OpenAI Startup Fund: GP Hallucination

Did an "AI hallucinated" GP temporarily manage OpenAI Startup Fund?

What if you asked ChatGPT to architect various corporate governance “dark arts” objectives? What would it recommend? Hallucinate? Would it be implementable?

Interestingly, there might be directional answers to these questions gleaned from OpenAI Startup Fund and the period Vespers Inc. temporarily managed the fund’s GP and its namesake “founder” - Mr. Vespers - was designated CEO:

A mosaic of disclosures indicate Vespers Inc. might be a front company, created with AI-assistance, that uses pseudonymous and/or fictitious individuals - including Mr. Vespers - to serve as “mannequin” (i.e. placeholder) Directors and Executives.

I believe this deserves A LOT of scrutiny and attention, because it’s evident to me the purpose of Vespers Inc.’s wasn’t to lead OpenAI’s VC fund, and there are disclosure-based signals its short-lived tenure was used to facilitate transactions and/or actions that Sam Altman and others don’t want attributed them.

Premium Subscribers: This write-up is a little redundant since it covers many issues already discussed in premium, but I do add some new thoughts/issues at the end of the write-up.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Edit: I’ve received a few comments on the pic I’m using. This image was AI generated from Bing using the prompt: “Mannequin CEO conducting a Boardroom meeting with mannequin Directors.” And yes, I’m aware it’s a bit inappropriate, but decided to intentionality go with the first image Bing generated. Apologies if you’re not a fan, but (in my opinion) the best way to “fix” these things is to put a spotlight on it.

Edit 2: Upon further consideration, I replaced the image. It took a few attempts.

OpenAI Premium Content

If you enjoy this write-up, consider subscribing to the Premium Newsletter to access my other OpenAI pieces and upcoming ones.

Premium explores “real time” situations and looks for interesting governance signals before they potentially happen and/or gets priced in.

That said, I do plan on sharing more OpenAI premium content in the future so feel free to hang out in “free” land if your interest in OpenAI isn’t time - or financially - sensitive. I’m kidding about the “financially” part, I think.

Means and Methods

Before I break-down OpenAI Startup Fund and Vespers Inc., the resources I rely on are available to anyone:

SEC EDGAR search to find Form Ds (i.e. fundraising info) and other disclosures.

ADV Disclosure search to find info on OpenAI Startup Fund and other funds.

California Business search to find entity specific disclosures and info.

Google and (unironically) ChatGPT.

As for “means and methods”, all I’m trying to do is 1) understand, 2) explain, 3) reconcile, and/or 4) corroborate what I’m seeing in OpenAI disclosures and media coverage. This write-up is the result (monstrosity?) of this process.

So if something is confusing, or doesn’t make sense to you, welcome to the club.

Let’s dig in!

GP Hallucination

“Is this an AI hallucination?”

AI hallucinations are incorrect or misleading results that AI models generate. These errors can be caused by a variety of factors, including insufficient training data, incorrect assumptions made by the model, or biases in the data used to train the model. AI hallucinations can be a problem for AI systems that are used to make important decisions, such as medical diagnoses or financial trading.

Source: Google Cloud

It’s a question I’ve been asking myself the more time I spend on OpenAI Startup Fund and go down the disclosure rabbit-hole.

Candidly, a part of me always felt OpenAI would help usher an AI revolution in corporate governance, but I didn’t think it be like this.

