Profiting from Corp Governance "Dark Arts": Part 4

"How To" Read A Proxy & Examining GreenSky's Equity Grant Practices

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Welcome to Part 4 of the ongoing Corporate Governance “Dark Arts” series!

For Part 4, I’m covering GreenSky (ticker: GSKY) and their aggressive equity grant practices. In particular, GreenSky implements an equity grant process for their March 2019 equity grants that (in my opinion) has no business being a part of modern equity grant practices. It’s that egregious.

Also, a few folks have asked how I look at proxies so I’m going to use this write-up to discuss how I develop a “big picture” view of proxy disclosures.

Note: If you want to skip the “big picture” proxy explanations and jump right into the GreenSky case study, scroll down to the section titled About GreenSky.

Disclaimer: This case study is for educational and entertainment purposes only. None of this is investment advice or recommendation.

Corporate Governance “Dark Arts” Series

Note: Feel free to skip this section if you’re familiar with the series.

For those unfamiliar with the “Dark Art” series, it’s an ongoing series where I discuss (through explainers and case studies) how companies use the “Dark Arts” of corporate governance to:

Take Advantage of Unsuspecting Shareholders and Directors

Influence Decision-Making

Profit

And yes, if you know what you’re doing, there are windows of opportunity to participate alongside.

If you’re new to the “Dark Arts”, I highly recommend reading Part 1 which provides a pretty thorough run down of the basics and high-level concepts. That said, I also provide an abbreviated summary of key concepts below so you’re not completely lost with what’s going on.

For Part 2, I walk you through a case study that features TPG, their co-CEO Jim Coulter, and the infamous acquisition of J. Crew.

For Part 3, I cover Stamps.com (ticker: STMP) and walk you through the company’s legendary (to me) 2019 options grant to management.

Key Concepts from “Dark Arts” Part 1

Note: Feel free to skip this section if you’re familiar with the key concepts.

Part 1 of Corporate Governance “Dark Arts” series focuses on the basics and high-level concepts of “dark” governance actions on the Board (especially actions tied to compensation).

I define the “Dark Arts” as actions that distort Management-Board-Shareholder alignment to primarily benefit insiders (who engage in the “dark” action) and to gain disproportionate control and/or influence over the governance process.

This does not necessarily mean the “Dark Arts” are illegal.

Compensation is the most important area to understand when examining corporate governance “Dark Arts”.

Compensation best practices noticeably die first when exposed to “dark” actions. That’s your signal to examine the situation closer.

The compensation committee chair is arguably the most powerful “independent” position on the Board, and can singlehandedly distort the power dynamics of the entire Board.

Of all the “dark” actions, monitoring equity grants is the most important. In particular, pay extra attention to “spring loading” and “bullet dodging” behavior.

Manipulating the timing of equity grants relative to material news releases is an easy way for insiders to capture value in excess of “target value”. If you can recognize the signs of this practice, you can profitably participate alongside. No, the SEC does not appear interested in cracking down on this behavior.

Proper Governance Requires an “Investor Perspective”

I previously discussed how Boards need an “investor perspective”. Without that perspective, governance systems can and will go haywire (hence the “Dark Arts” series).

I truly believe proper governance and oversight requires an “investor perspective”. This applies to both Boards AND shareholders.

But don’t shareholders already have an “investor perspective” when it comes to governance? Not necessarily.

I’ve noticed many institutional funds have decoupled their proxy voting and governance process (i.e. have a separate governance department or rely on proxy advisors) from their investment process. This is a mistake in my opinion.

An investment process that de-emphasize governance ends up missing critical pieces of information that can actually impact investment outcomes, and corporate governance departments (and proxy advisors) tend to lack the proper “investor perspective” needed to critique situations beyond rigid proxy voting guidelines.

I believe a thoughtful investor can pick up on peculiar governance decisions missed by proxy advisors and governance departments, because they examine the proxy with an “investor perspective”. They can link governance decisions back to underlying business and strategic priorities. It all fits together.

