I want to mix things up and start a new series that explores the counterpart to Corporate Governance “Dark Arts”:

Corporate Governance “Light Arts”

Think of “Light Arts” as governance practices and/or actions that are positive force multipliers of long-term value creation.

For example, a hallmark of “Light Arts” is a company’s ability to purpose-build their incentives to align with - and reinforce - their long-term strategy, objectives, and value drivers.

Everyone says their incentive system aligns with long-term value creation, but (in my experience) few companies have shown a demonstrated ability and understanding of aligned-incentives.

There’s a big difference between companies that generally use incentives as a motivating tool, and those that can effectively align incentives to leverage it as a moat widening tool.

With this in mind, I wanted to discuss HVAC distributor Watsco (ticker: WSO), and explore how their unique equity compensation program has contributed to their multi-decade “compounder” story.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Premium Newsletter

If you enjoy this write-up, consider subscribing to the Premium Newsletter.

Premium explores “real time” situations and looks for interesting governance signals before they potentially happen and/or gets priced in.

Watsco’s “Retirement Age” Equity Vesting

To say Watsco has a unique equity compensation program would be an understatement.

Unlike most companies that grant restricted shares with a 3 to 4 year vesting schedule, Watsco restricted shares don’t vest until a grantee reaches “retirement age” (age 62 or older):

Our approach to long-term incentives is unique. Unlike most companies, which grant their officers and employees restricted shares that vest over a period of a few years, our restricted share awards cliff-vest toward the end of an employee’s career (age 62 or older). For employees extending their careers beyond age 62, vesting may occur even later. (2024 Proxy)

If an grantee leaves the company before reaching retirement age, their restricted shares are forfeited:

If, for any reason other than death or disability, a holder of restricted shares leaves the Company, 100% of his or her restricted shares are forfeited. (2024 Proxy)

The intent of this vesting structure is to maintain high employee retention and instill an “ownership culture linked to value creation”:

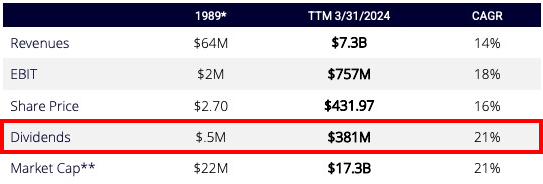

While I think most investors generally agree an “ownership culture” is conducive to creating shareholder value, Watsco’s “retirement age” vesting schedule still felt impractical to me (upon initial review). And yet, it works for them and has contributed to tremendous shareholder returns:

I believe the key to understanding why this vesting model works for Watsco is to focus on how their equity compensation program “links” to value creation.

Business Strategy: Acquiring Local Moats

To understand how Watsco’s incentive structure is “linked” to their strong performance, it’s important to first understand their business strategy.

Watsco is the largest distributor of air conditioning, heating and refrigeration equipment and related parts and supplies in the HVAC/R industry.

They, by-and-large, accomplished this by focusing on M&A and “consolidating” a fragment HVAC/R distributor industry:

Watsco began its HVAC/R distribution strategy in 1989 and has grown by using a “buy and build” philosophy, resulting in substantial long-term growth in revenues and profits. The “buy” component of the strategy has focused on acquiring or investing in market leaders to either expand into new geographic areas or gain additional market share in existing markets. We have employed a disciplined and conservative approach, which seeks opportunities that fit well-defined financial and strategic criteria.

While the company has “compounded” through M&A, Watsco’s leadership, understandably, doesn’t like being called a “roll-up”. And to be fair, Watsco doesn’t apply the tactics often attributed to roll-up strategies (i.e. major cost cutting, single-name branding, top-down directives, etc.) and takes a more holistic, relationship-based approach to drive growth and returns:

The “build” component of the strategy has focused on encouraging growth at acquired companies, by adding products and locations to better serve customers, investing in scalable technologies, and exchanging ideas and business concepts amongst leadership teams. Newly acquired businesses have access to our capital resources and established vendor relationships to provide their customers with an expanded array of product lines on favorable terms and conditions with an intensified commitment to service.