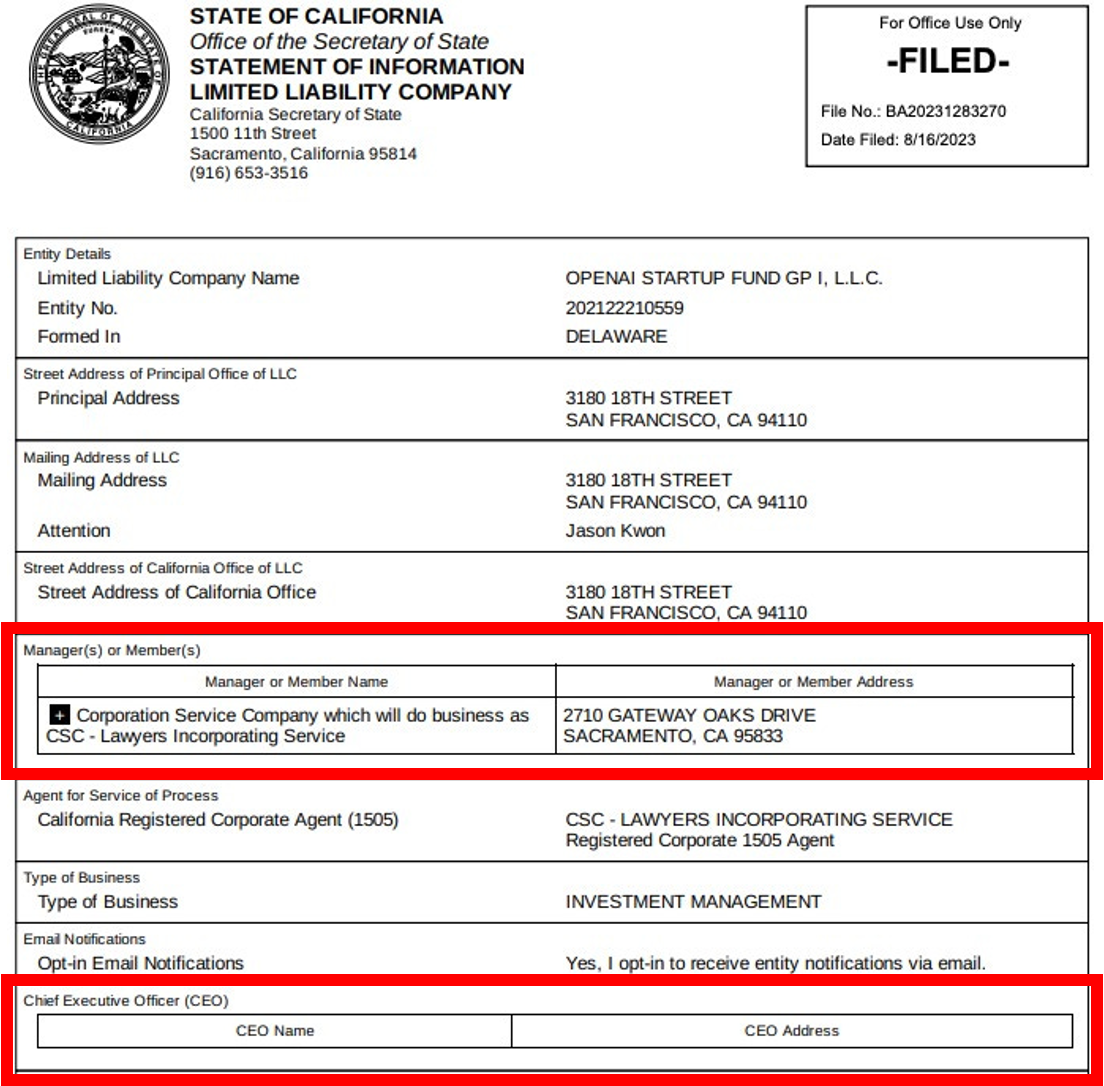

Specifically, on April 3, 2023, OpenAI Startup Fund GP I, LLC - the General Partner of OpenAI Startup Fund I, LP - disclosed it changed its Manager from (presumably) Sam Altman to Vespers Inc. and its CEO would be Mr. Vespers:

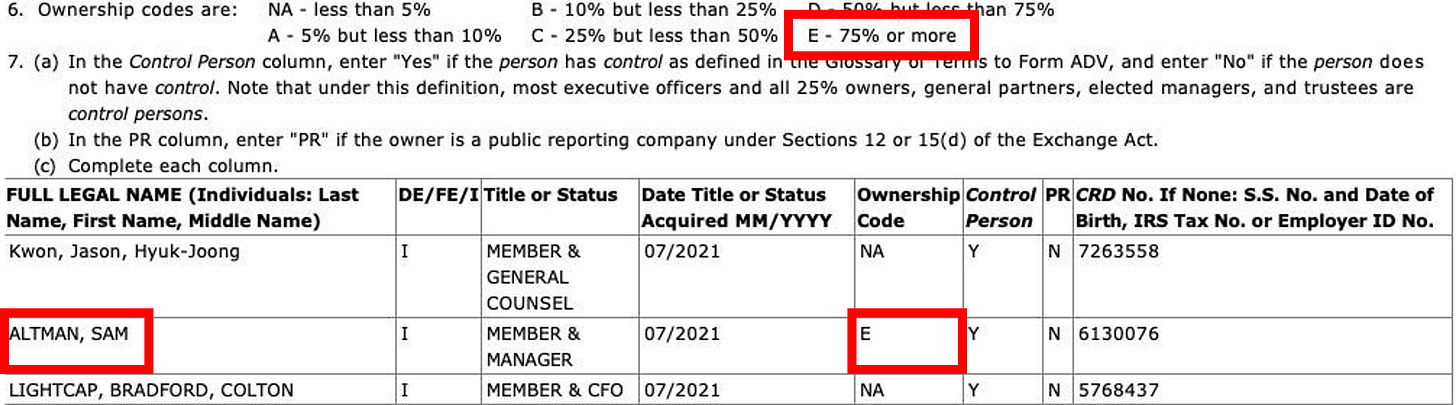

I initially thought this California business disclosure was peculiar, but it didn’t dawn on me how problematic this disclosure potentially is until Axios reminded me Sam Altman owns and controls OpenAI Startup Fund, which can be corroborated in their ADV filing:

Why did Sam Altman (optically) relinquish control of OpenAI Startup Fund to Vespers Inc. and appoint a (literal) no-name CEO to run the fund despite having no discernible investment track record nor any clear connection to Mr. Altman?

For context, based on my research and belief, OpenAI Startup Fund GP I is responsible for managing and operating the day-to-day business and affairs of OpenAI Startup Fund I. This would also make OpenAI Startup Fund GP I liable for the debts, liabilities, and obligations of OpenAI Startup Fund I, including litigation and judgments.

Consequently, designating Vespers Inc. the manager of the GP and Mr. Vespers its CEO should be considered a major flag.

Obviously, this venture fund is very important to Sam Altman given his need to own it, and he was reportedly looking for an established investor to lead more AI startup deals the same quarter this disclosure was made.

That’s why this Vespers Inc. disclosure doesn’t make much sense to me, but I, candidly, didn’t investigate the issue until the NY Times reported some of OpenAI’s Board members “grew concerned that Mr. Altman used [OpenAI] fund to skirt accountability from OpenAI’s nonprofit governance structure”.

That’s when I recognized there’s potentially a plausible and sensical reason for this disclosure and why Vespers Inc. was given management control of OpenAI Startup Fund GP I.

If Sam Altman was about to “skirt accountability” on transactions/actions involving OpenAI Startup Fund, and was keen on limiting his liability exposure, this Vespers Inc. disclosure starts to make a lot more sense.

The question was whether or not I could find any disclosures that (directionally) corroborates this view and helps to explain/frame how Vespers Inc. could’ve been used to “skirt accountability” and shield liability.

When I reviewed the disclosures, with this objective in mind, that’s when this whole Vespers GP situation started to look like an AI hallucination.

I started seeing signs Vespers Inc. was potentially a front company, created with AI-assistance, that uses pseudonymous and/or fictitious individuals to serve as “mannequin” Directors and Executives.

It literally felt like someone asked ChatGPT to architect a front company that uses pseudonymous/fake personas to: 1) obscure who’s actually involved, 2) add layers of liability protection, and 3) facilitate undisclosed transactions/actions. The thing is a half-competent review would tell you its recommendation is an AI hallucination.

Of course, this is all alleged and will walk you through the disclosures and my rationale so you can make up your own minds to the question:

“Did an AI hallucinated GP temporarily manage OpenAI Startup Fund?”

Wired Article: Agents, Secrecy, and Fake Personas

I’ll be the first to admit I initially didn’t think an “AI hallucinated” GP was remotely plausible. If anything, I thought I was experiencing a Non-GAAP hallucination.

There’s no way Sam Altman would do this, right? Even if he wanted to, there’d be several checks-and-balances in place to prevent it, right? Right?!