On the other hand, proxy advisors and governance departments can miss key pieces of information, because it is not a priority to have a forward looking “investor perspective”. They may eventually catch on to an egregious practice and update their “best practices” guidelines, but the lag between identifying egregious practices and enacting corrective measures can take a long time (if at all).

Governance needs to be part of the investment process to ensure alignment and drive long-term value.

How to Look at a Proxy: Big Picture

Big picture, how to look at a proxy is no different from how you should look at a financial statement. You need to have an “investor perspective” and connect governance decisions with business and strategy decisions.

Think how you can look at the gross profit or the operating expenses of a familiar company and intuitively notice when something is “off” so you dig into the footnotes to figure out why.

The same concept applies to proxies. Does an equity grant look “off”? Do the performance hurdles look misaligned to investor expectations? Dig into the proxy disclosures and figure out why.

Obviously, developing thoughtful proxy insights takes time, but just like being a good investment analyst it’s a matter of “at bats” and repetition. Eventually you’ll develop a pattern recognition for what matters and start noticing when things look “off” in a proxy.

So how do you maximize quality proxy “at bats”?

The same way you would improve your financial analysis skills. Examine proxies of companies that you’re familiar with and already have an “investor perspective”. (Insert circle of competence joke here.)

Some general suggestions:

Review proxy periods where there’s price volatility or a shift in strategy. What changes were made (especially to compensation) to accommodate volatility and/or shifts in strategy? Is the Board shifting more compensation to equity?

Examine how the company is incentivizing priorities and behaviors.

How is the Board ensuring talent is retained and incentivized, especially if their existing options are underwater? Did they get “make-up” grants? Are they shifting the timing of grants to juice values?

Is there misalignment between what you think drives value and the metrics the Board is incentivizing?

Look at the financial targets and hurdles. Are they sensible? Will they drive shareholder value? Or are they optimized to pay management?

Your “investor perspective” will naturally prioritize what issues and questions you should investigate in the proxy.

How to Look at a Proxy: Checklist

Full disclosure, I don’t actually have a checklist when I go through a proxy. (Insert mental model joke here.)

Consider this checklist a general framework to start with:

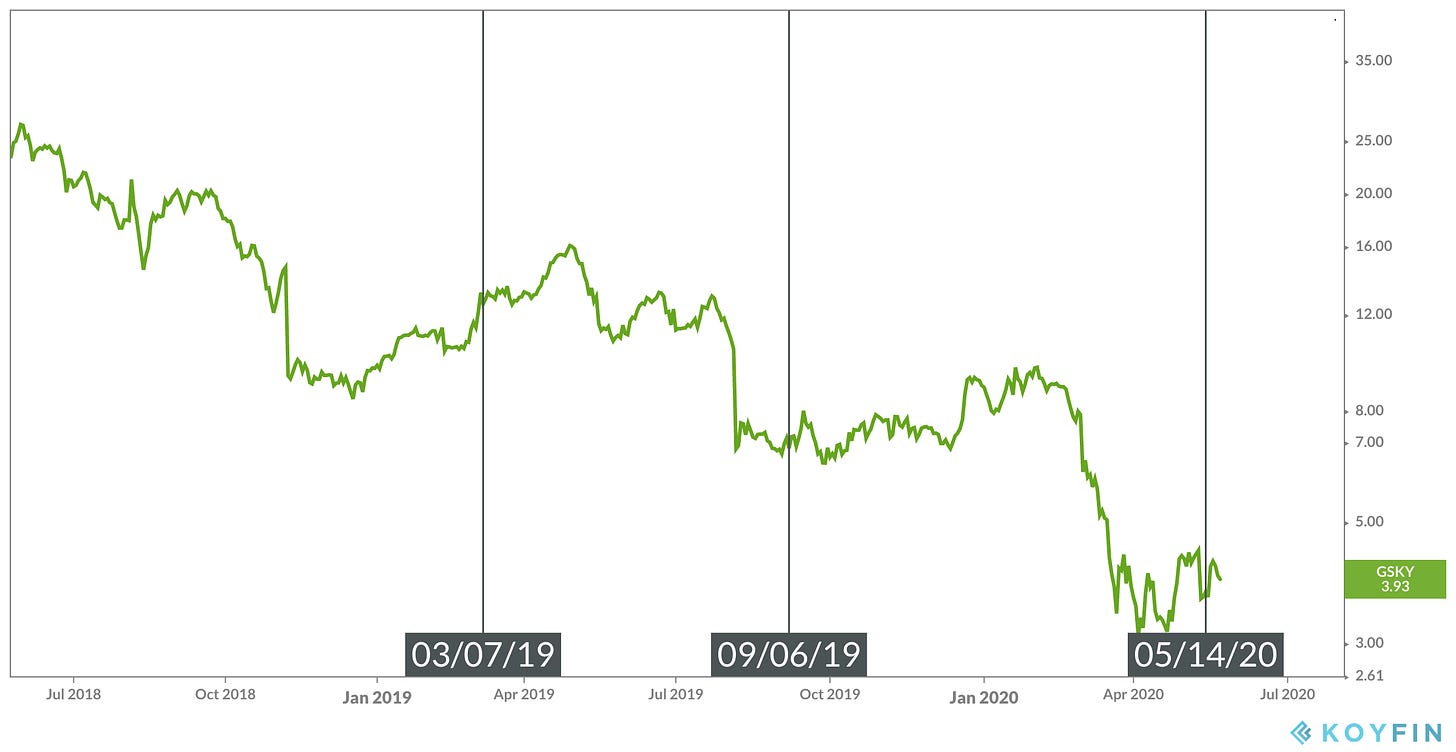

Stock Chart: Before opening the proxy, look at the stock chart. Volatile stock activity tends to cause changes and/or adjustments to governance and compensation. Think about how the Board would respond to a volatile stock and the potential adjustments to compensation or financial hurdles.

I’ll also overlay equity grants and insider buying (disclosed in the Proxy and Form 4s) to see if there are any visual patterns I can pick up.

Compensation Discussion and Analysis ("CD&A"): Read this section in total if the company has a CD&A section. That said, I’ll skip around and start with the long-term equity discussion and go from there. Also, companies with “emerging growth company” status are exempt from CD&A and tend not to disclose much. This can be frustrating, but also an opportunity. Here’s a rundown of key things to look for in the CD&A:

Long-Term Equity (MOST IMPORTANT): This is the most important section of the whole proxy. Read it thoroughly and understand the decision-making process. Understand the mix of equity, hurdles, grant dates, target value calculation, vesting schedule, key changes, etc. Think about how the company’s performance and business model influences the long-term equity plan, and how long-term equity plans influences management’s incremental decision-making.

Compensation Disclosures for Current Year: Occasionally the proxy will disclose key changes to the current year’s compensation program relative to what’s disclosed in the CD&A. If there are changes, try to figure out why the changes were made.

Equity in Lieu of Cash: Check to see if management received a portion or all of their annual bonus (and salary) as equity in lieu of cash. That can signal management believes the stock is undervalued.

Annual Incentive/Bonus: Identify financial hurdles and compare to company guidance. Is there a material mismatch? Poor or misaligned hurdles can indicate poor governance controls.

Grants of Plan Based Awards Table: Review grant dates and approval dates (if disclosed). Was it before or after material news disclosures (i.e. earnings)? Are there any one-off grants that need further review?

Outstanding Equity Awards Table: Look at grant dates of outstanding grants. Was equity granted consistently year-to-year or does it move around? Did the type of equity (RSUs vs. Options vs. PSUs) change meaningfully year-to-year? Are the vesting schedules consistent? If there are changes, you need to figure out why. Did the changes occur before or after major price move? Was there a change in strategy?

Ownership Table: Does anyone have disproportionate voting power? Identify them. Are they on the Board? That’s going to influence the Board dynamics. Determine their potential motivations and how they would exert influence.

