real time situations as a reference point. I can't promise you "fish", but you'll "learn to fish".

Hopefully, these unlocked write-ups give you a better idea of the premium content.

On November 13, 2020, I wrote about HD Supply potentially evaluating strategic alternatives with pay-off likely occurring within 30 days (if it were to happen):

[I believe] HD Supply is seriously evaluating strategic alternatives (regardless of interest by Lowe’s), and the stock isn’t appropriately pricing in the possibility a transaction may happen sooner rather than later.

The write-up touches upon media news flow, “negotiating in public”, capital allocation planning cycles, activism, and how the process of selling can play out over years.

On November 16, 2020, Home Depot announced an agreement to acquire HD Supply for $56.00 up 25% from the $44.81 write-up date 3 days earlier.

2. Most Egregious Equity Grant of 2020?

On June 4, 2020, I discuss LivePerson and what I consider one of the most egregious equity grants of 2020:

Long story short, LPSN granted executive stock options in May 2020 with an exercise price of $27.39 materially below the grant date stock of $37.96.

I walk through how this below market price grant is possible (they implemented a 30-day average price formula) and why I think shareholders should be demanding changes.

LivePerson has a history of peculiarly timed equity grants so it’s not a complete surprise this happened.

Evangelizing good corporate governance is important to me so I make it a point to shine a light on bad practices when I find them and show how insiders can manipulate the governance process to enrich themselves.

Since the original write-up, the stock has run to ~$65.00 (not taking credit for that) and in hindsight there was no reason for the Board to get this aggressive with their equity compensation practices. It will be interesting to see if shareholders reprimand the Board at the 2021 Annual Meeting for this grant.

3. e.l.f. x Activist Collaboration?

On May 7, 2020, I explain why I think activist Marathon Partners is going to pursue a proxy contest at e.l.f. Cosmetics with the likely outcome being a settlement:

Upon further examination of Marathon’s 13D filing, I believe Marathon is setting the table to run a proxy contest at ELF. It’s hard to know for certain, but I wouldn’t be surprised if Marathon and e.l.f. Cosmetics end up collaborating on an activist settlement very soon.

This post was in early May 2020 when the stock was $12.99 and before Marathon actually nominated a slate of directors in late May. As I expected, ELF and Marathon would announce a settlement on July 2, 2020.

This write-up gets into activist investing game theory, and shows how you can identify and anticipate activist moves before they happen. In particular, this post highlights how an activist investor uses the nomination deadline as leverage to drive changes and/or settlements. The stock currently trades at ~$23.00.

Pricing Announcement

I’ll be raising prices for the premium newsletter on February 1, 2021 to $39/month or $333/year (29% discount to monthly).

If you’re a monthly premium subscriber and have enjoyed the newsletter so far, consider locking in a $300 annual subscription this month.

I appreciate your support. On to the write-up!

Being Intentional with “Narrative” in your Process

First, I want to acknowledge everyone has their own take on “narrative”, its role in investing, and the impact/influence it has on stock price. There’s no “right” way to evaluate “narrative”, and I don’t expect you to agree with everything I say.

That said, I thought it’d be fun to share my general take on this topic and walk through how I think about “narrative” using MicroStrategy as a case study.

I’d say the biggest difference between how I look at “narrative” and how most investors (I know) look at it is I’m very intentional about “narrative” analysis. It’s an explicit, standalone part of my investment process.

Most investors I know embed/attach “narrative” into various parts of their investment process. For example, an investor may apply a premium valuation which implies certain (optimistic) narratives without explicitly acknowledging what they are.

There’s nothing wrong with that, but I believe explicitly acknowledging “narrative” allows you to better anticipate “narrative shifts” before others fully appreciate and price in what’s going on.

The simplest way to be intentional and explicit about “narrative” is to add qualitative questions around “narrative” to your existing investment process. I suggest adding questions that best fit your process, but some questions I ask include:

What narrative is getting priced into the stock?

What kind of narrative is management pushing? Is that priced into the stock already? Is it a reasonable/realistic narrative? Do the fundamentals support it?

