SIVB: Held-to-Mortem Governance

When did Silicon Valley Bank insiders begin to realize they were potentially in trouble?

With Silicon Valley Bank’s well-publicized blow-up underway, a question I have is when did insiders begin to realize they were potentially in trouble?

Examining recent disclosures in the 2023 Preliminary Proxy, a governance-based argument could be made insiders were quite aware the situation was serious throughout 2022.

In particular, the most interesting disclosure is the company didn’t have a Chief Risk Officer for much of 2022, and (from what I can gather) doesn’t explicitly communicate this to shareholders until the 2023 Preliminary Proxy is filed on March 8, 2023.

This non-disclosure immediately makes me wonder what caused former Chief Risk Officer Laura Izurieta to leave the role and create such a glaring hole in risk oversight during such a critical time.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Premium Newsletter

If you enjoy this write-up, consider subscribing to the Premium Newsletter.

Premium explores “real time” situations and looks for interesting governance signals, like indicators of strategic options and other noteworthy inflections, before they potentially happen and/or gets priced in.

Note: If you previously subscribed to premium, a friendly reminder you were issued a pro-rated refund in February 2022 and will need to re-subscribe to receive premium emails again.

Held-to-Mortem Governance

For those unfamiliar with the governance of banks, the Risk Committee is probably the most important Board committee:

The Risk Committee of the Board oversees the Company’s enterprise-wide risk management, in coordination with and support from the other committees, where appropriate.

The Risk Committee has primary oversight responsibility of the Company’s enterprise-wide risk management framework (including the oversight of risk management policies) and risk governance and culture, and the monitoring of the Company’s risk profile and emerging risks.

The Company's Risk Appetite Statement, which sets forth the tolerance levels with respect to the amount and types of key risks underlying the Company's business, is primarily overseen by the Risk Committee and approved on at least an annual basis by the Board.

The Risk Committee has primary oversight of the Company's risk management across all major risk categories, including liquidity, credit, market, operational, compliance, strategic and reputational risk. Moreover, the Risk Committee oversees our capital management, including our Capital Plan (in coordination with the Board). The Chief Risk Officer of the Company reports directly to the Risk Committee, as well as, on an administrative basis, to the Chief Executive Officer.

Source: 2023 Preliminary Proxy

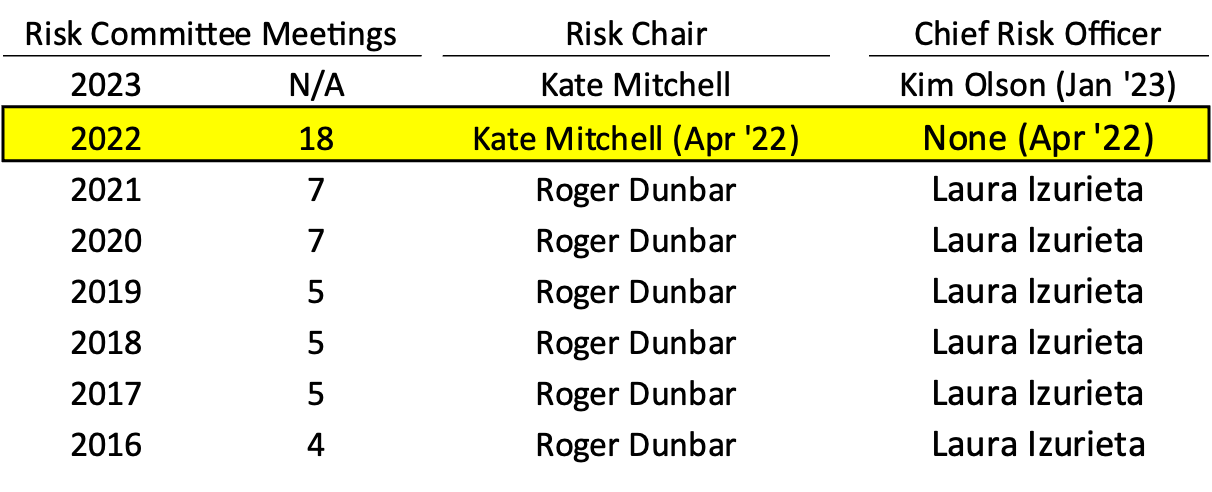

So when I read the 2023 Proxy and see that the Risk Committee 1) met 18 times in 2022 vs. their typical 5-7 times per year, 2) appointed a new committee Chair, and 3) didn’t have a Chief Risk Officer in place for much of the year, that’s a pretty strong set of signals the company might have been aware they had a serious problem relative to what they were communicating:

No Chief Risk Officer in 2022?