Compensation Committee: What are the backgrounds of the committee members. What connection/relationship do they have with management? 2-person committees signal compensation is tightly controlled and can really tilt the power dynamics on the Board to 1-2 people.

Compensation Committee Chair: Who is the comp chairman? What is their background? Try to understand their potential motives and interests. Pay extra attention if they have a PE/VC background or are a CEO of another company. If they are also the Chairman of the Board or Lead Independent Director, they are ridiculously powerful. That power is by design.

Compensation Committee Disclosures: How many meetings did the committee have? Does that feel like an appropriate number of meetings? Are they relying on unanimous written consent to get things done? It can be a “tell” if there are significant changes/adjustments to compensation, but few meetings. This tends to signal backroom dealmaking and that the committee is tightly controlled.

Compensation Philosophy: Take note of disclosed policies and look for any disclosures on equity grant practices (especially around timing). The absence of disclosed equity grant practices can mean the Compensation Committee has a lot of freedom on when and how they grant equity. Are there any targeted or disclosed compensation percentiles? You’ll often see peculiar activity at companies where the team is highly paid and the stock is volatile or underperforming.

Compensation Consultant: Who is the consultant? Some are more reputable than others. Lack of consultant signals the Compensation Committee Chair has a lot of power and freedom on compensation matters.

Repeat: If you pick up on peculiar changes or grants, you’ll need to review previous proxies to (hopefully) get a better understanding of what’s going on and see if there’s a pattern.

Over time, you’ll develop your own proxy process and mental model that reflects your own “investor perspective”. Now that we have the proxy basics covered, let’s jump into the GreenSky case study!

About GreenSky

GreenSky is a fintech company founded in 2006, and publicly-traded since May 2018, that offers point of sale financing and payment solutions to make loans to consumers for home improvement, solar, healthcare and other purposes.

Their go-to-market is nearly 18,000 active home improvement merchants and elective healthcare providers located throughout the U.S.

According the S&P Global, GreenSky has a complex business model that has at times confused investors:

The online lender connects banks with consumers looking to finance large purchases at checkout through an efficient digital application process. GreenSky charges merchants a transaction fee every time a loan is made through the platform. It also charges the lenders an ongoing servicing fee, which is a fixed percentage of the outstanding loan balance.

But it also absorbs part of its bank partners' credit risk in what the company has called a waterfall funding model.

While many believe GreenSky has impressive origination technology, the company’s funding dynamics, liquidity constraints, and economic sensitivity makes GreenSky difficult to model and value.

One thing I’ve noticed about the “Dark Arts” is they tend to pop up in volatile situations and/or battleground stocks. I can only speculate to why this is the case, but these situations definitely put pressure on Boards to keep management teams motivated and there’s strong temptation to capitalize on (or avoid) material price moves.

Why GreenSky?

I initially followed GreenSky because of TPG. GreenSky is a TPG portfolio company, and I always follow TPG situations. If you’re wondering “why TPG?”, read part 2 of the “Dark Arts” series.

That said, I’m not pinning egregious governance decisions at GreenSky on TPG. While they had a representative on the Compensation Committee that approved GreenSky’s (in my opinion) egregious March 2019 equity grant, we don’t know who actually architected the grant and how it was pushed through.

Anyway, the big takeaway for you is you’ll begin to compile your own (mental) list of companies and individuals to keep an eye on the longer you follow this stuff. Reading a proxy is a lot like reading a scouting report. You’ll start picking up tendencies that you can capitalize on in the future.

GreenSky 2020 Proxy

If you’re new to proxy analysis and want to learn, I highly recommend you pause here, open up the GreenSky 2020 Proxy, and critique the March 2019 equity grant applying some of the concepts mentioned in the checklist. Once you’re done, circle back to this section to compare notes and takeaways.

For everyone else, let’s dig in!

“Busted IPO”

Before opening the proxy, I like to look at the stock chart to see if I can pick up on any potential narratives visually.

