[Unlocked] Pumping Cash to Shareholders

Driving with a tank full of cash to deliver shareholder returns

This write-up examines recent company disclosures (i.e. governance, compensation, debt raise, capital returns, and insider transactions) at Pioneer Natural Resources (ticker: PXD).

For much of 2022, PXD aggressively returned free cash flow (FCF) to shareholders, and in 2023, aligned equity compensation to further incentivize capital returns (especially dividends).

When contemplating this change to incentives with a mosaic of other “bullish” decisions, this could finally set the stage for strategic alternatives down the road:

Changing 2023 equity compensation to focus on FCF per share and ROCE aligns with acquirers being ROI focused when assessing deals.

Recently amending and standardizing change in control agreements ties up loose ends for a future sales process.

Granting RSUs to the CEO and aggressively returning excess cash to shareholders via buybacks and dividends could be viewed as “getting paid to wait” on M&A and managing the stock price through a commodity cycle.

Beginning in July 2022, the company began doing share repurchases through a 10b5-1 plan which permits them to “repurchase shares at times that may otherwise be prohibited under the company's insider trading policy”, and gives them flexibility to return capital while proactively assessing strategic alternatives.

The company continues to maintain a fairly clean, under levered balance sheet with the 2025 convertible notes likely being called and/or converted to shares in May 2023.

As per Non-GAAP Newsletter tradition, this write-up looked way better while sitting in my drafts in March 2023 and before OPEC announced a surprise oil output cut. Nevertheless, PXD might be worth kicking the tires if you’re looking for more energy exposure with a company that’s incentivizing management to be capital returns focus.

A key risk factor is PXD forgoes a sale and pursues another large acquisition, but the company has publicly stated they are not contemplating a significant business combination or other acquisition transaction, and the new equity incentive structure seems to align with this stance.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