My views on this really evolved, though, after serendipitously reading a Wired article titled: The Secrets Factory (March 5, 2024).

This piece features Registered Agents Inc. and explores the wild-west world of business formations, registered agents, the lengths some will go to maintain secrecy/privacy, and how the system is ripe for abuse due to lax oversight and fragmented regulation:

The registered agent industry, which incorporates businesses and acts as a point of contact for legal notices, is already effective at masking the identity of who owns a company. Registered agents have many legitimate uses, and states often require that a company have a registered agent. In some instances, however, these services have benefited “oligarchs, criminals, and online scammers,” according to a 2022 investigation by The Washington Post and the International Consortium of Investigative Journalists. Experts say a lack of adequate federal and state regulations of registered agents helps to make the United States a hotbed for money-laundering and other shady business dealings.

In particular, the article mentions how many states don’t fully investigate incorporation filings to determine whether or not signatories are legitimate, and highlights the practice of using fake personas to incorporate companies:

WIRED’s analysis found that these companies are registered in 20 different states and appear to provide services ranging from law enforcement training to landscaping. Many of these companies with officers using an alleged fake name were registered to addresses known by sources to belong to Registered Agents Inc. For example, six allegedly fake names were listed as officers for 887 of businesses registered to the same address in Sheridan, Wyoming—an office of Registered Agents Inc.

That’s when I realized the idea OpenAI Startup Fund could have a company with fake personas nested in its org structure shouldn’t be considered shocking or farfetched. Also, even if fake personas were used, there’s the distinct possibility Sam Altman and others involved at OpenAI Startup Fund had no idea this happened.

Nevertheless, I consider the alleged use of fake personas at Vespers Inc. a secondary issue to a much more pressing issue: A mosaic of disclosures indicate Vespers Inc. might be a front company.

Front Company

It’s one thing if Vespers Inc. allegedly used fake personas, but it’s a whole different ballgame if the entity wasn’t used in a legitimate way and was a front company to inappropriately facilitate transactions/actions that Sam Altman and others don’t want attributed them:

A front company, in its simplest definition, is a business that appears legitimate but primarily exists to conceal or mask an underlying, often illegal, activity. Unlike standard businesses, front companies are set up as a façade or a disguise. (source)

That’s where this situation goes from a minor infraction, at-worst, to potentially blowing up OpenAI Startup Fund and taking OpenAI down with it too.

Before we can explore the alleged “inappropriateness” of Vespers Inc.’s involvement, we first need to establish the plausibility Vespers might be a front company.

I believe there are a mosaic of disclosures that support this allegation based on its:

Incorporation Date

Type of Business

Absence of Sam Altman

Changing Addresses

Short Tenure as Manager

Use of Pseudonymous Identities

Combine these disclosures with the control Vespers Inc. and Mr. Vespers had of OpenAI Startup Fund GP I, LLC as Manager and CEO, and I believe a compelling case can be made the company was a front company to facilitate and conceal transactions/actions involving OpenAI Startup Fund I, LP.

