SVB: Conflicts of (Insider Loan) Interest

Investigating Insider Loans, VC Conflicts of Interest, and Director "Independence"

Silicon Valley Bank’s governance situation just keeps getting worse. Specifically, Bloomberg reported loans to insiders tripled in the December 2022 quarter (vs. September 2022 quarter), and when I connect the governance dots, a portion of those loans may have gone to start-ups funded by Director Kate Mitchell’s VC firm. The company doesn’t provide disclosure of these loans in the Proxy Statement so we don’t know for sure, but I’m having a hard time dismissing the aforementioned claim (I really tried).

Now, even if the claim is true, that doesn’t mean there was wrongdoing, but it does raise some serious questions regarding VC conflicts of interest and Director “independence” in overseeing the SVB and addressing risk management issues given Ms. Mitchell is Chair of the Risk Committee.

Disclaimer: This newsletter is not investment advice. Views or opinions represented in this newsletter are personal and belong solely to the owner and do not represent those of companies that the owner may or may not be associated with in a professional capacity, unless explicitly stated.

Summary

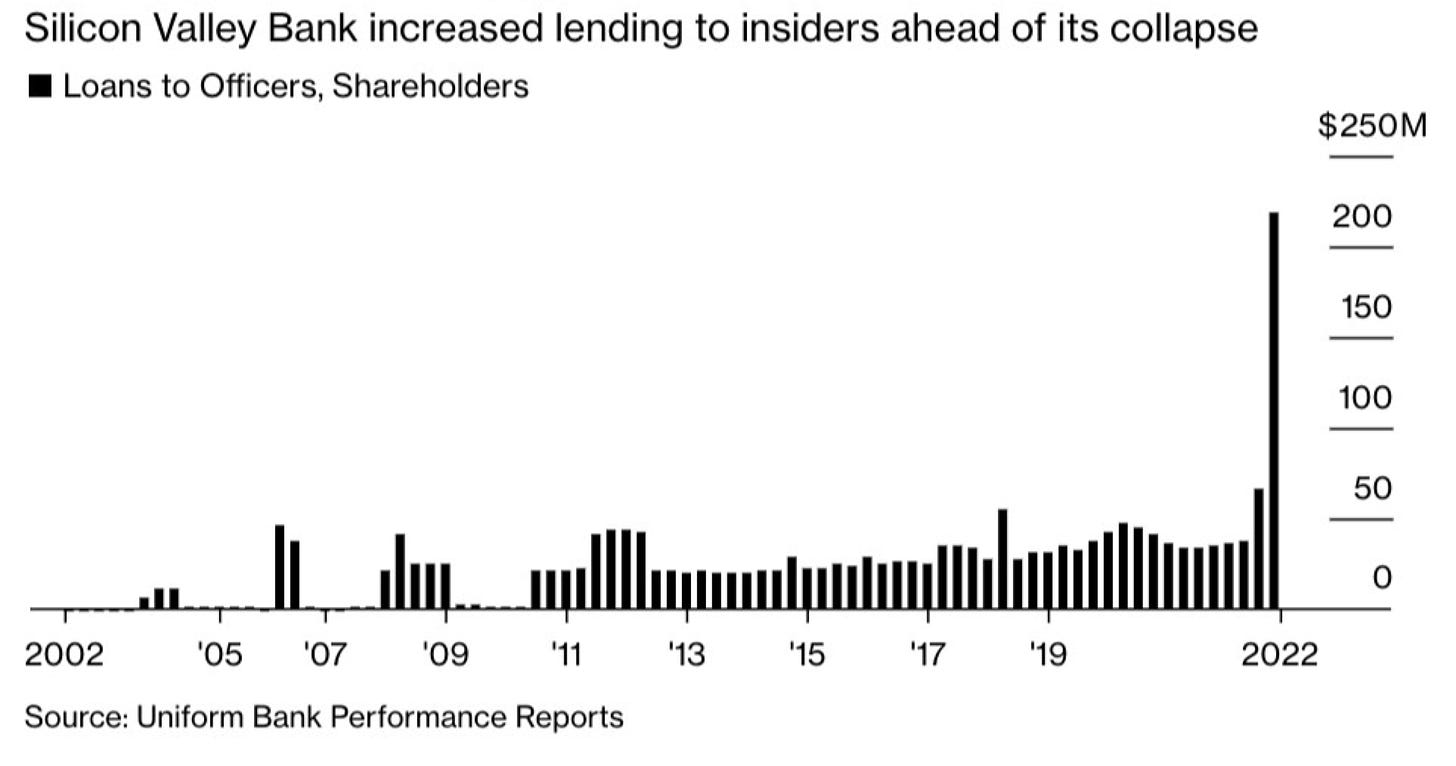

On March 21, 2023, Bloomberg reported loans issued to insiders tripled in the December 2023 quarter to $219 million, or $153 million sequentially vs. September 2022 quarter ($66 million).