Is the market missing anything or not correctly pricing in the narrative I think will prevail? What needs to happen for my narrative to capture mindshare? Where am I potentially wrong?

What changes the narrative? What’s the price impact of such change?

Who is the incremental buyer of my narrative? Will current shareholders embrace my narrative or do I need shareholder turnover?

Adding a few simple questions can go a long way in enhancing your existing investment process. I’ve also found that having “narrative” as a separate and distinct part of my process makes me less rigid analytically and I do a better job integrating new information.

Activist’s Approach to “Narrative”

Taking an intentional and explicit approach to “narrative” was something I learned early on in my investment career while doing activist investing at Relational Investors.

Most understand the typical levers of activist investing which include improving operations, capital allocation, and capital structure, but in my experience these improvements don’t get instantaneously priced into the stock. Companies often need to communicate their story, build upon the desired narrative, and show marked progress before getting proper credit for what’s happening.

I’d say the most under appreciated part of “friendly activist” investing is working closely with the Board and management team behind-the-scenes to change the company’s “narrative”.

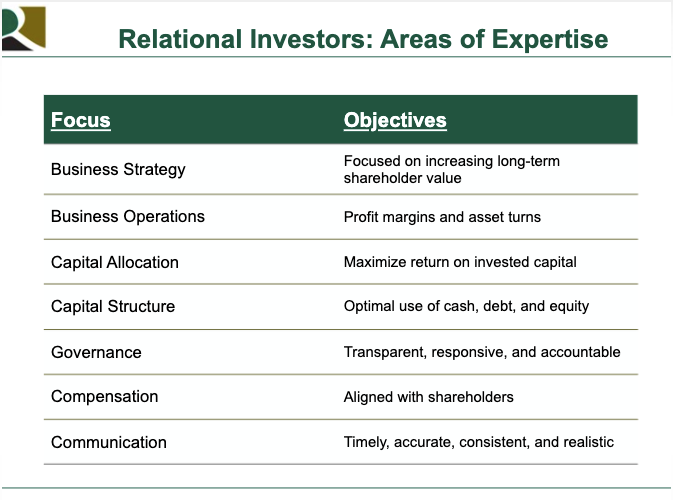

At Relational Investors, we spent a lot of time on “communication” and considered ourselves an expert in this area:

The slide above is one of the first things an executive and/or Board would see when engaging with Relational Investors, and we were always prepared to discuss the company’s communication, the key issues, and ways it can improve. Communication was not an afterthought.

Communication (and narrative) was a core part of the Relational playbook, because we recognized how important “narrative” was in unlocking shareholder value and driving returns.

The best way to explain why we felt this way is to walk through a real example where “narrative shift” played a role in unlocking value so let’s dive into MicroStrategy.

MicroStrategy: From B.I. Vendor to Bitcoin Darling

On August 11, 2020, business intelligence (B.I.) provider MicroStrategy (ticker: MSTR) became the first public-listed company to adopt bitcoin as a primary treasure reserve asset acquiring 21,454 bitcoins for $250 million. The company would subsequently go “all in” acquiring 70,470 bitcoins in total by the end of the year.

Unsurprisingly, the stock has rocketed towards ~$600 per share from $123.62 (pre-bitcoin announcement) as the stock tracks bitcoin’s price ramp.

I think it’s fair to say MicroStrategy has turned into a bit of a bitcoin darling.

For this “narrative” focused write-up, I want to key in on two important periods in 2020 leading up to the current stock run:

The time between MicroStrategy’s Q2 2020 earnings call (July 28, 2020) and their initial $250 million bitcoin purchase announcement (August 11, 2020)

The time between their announced tender buyback offer (August 11, 2020) and the subsequent decision to buy $175 million more of bitcoin (September 15, 2020)

It is within these two periods I believe investors had a risk-adjusted window of opportunity to buy into the MicroStrategy bitcoin “narrative shift” before it was properly priced into the stock.

MicroStrategy’s Pre-Bitcoin Narrative: “Dead Money”

I think it’s fair to say MicroStrategy’s core business is characterized as a legacy business intelligence software vendor that has languished for years as the company continues to navigate the on-premise to cloud transition.