To start, GreenSky has a pretty ugly chart. Without digging into the fundamentals, we already know we’re dealing with a “busted IPO” (company went public May 2018).

Right out of the gate, you should be pondering:

How do pre-IPO investors feel about this situation? Many are “stuck” in the stock and will want to remedy the situation. What levers do they have?

What strategic or operational changes will be enacted or needs to happen? Sell-offs tend to create a sense of urgency and focus.

What are the management turnover and retention considerations? Executives will probably leave or be replaced. Who needs to be retained?

What will the compensation adjustments be? Assume the Board is figuring out ways to “make whole” underwater and/or below-market compensation to management.

Interesting Equity Grant Pattern

When you overlay executive equity grants to GreenSky’s stock chart, the inconsistent grant pattern immediately jumps out.

Initial takeaways:

March 7, 2019 grant looks like a “normal” equity grant.

Seeing an “off cycle” grant on September 6, 2019 after a major step down in price in August 2019 is a major flag and warrants further investigation.

Upon further investigation, the August 2019 step down was due to Q2 earnings where the company suspended 2019 guidance and announced their intent to explore strategic alternatives and seek new funding arrangements to lessen earnings volatility.

The grant comes off the announcement of a strategic alternatives process which is interesting.

May 14, 2020 grant looks like a push out due to COVID-19 volatility in March 2020.

The Compensation Committee appears proactive with their equity grant practices which is a “tell” to me. They are definitely focused on ensuring management stays incentivized.

If you know the Compensation Committee is trying to give retention or “make up” grants, there’s a good chance they’ll try to time the grants to maximize value.

There are no guarantees the grants will stays in-the-money as illustrated by GreenSky’s continued weakness, but a great way to keep executives incentivized is to grant them equity they expect to be in-the-money (possibly deep in-the-money) in the near future.

CEO David Zalik Controls GreenSky

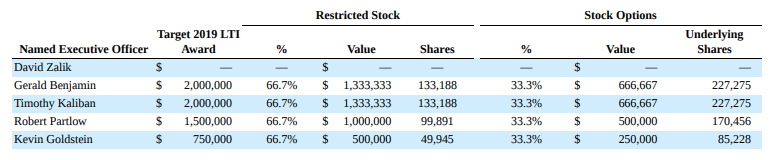

Normally, when I examine equity grants, I focus on the equity granted to the CEO. What’s interesting with GreenSky is the CEO does not receive equity:

Due to Mr. Zalik's current ownership interest in GreenSky, he has elected to not receive annual LTI awards.

When you review the ownership table in the 2020 proxy, you quickly realize CEO David Zalik has voting control of the company.

This raises some interesting questions and takeaways.

First, whatever is happening on the Board or with governance/compensation, it’s a safe bet the CEO is heavily influencing the decision-making. He definitely has the voting control and the power to push-the-envelope to take care of his team.

While it’s fair to assume a CEO with voting control is incentivized to drive long-term value, that doesn’t necessarily mean their decisions will be aligned with the interests of minority shareholders.

For instance, the CEO can potentially seek to capture a greater share of long term value for himself and his team at the expense of minority shareholders by acquiring the company at a deeply discounted price.

Keep this dynamic in mind as the company wraps up their strategic alternatives process later this year.

GreenSky’s Not-So-Normal March 2019 Equity Grants

Remember how I said GreenSky’s March 2019 equity grants looked “normal”?

They’re definitely not normal.

While the grant occurred after Q4 2018 earnings (generally considered “best practice”), the Compensation Committee implemented an equity granting process that (in my opinion) essentially turned them into “spring loaded” equity grants.