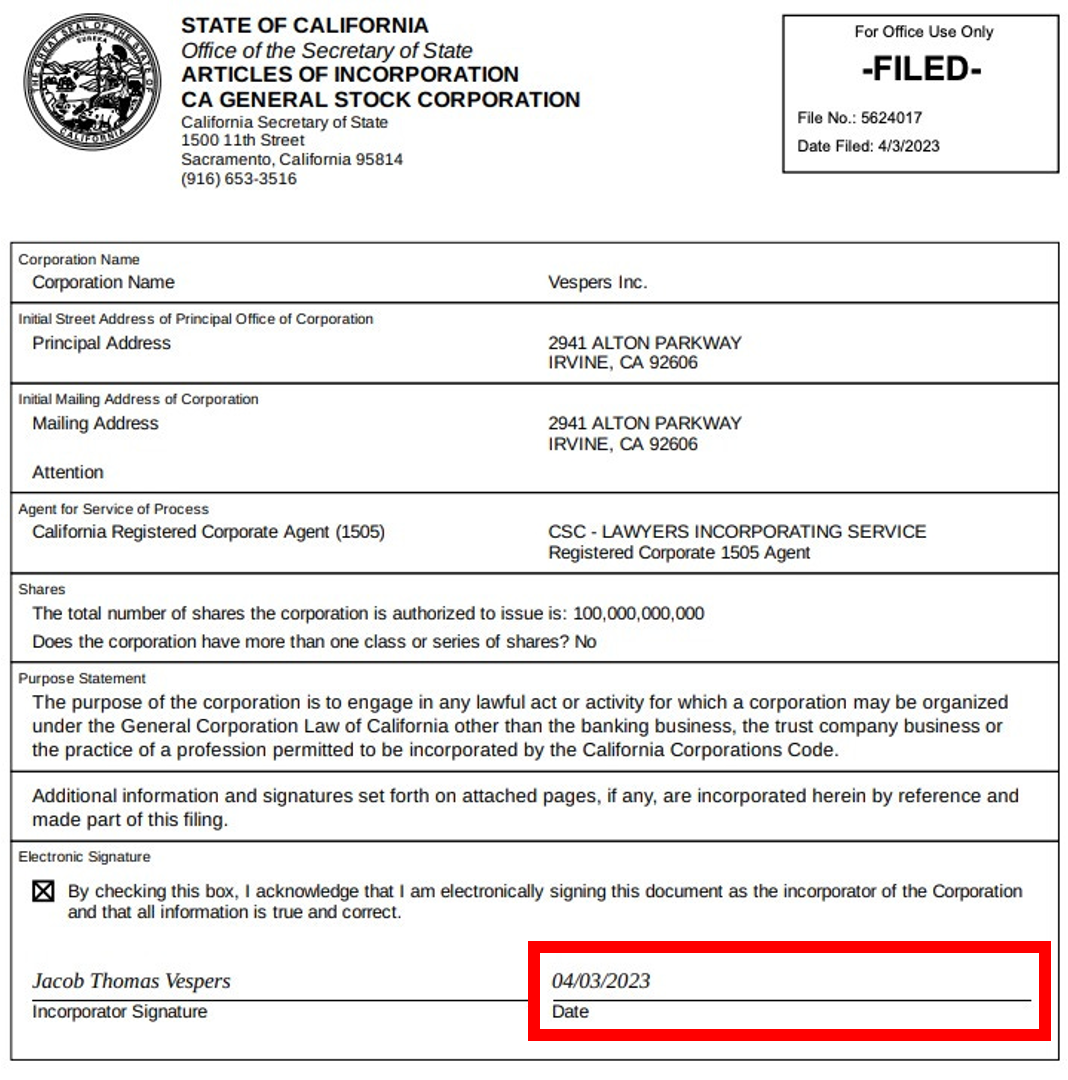

1. Incorporation Date: The company was incorporated in California on April 3, 2023 the same day it was appointed Manager of OpenAI Startup Fund GP I, LLC. This wasn’t an established investment management firm being appointed Manager, and the timing of its formation - despite optically looking “independent” from OpenAI Startup Fund - implies there was close coordination with OpenAI Startup Fund to hand-off GP control:

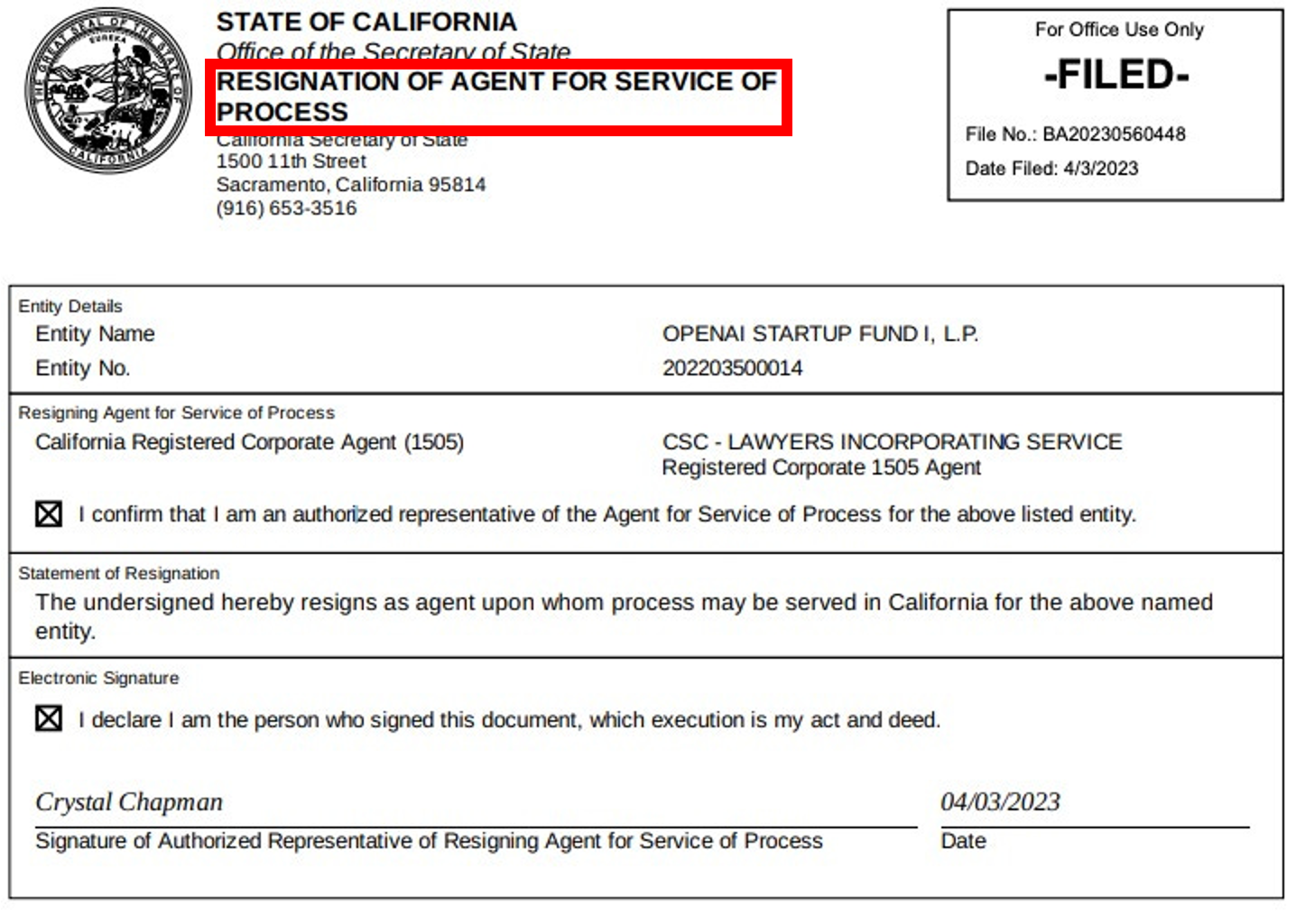

Interestingly, the Agent for Vespers Inc. is CSC (anonymized) while, on the same day, the Agent for OpenAI Startup Fund GP I, LLC changes from CSC to OpenAI’s Kwon using an Irvine, CA address (i.e. same address as Vespers Inc.).

CSC would also resign as the agent for OpenAI Startup Fund I, LP on April 3, 2023:

So we have ourselves a situation where, if you only looked at Vesper Inc.’s incorporation filing, there’s no connection of OpenAI Startup Fund, but OpenAI Startup Fund GP I, LLC’s filing on the same day shows a relationship between the two and OpenAI Startup Fund arguably having control of Vespers Inc.

2. Type of Business: On May 2, 2023, a month after being appointed Manager of OpenAI Startup Fund GP I, LLC, Vespers Inc. discloses they’re an “Assistive Intelligence Services” business and not an investment management firm:

Basically, the Manager of OpenAI Startup Fund GP I, LLC - a position previously held by Sam Altman and responsible for investment decisions at OpenAI Startup Fund I, LP - was placed under the control of a company (Vespers Inc.) that self-describes itself as an “Assistive Intelligence Services” business with no discernible expertise or background investing in startups.

