Profiting from Corp Governance "Dark Arts": Part 3

Case Study: Stamps.com and One of the Greatest (Alleged) "Bullet Dodge" Grants I've Seen

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Welcome to Part 3 of the ongoing Corporate Governance “Dark Arts” series!

For Part 3, I’m covering Stamps.com (ticker: STMP) and the company’s legendary (to me) 2019 options grant to management. It’s one of the greatest (alleged) “bullet dodge” grants I’ve seen.

Interestingly, STMP’s annual meeting is coming up on June 10, 2020, and investors will have an opportunity to vote their “opinion” on this grant via the “say on pay” proposal.

Disclaimer: This case study is for educational and entertainment purposes only. None of this is investment advice or recommendation.

Corporate Governance “Dark Arts” Series (feel free to skip if you’re familiar with the series)

For those unfamiliar with the “Dark Art” series, it’s an ongoing series where I discuss (through explainers and case studies) how companies use the “Dark Arts” of corporate governance to:

Take Advantage of Unsuspecting Shareholders and Directors

Influence Decision-Making

Profit

And yes, if you know what you’re doing, there are windows of opportunity to participate alongside.

If you’re new to the “Dark Arts”, I highly recommend reading Part 1 which provides a pretty thorough run down of the basics and high-level concepts. That said, I also provide an abbreviated summary of key concepts below so you’re not completely lost with what’s going on.

In Part 2 of the “Dark Arts” series, I walk you through a case study that features TPG, their co-CEO Jim Coulter, and the infamous acquisition of J. Crew. Incidentally, J. Crew recently filed for bankruptcy closing one of the more interesting “Dark Arts” situations I’ve studied over the decades. From the WSJ:

The bankruptcy filing is a black eye for private-equity firms TPG and Leonard Green & Partners, which paid $3 billion a decade ago to take over the retailer but were unable to overcome the shifts to fast fashion and online shopping.

TPG’s involvement in J.Crew dates back more than two decades. The firm first took the retailer private in 1997 and made several times its money after the company’s 2006 IPO. It partnered with Leonard Green to buy J.Crew again in 2011 with the support of the company’s longtime leader, Mickey Drexler.

Check out Part 2 of the “Dark Arts” series to get more color on the TPG, Leonard Green, and Mickey Drexler “partnership”.

Key Concepts from “Dark Arts” Part 1

Part 1 of Corporate Governance “Dark Arts” series focuses on the basics and high-level concepts of “dark” governance actions on the Board (especially actions tied to compensation).

I define the “Dark Arts” as actions that distort Management-Board-Shareholder alignment to primarily benefit insiders (who engage in the “dark” action) and to gain disproportionate control and/or influence over the governance process.

This does not necessarily mean the “Dark Arts” are illegal.

Compensation is the most important area to understand when examining corporate governance “Dark Arts”.

Compensation best practices noticeably die first when exposed to “dark” actions. That’s your signal to examine the situation closer.

The compensation committee chair is arguably the most powerful “independent” position on the Board, and can singlehandedly distort the power dynamics of the entire Board.

Of all the “dark” actions, monitoring equity grants is the most important. In particular, pay extra attention to “spring loading” and “bullet dodging” behavior.

Manipulating the timing of equity grants relative to material news releases is an easy way for insiders to capture value in excess of “target value”. If you can recognize the signs of this practice, you can profitably participate alongside. No, the SEC does not appear interested in cracking down on this behavior.

“Play the Man, Not the Cards”

Before we get into Stamps.com, a friendly reminder that this write-up is focused on governance dynamics and compensation quirks. Given that this is a battleground stock, there are a lot of “what abouts” and “what ifs” to contemplate in order to have a proper view of the situation.

I don’t spend any time on the various scenarios nor the fundamentals of the company. That said, governance analysis is at its best when it complements your existing fundamental research process.

But for this particular case study, I’m stripping out much of the fundamentals and focusing on “playing the man, not the cards”. The goal is to share the concepts and subtleties you can takeaway to hopefully help you improve your investment process (that is unique to you).

Let’s jump into the case!