The lack of Chief Risk Officer for much of 2022 is very alarming (to me) considering that this role directly reports to the Risk Committee and plays a critical role in bank operations.

If there’s no Chief Risk Officer providing the Risk Committee with the appropriate information and recommendations needed to make informed decisions, who is taking on that role?

After all, newly appointed Chief Risk Officer Kim Olson joined in January 2023, and the company would subsequently propose a capital raise shortly thereafter on March 8, 2023.

Would the company have raised capital sooner - or pursue other de-risking transactions - if there was a Chief Risk Officer in place in 2022?

Was it an intentional decision to have no Chief Risk Officer in place to avoid the recommendation of raising capital and essentially try to “buy more time” for the venture market to recover?

Regardless of the reasons, as a bank holding company, it is my understanding (and I could be wrong) regulators mandate a Chief Risk Officer:

Chief risk officer—(1) General. A bank holding company with total consolidated assets of $50 billion or more must appoint a chief risk officer with experience in identifying, assessing, and managing risk exposures of large, complex financial firms. (source)

So how was it possible for Silicon Valley Bank to operate without a Chief Risk Officer in place for much of 2022?!

I’m a bit dumbfounded on this, but it seems clear to me the company waited as long as possible to explicitly acknowledge they didn’t have a Chief Risk Officer, and that delay in disclosure is a pretty material red flag for me.

Why Did Former Chief Risk Officer Laura Izurieta Leave?

In fact, the “we have no Chief Risk Officer” non-disclosure immediately makes me wonder what caused former Chief Risk Officer Laura Izurieta to leave the role and create such a glaring risk oversight hole during such a critical time:

Ms. Izurieta departed the Company on October 1, 2022. The Company initiated discussions with Ms. Izurieta about a transition from the Chief Risk Officer position in early 2022. Accordingly, the Company and Ms. Izurieta entered into a separation (without cause) agreement pursuant to which she ceased serving in her role as Chief Risk Officer as of April 29, 2022 and moved into a non-executive role focused on certain transition-related duties until October 1, 2022.

Source: 2023 Preliminary Proxy

This is the “elephant in the room” for me. What happened here?

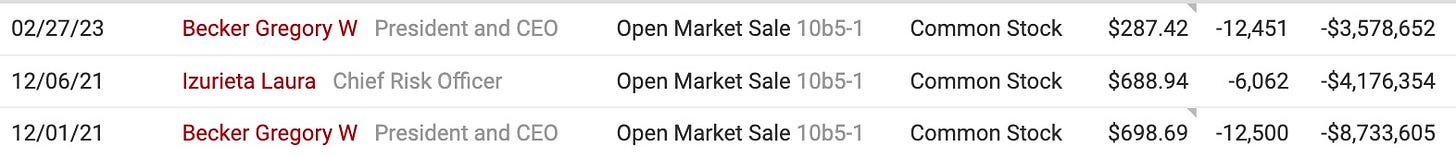

Given that Ms. Izurieta sold $4 million worth of shares in December 2021 just before the company would approach her to begin discussions regarding her transition out of the Chief Risk Officer role, I can’t help but wonder if she realized the bank’s balance sheet was a ticking time bomb when she sold the stock.

The optics look pretty bad.

CEO Greg Becker’s "10B5-1" Trading Plan

It also doesn’t help that CEO Greg Becker sold a significant amount of shares in December 2021 as well, and followed that up with another meaningful sale in February 2023 before the company would propose a capital raise:

One thing to keep in mind is both Ms. Izurieta’s and Mr. Becker’s 10B5-1 plans were adopted just a month prior to the sales occurring, and these transactions appear to be one-time in nature. They’re arguably open market sales masquerading as 10B5-1 transactions.

Also, one month is not much of a “cooling off” period for adopting a 10B5-1 plan, and this scenario is literally what the SEC is trying to crack down on with by requiring a “cooling off” period of 90 days for 10B5-1 plans.

Further, it doesn’t help that Mr. Becker was selling shares in February 2023 by exercising options with a $105.18 strike price. Exercising options arguably create an extra incentive to front-run any proposed capital raise announcement to maximize value.

Combine this transaction with the lack of timely disclosures regarding the vacant Chief Risk Officer role in 2022, and it’s hard for me to believe Greg Becker adopted this 10B5-1 plan in good faith.

This is not fine. Things are not fine.

Sept exit no accident....as she saw what was happening...

So big was this drawdown that on a marked-to-market basis, Silicon Valley Bank was technically insolvent at the end of September. Its $15.9 billion of HTM mark-to-market losses completely subsumed the $11.8 billion of tangible common equity that supported the bank’s balance sheet.