This implies the “true” purpose of Vespers’ appointment to Manager had nothing to do with the actual role of finding and leading AI startup deals, and arguably shows their appointment to Manager was to facilitate transactions/activities that requires GP control.

For comparison, OpenAI Startup Fund GP I, LLC is described as an “Investment Management” business.

3. Absence of Sam Altman: The absence of Sam Altman, or anyone “connected” to Sam Altman, on Vespers’ publicly disclosed Board (as of May 2, 2023, but this information wasn’t publicly disclosed on California’s Secretary of State site until December 4, 2023) is a screaming red flag to me:

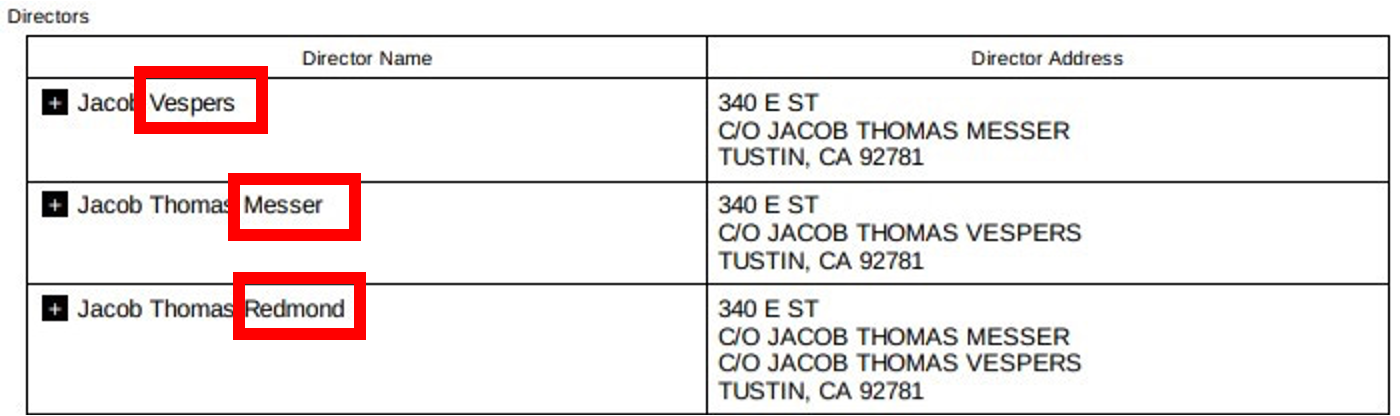

Note: Take mental note of the Director names. Their relevance will be explained later.

Is Sam Altman really handing over control of OpenAI Startup Fund to an entity where he doesn’t have a Board seat and/or direct influence/rights?

I think we can all agree the answer to that question is probably “NO” so that would imply his disclosed “absence” is intentional. I can only speculate, but his absence could be so Vespers Inc. can optically appear independent and his direct involvement/influence occurred either before or after this Statement of Information was filed by Vespers Inc. on May 2, 2023.

The “tell” here are the 7 vacant Board seats. Who occupied those 7 vacant Board seats at Vespers Inc. when they were appointed Manager of OpenAI Startup Fund GP I, LLC?

4. Changing Addresses: As previously mentioned, on April 3, 3023, the address used for OpenAI Startup Fund GP I, LLC is changed from OpenAI's SF address (3180 18th Street) to the same address Vespers Inc. (initially) uses in Irvine, CA (2941 Alton Parkway).

It’s, frankly, really peculiar to me OpenAI Startup Fund GP I, LLC would change its address away from OpenAI’s SF address. After all, this is supposed to be OpenAI’s corporate venture fund and Sam Altman’s control of it is purportedly temporary.

Was OpenAI’s Board aware of this address change and sign off on it?

Also, on May 2, 2023, Vespers Inc. would change its address to an address in Santa Ana, CA (2151 East 1st St, Unit 234) that - according to Google search results - is an affordable housing apartment that serves "chronically homeless residents earning at or below 60% of the Area Median Income.”

What in the world is going on here?!

This particular Santa Ana address is also linked to multiple companies using similar names seen in Vespers’ disclosures.

Incidentally, it appears Vespers’ disclosed address (Unit 234) is photographed on the affordable housing website:

Why is Vespers’ address located in an affordable housing apartment in Santa Ana, CA potentially at the same time they were the Manager to OpenAI Startup Fund GP I, LLC ?

It would have looked really bad if OpenAI Startup Fund GP I, LLC also moved to this Santa Ana address, but it seems it remained in Irvine, CA until August 16, 2023 when the address reverts back to OpenAI’s SF address and Vespers Inc. is no longer disclosed as Manager, nor is Mr. Vespers listed as its CEO:

5. Short Tenure: While August 16, 2023 is the disclosed date Vespers, Inc. is no longer the Manger of OpenAI Startup Fund GP I, LLC, the actual date remains a bit of a mystery to me.

I suspect Vespers’ involvement may have ended well before that August 16, 2023 California filing date.

Specifically, OpenAI Startup Fund I , LP would file an amended Form D on May 24, 2023 disclosing Sam Altman as the “Manager of the General Partner”, implying Vespers Inc. was no longer the Manager of OpenAI Startup Fund GP I, LLC at that time.

This means their tenure as Manager was short-lived and whatever Vespers Inc. was tasked to do, it was most likely completed by mid-May 2023 and there’s a possibility it was complete by May 2, 2023 when Vespers Inc. filed their Statement of Information with California given the 7 vacant Director seats.

6. Pseudonymous Identities: When Vespers Inc. was first incorporated in California on April 3, 2023, the last name used to sign the filing was “Vespers”. When the company filed on May2, 2023, the last name changed and “Vespers” is no longer used:

The use of different pseudonyms/alias to sign these disclosures is a pattern I’ve seen in multiple disclosures and it’s hard to ignore them. They look like “AI hallucinations” to me, and makes me genuinely question the both the legitimacy and authenticity of these entities and individuals.

That said, Vespers Inc. might genuinely be an “Assistive Intelligence Services” company, but I think a reasonable case can be made that this entity was potentially used as a front company to hide/mask transactions and decisions while serving as Manager of OpenAI Startup Fund GP I, LLC.