About Stamps.com

Stamps.com provides Internet-based mailing and shipping services. From wikipedia:

Stamps.com allows users to print official United States Postal Service stamps and shipping labels for a monthly subscription fee of $17.99. Stamps.com sends customers a digital scale to weigh letters and packages to ensure the correct amount of postage is applied to the piece of mail. The amount of postage applied is then deducted from the customer's Stamps.com account. Customers can print postage on envelopes, regular paper or adhesive labels.

The company has been a battleground stock with concerns over business model, competition, management, and their relationship with the U.S. Postal Service relationship creating volatility in the stock. This battle would culminate in STMP ending their exclusive partnership with U.S. Postal Service, driving the stock down nearly 50% in February 2019 and setting the stage for a potential “bullet dodge” grant.

Why Stamps.com?

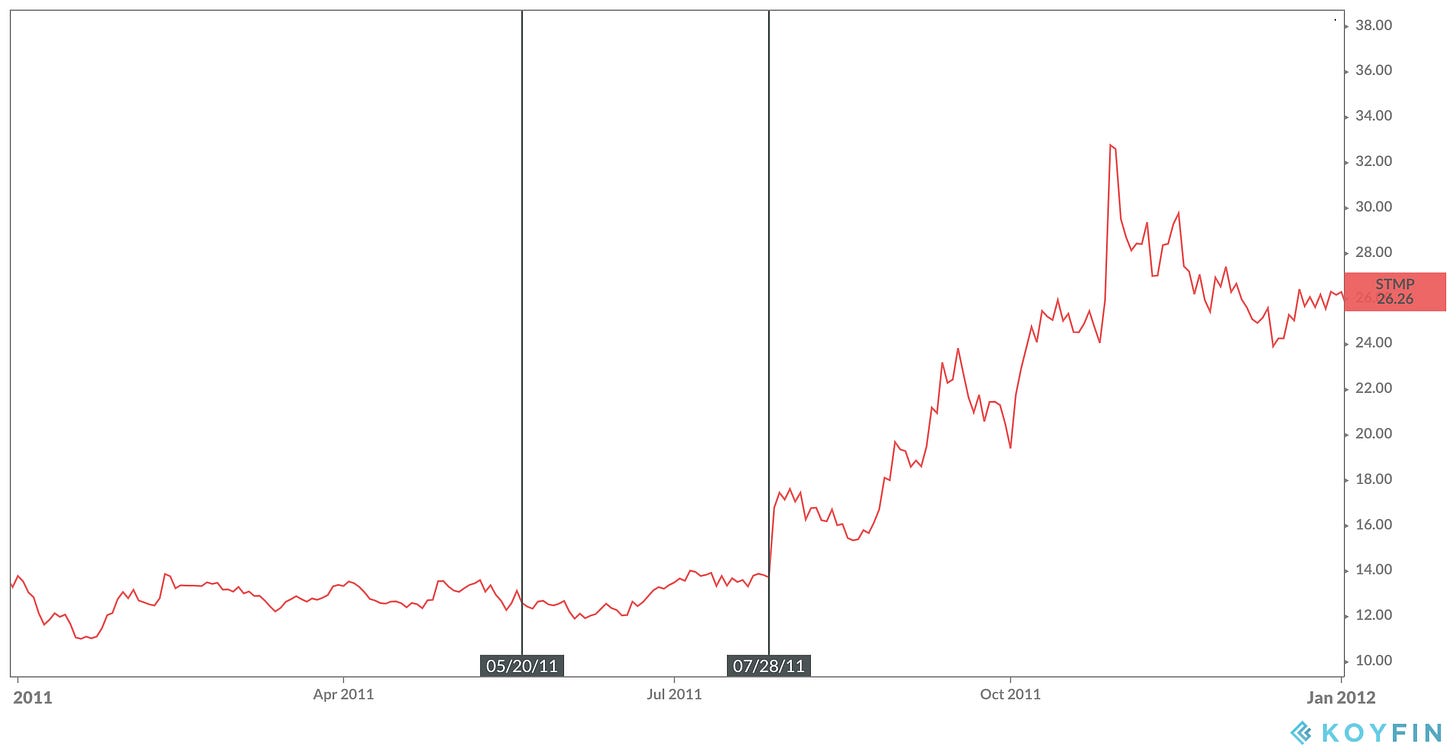

So why do a case study on Stamps.com (STMP)? Chaos, that’s why. Look at the company’s recent price chart:

That’s some serious volatility over the last ~16 months.