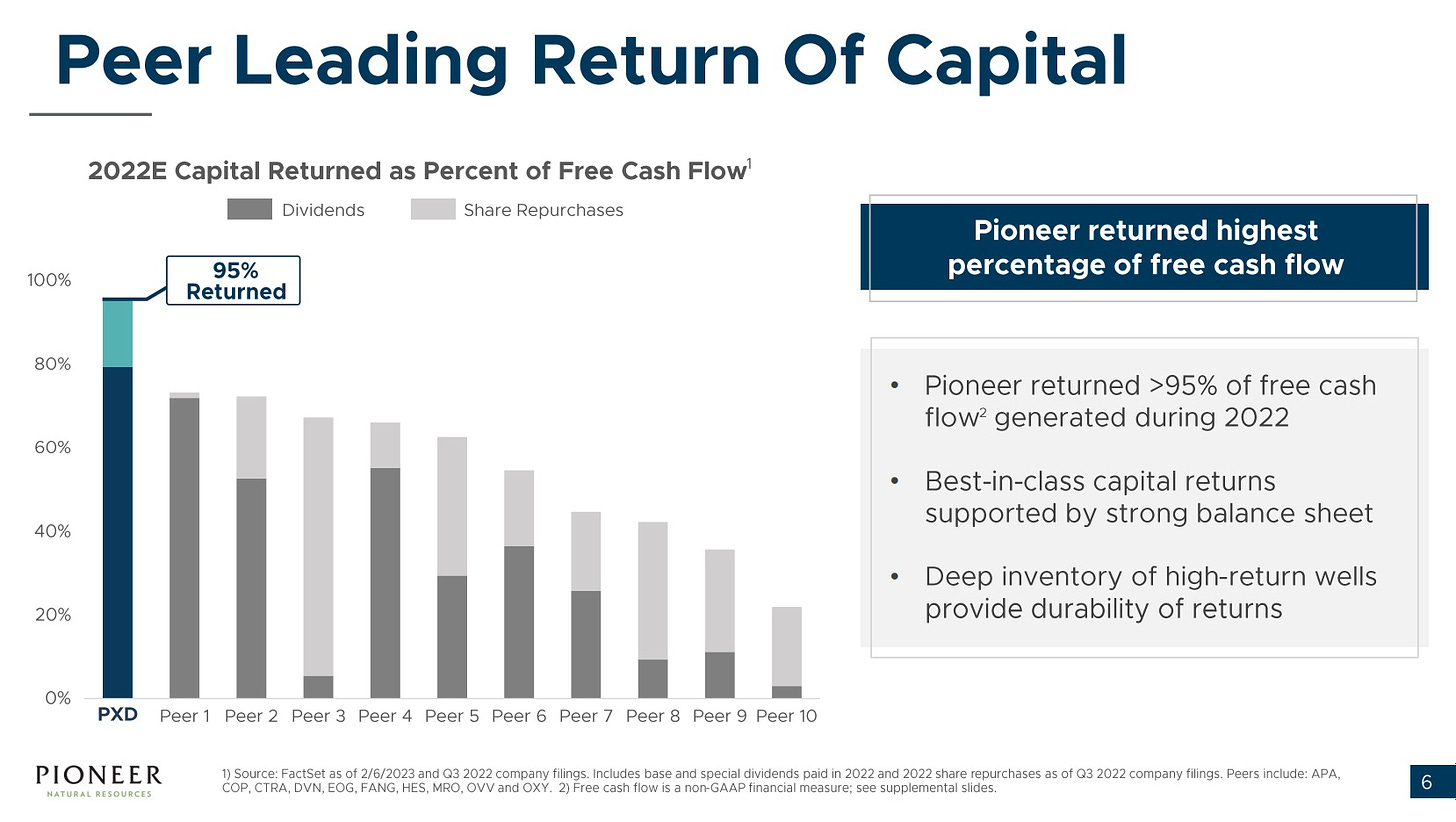

Aggressively Returning FCF to Shareholders

In 2022, PXD aggressively returned excess capital to shareholders:

In addition to the strong dividend payout, we continue to see attractive value in repurchasing our shares. We believe trade at a significant discount to our intrinsic value. Demonstrating this commitment, during the fourth quarter, Pioneer repurchased $400 million of stock, further reducing shares outstanding, which benefits long-term share returns and, importantly, improves per share metrics. In addition to the fourth quarter share repurchases, we completed an additional $250 million of share repurchases during the first quarter of '23 under a 10b5-1 plan, exhibiting our willingness to actively repurchase shares.

In total, Pioneer has repurchased $1.9 billion in equity since the beginning of 2022, reducing shares outstanding by approximately 3.5%. With $2.1 billion remaining under our $4 billion authorization, we have additional opportunities to reduce our share count further in 2023.

- Richard Dealy, President & COO (Q4 2022 Earnings)

Going into 2023, PXD continues to communicate an aggressive stance in returning excess FCF to shareholders:

At strip pricing, after funding our 2023 program, we expect to generate substantial free cash flow, the majority of which we plan to return to shareholders through dividends and share repurchases.

- Richard Dealy, President & COO (Q4 2022 Earnings)

To reinforce and incentivize capital returns, PXD has remodeled their 2023 equity compensation and implemented capital return focused performance metrics.

2023 Equity Compensation: Incentivizing Capital Returns

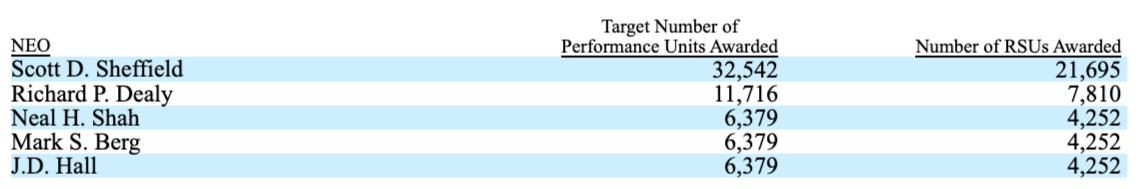

On February 13, 2023, PXD disclosed they remodeled equity compensation with the CEO now receiving RSUs as part of his equity compensation, and performance metrics for PSUs focusing on FCF per share and Return on Capital Employed (ROCE) with a TSR modifier:

The allocation of the target value of the NEOs’ equity awards between performance units and time-based awards was 60% allocated to performance units and 40% allocated to time-based awards.

Performance units entitle the recipient to the payment of shares following the end of a three-year performance period ending December 31, 2025 if, and only to the extent of, achievement of the applicable performance measures, as follows: payout of 50% of the performance units is based on the Company’s achievement of Free Cash Flow/Share metrics, and payout of 50% of the performance units is based on the Company’s achievement of Return on Capital Employed metrics, in each case subject to certain other adjustments (up or down by up to 25%) based on the Company’s Total Shareholder Return over the performance period relative to that of the Company’s peers.