AI-Assisted Creation

Obviously, Vespers Inc. describing itself as “Assistive Intelligence Services” company is a major flag the company is potentially an AI-assisted creation, but what really compels me to believe this possibility are the cluster of other entities formed around the same time Vespers Inc. was created that use the same address and have similarly named Directors and Officers:

One of the entities created is also described as a “Multiversal AI tech and services platform”, and it appears the person creating all these entities describes himself as an AI Research Scientist and claims to be a Forensic Fraud specialist. This person also appears to be a developer of ChatGPT apps.

There are also entities created at the Santa Ana, CA address Vespers Inc. is currently registered at that appears to follow similar patterns - and use similar pseudonyms - as well.

Basically, I think the probability all these entities were “hand filed” by this person, given their experience and background, is about the same probability all the named Directors and Executives in these filings are real and distinctly separate individuals.

Using “Mannequin” Directors and Executives

I’m admittedly being vague and intentionally trying not to directly name/link them (outside of calling him “Mr. Vespers” and sharing screenshots so readers can visually see the “pattern” I’m noticing) in this write-up, because the focus of this situation should be on OpenAI Startup Fund and exactly what they used Vespers Inc. for.

Obviously, all these disclosures are publicly available, and you can track down the filings to corroborate everything I’m saying for yourself if you insist, but I genuinely prefer to focus on OpenAI Startup Fund and not Mr. Vespers.

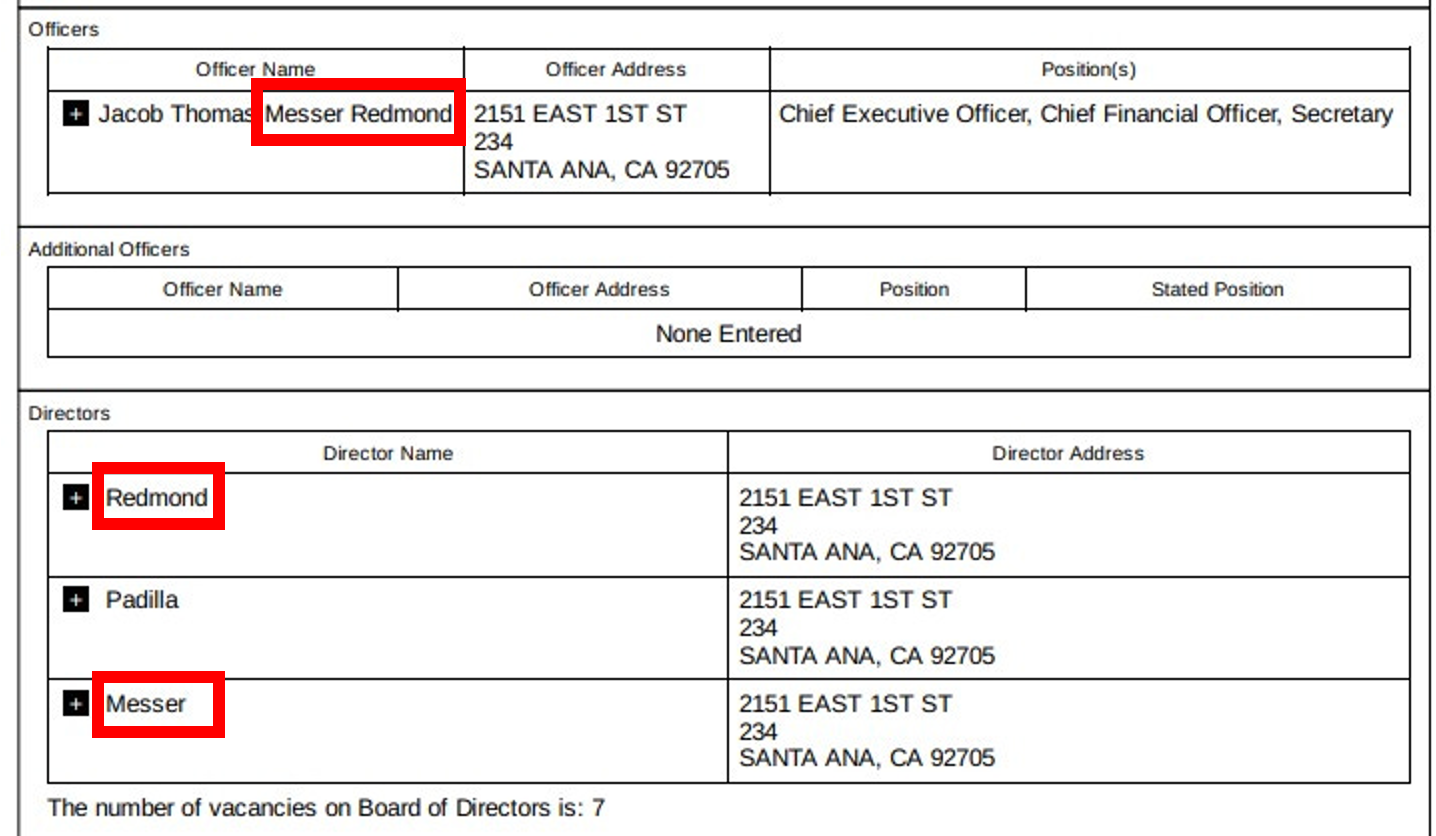

With this context in mind, when you review the various names listed as Directors and Executives in all these entities, you’ll see the same aliases come up over-and-over again serving various roles:

Despite all these listed “individuals”, as far as I can tell, it appears to be one person appending various aliases as their last name to represent multiple Directors and Executives.

The aliases used will also change from time-to-time as seen at Vespers Inc. with Mr. Vespers disappearing and replaced by a similarly named individual with a different alias/pseudonym appended as a last name in subsequent filings.

So when you review the Directors (as of May 2, 2023) disclosed by Vespers Inc., when they were potentially still the Manager of OpenAI Startup Fund GP I, LLC, you’ll notice the same aliases being used here as in other filings:

Basically, if you were to attend a Vespers Inc. Board meeting in person, I suspect you’d see a room full of mannequins and 1 real person. Obviously, that would be a problematic arrangement if OpenAI Startup Fund was under the control of 1 real person and a bunch of mannequin directors and executives.