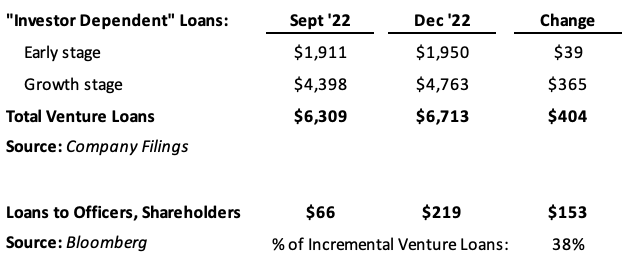

Assuming these loans were primarily venture debt lent to start-ups funded by Director affiliated venture capital firms, by my crude math, approximately ~38% of SVB’s reported sequential venture debt growth ($404 million of incremental loan growth) went to insider-affiliated start-ups:

Given the growing reliance and demand by start-ups for venture debt to address an uncertain funding environment, the optics of SVB - a market leader in venture debt - allocating a material share of their venture debt to insider-affiliated start-ups is an area of concern.

That doesn’t mean there was wrongdoing, but it does raise questions regarding the “independence” of Directors affiliated with these loans and how arm’s length was the underwriting process to green light these loans relative to other opportunities.

In particular, Risk Committee Chair Kate Mitchell is co-founder and Partner of Scale Venture Partners, and if Scale portfolio companies were the primary recipient of venture debt, I can’t help but ask what influence - if any - this may have played in delaying disclosures that SVB didn’t have a Chief Risk Officer for much of 2022 and allegations the company was covering up their risk-management issues.

Support Me Firing Hot Takes: Join Premium

The main hero of [The Naked Gun], Drebin serves to fight crime and uphold the law… but is too much of an idiot to do it properly. But despite his numerous shortcomings, he's usually the last line of defense against any nefarious schemer. (TVTropes)

If you enjoy this write-up, consider subscribing to the Premium Newsletter.

Premium explores “real time” situations and looks for interesting governance signals, like indicators of strategic options and other noteworthy inflections, before they potentially happen and/or gets priced in.

Note: If you previously subscribed to premium, a friendly reminder you were issued a pro-rated refund in February 2022 and will need to re-subscribe to receive premium emails again.

Alrighty, back to firing Non-GAAP hot takes…

Why Did Insider Loans Materially Spike in December 2022?

So why did insider loans spike?

Loans to officers, directors and principal shareholders, and their related interests, more than tripled from the third quarter last year to $219 million in the final three months of 2022, according to government data.

That’s a record dollar amount of loans issued to insiders, going back at least two decades.

Source: Bloomberg

The sheer amount of incremental insider loans ($153 million added) immediately leads me to believe these loans were commercial/venture in nature and not personal.

After all, by Q4 2022, the Board was dealing with an undisclosed risk management tire fire, and I really doubt they’d be signing off on huge personal loans to insiders under these circumstances.

Also, per the 2023 Proxy, we know these insider loans can include venture debt lent to start-ups where Director-affiliated venture funds own 10% or more of the company:

Ordinary Course Loan Transactions

During 2022, the Bank made loans to Related Parties, including certain companies in which certain of our directors or their affiliated venture funds are beneficial owners of 10% or more of the equity securities of such companies, that were (i) in the ordinary course of business, (ii) on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, and (iii) not involving more than the normal risk of collectability or present other unfavorable features.

Knowing this, the most common sense explanation (to me) for why insider loans materially spiked in Q4 2022 is SVB lent venture debt to late-stage start-ups that had a VC firm (affiliated with SVB Directors) with 10% (or more) ownership in the cap table.

This makes sense to me given the growing reliance and demand by start-ups for venture debt in 2022 to address an uncertain funding environment, and SVB is a market leader in venture debt with $6.7 billion loans outstanding.