Previously, the CEO’s equity compensation was 100% performance-based shares that was tied to relative TSR performance:

Big picture, using FCF per share and ROCE as performance metrics is a departure from the industry practice of using relative TSR which even returns-focused EOG uses for their PSU grants:

Pursuant to the amended form of award agreement, the applicable performance multiple (ranging from 0% to 200%), determined based on EOG’s “TSR Rank” relative to the specified peer companies, will be adjusted by applying a specified modifier ranging from minus-70% (-70%) to plus-70% (+70%), based on EOG’s average return on capital employed over the three-year performance period (Absolute ROCE Modifier), provided that in no event will the performance multiple, after applying the Absolute ROCE Modifier, exceed 200%. (EOG 8-K)

Granting RSUs to PXD’s CEO is also an interesting “capital returns” signal, because management is entitled to receive dividends on their RSUs, whereas dividends paid to PSUs are deferred and only delivered on earned shares:

In the event that the Company declares and pays a dividend in respect of its outstanding shares of Stock and, on the record date for such dividend, you hold Restricted Stock Units granted pursuant to this Agreement that have not been settled, the Company shall pay to you an amount in cash equal to the cash dividends you would have received if you were the Beneficial Owner. (2023 RSU Award Agreement)

[For PSUs] dividends declared during the performance period will be paid at the end of the three-year performance period only on shares delivered for earned units.

Overall, the 2023 equity compensation structure incentivizes management to return excess capital to shareholders and take a “per share” returns-based approach to capital allocation. It’s reminiscent of a capital allocation framework you’d see for the tobacco industry.

Balance Sheet Clean-Up: PXD Issues $1.1 Billion Debt

With management focusing on FCF per share and ROCE, it’ll be interesting to see how the company utilizes its under-levered balance sheet going forward:

Question: You effectively have no debt on the business or very low leverage levels. Do you have the optimal capital structure? Or does it make sense if you go into an air pocket around commodity prices, to be more aggressive around returning capital and taking a little bit more debt onto the business in order to fund it?

CEO Scott Sheffield (GS Conference 1/5/23): Yes. Our debt to EBITDA is down to 0.3. Longer term, I personally would like to get down to 0. I think that's the better balance sheet in a fluctuating commodity price, long term. So what you want to do is be able to -- when you look at what happened in 2020, when our stock got down to $50, you want several billion of firepower to be able to go in there and buy the stock really cheap. And there's not one oil and gas company, including the majors, that bought their stock in the bottom of the COVID market. And that's when you really want the firepower go in there and buy the shares. We know our business. We know what's going to come back. And so that's the reason you want the balance sheet to zero debt.

On March 27, 2023, PXD issued $1.1 billion senior notes which is presumably being used to pay off their $750 million senior note due May 15, 2023:

We estimate that the net proceeds of this offering will be approximately $1,095.6 million, after deducting underwriting discounts (excluding fees and expenses of the offering). We intend to use the net proceeds of this offering for general corporate purposes, which may include, but are not limited to, the repayment or repurchase of our 0.550% senior notes due 2023 (the “2023 Notes”) or other corporate obligations.

That said, the more interesting balance sheet liability to monitor is PXD’s 2025 convertible note. In May 2020, PXD issued $1.3 billion of convertible notes due 2025 with an adjusted conversion price of $97.25 and an adjusted capped price of $138.40 that is callable on May 20, 2023. The company currently carries $925 million (carrying value) of this convertible note debt which is now worth $2.2 billion (fair value) as of December 31, 2022:

The Company may not redeem the Convertible Notes prior to May 20, 2023, and after such date, may redeem the Convertible Notes only if the last reported sale price of the Company's common stock has been at least 130 percent of the Conversion Price for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which the Company provides the notice of redemption. The redemption price is equal to 100 percent of the principal amount of the Convertible Notes to be redeemed, plus accrued and unpaid interest.

I’m assuming the convertible notes will be converted to shares before they’re actually called, but cleaning up the balance sheet and removing the convertible note overhang will open the door for more aggressive capital returns (i.e. larger special dividends) and possibly strategic alternatives going forward.

Amendment to Change in Control Agreements

In conjunction with disclosing changes to PXD’s equity compensation, the company also amended their change in control agreement with management:

Amendment to Change in Control Agreements. On February 8, 2023, the Committee also approved an amendment to the Pioneer Natural Resources Company Change in Control Agreements previously entered into with each NEO. (PXD 8-K)

Big picture, the amendments themselves aren’t material, but I think standardizing the agreement and adding more specific, incremental benefits is indicative of a company that’s seriously contemplating the ramifications of a sale and going through a checklist of “holes” to address in the event of a change in control happens.

Mosaic of Disclosures: Changes Informed by M&A?

The amended change in control agreements also comes off the heels of experts predicting a wave of consolidation in 2023, and oil majors, like Exxon, recently communicating an interest in acquiring Permian assets:

We do think with time, the work we've been doing in the Permian will provide a value opportunity that we can leverage when we -- when the market is right. And I think expectations start to align around values from a buyer standpoint as well as a seller standpoint. And so there's an element of that where it's difficult to go in and buy at the top of a commodity cycle.