Why Was Vespers Inc. Involved at OpenAI Startup Fund?

I’ve written A LOT on why I think 1) Vespers Inc. might be a front company, 2) created with AI-assistance, 3) that uses pseudonymous and/or fictitious individuals to serve as “mannequin” Directors/Execs, but the most important question remains:

Why would OpenAI Startup Fund and Sam Altman go through all this effort and hassle to involve an allegedly “fake” company and give it “control” of the fund?

Referring back to the Wired article, a “fake” company can potentially be used to hide/obscure transactions, involved parties, and other various corporate actions. It can also help shield parties from legal fights and liability.

Based on a mosaic of disclosure and news-flow I’ve reviewed, I believe there are very valid reasons why select OpenAI Board members were concerned about OpenAI Startup Fund being used “to skirt accountability from OpenAI’s nonprofit governance structure”.

If I’m (directionally) correct about Vespers Inc., giving this entity control of OpenAI Startup Fund GP I, LLC would arguably make it possible to facilitate undisclosed transactions and/or actions that wouldn’t be directly attributed to Sam Altman or any other OpenAI-linked parties/entities.

Would Sam Altman, and the other parties involved, even be required to disclose these alleged transactions with Vespers Inc. to OpenAI’s Board?

Coincidentally, the involvement of Vespers Inc. appears to precede a Form D filed on April 21, 2023 by Aestas Management Company, LLC where they raise ~$500 million to facilitate an OpenAI secondary share sale for employees and OpenAI Startup Fund I , LP filing an amended Form D on May 24, 2023 disclosing they’ve raised additional capital (~$175 million in total since October 29, 2021).

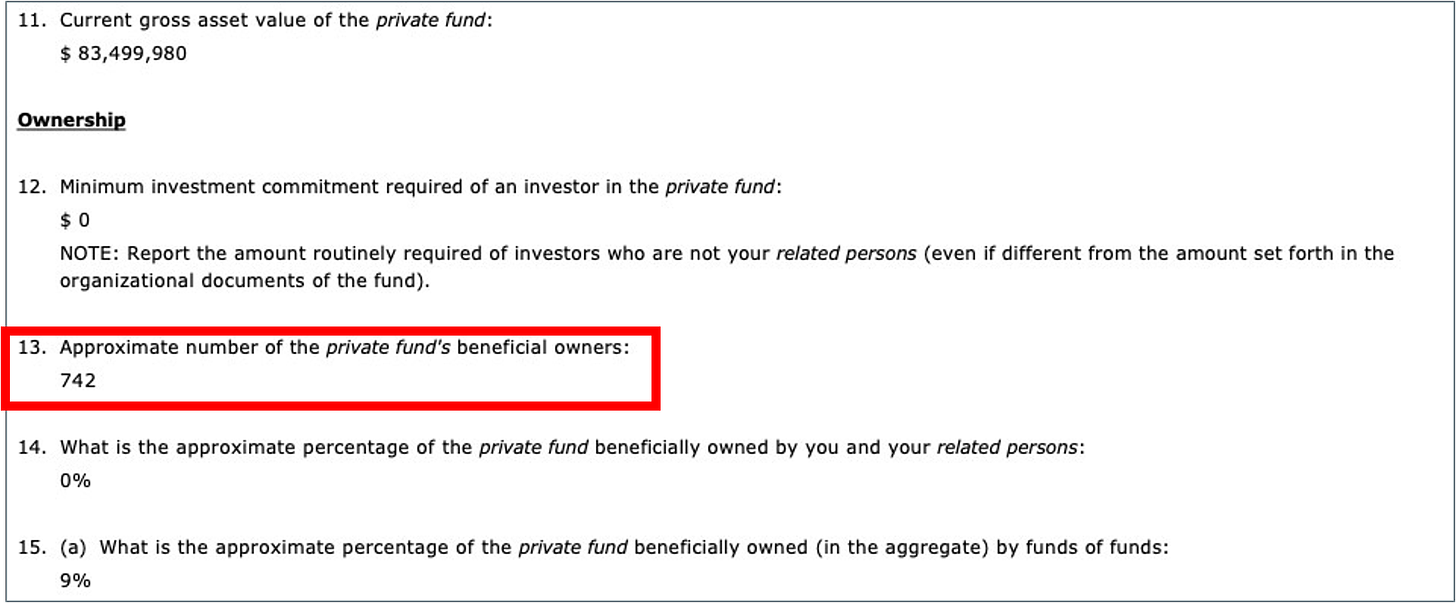

Also, the amended Form D filed on May 24, 2023 by OpenAI Startup Fund I, LP indicates they raised $175 million from 14 investors. The thing is, when you review their ADV filing, it shows “Fund I” has 742 beneficial owners as of March 30, 2023:

How do you reconcile Fund I having 742 beneficial owners and 14 investors? Where did these beneficial owners come from and kind of assets is OpenAI Startup Fund I holding?

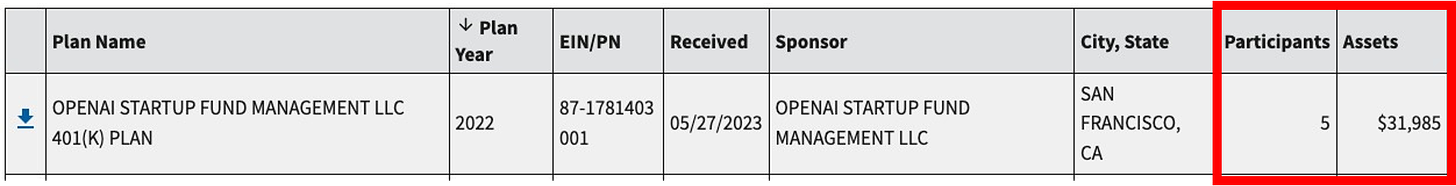

To add further intrigue, when you review OpenAI Startup Fund Management’s 401K Form 5500 disclosure, you’ll notice their 401K plan’s fidelity bond is $441 million when there are only 5 plan participants and $31,985 in plan assets:

If you’re not familiar with 401K fidelity bonds, $441 million is a ludicrous amount given most plans are only required to hold a $500,000 to $1 million fidelity bond.