Normally a languishing stock coupled with an overcapitalized balance sheet would attract an activist investor, but shareholders can’t assert much influence here (although they’ve tried) due to Chairman and CEO Michael Saylor’s 72% voting power.

Consequently, MicroStrategy’s pre-bitcoin narrative was (in my opinion):

A “dead money” legacy software company controlled by a CEO that prefers holding excess cash over implementing “shareholder friendly” capital allocation.

Very few investors are going to buy into a story like this which means the valuation needs to be at a decent discount to attract investors.

This is why I think Q2 2020 was a very important turning point for MicroStrategy as the company announced a commitment to “shareholder friendly” capital allocation and returning a significant amount of capital sitting on the balance sheet.

Q2 2020 Call: Returning Capital & Alternative Investments

After decades of having an overcapitalized balance sheet, MicroStrategy announced major changes to their capital allocation during their Q2 2020 earning calls:

We believe we can manage our day-to-day business with approximately $50 million of operating cash. This leaves approximately $500 million of excess cash, cash equivalents and short-term investments, which will be more active in managing.

Accordingly, today, we are announcing a capital allocation strategy under which we plan to return up to $250 million to our shareholders over the next 12 months. In addition, we will seek to invest up to another $250 million over the next 12 months in one or more alternative investments or assets, which may include stocks, bonds, commodities such as gold, digital assets such as bitcoin or other asset types.

I always pay attention when a company announces major changes to their capital allocation, because in my experience markets tend to be slow fully pricing in major capital allocation changes (good and bad). This means observant investors have a window of opportunity to put on a position before others figure out what’s going on.

What made the MicroStrategy even more interesting to me was the commitment to invest $250 million in alternative investments. When I heard that statement, I literally muttered to myself, “They’re going to turn this into a bitcoin cult stock.”

Window of Opportunity #1: Cult Stock Potential

Following Q2 2020 earnings, the stock only moved up 4% to $122.74 which didn’t make much sense to me:

Given the low trading volume in the stock, committing to a $250 million buyback over the next 12 months essentially signaled MicroStrategy would need to do a tender offer (likely at a decent premium).

CEO Michael Saylor has been reluctant to return capital for a long time. Investors shouldn’t underestimate the significance of his decision to finally do something about MicroStrategy’s overcapitalized balance sheet. The decision to buyback stock could be signaling there’s real progress happening in the business and he’s comfortable with finally returning cash to generate an ROI.

Investing in bitcoin was going to grab headlines and attract a rabid base that will potentially improve trading volumes and bid up the stock.

Bitcoin was starting to run and other investment vehicles that tracked bitcoin such as Grayscale Bitcoin Trust (GBTC) were trading at 20%+ premium to NAV with 2% management fee. There’s a momentum factor at play here.

Given all these factors, I felt the stock should have reacted more strongly to the upside.

Because of the lack of market response, I felt there was a risk-adjusted window of opportunity to buy into the stock to play a bitcoin “narrative shift” with downside protection provided by MicroStrategy’s commitment to repurchase $250 million shares.

These “windows of opportunity” exist, because markets tend to take a wait-and-see approach (not so sure in this current market) and want to see marked progress before pricing in new narratives. In the case of MicroStrategy, it meant actually buying bitcoin.

Bitcoin and Buybacks

On August 11, 2020, MicroStrategy would announce they purchased $250 million in bitcoin and was commencing a tender buyback of up to $250 million at $122 to $140 (versus August 10, 2020 price of $123.62).

Following these two announcements, the stock would trade up 9% to $134.89 and proceed to trade above $140 for much of the tender buyback period.