I enjoy examining these chaotic situations, because volatility tends to create opportunity and lessons. It causes management teams and Boards to focus. It also forces them to think critically about next steps and (if necessary) adjust incentives (sometimes drastically). Those changes in compensation can end up being a material signal for investors.

With COVID-19 creating chaos and volatility across multiple industries, I figure I do a case study on STMP since a lot of Boards and management teams are going through similar triage exercises that STMP went through a year ago.

Who knows, by studying STMP, you might pick up on a similar “dark” pattern at other companies.

“Bullet Dodge” Equity Grants

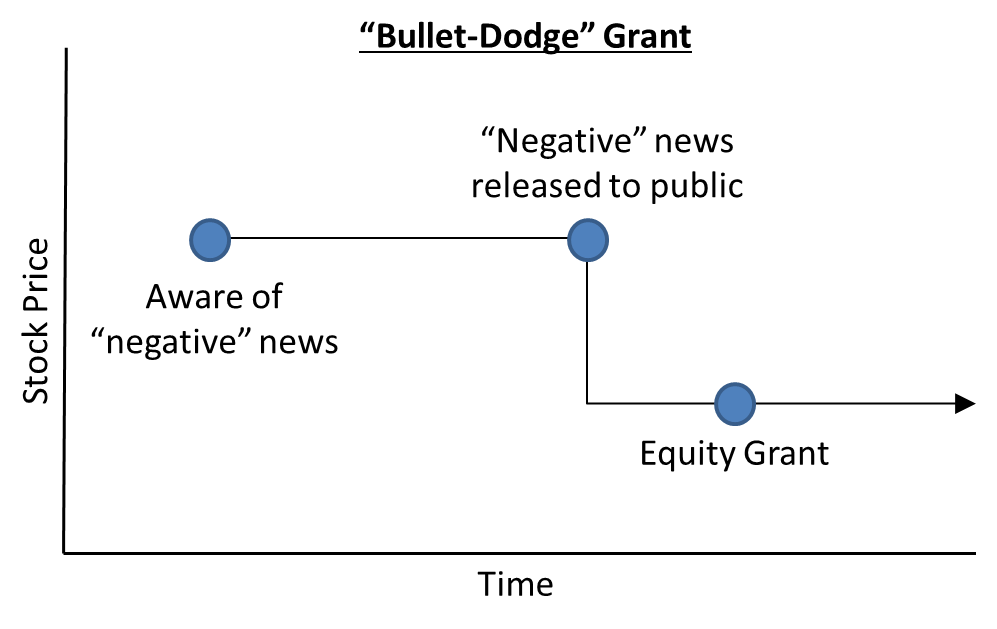

Before we jump into things, let’s make sure we’re on the same page with what a “bullet dodge” equity grant is. Per Investopedia:

Bullet dodging is a shady employee stock option granting practice, in which the granting of the options is delayed until a piece of really bad news involving the company has been made public and the stock's price falls. Because an option's exercise price is linked to the underlying stock's price when it is issued, waiting for the stock price to drop allows option holders to benefit from a lower exercise price.

Personally, if I’m putting on a trade, I prefer “bullet dodge” grants over “spring load” grants (“spring load” is when equity is granted before releasing news that positively impacts the stock price).

In my opinion, “bullet dodge” grants tend to come with meaningful, lasting changes (operationally, strategically, etc.) that drive long-term value which makes them more compelling to me. I’m more comfortable holding “bullet dodging” stocks whereas you tend to exit “spring load” trades shortly after earnings.

That all said, “bullet dodge” grants are harder to find since “best practice” is to grant equity after earnings. Speaking of “best practice”, companies who get caught “bullet dodging” tend to defend their decision by saying they’re implementing standard best practices.

Stamp’s (Alleged) 2019 “Bullet Dodge” Options Grant

Now that we know “bullet dodging” occurs when the company releases news that negatively impacts the stock price and then grants equity, let’s take a look at Stamp’s (alleged) 2019 “bullet dodge” options grant:

Soak this in for a moment. Nothing is certain and maybe it’s all coincidence, but this is exactly what a textbook “bullet dodge” grant looks like.

What’s really interesting is you could have anticipated a potential “bullet dodge” grant was underway by reading the 2019 Proxy (filed April 30, 2019 before the earnings release).