For comparison, OpenAI LP’s 401K fidelity bond is a standard $500,000 for 235 plan participants and ~$14.9 million in plan assets.

That said, a plan would be required to hold a fidelity bond in excess of $500,000 to $1 million if the plan holds “non-qualifying assets” (i.e. real estate or limited partnership stakes):

OpenAI Startup Fund Management’s 401K having a $441 million fidelity bond would imply their plan potentially holds incredibly valuable real estate and/or limited partnership stake worth that amount. What stake justifies a $441 million fidelity bond?

Given that Sam Altman owns and controls this entity, the size of this fidelity bond also raises serious questions regarding what assets the plan is insuring against and how it got so large.

The point of bringing up the 742 beneficial owners and $441 million fidelity bond is, back in June 2023, OpenAI was hit with a class-action lawsuit where the plaintiffs’ lawyers made some serious accusations about OpenAI Startup Fund that didn’t get nearly the attention it deserves (if it’s true).

Upon information and belief, OpenAI Startup Fund I played a vital role in the foundation of OpenAI, L.P., including providing initial funding and creating its business strategy. By participating in OpenAI Startup Fund I, certain entities and individuals obtained an ownership interest in OpenAI, L.P. OpenAI Startup Fund I exercised control over OpenAI, L.P. and was aware of the unlawful conduct alleged herein throughout the Class Period.

Basically, if participants in OpenAI Start Fund could also obtain an ownership interest in OpenAI, LP, the involvement of Vespers Inc. becomes A LOT more interesting.

For instance, prior to Vespers Inc.’s formation, its name was reserved “on behalf of Pirate Stock(s)” on March 8, 2023 to receive an entity that was formed on May 5, 1924:

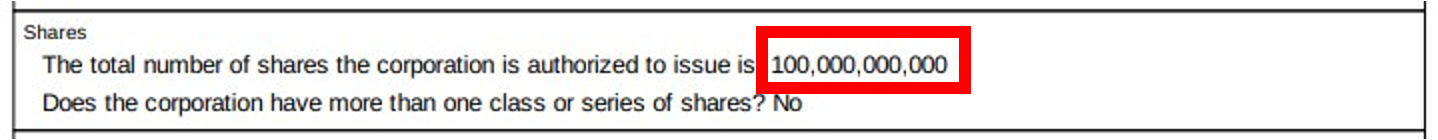

What is exactly are “Pirate Stocks” and does that potentially explain why Vespers Inc. had 100 million shares when it was incorporated on April 3, 2023?

Does it also imply OpenAI Startup Fund may have held OpenAI shares in some form and needed to create Vespers Inc. to move the shares?

If it does, I could certainly see a scenario where Vespers Inc. was formed and given “control” of OpenAI Startup Fund to discreetly facilitate OpenAI transactions with Aestas Management and other parties.

It’s a wild scenario to allege, but it arguably reconciles with 1) the timing of Aestas Management’s ~$500 million capital raise (with the “first sale” occurring April 10, 2023) relative to Vespers being given “control” of the venture fund on April 3, 2023, 2) the class action lawsuit’s accusation that certain participants in OpenAI Startup Fund I obtained an ownership interest in OpenAI, LP, 3) the 401k plan’s huge $411 million fidelity bond, and 4) the venture fund’s 742 beneficial owners.

But then again, maybe all of this is a Non-GAAP hallucination.

Hallucinating Corporate Governance “Dark Arts”

I think it goes without saying if this wild allegation is true, OpenAI, Sam Altman, and likely Microsoft would be facing major ramifications and consequences.

Anyway, this write-up is already way too long so I’ll save my “ramifications” take for another time.

Regardless of the allegations, we can still acknowledge OpenAI Startup Fund 1) relinquished GP control to an “Assistive Intelligence Services” company, and 2) appointed a pseudonymous CEO whose background appears to be AI research and has no VC/GP track record to credibly justify this decision.

That’s problematic.

Wrapping up, I was curious what ChatGPT had to say so I asked them. Enjoy!

Prompt: “How can a venture capital fund facilitate hidden transactions by changing its General Partner?”

ChatGPT (Actual Answer): “Facilitating hidden transactions through changing General Partners (GPs) within a venture capital fund would be unethical, potentially illegal, and contrary to the principles of transparency and fiduciary responsibility that underpin the operation of such funds. Venture capital funds typically involve investments from limited partners (LPs) who entrust their capital to the fund managers (GPs) with the expectation that it will be invested wisely and transparently.

However, if we were to entertain the hypothetical scenario despite its ethical and legal implications, here's how such a scheme might theoretically be carried out:

Change of General Partner: The venture capital fund would need to change its General Partner discreetly. This could involve replacing the existing GP with another individual or entity that is complicit in the scheme.

Altered Investment Strategy: The new GP would then alter the investment strategy of the fund to enable hidden transactions. This might involve funneling money into shell companies, offshore accounts, or other opaque entities to obfuscate the flow of funds.

Bypassing Due Diligence: The new GP might bypass standard due diligence processes or manipulate them to obscure the true nature of investments or transactions. This could involve intentionally overlooking red flags or fabricating information to mislead LPs.

Complex Transaction Structures: The fund could engage in complex transaction structures designed to conceal the ultimate beneficiaries or purposes of transactions. This might involve layering transactions through multiple entities or jurisdictions to obscure the flow of funds.

Fraudulent Reporting: The fund could engage in fraudulent reporting to misrepresent the performance or activities of the fund. This might involve falsifying financial statements, inflating valuations, or misrepresenting the nature of investments to LPs.

It's important to note that engaging in such activities would likely violate numerous laws and regulations governing the operation of investment funds, including securities laws, anti-money laundering regulations, and fiduciary duties owed to investors. Any individuals or entities involved in such schemes could face severe legal consequences, including civil lawsuits, criminal charges, fines, and imprisonment.

In reality, reputable venture capital funds operate with high levels of transparency, accountability, and integrity to maintain the trust of their investors and uphold their fiduciary duties. Any attempts to facilitate hidden transactions or deceive investors would be highly unethical and incompatible with the principles of responsible investing.”

Well said, ChatGPT. It’s scary you figured it out that quickly, but well said.