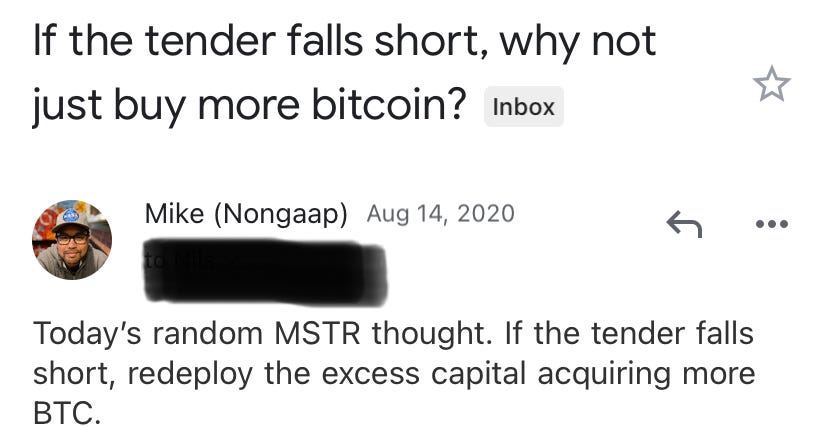

Given the price action, many assumed MicroStrategy would need to increase their tender offer price to fully exhaust the $250 million tender allocation, but I actually felt MicroStrategy should lean into bitcoin and redeploy excess proceeds to acquire more bitcoin.

Note: I’ve been fortunate to interact with many thoughtful investors who are gracious with their time and tolerate my random inbound emails.

The bitcoin “narrative shift” was just starting to play out with a lot of media coverage, and I felt another window of opportunity was presenting itself if MicroStrategy went “all in” on embracing bitcoin.

Window of Opportunity #2: Going “All In” on Bitcoin

On September 11, 2020, MicroStrategy would announce the preliminary results of their tender offer and disclose 443,482 shares were tendered for $62.1 million, leaving ~$187.9 million of excess capital.

The question now was what will MicroStrategy do with this excess capital?

They had plenty of time and opportunity to increase the tender offer price and didn’t. This made me believe the company intended to go “all in” and redeploy the excess capital to bitcoin.

By this point, the stock was trading at $141.13 and was unlikely to trade below $140 in the near-term. This presented investors with a second window of opportunity to buy into the “all in” narrative shift on the prospect of MicroStrategy redeploying excess capital to bitcoin.

On September 14, 2020, the company would file an 8-K that essentially confirms a redeployment to bitcoin was happening by disclosing MicroStrategy may go over their $250 million investment in bitcoin:

[The] Company’s holdings of bitcoin may increase beyond the $250 million investment that the Company disclosed on August 11, 2020.

The stock didn’t react too much to this filing moving up 1% to $142.62.

On September 15, 2020, MicroStrategy would disclose they bought an additional $175 million in bitcoin and the stock would close up 9% to $155.75 on the news.

Overall, a 27% stock price move from late July 2020 to mid September 2020 isn’t a bad risk-adjusted return. Obviously the stock has moved a bit more since then (HODL), but hopefully this helps you better understand how to think about and trade a “narrative shift”.

MicroStrategy’s New Narrative

MicroStrategy would purchase more bitcoin in December 2020 and exit the year allocating $1.125 billion (cost basis) to bitcoin in total and the stock has gone parabolic.

With the company’s bitcoin strategy now well understood, I’d say MicroStrategy’s new narrative is:

A bitcoin “cult stock” with a leader who is “all in” and passionate about bitcoin. Excess cash flow from their (improving) BI business will be redeployed to bitcoin, meaning bitcoin per share should accrete over time.

It’s amazing how quickly the narrative changed here.

Going forward, the stock is a bit of a battleground stock with plenty of sum-of-the-parts and implied valuation debates happening. The nature of bitcoin will make this stock volatile for the foreseeable future.

Nevertheless, the market is definitely ascribing a very high multiple for reinvesting excess cash flow to bitcoin. I’ve heard of companies getting a “good” capital allocation premium, but MicroStrategy is the first to get a “bitcoin good” capital allocation premium.

One of your most interesting posts to date!

Good article and I like the concept. How would differentiate, if at all, between the idea of narrative or expectations embedded in a stock? My first thought was expectations could be quantitative in the form of numbers and narrative qualitative, but I still think expectations can be qualitative. Any thoughts? One more question: do you think DBX fits into this framework, going from growth mode to profitability, with a focus on capital allocation?