“We're always looking to grow through acquisitions and to develop relationships with companies to help them grow and reach their full potential,” Urban [manager of strategic projects] says. “We have significant financial resources, not to mention we as a family are the largest customer of many of our vendors. That's one of our core strategies for growth, and that is the way that we are looking to grow.” It is a highly relational industry; Urban says Watsco is slow to develop new markets on its own. “We prefer to grow through acquisitions.” (source)

The reason for this relationship-based approach is the “moat” in this industry resides at the local level.

The HVAC/R distributor business is very dependent on exclusive local distribution rights and customer relationships built in local markets over years (if not decades).

A large, national distributor can’t just enter a local market, dominate via scale, and squash the local incumbent.

Consequently, these local distributors, for all intents-and-purposes, know 1) they don’t have to sell, and 2) it would potentially be damaging to the local franchise/moat to do so. In a way, they’re like highly-protective fiefdoms that won’t tolerate “financial engineering” roll-up tactics so it requires a more relationship-based approach to win them over:

The current state is, again, manufacturers are highly protective of current distribution through exclusivities of rights. As long as that is the case, we've got to simply know the families, romance the families and get them off the idea of generationally staying on ours because of technology we're bringing this technology conversation to them at a more impactful way. I think it's brought more people talking into the table about talking about selling their business. - Barry Logan (June 2019)

Overall, I think a good way to frame Watsco’s M&A strategy is they acquire local “moats” and use their platform to help these acquired distributors widen those local moats and accelerate their trajectory for mutual benefit.

Federation of Distributed Moats

When you map Watsco’s M&A history and their distribution footprint, the company starts to look like a “federation of distributed moats”.

Acquired distributors get to keep their business names and operate with a lot of autonomy. This is partly to maintain familiarity, leverage local knowledge, and keep relationships with customers intact, but also to honor the great businesses these sellers have built.

The reason distributors often sell to Watsco is due to family-owned business succession considerations, a desire for financial diversification, and belief Watsco will (more-or-less) allow them to operate the business as they see fit:

During 2004, the owners of East Coast Metal Distributors gave consideration to selling the 50-plus-year-old company to the Watsco organization. “While debating the reasons of why to sell and the ramifications of what happens to the dedicated personnel that would remain, we became convinced that being a part of the Watsco family of subsidiaries was the best choice for our organization,” says Jeff Files, chairman of the Board. (source)

These distributors don’t want to sell their business only to see it “optimized” via cost synergies and have long-time, loyal employees get laid off. Watsco recognizes this and has structured their M&A approach and operations accordingly.

This approach also creates a “virtuous cycle” where the biggest advocates of Watsco’s M&A strategy are the acquired distributors who see significant value being a part of a national platform and talk glowingly of the company to other family-owned distributors. This ultimately makes it easier to facilitate future acquisitions when those distributors are ready to sell.

Decentralized Operating Model

Given Watsco’s M&A-centric strategy and the type of assets they’re looking to acquire, that’s going to heavily influences their corporate operating model and culture:

Watsco's successful growth strategy has been maintaining its subsidiaries' local market knowledge while backing each one with the strength and power of a national organization. Each subsidiary is responsible for its branches and the products they carry. Watsco's corporate structure empowers each subsidiary to do what they think is best for their particular market. Says Urban: “We do not operate as though the corporate office has a better understanding than someone in the field who knows what's going on day to day.” The only centralized functions handled out of Watsco's corporate office are treasury management, commercial insurance and the 401(k) plan. (source)

In many ways, empowering distributors to make local decisions is a byproduct of Watsco’s M&A strategy and their sales pitch to family-owned distributors.

This, in turn, is a “forcing function” that necessitates a decentralized operating model and a company culture that aligns with family-owned values and priorities to successfully execute their strategy.

A Federation Reinforced by “Retirement Age” Vesting

To ensure the “federation of distributed moats” is aligned with Watsco, the company implemented “retirement age” vesting in 1997.