Let’s go through the proxy:

At its April 5, 2019 meeting, the Compensation Committee examined equity grant practices over the three fiscal years ending in 2018 at 58 public companies…

…The Compensation Committee then decided to issue a company-wide option grant of 1.65 million total options. The Compensation Committee instructed Mr. McBride to develop a recommended allocation for such company-wide option grant and to return to the Compensation Committee with his recommendation. The proposed 1.65 million targeted company-wide option grant is meant to be a retention grant to all existing employees, including executive managers, for the next three years.

What do we learn from this section?

The Compensation Committee met on April 5, 2019 (stock was $80.27).

They decided to issue 1.65 million options to management.

The Compensation Committee instructs the CEO “to develop a recommended allocation for such company-wide option grant”.

The grant is meant to be a retention grant for the next 3 years.

Fire alarms should be going off.

STMP’s stock had already blown up in February 2019 so you know there was going to be a ton of attention on the next earnings release in May 2019. One way or another, you were probably going to get a sharp price move post earnings.

Meeting on April 5th also implies the Compensation Committee had a good idea of March quarter results and visibility on updated forward guidance when they decided to grant options to management.

Because the options grant is based on number of shares and not target value, there’s also extra temptation to manipulate the timing of grants and/or financial outlook to get a favorable strike price, especially when you consider it’s a large grant meant to cover the next 3 years of equity compensation.

Finally, the explicit callout of the Compensation Committee instructing the CEO to develop an “allocation” for the options grant feels unusual to me. I can’t recall ever seeing this before.

What does the committee mean by “allocation”?

Did this the committee’s request give the CEO undue influence on the timing of share grants?

The disclosure is a bit unclear, but if CEO wanted to delay grants until after earnings, all he would need to do is make his “allocation” recommendations after earnings. If he wanted the grants before earnings, submit the recommendation before earnings and diplomatically advocate for a pre-earnings grant. There was plenty of time leading up to the May 2019 earnings release date to get something done.

Whatever the circumstances, this dynamic means you could anticipate a potential “bullet dodge” by keeping an eye on Form 4 filings (the form they disclose equity grants) leading up to the May 2019 earnings release date:

If the company granted options before earnings, a “spring load” is on the table.

If the company doesn’t grant options before earnings, a “bullet dodge” is on the table.