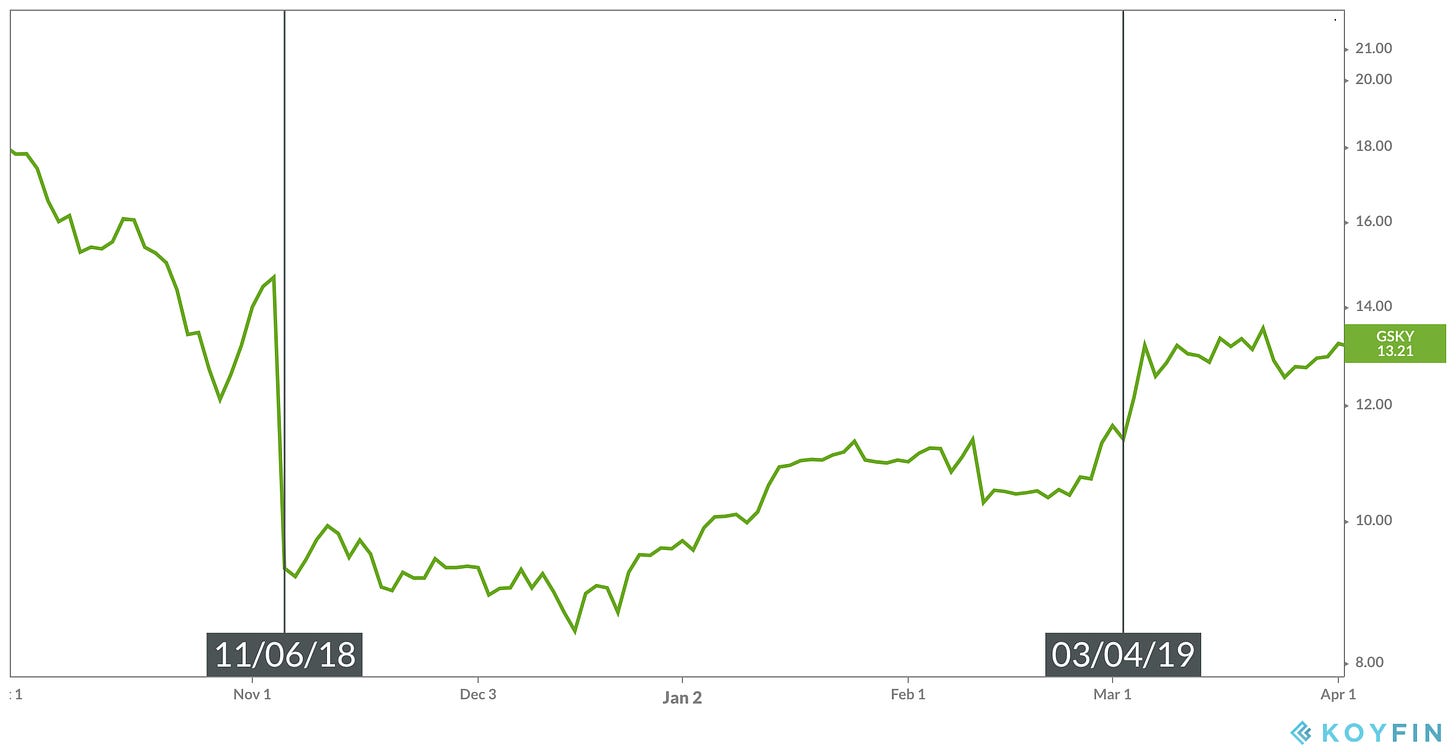

Here’s the key passage in the proxy:

Due to significant volatility in the market price of our Class A common stock since we became a public company, we used the average closing price of our stock between November 6, 2018 and March 4, 2019 ($10.01) to determine the number of shares to grant our NEOs. This time period was chosen because it was between the release of our financial statements for the quarter ended September 30, 2018 and the release of our financial statements for the year ended December 31, 2018.

Folks, this is some powerful corporate governance “dark arts” right here. It is absolutely brilliant in its subtlety. No joke, whoever came up with this process is a “dark arts” genius.

Why am I so impressed?

They juiced the “target” equity granted to management while making it look like a “normal” best practice grant. Let’s break down how they did it.