I believe this vesting model serves as the “glue” of the federation:

We have also developed a culture whereby leaders, managers and employees are provided the opportunity to own shares of Watsco through a variety of stock-based equity plans. We believe that this culture instills a performance-driven, long-term focus on the part of our employees and aligns their interests with the interests of other Watsco shareholders.

Watsco gives a lot of autonomy to local operators, but expects key leaders to faithfully operate these business and leverage their institutional knowledge until retirement. If they quit or are fired, they lose all unvested shares. The unvested shares are both a carrot and stick.

“So in our case of equity, our key leaders, about 120 people get equity in Watsco, including myself, where it does not vest until somebody turns 62 at the end of their career. So you're 32, you've got 30 years to wait. If you leave, it's forfeited. If you get fired, it's forfeited. So today, we have, again, almost $400 million of equity owned by 110 people. And not the senior leadership, CEO and myself in that number. This is people running our company in the field. And over the last 10 years, we've had about $65 million of shares vest. And the -- in terms of people reaching that age at the end of their career, 9 out of 10 people stayed longer beyond that date, which is interesting. And today, we have about 94% of what we've ever issued, still issued and invested over the last 25 years. This plan started 25 years ago.”

-Barry Logan (June 9, 2022)

It should be noted that in 1998, a year after Watsco implemented this vesting schedule, they sold off most of their manufacturing business to focus on the faster growing distribution business.

I think it’s fair to say their “retirement age” vesting schedule served as the lynchpin in making the M&A model “work” and keeping acquisitions aligned with the company.

After all, if you believe the “moat” resides at the local level, the last thing Watsco wants to see is key people (both at the local and corporate level) leaving the company to compete with them directly post-acquisition. “Retirement age” vesting ensures there are financial consequences for doing that.

Dividend and Conquer

While Watsco’s vesting schedule feels quite punitive and draconian, they pragmatically allow voting and dividend rights:

Restricted share awards are subject to significant market, performance, and forfeiture risks. During the vesting period, shares of restricted stock include the right to vote and the right to receive dividends.

Typically, it’s considered “best practice” to accrue dividends and only release the cash when shares are vested. This policy of paying out dividends on unvested shares makes the vesting schedule more palatable, and essentially serves as the primary “financial windfall” mechanism for those under the plan during their “working years”.

Receiving dividends allows everyone to stay focused on the long-term and to “divide and conquer” the industry.

This dividend payout policy also gives leadership a lot of incentive to stay disciplined on capital allocation and compound the dividend:

I suspect Watsco maintains a robust capital position and balance sheet due to dividends being the primary source of financial windfall for “restricted” shareholders. Voting rights ensure they have a say on governance issues as well.

This means there’s a lot less incentive to be overly promotional to inflate the valuation when financial windfalls aren’t reliant on selling vested options/shares and is primarily tied to growing free cash-flow per share to increase the dividend payout.

The Friction Between Retention and Succession

That all said, it’s important to remember there’s no perfect incentive system and any approach is going to introduce their own set of constraints and trade-offs.

For instance, there’s natural friction between retention and succession.

“Retirement age” vesting encourages high retention, but the trade-off is it can impact future hiring, succession, and promotion.

If many key leaders reach retirement age and leave en-masse, that creates real issues if there isn’t a well planned talent pipeline to fill the leadership void.

These risks are manageable, especially at the corporate level, but succession at the subsidiary level (i.e. where the moat resides) is key. The hand-off to the next generation of leaders - who likely won’t have comparable financial interests as their predecessors - is something the company will need to navigate.

While Watsco’s vesting schedule has played an important role in “linking” ownership culture to value creation, it’ll be interesting to see what impact - if any - there will be on the effectiveness and alignment of their equity compensation program as more restricted shares “retire” and roll-off.

Obviously, these are my opinions and takeaways so I could certainly be wrong, but hopefully this piece highlights how to think about “Light Arts” and ways governance decisions can “link” to long-term value creation and potentially be a positive force multiplier.