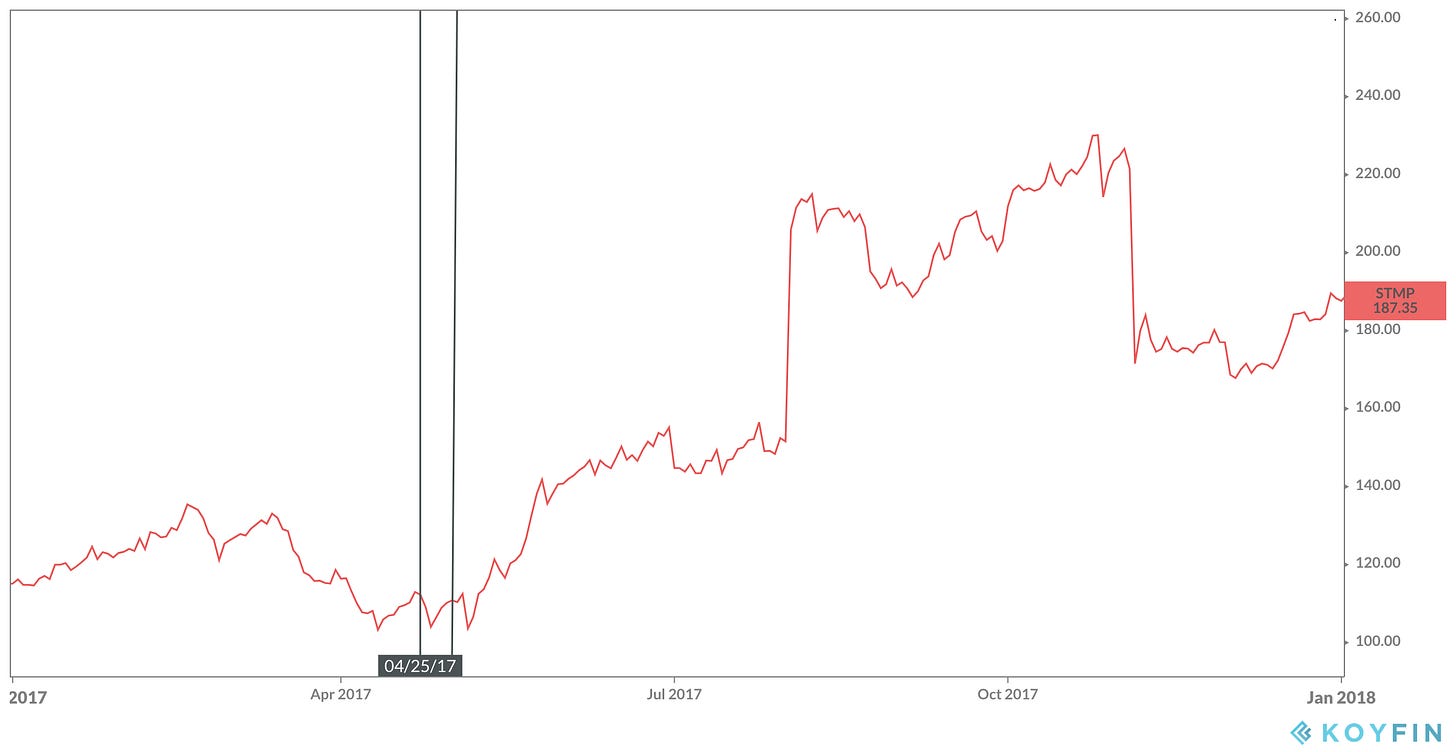

The company would end up granting CEO Ken McBride 150,000 options with a strike price of $35.04 after earnings (stock was $83.39 pre-earnings announce) and after the stock would blow up for the 2nd time in 2019 on lowered guidance. Coincidentally, management would begin to raise guidance post equity grant.

The decision to grant options after earnings would turn into a massive financial windfall for management as the stock rallied from $35 to over $200 per share today. The CEO’s 2019 grant are currently worth $22M to $28M (depending on your options assumptions) vs. their $2.9M grant date value. It’s probably one of the greatest 1 year return on executive compensation I’ve seen.

Yes, it still takes a lot of work and execution to get the stock back to current levels, but it opens a huge can of worms and raises a lot of questions the way the 2019 grant was handled.

To get a clearer picture of the situation, I think it helps to study STMP’s equity compensation history and philosophy.

Stamp’s Equity Philosophy and Grant History

Stamp’s equity philosophy and grant history is pretty interesting.

From the 2019 proxy:

The majority of our compensation decisions are generally made in March or April each year, when the Compensation Committee meets to determine the final incentive compensation for the prior year and establishes the base salaries, equity grants (when applicable), and non-equity incentive compensation plan for the coming year for corporate officers. The Compensation Committee may also meet at other times of the year to address equity grants.

As it has been our general practice to grant awards of stock options to our executive management team every three years, we expect that, historically, our CEO pay ratio would be significantly higher in years when our chief executive officer receives such grants and lower in the two intervening years (although we may make smaller more frequent awards of stock options to executives in the future, which would result in a more consistent CEO pay ratio).

So we know:

Compensation decisions are generally made in March or April of each year. (That’s not too unusual.)

The Committee may meet at other times to address equity grants. (This seems to give the Compensation Committee the flexibility to grant equity outside the typical window you’d see at other companies.)

They generally grant stock options every 3 years, but may consider making smaller more frequent awards in the future. (Multi-year grants can be abused and are problematic when there’s volatility.)

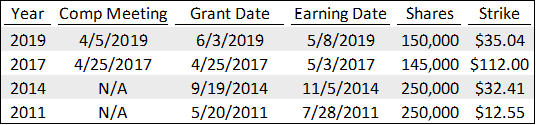

Now let’s take a look at management’s every 3 years “routine” equity grant history:

The first thing that sticks out is management’s equity grant dates are all over the place. When I see grants all over the place, I immediately try to map grant dates to earnings dates to see if there’s a “pattern to the randomness”:

2017 Grant: Options were granted a week before earnings. No meaningful price move post-earnings but the stock would pop on the subsequent earnings date.