First, companies can’t manipulate the strike price of options. The options backdating scandal ensured this manipulation was eliminated. You simply can’t grant options with a $10 strike when the stock is trading at $12 per share.

GreenSky’s own compensation philosophy explicitly mentions this:

No stock options granted with an exercise price less than fair market value. All stock options are granted with an exercise price at the closing price on the date of grant.

If you can’t manipulate the strike price, how can you juice equity compensation?

This is where “spring loading” usually kicks in. Grant equity before the release of good news (i.e. before consensus beating earnings), and management can benefit from the price appreciation.

The problem with “spring loading” is you must grant equity before “good” news is released which signals your intent. You generally can’t hide “spring loading”. At least that’s what I thought until I came across GreenSky’s March 2019 grant.

GreenSky grants equity after earnings, but cleverly calculates the number of “target” shares they grant by applying a below-market price. You can’t manipulate the strike price on your options, but you can manipulate the number of shares granted.

How does GreenSky pull this off?

They use the average closing price of GreenSky’s stock between November 6, 2018 and March 4, 2019 ($10.01) which conveniently begins after the stock tanks on Q3 2018 earnings and before the stock pops on Q4 2018 earnings.

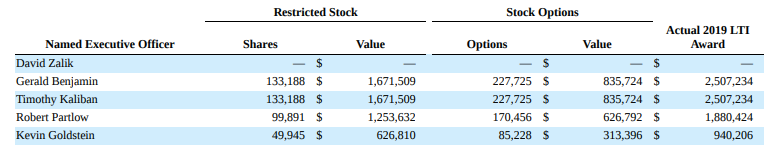

GreenSky then applies $10.01 per share to calculate the target number of shares each executive is entitled to. For instance, Gerald Benjamin (Chief Administrative Officer and Vice Chairman of the Board) has a target equity award of $2 million and is granted 133,188 RSUs and 227,275 options using $10.01 as the reference price.

Keep in mind $10.01 is 12% lower than GreenSky’s stock price on March 4, 2019 ($11.37) so this is a more lucrative way to juice equity compensation versus doing a “spring load” equity grant.

GreenSky would then grant the calculated “target” number of shares on March 7, 2019 when the stock price was $12.55. This means Gerald Benjamin’s $2 million in “target” shares (using $10.01) converts to $2.5 million in value when applying the grant date stock price.

GreenSky juiced target equity compensation by 25% (very similar to a “spring load”) and makes it look like a “normal” grant. These guys are good.

Needless to say, this is opening Pandora’s box. It would be incredibly easy to manipulate the granting process year-to-year to maximize annual payouts. ISS and Glass Lewis must explicitly crack down on the practice before it spreads.

I’m honestly surprised GreenSky’s compensation consultant Pay Governance signed-off on it.

“Real Time” Critique of GreenSky’s September 2019 Grant

If you made it this far, thanks for reading! This is the last section.

I thought it be fun to share some old “real time” notes I had on GreenSky’s September 2019 equity grant. If you follow me on Twitter, I flagged the grant as something to keep an eye on:

My notes at the time:

Out of cycle equity grant following announcement of strategic alternatives process.

Not every executive received grants. Why?

Looks like a retention grant is pretty sizable when compared to March 2019 grants for those who got it.

TPG on the compensation committee but not the chair. Unsure how much influence they have given CEO’s controlling stake.

Could this be a Snapchat style - at the bottom - retention grant?

Announced strategic alternatives and pursuing alternative funding.

CEO has voting control and can presumably push through a deal if he wants one (assuming there are buyers…are there buyers?)

Decent short interest - possible squeeze if deal announced? Short interest warranted.

Tough to trade without clear catalyst date.

Strategic alternatives will likely take time.

Funding announcement could be a positive but tough to gauge upside.

I didn’t trade GreenSky following the September 2019 grant, but it’s still a fun thought exercise to go through. The company would eventually see an OK pop in December 2019 after they announced new funding arrangements, but nothing that made me feel I missed out.

Happy Memorial Day!

See you at part 5 soon!