You tend to want to -- at least I want to focus in on where you see more, I'd say, longer-term price cycles being priced into assets. That will be one of the functions or one of the things that you've got to consider in this space. But it really is and we continue to look for where we see the opportunity of bringing value for undeveloped resources in the Permian.

- Darren Woods, Exxon Chairman, President, & CEO (Q4 2022 Earnings, 1/31/23)

PXD CEO Scott Sheffield also recently predicted “massive M&A activity” will happen:

Question: And do you think the Permian will consolidate over time, and these independents will end up in the hands of either the majors or merging with each other?

CEO Scott Sheffield (GS Conference 1/5/23): I think well, because of some of the slides I showed before in regard to people running out of inventory, reserve replacement, there has to be massive M&A activity. The biggest issue is that people -- we had a series of companies in 2020 and '21 that sold out toward the bottom of the market and sold out a small premium. Nobody wants to sell at a small premium. Now eventually, what will happen with a lot of these companies that don't sell out, the multiples will continue to decline as their inventory depletes. So they have a choice to merge with somebody with another inventory in high grade or do I just take a lower, lower and lower multiple over time. That's what I predict will happen. So it will be a combination. Some will choose the merger route and some will choose just to stay.

CEO Scott Sheffield (GS Conference 1/5/23): The majors are way below 100% [reserve replacement]. The independents are now down to about 100% reserve replacement. So that's setting up for a lot of things to happen over the next 7 years in regard to whether it's higher oil prices or whether it's to a lot greater extent to great M&A activity over the next 7 years.

When viewed through the “eventual M&A” lens, it makes a lot of sense that the disclosed changes would be informed by M&A:

Changing 2023 equity compensation to focus on FCF per share and ROCE aligns with acquirers being ROI focused when assessing deals.

Amending and standardizing change in control agreements ties up loose ends for a future sales process.

Granting RSUs to the CEO and aggressively returning excess cash to shareholders via buybacks and dividends could be viewed as “getting paid to wait” on M&A and managing the stock price through a commodity cycle.

Beginning in July 2022, the company began doing share repurchases through a 10b5-1 plan which permits them to “repurchase shares at times that may otherwise be prohibited under the company's insider trading policy”, and gives them flexibility to return capital while proactively assessing strategic alternatives.

The company continues to maintain a fairly clean, under levered balance sheet with the 2025 convertible notes likely being called and/or converted to shares in May 2023.

Overall, an argument can be made the mosaic of decisions appear to be informed by future M&A.

Assessing “Succession Alternatives”?

With PXD being a perpetual takeout target and M&A potentially on the horizon, it should be noted CEO Scott Sheffield is turning 71 years old this year.

Generally speaking, if serious succession planning is happening due to the CEO’s age, strategic alternatives is likely being seriously considered as well (I’m calling this dynamic “succession alternatives”).

I don’t think it’s a coincidence many of the companies featured in the newsletter for M&A signals have subsequently announced CEO succession.

Insider Transactions: “Gifting” a Bullish Signal?

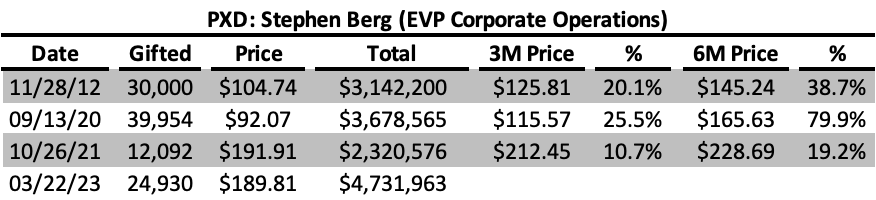

Finally, I thought it was interesting Stephen Berg (EVP Corporate Operations) recently gifted $4.7 million shares to his spouse for estate planning purposes. I’ve previously discussed how stock gifts can be a bullish signal:

Generally speaking, gifts to family/spouse can be quite bullish since executives are usually keenly aware of the go-forward opportunity of their stock when executing these estate/tax motivated transactions. The signal isn’t perfect, but executives gifting stock in-size is worth paying attention to. (VRNS Write-Up)

With this “bullish” signal in mind, when you review Mr. Berg’s historical stock gifts, PXD’s stock incidentally performs well 3 to 6 months out:

Past performance is no guarantee of future success, but I find the timing of his stock gift noteworthy given the mosaic of other decisions mentioned.