Why Weren’t These Loans Disclosed in the Proxy?

Another reason why I believe the spike in insider loans was primarily venture debt lent to start-ups with 10%+ Director-affiliated VC ownership is the lack of disclosure in the Proxy Statement.

Insider loans must adhere to the requirements of Regulation O of the Federal Reserve Act, and from what I can tell, the regulations don’t require disclosure of loans made to parties affiliated with Directors:

Further, upon receipt of a request from a member of the public, a member bank must disclose the names of its executive officers and principal shareholders who, along with their related interests, received extensions of credit, either from the member bank or from all correspondent banks of the member bank, that in the aggregate equaled or exceeded 5 percent of the member bank's capital and unimpaired surplus or $500,000, whichever is less.

Of course, I can be wrong since SVB has already shown their disregard for disclosure with how they handled disclosing the departure of their Chief Risk Officer in 2022, and could be disregarding disclosure requirements for these loans.

Where Did the Loans Possibly Go?

Assuming the spike in insider loans in Q4 2022 is primarily due to venture debt lent to start-ups with 10%+ Director-affiliated VC ownership, we can narrow the pool of start-ups to companies funded by 3 firms:

Benhamou Global Ventures: Director Eric Benhamou is Founder and GP

Blockchain Coinvestors: Director Alison Davis is Managing Partner and Co-Founder

Scale Venture Partners: Director Kate Mitchell is Partner and Co-Founder

Of the 3 VC firms, Scale Venture Partners funded Locus Robotics announced a $117 million Series F round on November 29, 2022 with a ~$2 billion valuation and participation from SVB:

Also participating in the Series F round were Stack Capital Group,Next47, Stafford Capital Partners, HESTA, Newton Investment Management North America, Gray’s Creek Capital, Silicon Valley Bank, Hercules Capital, Inc., BOND, and Scale Venture Partners.

Interestingly, venture debt lender Hercules Capital participated in the Series F round, and separately mentioned they secured a $60 million debt commitment in Q2 2022:

In Q2 2022, Locus Robotics, the leader in autonomous mobile robots for fulfillment and distribution, secured a $60 million debt commitment from Hercules. In November 2022 the company announced a $117 million Series F funding, bringing its valuation to close to $2 Billion. (Hercules Capital 2022 in Review)

While I can’t confirm (i.e. find a disclosure) SVB lent venture debt to Locus Robotics in Q4 2022, they’re my prime suspect for why insider loans at SVB spiked in Q4 2022:

Scale Venture Partners is likely a 10%+ owner having led their Series B round and participated in subsequent rounds.

Locus Robotics has a $2 billion valuation which likely gives them meaningful venture debt capacity.

Their sizable Series F round was announced in Q4 2022 and venture debt is typically made available alongside an equity raise.

They previously secured a $60 million debt commitment from Hercules in Q2 2022 signaling venture debt is part of their capital raising and allocation strategy.

SVB participated in the Series F.

The key ingredients are there for Locus Robotics to potentially close a meaningful venture debt deal with SVB in Q4 2022 that would - in turn - move the needle on SVB insider loans.

VC Conflicts of Interest and Director “Independence”

Regardless of which start-ups specifically received loans from SVB, a bigger issue to unpack is the seemingly disproportionate share of venture debt insider affiliated start-ups received in Q4 2022.

Assuming these insider loans were primarily venture debt lent to start-ups funded by Director affiliated venture capital firms, by my crude math, approximately ~38% of SVB’s reported venture debt growth ($404 million incremental loan growth) went to insider-affiliated start-ups.

As mentioned earlier, given the growing reliance and demand by start-ups for venture debt to address an uncertain funding environment, the optics of SVB - a market leader in venture debt - allocating a meaningful share of their incremental venture debt to insider-affiliated start-ups is an area of concern.

That doesn’t mean there was wrongdoing, but it does raise questions regarding the “independence” of Directors affiliated with these loans and how arm’s length was the underwriting process to green light these loans relative to other opportunities.

In particular, Risk Committee Chair Kate Mitchell is co-founder and Partner of Scale Venture Partners, and if Scale portfolio companies were the the primary recipient of these reported insider loans, I can’t help but ask what influence - if any - this VC conflict of interest may have played in delaying disclosures that SVB didn’t have a Chief Risk Officer for much of 2022 and allegations the company was covering up their risk-management issues.