2014 Grant: Options granted later in the year and before earnings. Stock would pop on next earnings. Why did the committee wait until September to grant options?

2011 Grant: Options granted before earnings. Stock would pop on next earnings.

These are some peculiarly timed options grants and price moves if you ask me.

By the way, did you notice STMP’s “routine” 2019 options grant is a year early?

The 2019 grant should have been granted in 2020 if the company followed their 3-year grant pattern. The 2019 grant was also was done after earnings instead of before earnings like the previous grants.

If the Compensation Committee wanted to move grants up a year early to 2019, why not give a smaller amount and transition to a more consistent annual grant policy? The committee went ahead and did a 3-year options grant near multi-year lows.

Also, the 2019 grant diverges from the 2017 practice of granting equity the same day the Compensation Committee determines equity compensation.

Whether or not the 2019 grant was truly a “bullet dodge”, there’s a lot of smoke here.

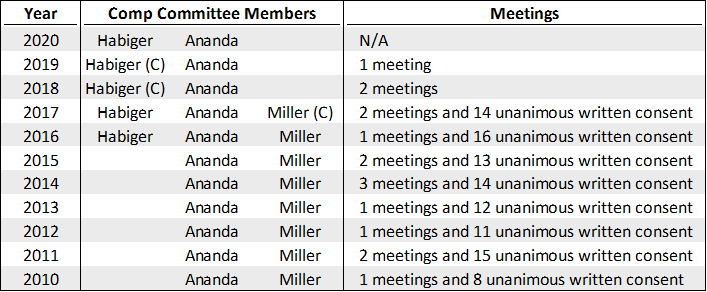

Compensation Committee

When I see peculiar grant patterns, I like to critique the composition and history of the Compensation Committee to get a better handle of Board dynamics.

Mr. Habiger is the CEO of of JD Power and Mr. Ananda is the founding Chairman, CEO, and President of Stamps.com.

A few takeaways:

Normally, I’d say the compensation chair is the most powerful “independent” position on the Board, but the power clearly resides with Mr. Ananda who has been on the Compensation Committee for a long time. To be honest, Mr. Habiger should critically examine his exposure here and at the very least ensure the optics do not get away from him.

I am always weary of 2-person Compensation Committees. 2-person committees tend to have fewer governance controls and leaves the Board vulnerable to all sorts of questionable dealings. It’s also a “tell” to me when the Compensation Committee is a 2-person committee.

The Compensation Committee does not have many meetings. One meeting in 2019 is unacceptable given the existential situation the company was facing. It’s very difficult to properly structure, discuss, and debate appropriate compensation measures in one meeting. It also appears the committee relies heavily on unanimous written consent. As mentioned in Part 2 of the “Dark Arts” series, unanimous written consent is a very powerful tool and allows for nimbleness (or abuse) of granting equity.

Finally, no compensation consultant was engaged to provide advice or recommendations on executive or director compensation. These compensation plans were solely structured and directed by the compensation committee.

Overall, I believe this is a problematic governance set up, especially when lined up with the company’s history of peculiarly timed equity grants to management.

Put everything together and STMP’s 2019 option grants uncomfortably possess all the characteristics you’d look for in a “bullet dodge” grant.

All Eyes on 2020 “Say on Pay”

Probably the most interesting part of all of this is shareholders will get to vote their “opinion” of the 2019 equity grant next month:

As required pursuant to Section 14A of the Securities Exchange Act of 1934, we are giving our stockholders the opportunity to vote, on a non-binding advisory basis, to approve our named executive officer compensation.

This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation.

In 2019, the advisory vote on our named executive officer compensation was approved by approximately eighty-nine and two-tenths percent (89.2%) of the shares present and entitled to vote.

The Compensation Committee has reviewed these results and considers these results supportive of our named executive officer compensation policies and decisions.

The company will hold their annual meeting on June 10, 2020 and I’m fascinated to see what their “say on pay” vote will look like. A big question I have is how will the proxy advisory firms (ISS and Glass Lewis) and institutional investors view the grants.

Everyone is making the push to be sophisticated ESG investors, but can they pick up on what may have happened at STMP?

We shall see.

Up Next: Open to Suggestions (but Probably More Case Studies)

I have plenty of other case studies to write about, but am open to suggestions if there are any specific topics you’d like covered.

See you at part 4 soon!